May Inflation Report Shouldn't Change The Fed's Mind

Summary

- The Bureau of Labor Statistics released the May inflation report this morning.

- While headline inflation dropped notably, core inflation remains stubborn.

- Instead of a change in rates, there are two other things I will be looking for from the Fed tomorrow.

Eoneren

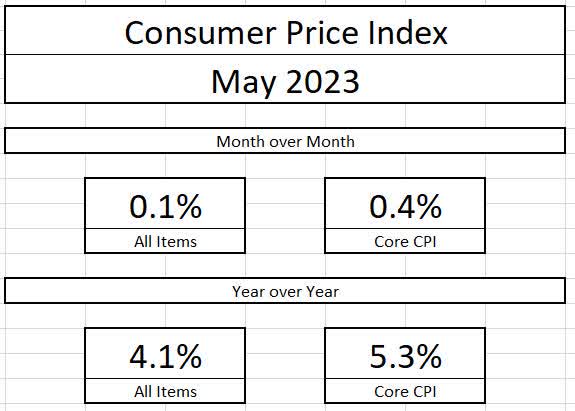

Earlier today, the Bureau of Labor Statistics released the Consumer Price Index for the month of May. The report is the first of two popular reports used to gauge price inflation in the economy. The results were mixed as headline inflation plummeted to 4.1% year over year, down 0.9% from last month. Core inflation remained stubborn at 5.3%, down 0.2% from last month.

Bureau of Labor Statistics

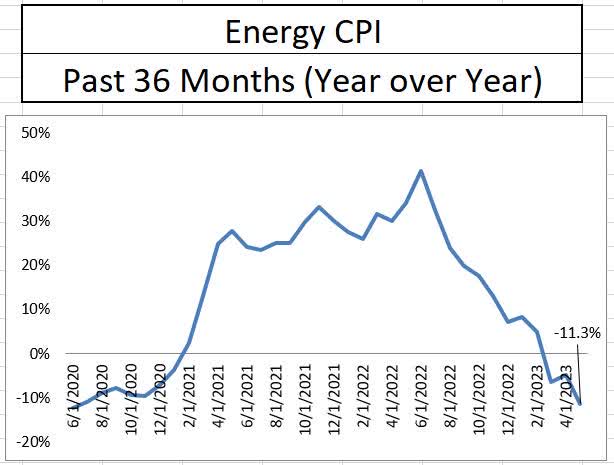

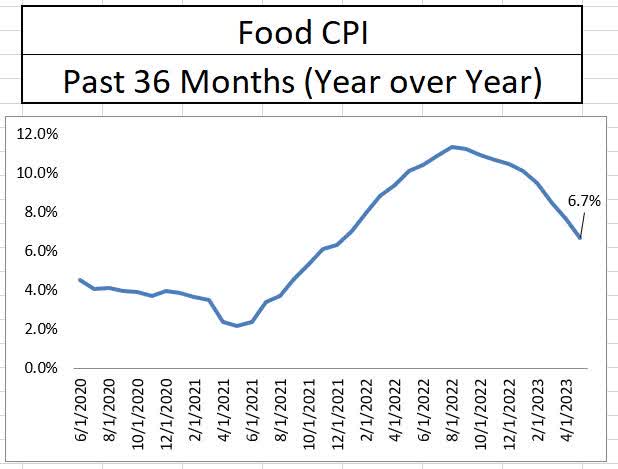

After two years of higher headline inflation than core inflation, the trend has reversed over the last couple of months. The 120-basis point discount in headline inflation is led by a large drop in energy prices. Food inflation continues to decline, but still remains robustly over 6%. Economists hope that the deflationary pull in energy pricing will spread to the broader sectors over the next several months.

