Dream Industrial: Look To Buy On A Pullback

Summary

- Dream Industrial continues to deliver stellar leasing spreads.

- The REIT has an extremely short debt maturity profile, though, and that creates some modest risks down the line.

- We look at the recent results and tell you why we booked our profits.

- Looking for a helping hand in the market? Members of Conservative Income Portfolio get exclusive ideas and guidance to navigate any climate. Learn More »

valtron84/iStock via Getty Images

All values are in CAD unless noted otherwise.

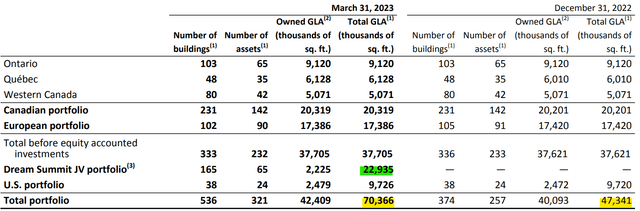

Dream Industrial Real Estate Investment Trust (TSX:DIR.UN:CA) has a portfolio of 536 industrial buildings across Canada, Europe, and United States. Its assets comprise distribution, urban logistics and light industrial buildings.

While the REIT owns 100% of most of the properties it manages, there are a few that are jointly owned by other parties. The REIT's US presence is via interest in an industrial fund. Dream Industrial also acquired a 10% interest in Summit Industrial Income REIT in Q1-2023 as part of a joint venture with GIC, a global wealth fund. The Summit transaction resulted in a big boost to the managed portfolio compared to 2022, also making Dream Industrial one of the largest of its kind.

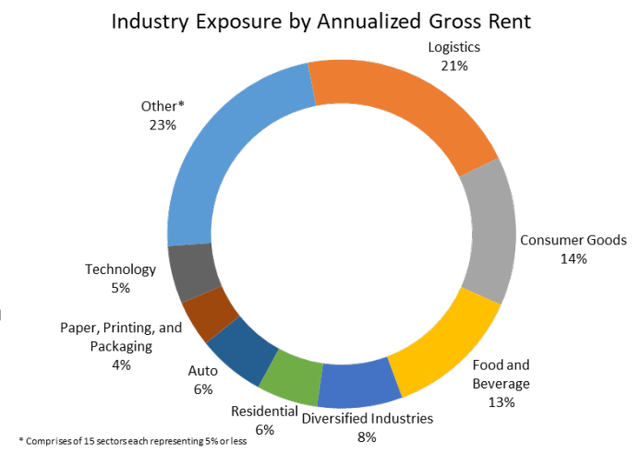

The REIT has a diversified roster of tenants, with no single industry contributing more than 21% of the annualized gross rent.

With over 98% of its portfolio occupied, no single tenant provides more than 3% of the gross annual rent. Collectively, excluding the Summit JV and US portfolio, the properties had a weighted average lease term or WALT of 4.5 years at the end of Q1.

Prior Coverage

We wrote about the Q4 results and the Summit transaction back in January of this year. We remained bullish after our assessment and summarized our sentiment for our readers.

The REIT currently yields 5.78% ($0.05833 cents/month dividend, current price $12.10). This is huge in relation to the industrial REIT Universe with only STAG Industrial (STAG) coming close. The rest of the bunch including, Prologis (PLD), Terreno Realty Corp. (TRNO) and Rexford Industrial Realty, Inc. (REXR) offer very little for the income investor.

STAG's assets are primarily in tier 2 locations and even that yield is lower. We can see a similar trend when looking at consensus NAV or price to AFFO multiples. Dream Industrial stands out, despite producing impressive growth and quality locations. The recent Summit purchase does dent our enthusiasm slightly, but the fact that they bought only 10% of this helps. We reiterate our Strong Buy rating on this and think the share price has a 40% upside in 2-3 years.

