Luna Innovations: Momentum Remains, But Price Seems Too High

Summary

- Luna Innovations Incorporated is experiencing steady growth in the optic tests market, with a solid outlook and demand for its services, such as fiber testing.

- The company has a strong product portfolio and exposure to several growing markets, including 5G deployment and AI/machine learning, but faces challenges with declining margins and a weak balance sheet.

- I currently rate Luna Innovations as a hold. Improvements in margins and balance sheet management are needed to justify its high valuation.

deepblue4you/iStock via Getty Images

Investment Rundown

Luna Innovations Incorporated (NASDAQ:LUNA) operates as a prominent provider of optic tests in a market that is growing at a steady rate. In the last report provided by the company they actually managed to grow the revenues faster than the market, which has likely helped push the share price up so much in the last few months.

With a p/e of around 33 however, even if they are growing revenues at 11% YoY in their slowest quarter of the year, I still do not view them as a solid enough investment right now. Paying a premium like that often means the company is expected to generate even more growth, 2023 is estimated to see about 20% YoY growth in revenues, but noting from Q1, the margins are dropping which presents more risk regarding the company right now. With that said, the company does have a solid outlook with plenty of demand it seems, and will be rated a hold from me.

Company Segments

As the company offers some very necessary services, like fiber testing, they work to ensure that we have solid critical infrastructure that is regularly getting checked up on.

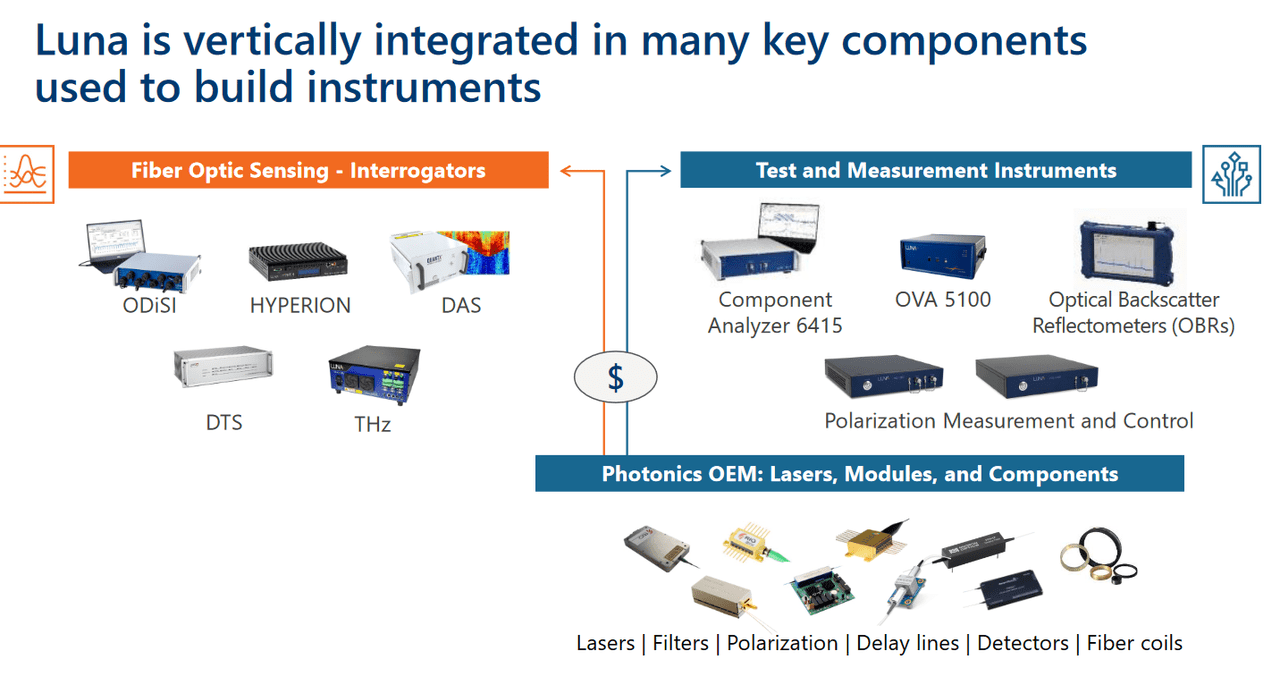

Product Line (Investor Presentation)

The company has built up a solid portfolio of products that they can use to measure and control light in next-generational optical communications, systems, and instruments. Apart from this, the sensing part of the business focuses on measuring the physical parameters of materials and keeping track of the health, usage, and security of certain assets.

