Impala Platinum: Hidden Assets And New Risks Discussed

Summary

- Majority control of Royal Bafokeng Platinum will likely provide Impala Platinum with needed breathing space and adds to its net asset base.

- The Waterberg project provides Mogalakwena-esque attributes, and Impala Platinum might capitalize once early ores are delivered.

- New risks have surfaced within South Africa, namely the 2024 national election and railway issues.

- This article conveys under-covered factors to the global investment arena and does not form a conclusion on price discovery.

- Looking for a portfolio of ideas like this one? Members of The Factor Investing Hub get exclusive access to our subscriber-only portfolios. Learn More »

choochart choochaikupt

Based on my/our observations, most of Seeking Alpha's readers are informed about the Impala Platinum Holdings Limited (IMPUY) net asset base, PGM (Platinum Group Metals) prices, and the systemic risks faced by the company. However, Seeking Alpha authors, including ourselves, have yet to discuss "hidden assets" such as Impala's majority acquisition of Royal Bafokeng Platinum and its minority investment in the highly anticipated Waterberg Project.

Furthermore, we felt it would be prudent to discuss upcoming risks that few are aware of. The idea was to provide our readers with the necessary context to allow for individual risk premium adjustments.

Therefore today's article about Impala Platinum serves two purposes: 1) Discuss hidden assets, and 2) Provide an indication of factors that might influence Impala Platinum's risk premiums. As such, this article does not explore price discovery; instead, it reveals idiosyncratic talking points.

Without further ado, let's get stuck in!

Hidden Assets

To fully comprehend Impala Platinum's current status within the PGM space, a few overlooked or "hidden assets" must be considered. The two primary projects that could influence the firm's near- to medium-term financial statements are the RB Plat acquisition and the Waterberg Project.

Royal Bafokeng Platinum

Salient Features

Impala Platinum's recent majority acquisition of Royal Bafokeng Platinum (RB Plat) is well-known within South Africa; however, it remains asymmetrical knowledge in the global investment arena.

As announced at the close of last month, Impala Platinum secured majority control over RB Plat, extending its ownership to 55.46% after acquiring the Public Investment Company's stake. The rest of the ownership is shared between Northam (owning approximately 34%) and minority shareholders.

In our view, the significance of Impala's majority ownership control in RB Plat is threefold.

Firstly, it allows Impala to consolidate the underlying entity's net asset base, net income, and cash flows holistically, which adds financial synergies in the form of cost-cutting and market share. In fact, a year ago, Impala determined that the acquisition would add approximately 10% to 20% in mining contribution and add roughly 10% to cost efficiency.

Secondly, Impala's majority control extends its influence on RBPlat, allowing it to fully exercise its renowned mining expertise. In our view, the PIC's (a politically-driven fund) disengagement allows for less political input into the project's strategic decisions and provides Impala Platinum with the necessary freedom to execute its well-known low-cost mining operations.

Lastly, as announced in its latest quarterly financial results, Impala had to tie down capital and put much of its expansion strategy on hold prior to the majority acquisition of RB Plat, meaning successful majority ownership of the entity voids unnecessary opportunity costs. In essence, the acquisition frees up the company's project sequencing.