Bureau of Labor Statistics

Bureau of Labor Statistics

Bureau of Labor Statistics

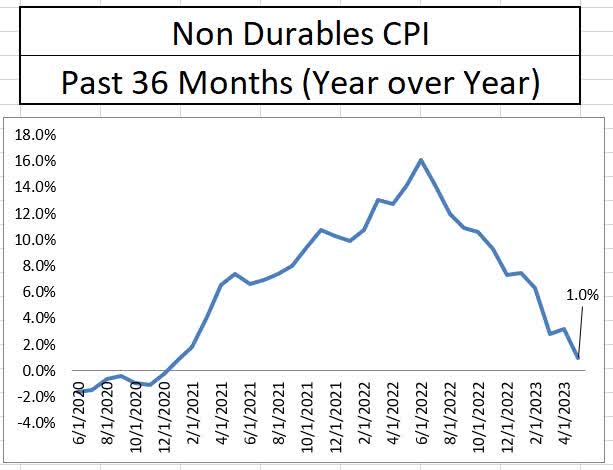

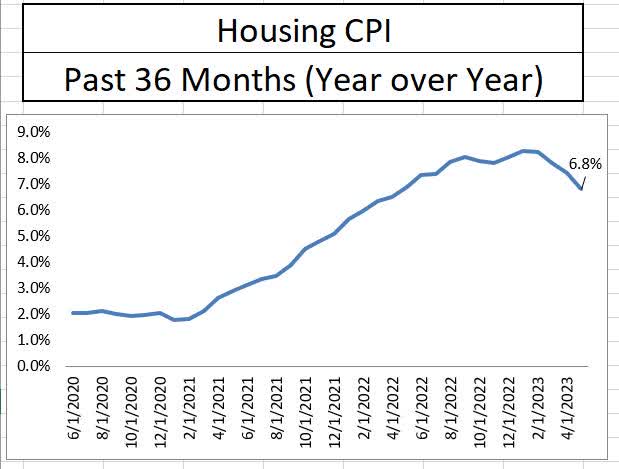

Despite the stubborn nature of the core CPI number, there was some promising data within the inflation report. First, nondurable goods, which are products that are disposable in nature, saw their price increase decline to just 1% year over year. This was the best reading in nearly two and a half years. Housing, which has seemed particularly stubborn with increased inflation up to January of this year, recorded its fourth consecutive month of disinflationary activity.

Bureau of Labor Statistics

Bureau of Labor Statistics

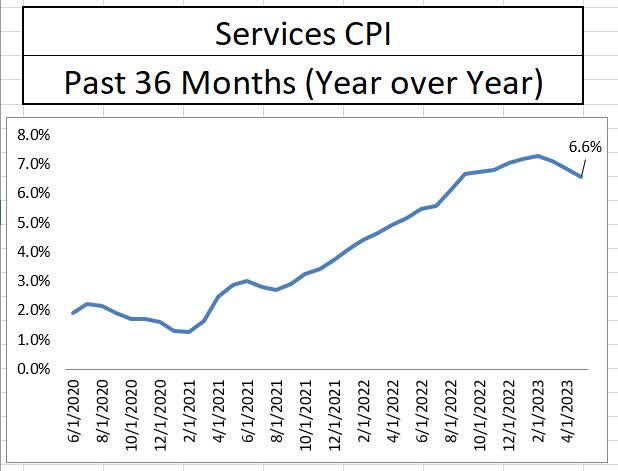

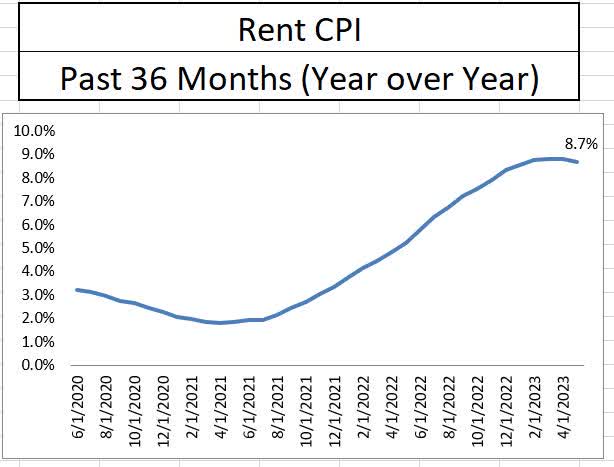

Yet, challenges remain in the Fed’s battle for price stability. Service sector pricing, despite dropping for the third consecutive month, remains elevated at 6.6%, just 0.7% away from its cyclical highs. Rent inflation finally dropped for the first time from its cycle high, but only by 0.1%. At 8.7%, rent inflation is far above any measures of price stability.