Their future prospects remain solid as the SAM is estimated at around $3.5 billion and growing 10 - 12 % each year, whilst the TAM is around $175 billion instead and growing 6 - 8% each year. This certainly highlights the sheer growth potential of LUNA right now. By their own estimations, LUNA sees their revenues growing between 15 - 20% each year in the short - mid-term as they are executing their growth plan, which involves expanding into new sectors and developing their software as a product. In the next 3 - 5 years they hope to achieve $250 million in revenues and maintain a 60% gross margin. Given the guidance of $130 million in revenues for 2023 they seem well on their way there.

Earnings Highlights

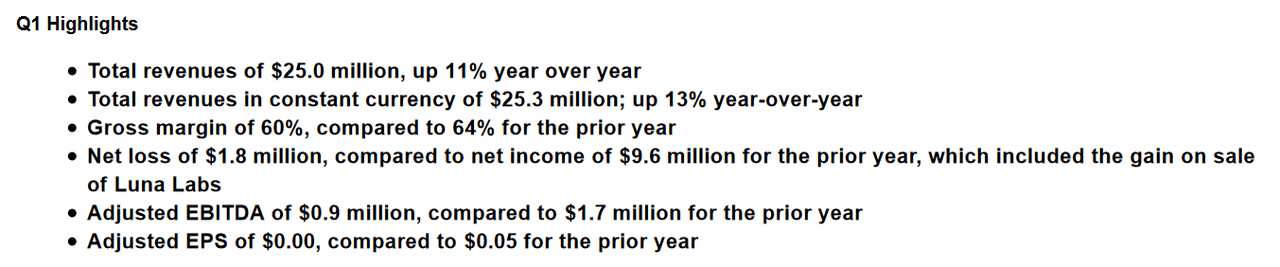

It's no secret that the last quarter was a success for the company by their own standards. CEO Scott Graeff noted that Q1 is typically their “softest revenue quarter”. So, seeing growth helped reassure the guidance the company set out for 2023 which at the high end would represent around a 20% increase in revenues.

Q1 Highlights (Earnings Report)

But it wasn't all sunshine and rainbows in the quarter, the margins did see a decline, going from 64% to 60%. This is still in line with the business mid-term goal of gross margins above the 60% line. But I don’t view this decrease as something that is helping a potential buy case in the company. With that said, the operating expenses do still remain rather high at $17 million which ensured that the company wouldn't have a profitable bottom line. Looking at a year-over-year comparison of the net income it might be slightly unfair as LUNA had a positive net income of $9.6 million in Q1 2022 thanks to the sale of their Luna Labs.

With a loss of $1.8 million in the quarter, the company sits in a tough position right now where they very likely will need to dilute shares in order to raise capital to continue operations and pay down liabilities. The cash position sits at around $3.6 million right now and if LUNA continues its decline in margins then it is hard to see a scenario where dilution won't happen.