Source: Dream Industrial: Like It, Love It, Want Some More Of It

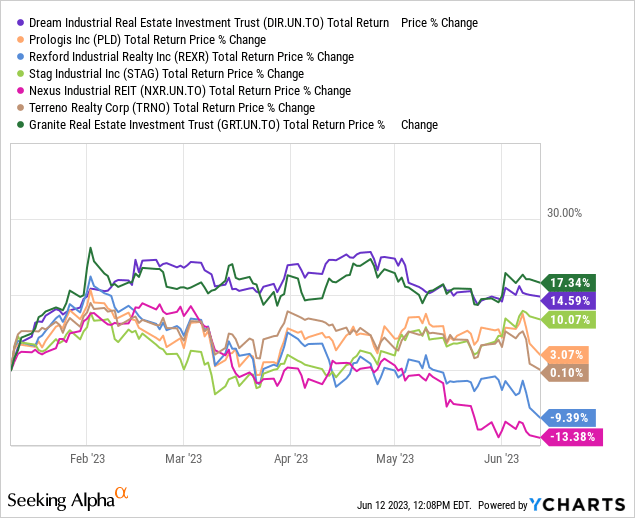

It has done well since then, only getting beat by another lean, mean and very well-run industrial machine, Granite Real Estate Investment Trust (GRP.U) (GRT.UN:CA).

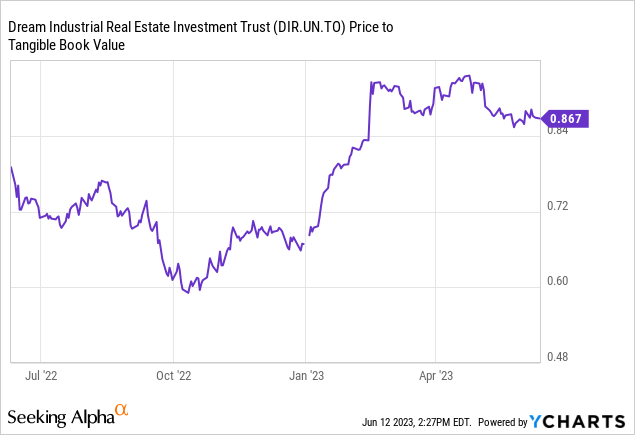

Back in January, the REIT traded at 15X 2023 AFFO and a 30% discount to its NAV. Now it is trading at close to 17X 2023 AFFO and the discount has narrowed to around 13%.

We had called for a 40% upside in share price in a 2-3 year timeframe. While on its way, it's not there yet. Let's check out the Q1 results to confirm that we still have the same expectation from Dream Industrial.

Q1-2023

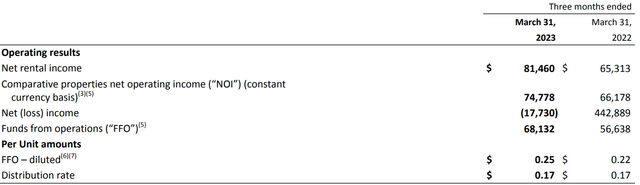

Riding on a demand wave, Dream Industrial enjoyed higher rental spreads on new and renewed leases. That combined with contractual rent growth, net property acquisitions, and higher management due to a larger portfolio resulted in higher year-over-year numbers.

The management spoke about the double-digit spreads achieved in the first quarter during the earnings call.

Within our portfolio, our strong leasing momentum from last year has carried forward to 2023. During Q1, we transacted 945,000 square feet of leases across our portfolio, achieving a rental spread of over 40%.

Source: Q1 2023 Earnings Call Transcript

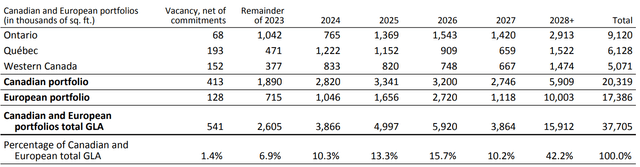

This trend bodes well for the balance of 6.9% of the portfolio that is set to mature this year.