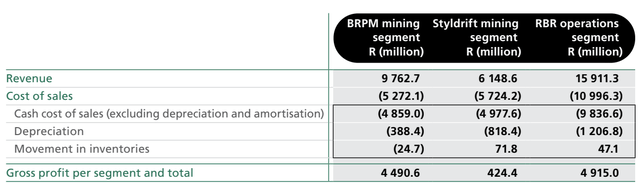

Breaking Down A Few Numbers

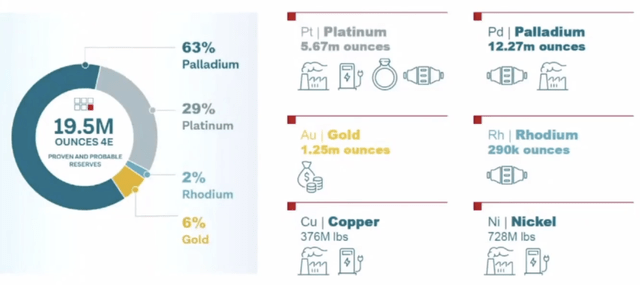

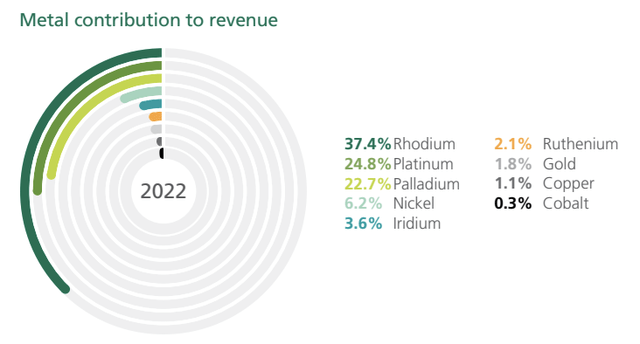

Royal Bafokeng is a nine elements company that primarily mines platinum group metals. Although Palladium might face a few headwinds from the possible slowdown in internal combustion vehicle sales, Platinum is considered a critical metal for the green economy, with the hydrogen economy being a possible catalyst. Furthermore, RB Plat generates meaningful income from base metals such as nickel and copper while also generating sustainable income from gold, which is a countercyclical asset.

Commodity Basket 2022 (RB Platinum)

Based on 2022's numbers, RB Plat has an asset base of nearly $2 billion. While slower PGM prices in 2023, higher interest rates, and a weaker South African rand might have impaired the company's asset base since RB Plat's 2022 integrated report, the long-term value additivity of South African PGM mining will probably result in continued growth for the entity.

A quick overview of RB Plat's 2022 numbers provides an indication of what lies ahead. Total revenue is growing at scale, primarily due to high-quality grades. Although there are interim challenges at the Styldrift ramp-up, we consider the property a critical asset. A mine with a 40-year + life expectancy, Styldrift's ramp-up was initiated in 2018, and we think long-term sequencing will add significant value.

RB Plat's operating margin sunk to a little over 24% in its latest operating year, receding from 31.09% in its previous. This was primarily due to Eskom headwinds and a weaker South African Rand. At the time of reporting, these concerns were uniform across the industry, and we expect them to abate, especially after the entity experiences further integration with its parent company, Impala Platinum, which is seeking off-the-grid energy solutions.

Lastly, RBPlat has an untapped debt facility of roughly $162 million. For those unaware, Impala Platinum is debt-free, and adding the debt facility with subsequent utilization might lower the firm's after-tax cost of capital.

Waterberg Project

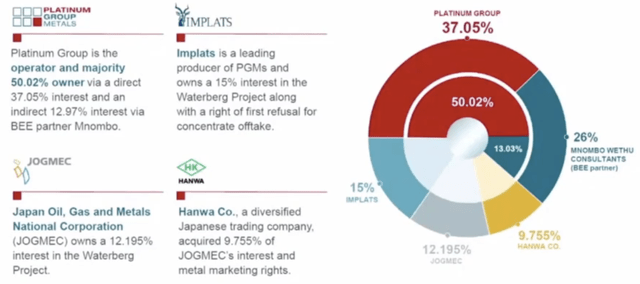

The Waterberg project is owned by Platinum Group Metals Ltd. (NYSE:PLG), and shared by numerous other investors, including Impala Platinum, which owns 15%.

Before I delve into the project's details, I would like to make a prediction. In my view, Impala will increase its 15% share to above 20% once the mine delivers its first commercial batch, subsequently allowing it to shift its investment from a financial security to an "investment in associates" on its income statement, allowing it to recognize proportionate net income instead of mere price gains/losses and dividends.

What substantiates my prediction?

