Dominos Pizza: Historic P/E Contraction

Summary

- Domino's Pizza stock is trading at decade-low multiples of earnings, making it an attractive buy for investors.

- DPZ has a consistent history of EPS growth and strong margins, as well as a healthy balance sheet with significant buybacks.

- Risks include potential impacts from student debt repayment on consumer spending and the possibility of being re-priced as a stalled growth story.

- We'll be looking at Domino's in a couple of different ways. First on a PEG ratio growth basis using Peter Lynch's PEG with a dividend kicker model.

- This will be followed by a Buffett owner earnings model to evaluate well-run businesses with a moat that have depreciation and amortization in balance with capital expenditures.

EyeOfPaul

This pie has been sliced

First, a thank you to fellow contributor Michael Dolen for bringing this one to my attention. I'll be using some of the data he provided to me throughout the article. Domino's Pizza (NYSE:DPZ), is a healthy margin small cap that is a mainstay of American fast food fare, trading at decade-low multiples of earnings. The stock used to be one of the larger holdings in Tobias Carlisle's Acquirer's Fund ETF (ZIG), that's where it first got on my radar, albeit I viewed it as expensive.

Now that the price-to-earnings multiple has contracted, let's take a look at the fair price of Domino's. I am currently considering it a fair buy, but not ultra cheap. However, sometimes fair is the best we get on some of America's best brands.

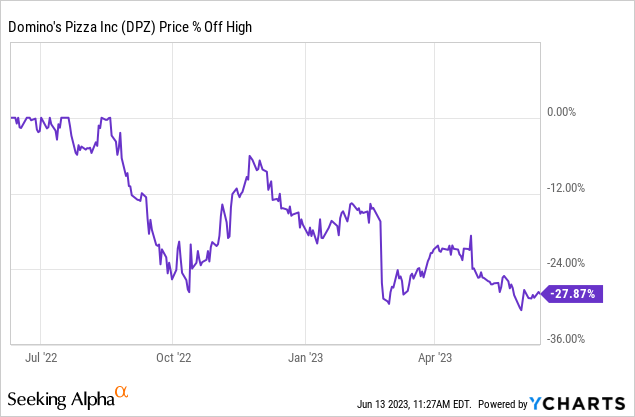

The chart

At near 30% off their high, the stock is certainly attractive from the perspective of being in a bear market of its own, down 20+%.

What they do

From the 10K:

Domino’s is the largest pizza company in the world with more than 19,800 locations in over 90 markets around the world as of January 1, 2023, and operates two distinct service models within its stores with a significant business in both delivery and carryout. Founded in 1960, we are a highly recognized global brand, and we focus on value while serving neighborhoods locally through our large worldwide network of franchise owners and U.S. Company-owned stores through both the delivery and carryout service models. We are primarily a franchisor, with approximately 99% of Domino’s global stores owned and operated by our independent franchisees as of January 1, 2023.

Franchising enables an individual to be his or her own employer and maintain control over all employment-related matters and pricing decisions, while also benefiting from the strength of the Domino’s global brand and operating system with limited capital investment by us.

The story

The market has been concerned about a drying up of disposable income on the horizon. I've expressed a similar sentiment in my article on J.M. Smucker (SJM) being a substitute for Starbucks (SBUX). Here is some color on the subject from Seeking Alpha:

Concern is growing in the restaurant sector over the implications of more than 40M Americans now on the schedule to restart making federal student loan payments in late August under the terms of the debt ceiling deal approved by Congress last week.

The SCOTUS decision is expected within a few weeks. Fast-food chains and fast-casual names with a higher than average mix of customers under the age of 30 include McDonald's (MCD), Yum! Brands (YUM), Restaurant Brands International (NYSE:QSR), Noodles (NDLS), Jack in the Box (JACK), Wendy's (WEN), Potbelly (PBPB), Chipotle (CMG), Domino's Pizza (DPZ), Papa John's International (PZZA), and Wingstop (WING). To a lesser extent, Starbucks (SBUX) could also be impacted if borrowers are pressed to cut back.

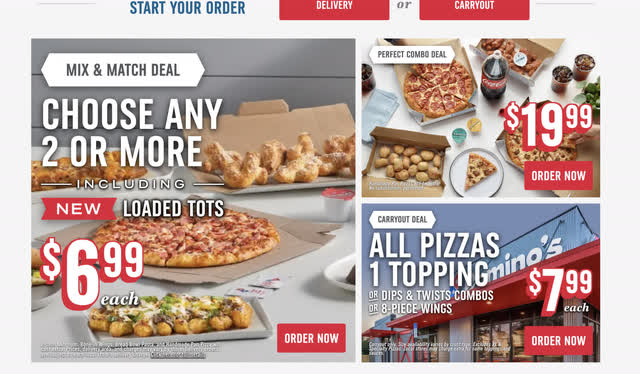

This has been looming for quite some time. However, in analysis of Domino's Pizza's menu and offerings, this does not strike me as a company that provides more expensive, discretionary meals:

Dominos.com

In actuality, I believe cheaper, quick takeout options should be the beneficiary of any reduction in spending by holders of student debt. Those that would dine out at restaurant, which are invariably more expensive than takeout or fast food options, may find Domino's or McDonald's as a replacement for more expensive options.