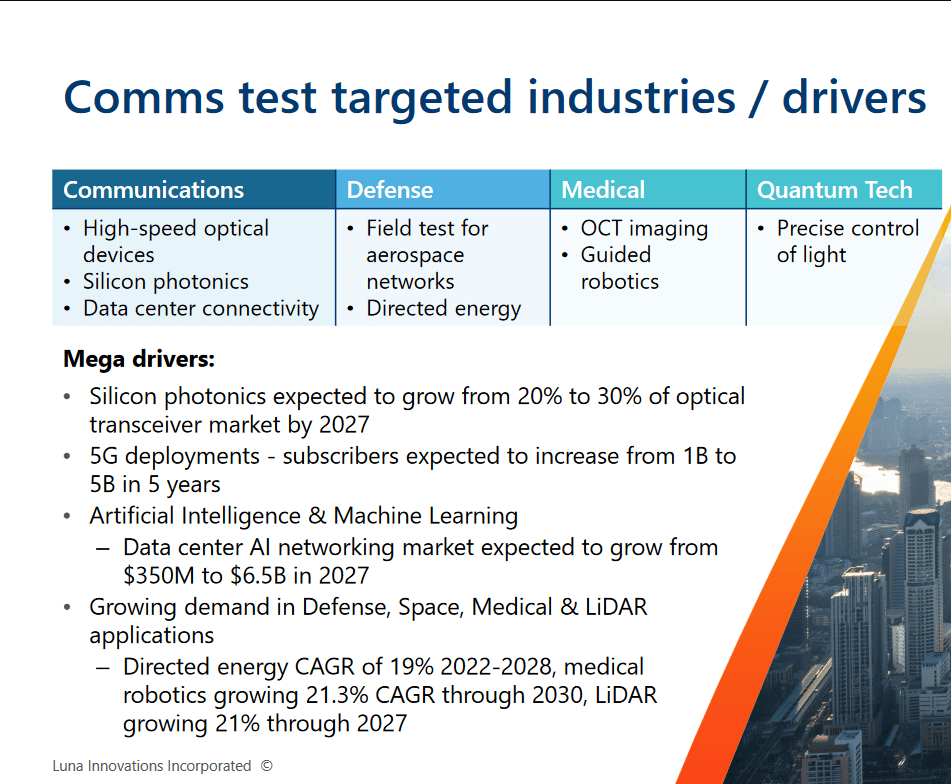

Comms Segment (Investor Presentation)

Looking at the comms part of the business they see the deployment of 5G as a major tailwind. With a massive increase in subscribers in just the coming 5 years I think the coming quarters will need to provide more clarity regarding the growth LUNA is seeing from this. If they can outperform their current revenues targets, then the current multiple might be fair to pay.

Another market that LUNA now is able to tap into will be the AI and machine learning industry, which is estimated to grow from $350 million to $6.5 billion by 2027, and likely see strong growth afterward too. I think this presents LUNA with another market opportunity where they can leverage their already established products to gain a foothold. I will be keeping an eye out for any development here in the coming reports. Besides this growth, another highlight from the last quarter was that LUNA was able to win a contract with Dominion Energy which will solidify LUNA as their monitoring service provider for their offshore wind project. LUNA has stated that they are experiencing significant demand from the energy industry and this proves just that.