Bureau of Labor Statistics

Bureau of Labor Statistics

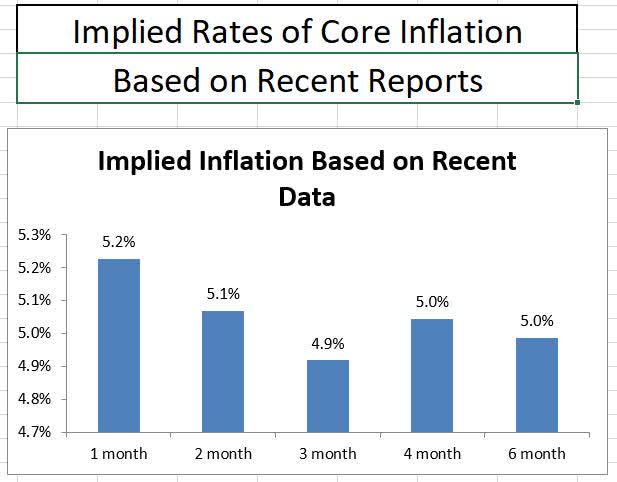

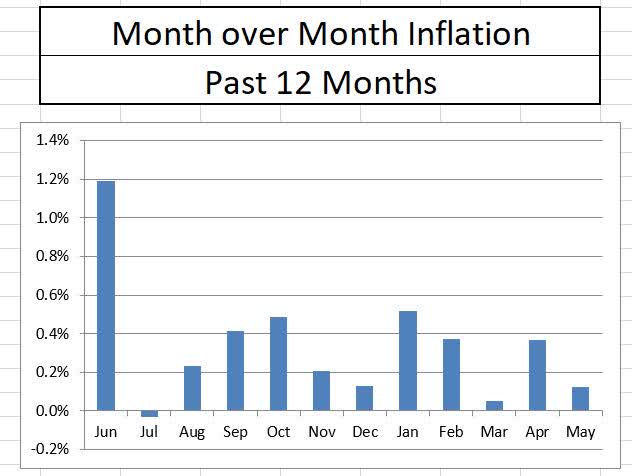

What may be most concerning is that there is nothing in the last twelve months of inflation data to show that core inflation is making any further progress. Currently, the last three months of inflation reports annualized is at 4.9%, and it represents the best possible near-term floor for core inflation. With progress moving slowly, it appears as if 2% core inflation may be more than two years out (at this rate).

Bureau of Labor Statistics

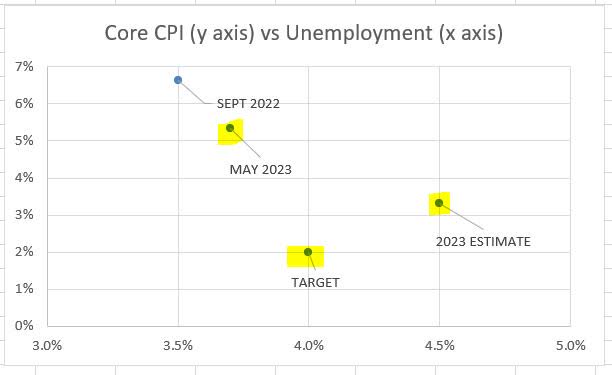

As for the Federal Reserve meeting tomorrow, I do think the committee will hold steady on rates, mainly because that was telegraphed into their economic projections back in March. However, do not be surprised if the Fed projects a 25 basis point increase into the forecasts for later this year, with a pause to follow. This would be due to the lack of progression along the Phillips Curve when it comes to both inflation and unemployment. While May’s readings in both areas moved us in the right direction, they are far off from the Fed's most recent 2023 estimates and even further away from the long-term targets.

Bureau of Labor Statistics

The June inflation report is likely to bring another downward drop in headline inflation as June 2022's 1.2% month over month inflation number will fall off the report. It is quite possible that we may be looking at a 3.0% headline number next month, but with energy being the primary driver behind disinflation, these trends can only continue if we see broader improvement in other pricing categories.

Bureau of Labor Statistics

Overall, the May inflation report represents a slow step in the right direction. The Fed will need to determine tomorrow whether the pace of disinflationary activity is acceptable or not. This communication point, combined with the latest economic projections, are what I will be looking for from the committee tomorrow.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.