Well, for one, Impala Platinum is actively involved in the mining process, and two, as shown by the RB Plat deal, Impala has a history of slowly buying up a majority or influential interest. Lastly, it makes no logical sense for Impala to invest in the project as an ordinary shareholder; it is a mining house and, by nature, wants to access synergies and enhance its market share.

Ownership Structure (Platinum Group Metals)

Let us delve into a few of the project's details.

Waterberg is considered a Tier 1 mining asset, with an expected mine life of 45+ years. It is a four elements project and is anticipated to deliver 420,000 ounces per year, with Palladium leading the way. Although early production is only expected to realize in three years' time, it is possible that gold streams will be delivered sooner, allowing the project to service any planned debt (discussed later).

Apart from its incredible mine life and proven reserves, Waterberg is a low-cost prospect. Instead of utilizing deep shaft mining, the project will leverage shallow ramp access. Moreover, the operation will focus much of its attention on the Northern Limb of South Africa's bushveld complex, allowing for Bulk mining, which is extremely rare and attracts a leaner, higher-skilled labor force, allowing for cost-cutting of up to 25% (versus industry standard).

A key value-add here is that Impala Platinum is actively involved in the mining process, which allows for experienced exploration input and cross-entity share of technology. Furthermore, JOGMEC (Japanese Organization For Metals and Energy Security) owns the metals marketing rights in an effort to supply PGMs to Japan's auto industry, which is headed for a restructuring.

From a financial vantage point, the project is expected to deliver a post-tax net present value of approximately $982 million with a maximum requirement of $617 million in funding. It is currently entering its initial construction phase with a surplus of $81 million in sunk capital realized. Although Waterberg is debt-free, it expects its initial production stage capital structure to settle at approximately 50% debt. In our view, acquiring the debt at favorable terms will not be an issue as the collateralized equity will probably be contributed on a pro-rata basis by the original equity investors. Moreover, the project is set to generate preliminary revenue from gold streams, allowing it to establish early-stage interest coverage.

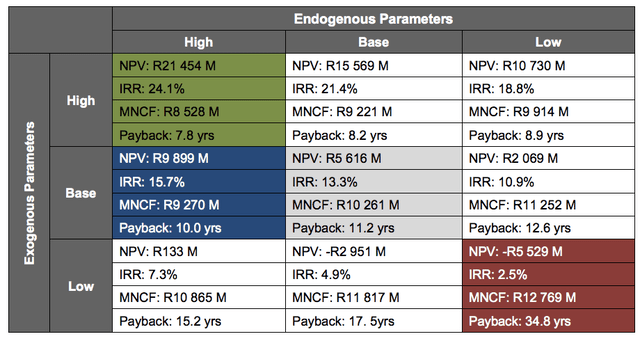

A scenario analysis suggests that the project's internal rate of return might settle between 2.5% to 24.1%. Waterberg is an exploration venture, meaning that sparse IRR (internal rate of return) projections are completely normal.

For those unaware, IRR is an annualized cash-on-cash return measurement often used in the private markets. As a rule of thumb, if IRR exceeds the cost of capital, your project is expected to add value.

IRR Projections (Platinum Group Metals)

In essence, Waterberg is a hidden asset that might add future value to Impala Platinum's asset base and contribute even further to the company's market share. To provide an indication of Waterberg's potential, many have compared the project to Anglo Platinum's (OTCPK:ANGPY) Mogalakwena mine, which is probably the most sought-after open-cast PGM mine in the world.

Risks - Drifting Away From The Eskom Debacle

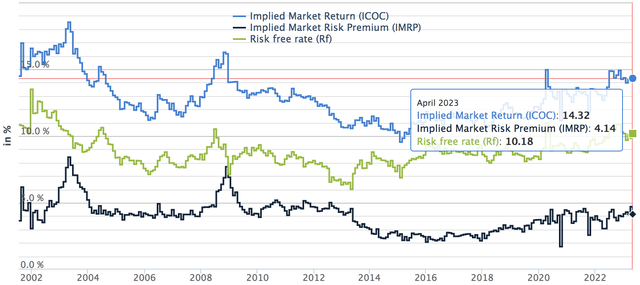

Impala Platinum's American Depositary Receipt has a beta of 1.4, which is measured against the U.S. stock market. Moreover, the company's primary listing is faced with rising risk premiums in South Africa.

