Meta Added To Cathie Wood's Flagship Fund

Summary

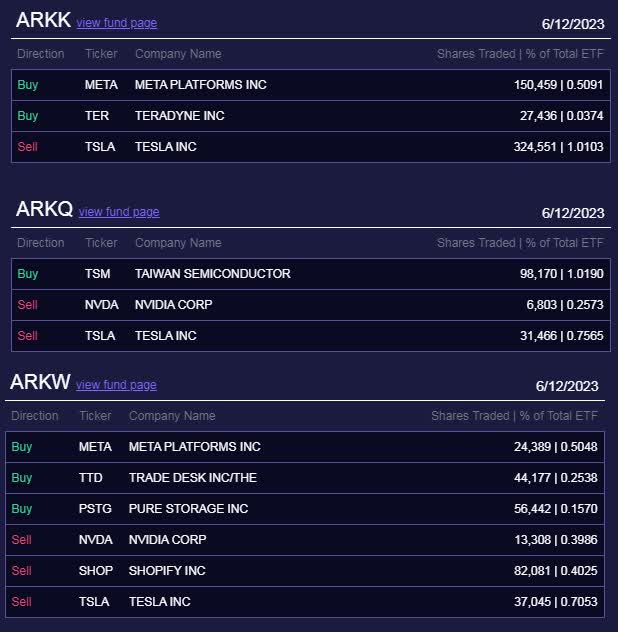

- Cathie Wood's Ark Invest added Meta Platforms to two of its ETFs, ARKK and ARKW, with a weight of around 0.5% in each.

- Meta shares have performed exceptionally well this year, primarily thanks to a reduced expense forecast.

- Ark Invest sold Tesla shares in three ETFs, despite Cathie Wood's recent $2,000 price target for the electric vehicle maker.

andresr/E+ via Getty Images

Back in April, I discussed how it was quite apparent that Facebook parent Meta Platforms (NASDAQ:META) was back in a big way. The social media giant reported a better than expected set of Q1 results, sending shares to a new 52-week high to help recover some of the major losses that investors saw back in 2022. Since then, Meta shares have continued even higher, and on Monday, the stock found a new notable supporter.

Each night around 8 PM Eastern, we get a daily trades e-mail from Ark Invest. Cathie Wood's firm sends out a list of moves made that day in the firm's six active ETFs. These are allocation trades, which are specific moves made to increase or decrease the weight of a name in a specific fund. These are different from daily inflow or redemption trades, where these ETFs buy or sell across the board depending on whether money came into or out of that specific ETF that day. Monday's moves came in the Ark Innovation ETF (ARKK), Ark Autonomous Technology and Robotics ETF (ARKQ), and Ark Next Generation ETF (ARKW).

Ark Trades E-mail June 12 (Ark Invest)

You may notice that electric vehicle maker Tesla (TSLA) was sold in all three ETFs. Tesla was the largest weight in each of those three funds going into Monday. That stock has certainly rallied a lot lately, but Cathie Wood was just on CNBC last week referencing her Tesla model and $2,000 price target. Tesla closed under $250 on Monday, so some might see those sales as rather curious. Tesla's weight had risen to more than 12% in ARKK and 16% in ARKQ, but it was only around 9% in ARKW. Remember, Cathie Wood won't buy more of a name if it goes above 10% weight, but there is no requirement to sell a name like this if the position reaches a certain size.

In both the ARKK and ARKW ETFs, Meta Platforms became a new holding on Monday, with a weight of around one-half of one percent in each. History suggests that we could see more purchases in the coming days to increase that weight, especially if the Ark team sees a lot more upside. I am slightly curious as to why Meta wasn't added to ARKQ here, given that ETF's focus on artificial intelligence investments.

Meta shares have done incredibly well so far this year. CEO Mark Zuckerberg has called this the "year of efficiency", where the company looks to get its cost base under control to help revive earnings growth and improve cash flow trends. When the year started, Wall Street analysts were expecting less than $8 in earnings per share this year, but that number now stands at $11.46. A lot of that has to do with the below updated expense forecast, as I detailed in my previous article:

The new $86 billion to $90 billion range, which includes $3 billion to $5 billion in restructuring costs, is down significantly from the original range of $96-$101 billion that included $2 billion in facilities charges.

One of the main reasons I like Meta shares currently is the strong cash balance and free cash flow. The ongoing buyback has lowered the share count nicely, with the diluted count used for the EPS calculation declining by almost 12% in the past five years. At the end of Q1, more than $41.7 billion remained authorized for future share repurchases. Not only does the buyback help the earnings per share figure at a given level of net income, but it adds another large buyer for the stock to the market.

Interestingly enough, Meta shares closed Monday six cents above the average price target on the street. Analysts have remained quite bullish, even as the stock has more than tripled from its 52-week low. At less than 19 times next year's expected EPS, investors are currently paying about the same multiple as the overall market, for a name that's expected to grow at a double-digit pace in the coming years. The other three major large-cap techs are averaging a little less than 25 times their expected calendar 2024 EPS, which would value Facebook at a little more than $350 if it traded at that multiple.

In the end, Meta found a new supporter on Monday. Cathie Wood and her team at Ark Invest added the social media giant to two of its ETFs, including the flagship ARKK fund. Meta certainly checks a lot of the innovation boxes when looking at the future, but shares have more than tripled from their 52-week low. It will be interesting to see if Ark builds this position to a much larger weight in these funds, and if more Tesla shares are sold at a small fraction of Ark's $2,000 price target to accumulate more Meta.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.