St. Louis Fed

People work more hours than a decade previous. This allows less time to eat at home, regardless of the desire to reduce costs. Dining outside the home is an inevitable part of American life. The full service restaurants will be at the greatest risk in my opinion.

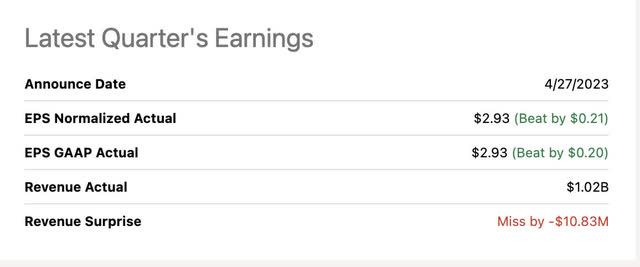

Earnings

Seeking Alpha

A recent and unexpected revenue miss started the next leg down of the price decline. The bottom line, however, continued to beat. In all honesty, the stock has been trading in tech growth territory. The multiple compression is now allowing us to nibble at fair prices when compared to their consistent low double-digit profit margins and operating efficiencies.

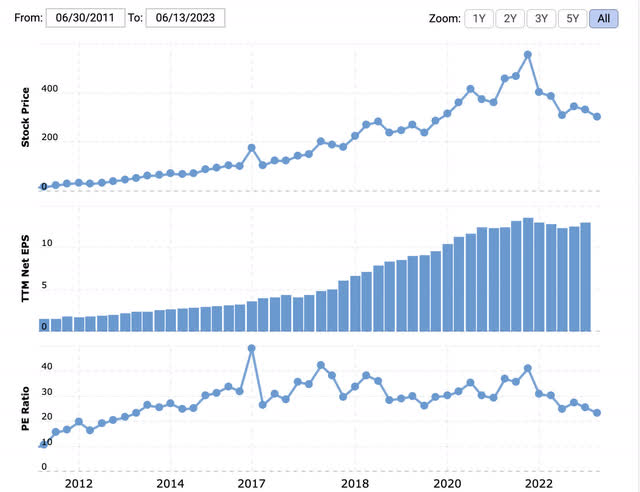

Historical trends

macrotrends.com

This striking comp chart, sent to me by Michael Dolen, shows just how unbelievably steady the EPS rise has been for Domino's over the past decade. It's easy to see why the market has paid more than 30 X earnings for several time increments during this comparison. Anytime you can produce such steady, consistent growth, the business is a model of efficiency.

On the flip side, you have the recent price action acutely to the downside. This could present a fortuitous entry point. Let's examine.

Valuation model

We'll be looking at Domino's in a couple of different ways. First, on a PEG ratio growth basis using Peter Lynch's PEG with a dividend kicker model. This will be followed by a Buffett owner earnings model to evaluate well-run businesses with a moat that have depreciation and amortization in balance with capital expenditures.

Peg model

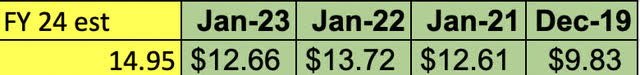

my own excel data from Seeking Alpha

Here we will derive a blended trailing 4-year to next year estimate model based on EPS CAGR. Looking from Dec 2019 at $9.83 to FY est EPS of $14.95 gives us a CAGR in EPS of 8.74%. The dividend kicker for Domino's is 1.62%, we will add this number to our multiple.

- Multiple= 8.74 + 1.62= 10.36

- FY 24 EPS EST $14.95

- 10.36 X $14.95= $154.88 FWD fair PEG 1

Owner earnings model

Next we have our owner earnings model. We'll also create a high and low based on both the short and long risk-free rates.