What does this mean? It tells us that Impala Platinum has a high beta risk and that systemic issues might play a big role in the stock's future performance.

South African Risk Premiums (marketriskpremia.com)

We have discussed Eskom's issues in numerous of our previous articles. In addition, most of it is priced by now, meaning other risk factors need to be considered.

The standout "new" risk factor that investors must consider is South Africa's 2024 national election, which is anticipated to be the most closely contested election in decades. The African National Congress (current governing party) has lost its stronghold over the general population as South Africa has reached borderline failed state status.

As a result of the ANC's loss in popularity, likely alternatives have emerged. In our view, South Africa might enter an anti-free market regime within the next two elections as the popularity of the EFF (an opposing political party with anti-free market views) has risen significantly. This might force a coalition between the ANC and the EFF, raising South Africa's risk premiums even further as property rights and free markets might be under threat.

In our view, an alternative outcome in 2024 or succeeding elections would be a multiparty opposition coalition between parties led by the Democratic Alliance. Although such a scenario would be a messy affair, the common denominator among the possible constituents would be support for private property rights and free market activities. In our opinion, this would lower South Africa's equity risk premium.

Sidenote: For further information about the factors mentioned in this section that pertain to South Africa's political landscape, visit this link.

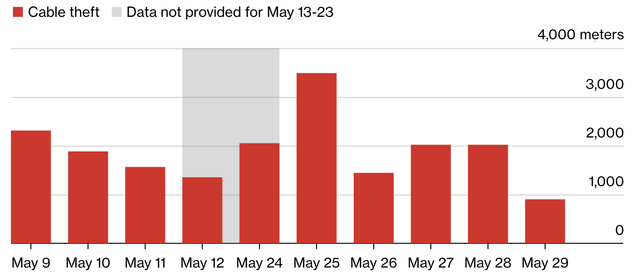

Lastly, cable theft in South Africa poses a significant threat to its miners. This might seem like a small issue; however, the reality is that local railways are poorly protected, and cable theft is becoming a lucrative business for local illicit businesses that are seeking to capitalize on poor security within the nation. Cable theft meant that Transnet's (national freight company) export lines operated at approximately 25% during May, raising systemic risk even further.

Cable Theft South Africa (Bloomberg)

In essence, Impala Platinum's newly surfaced risks are primarily systemic. The company has few structural concerns; therefore, we deem South Africa's political landscape and poor public infrastructure upkeep as its primary non-priced risks.

Final Word

Our analysis shows that Impala Platinum Holdings Limited's majority control over Royal Bafokeng Platinum allows the firm to proceed with its long-term value-creation strategy. Moreover, assuming Impala Platinum ups its stake in the Waterberg project, we see a significant opportunity for the company to add value to its net asset base with a Mogalakwena-esque property.

Furthermore, we think newly established risks like South Africa's 2024 national election and a defunct railway system are not yet priced by global investors. Nevertheless, structural issues within Impala Platinum are far and few (it is a powerhouse).

- Note: As mentioned in the introduction, this article serves the purpose of conveying under-covered information to global investors instead of discussing price discovery.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Looking for structured portfolio ideas? Members of The Factor Investing Hub receive access to advanced asset pricing models. Learn More >>>

This article was written by

Quantitative Fund & Research Firm with a Qualitative Overlay.

Coverage: Global Equities, Fixed Income, ETFs, and REITs.

Methods: Factor Analysis, Fundamental, Valuation, Street Gossip, and Common Sense.

Our work on Seeking Alpha consists of independent research and not financial advice.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.