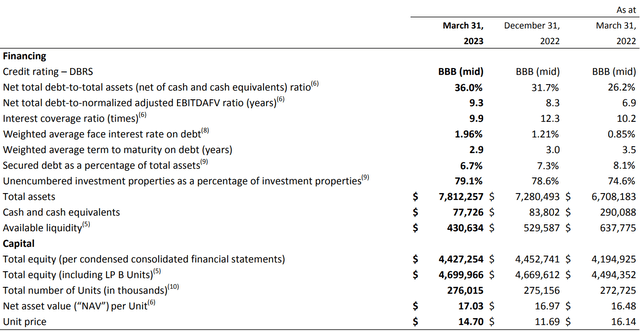

As Dream Industrial executes its strategy to grow and upgrade the quality of its portfolio, we can expect it to reflect on its debt metrics. The interest coverage has reduced since December 31 of last year, with a corresponding rise in the average interest rate.

The $431 million in available liquidity, combined with the $7.8 billion in unencumbered assets, are more than sufficient to meet the 2023 debt obligations.

The management was already in talks to refinance the upcoming maturities and noted that in the Q1 conference call.

Looking forward to the remainder of the year and consistent with our business plan, we expect that investment opportunities can be fully funded with our current balance sheet capacity. Our near-term debt maturities are limited with approximately $265 million Canadian equivalent of European mortgages maturing this year. We are in advanced discussions with our European lenders and expect to refinance these mortgages with all-in rates in the mid to high 4% range.

Source: Q1 2023 Earnings Call Transcript

Verdict

The REIT guided for around 95 cents in FFO/unit for 2023 and with the leasing momentum we have seen in Q1, we expect that they will achieve that. While the debt levels have increased since our last visit, its balance sheet is still fine on a debt to asset level. On the other hand, the debt to EBITDA looks unwieldy, and that is often the case when the properties in question have very low cap rates. With a short weighted average maturity of 2.9 years on its debt, the interest rate will also show an uptick in the subsequent quarters. Dream Industrial is not the worst Canadian REIT abuser of the short maturity schedule, but this number will weigh on it in the quarters ahead. At 17X AFFO, it is still more reasonably priced compared to its peers and is still trading at a discount to NAV. It was likely pressured a bit also by the news that its sister company Dream Office (D.UN:CA) landed upselling some units to improve its own capital position.

Dream Office Real Estate Investment Trust ("Dream Office REIT", the "Trust" or "we") today announced it has entered into an agreement to sell, on a bought deal basis, 12,500,000 units of Dream Industrial REIT (DIR.UN-TSX) (the "DIR Units") at a price of $14.20 per DIR Unit to a syndicate of underwriters led by TD Securities Inc. (the "Underwriters") for total gross proceeds of approximately $177.5 million (the "Secondary Offering"). Closing of the Secondary Offering is subject to certain customary conditions. The Secondary Offering is expected to close on or about May 16, 2023.

Source: Business Wire

We did sell our position out and booked our profits as we think this is not the market to take additional risks. That said, this is the first industrial REIT we are likely to pick up in a pullback. We are downgrading this to a "Hold/Neutral" rating.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Are you looking for Real Yields which reduce portfolio volatility? Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Give us a try and as a bonus check out our Fixed Income Portfolios.

Explore our method & why options may be right for your retirement goals.

This article was written by

Conservative Income Portfolio is designed for investors who want reliable income with the lowest volatility.

High Valuations have distorted the investing landscape and investors are poised for exceptionally low forward returns. Using cash secured puts and covered calls to harvest income off value income stocks is the best way forward. We "lock-in" high yields when volatility is high and capture multiple years of dividends in advance to reach the goal of producing 7-9% yields with the lowest volatility.

Preferred Stock Trader is Comanager of Conservative Income Portfolio and shares research and resources with author. He manages our fixed income side looking for opportunistic investments with 12% plus potential returns.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.