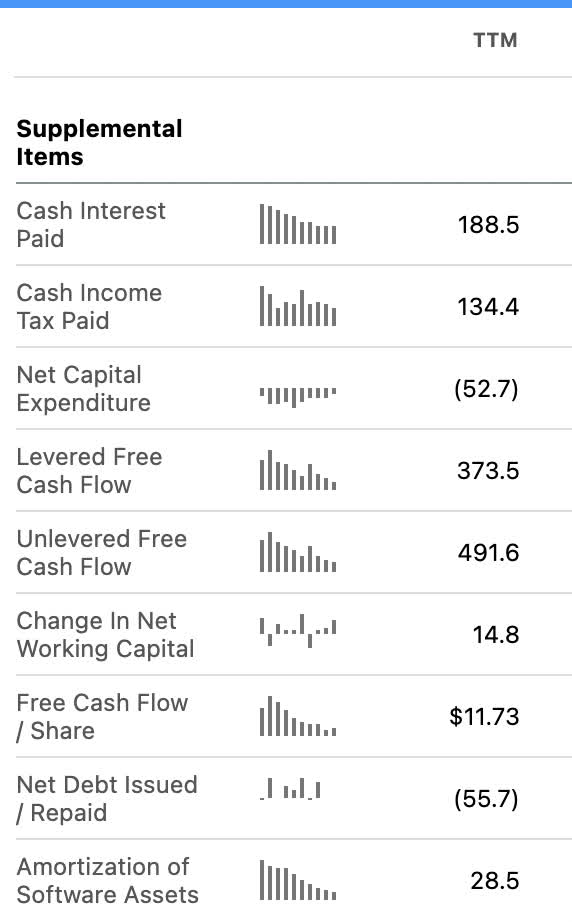

All numbers in millions, data courtesy of Seeking Alpha

- TTM Net income $466.1

- Plus TTM Depreciation and Amortization of $50.9

- Minus CAPEX of $93.8

- Equals owner earnings of $423.2

- Discounted at 10 year treasury RFR of 3.8% = $11,136.84

- Divided by shares outstanding of 35.3 = $315.49

- Discounted at short 2 year treasury RFR 4.63%= $9,140.39

- Divided by shares outstanding of 35.3= $258.93

- Blended= $287.21

High low and mid-price targets

After going over all the models we have our high range value at $315.5, mid at $258.93 at low at $154 based on PEG.

Wall Street price targets

Seeking alpha

Comparing my price targets to Wall St., the price ranges are pretty similar. The one caveat is the low range if the market starts to price the company on growth versus the consistent margins and operations where new capital expenditures do not exceed depreciation and amortization by a wide margin.

Margin trends

seeking alpha

Gross and operating margins have hovered around 20% while profit margins are more or less tethered close to 10%.

Balance sheet trends

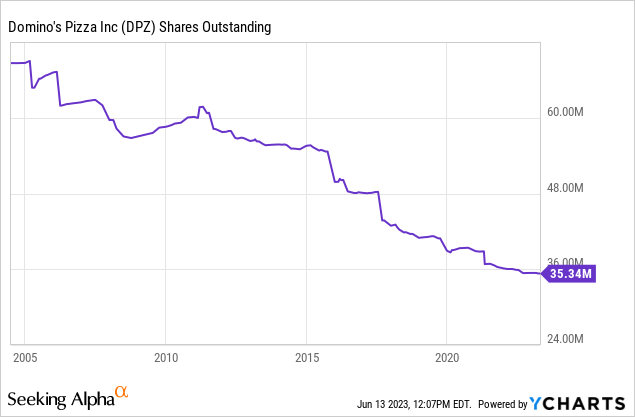

Domino's pizza is a buyback stalwart. Having reduced the float by about half since 2005, what more could you ask for?

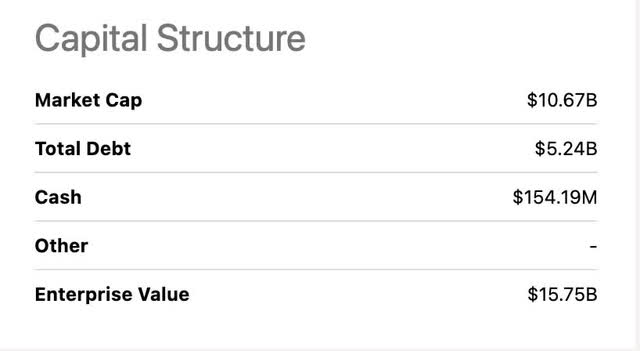

seeking alpha

Market cap is about double total debt, healthy at the moment. The company is a bit cash-light as interest expense is currently $197.9 million with $154 million in the coffers.

Free cash flow

seeking alpha

Nevertheless, Domino's is generating $373 million in levered free cash flow after interest payments. Making the cash on the balance sheet to interest expense a non-factor.

The dividend

Seeking alpha

Although Seeking Alpha is only giving Domino's a C- dividend safety grade, the payout ratio is only 34.77%. With a free cash flow/share of $11.73 and a payout ratio of only 41%, maybe they're seeing something I'm not. Looks like an amazing 5-year growth rate of 18.5% and a well-covered yield to me.

Catalysts

A return to top-line growth and a not coming to fruition of a looming recession. My opinion is that Domino's is an affordable enough option that they should be able to absorb business from dine-in options. Takeout usually results in the patron also giving lower to no tips versus a dine-in option. Also, a receding of inflation across commodities used in the food industry should raise the profit margins of both restaurants and consumer staples.

Risks

If this student debt repayment shock affects consumer spending in restaurants, we'll see the narrative hit the media pretty quickly. Since so many sectors are bound by their sector ETFs, one bad operator could depress the entire segment. Also, if Domino's gets priced as more of a stalled growth story and the market starts to re-price it on growth versus consistency, I could see this dropping down below $200.

Conclusion

I will add this to my board and begin to nibble at it. It is priced fairly on my high end. I would be more aggressive if it hits my blended owner earnings price level of around $287. I can see the rationale for this being priced historically low on a GAAP earnings basis.

It could be a great opportunity should this just be a blip on the radar of Domino's consistent EPS march combined with their share reduction. An increase in buybacks at these levels would be welcomed. Since they don't need much CAPEX over depreciation and amortization to maintain their growth rate, excess capital can still be safely allocated to buybacks and dividends.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SJM, MCD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.