Financials

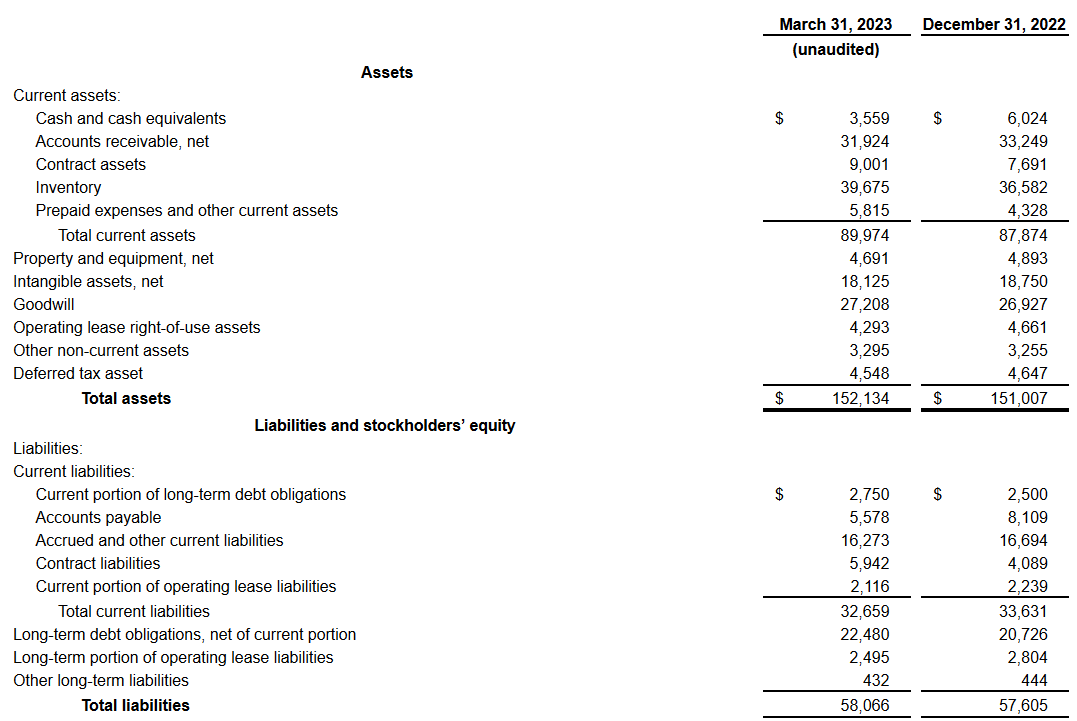

Taking a quick peek at the balance sheet from LUNA, I think one of the worrisome parts here is the very small cash position they have. It's not nearly enough to cover even a quarter of operating expenses. $3.6 million in cash with $17 million in operating expenses looks to me like LUNA has some work to do regarding its balance sheet. They had a negative EPS quarter last time but are expected to see a full-year EPS of $0.23 for 2023. With the margin expansion and maintenance, the company anticipates paired with the top-line growth I hope the coming few years will bring more possibility for LUNA to save cash and build up a stronger balance sheet.

Surprisingly, there hasn't been a massive amount of dilution over the last few years despite the slim balance sheet and high operating expenses. Shares have increased by around 18% in the last 5 years, which of course isn't good, but for a growing company like LUNA, it's not an insane amount either.

Balance Sheet (Q1 Report)

Looking at the liabilities of the business, however, the debt seems to present a slight risk and they have also increased quite a lot on just a QoQ basis. Going from $20.7 million to $22.4 million. That together with a negative EPS quarter and a nearly 50% decrease in the cash QoQ doesn't paint a strong investment picture here for LUNA. I would have much rather preferred to see the debts remained the same and perhaps have a slightly slower quarter or growth. There is an improvement on the balance sheet that needs to happen in order to support a buy at these prices in my opinion. Firstly, the margin expansion expected will need to result in the company prioritizing deploying the profits to the cash position rather the buying back shares or distributing a dividend. That comes later. Secondly, the coming quarters shouldn't include an increase in long-term debts. Once margins are improving, using the capital from that should be much more financially sound.

Risks

The primary risk I see with LUNA is that they have a very high valuation right now which opens up the opportunity for a drop in the share price should they have a bad quarter. I believe they haven't yet gathered up solid enough fundamentals to trade on to help ease a drop in share price. The gross margins might be very strong, but the bottom line lacks strengths. This paired with delays regarding their speed at adapting and merging into new markets I think would mean LUNA would get a p/e more in line with the sector, which would be around 18 - 20.

Valuation

LUNA has experienced solid growth in the top line over the last couple of years and with that consistency it has helped contribute to a high multiple right now. The p/s sits at 3.54 on a forward basis which I find quite high, somewhere around 2 would be a fair and appropriate valuation in my opinion.

With a high multiple like that, you would expect more growth than what they currently have. With the negative cash flows, the company is also trading at a negative p/fcf which is worrisome and raises the risk level associated with an investment. With that said, the net debt/EBITDA ratio is a little high too at 5.1 right now. I would prefer a lower ratio of under 3 and a p/e of somewhere closer to the sector at 20x. Looking historically the company seems to have traded somewhere around 10 - 15 so the current multiple seems unsupported based on historical measurements.

Final Words

LUNA has exposure to plenty of markets as its products can help businesses maintain solid infrastructure. They have noted the coming years will be strong regarding revenue growth as it rides on the back of several megatrends, like the deployment of 5G which will see a massive adoption in just the coming 5 years.

The vast product line the company has isn't plateauing, in fact, they remain confident new products will be responsible for 25% of the company's revenues. The future certainly seems bright for LUNA but the current price to pay for the business seems a little out of line to make an investment. Even if growth is strong, some of the improvements I’d like to see will need to happen if paying 33x forward earnings will ever be appealing. Right now for LUNA, they will be rated a hold from me.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.