Why I Sold ZIM Integrated: What's Next After Dividend Elimination And Upcoming Storm

Summary

- ZIM Integrated Shipping Services Ltd. is no longer a dividend stock.

- With freight rates back to pre-pandemic levels, the company saw all of its profits disappear.

- Barring another pandemic, this may be the new norm.

- I explain why I sold my position and what's ahead for ZIM Integrated stock.

- Looking for a portfolio of ideas like this one? Members of Best Of Breed Growth Stocks get exclusive access to our subscriber-only portfolios. Learn More »

shaunl

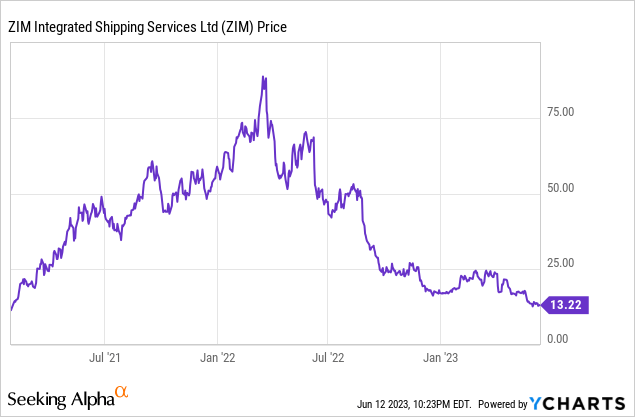

ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) appears to have lost much of its loyal investor following after its latest earnings report. After experiencing a financial boom during the pandemic as freight rates soared to astronomical levels, ZIM has now seen its profits evaporate as freight rates normalized to pre-pandemic levels. This is a company that has paid multiples of its current stock price in dividends over the last couple of years, but has most recently declined to pay its typical quarterly payout.

I caution dividend investors from focusing too much on recent history, as it is unlikely for those same ideal conditions to occur again in the near future, let alone on a sustainable basis. I have sold off my tiny stake, as the lack of visible catalysts make this a difficult position to defend.

ZIM Stock Price

The pandemic led to many unusual changes in society - increasing the popularity of shipping stocks among dividend investors among them. ZIM was once a "dividend hero," as it was able to generate so much in profits that its dividend yield was near triple digits. Those days are now over.

I last covered ZIM in December, where I rated the stock a buy due to valuation. The macro environment has deteriorated significantly since then, and I am thus thankful that my position size was very small. It is possible that ZIM eventually has another bull phase, but the likelihood of such an event is not looking favorable.

ZIM Stock Key Metrics

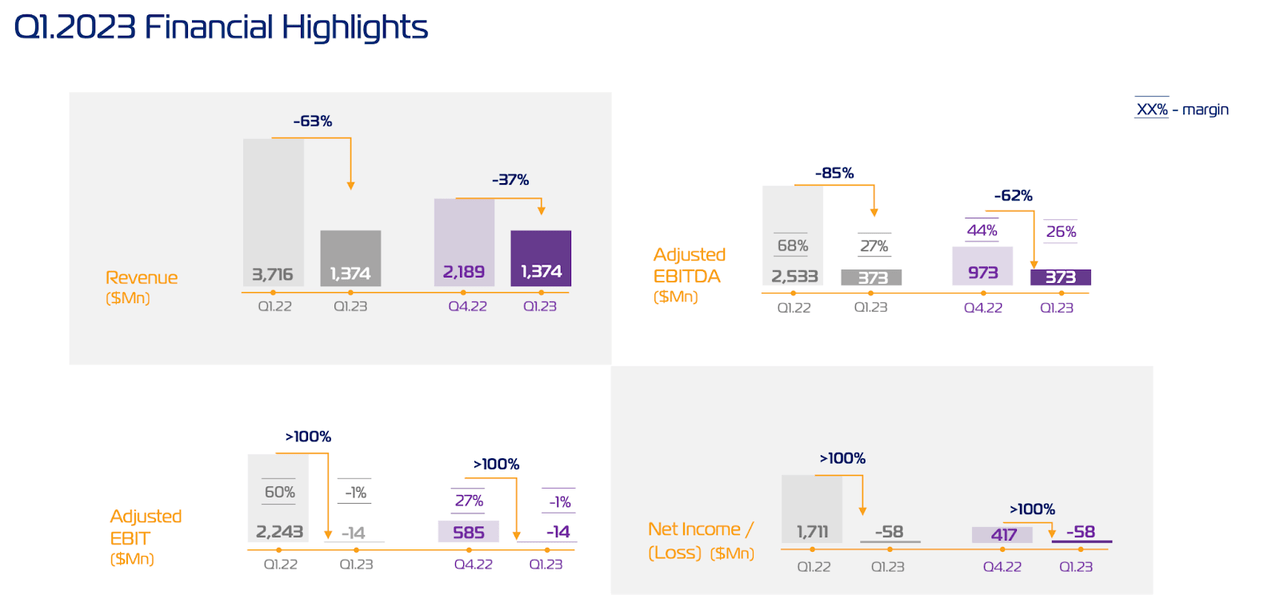

In its most recent quarter, ZIM saw a dramatic reversal of its financial fortunes, with its revenue declining 37% sequentially and 63% YOY. Due to operating leverage, adjusted EBITDA declined 85% YOY.

Depreciation & amortization totaled $387 million in the quarter, but repayment of lease liabilities and borrowings totaled $395 million. In the 2022 full-year, D&A totaled $1.4 billion and repayment of lease liabilities and borrowings totaled $1.5 billion. Those numbers suggest that adjusted EBITDA is a poor proxy for free cash flow. Yes, management has used adjusted EBITDA quite frequently in the past due to the company's high conversion of adjusted EBITDA to free cash flow in recent years, but the recent years can only be considered as extraordinary. Instead, investors should focus on adjusted EBIT, which went from positive $2.2 billion to negative $14 million. ZIM ended the quarter with $4.3 billion in cash and $381 million in net debt.

As I have discussed in my prior reports, there is some discrepancy between how retail investors are calculating net cash versus management's view of the same metric. Management has included lease liabilities in their calculation of net debt - excluding lease liabilities, the company continues to have a large "net cash" position. However, as just discussed above, the company has significant lease liabilities which can not be ignored. Now that freight rates have plummeted, investors who had previously been of the view that ZIM carried a net cash position might now have a strikingly different view of the balance sheet position.

Despite the tough first quarter results, management reaffirmed full-year guidance with expectations for up to $2.2 billion in adjusted EBITDA and $500 million in adjusted EBIT.

As discussed on the conference call, management discussed their assumptions for better macro conditions in the second half. At this point, I personally am of the view that it will be very difficult for the company to hit this guidance, as there is little indication that macro conditions can improve from here. Management did note that they may be able to drive some operational efficiencies as they replace expiring charters with newer large vessels, but the potential gains from these efficiencies pale in comparison with the insane cash flows that investors have come to expect.

Some investors may be concerned that the company might enter unprofitable contracts in order to maintain business relationships throughout the cycles. This is what management had to say:

Or do we end up would we -- do we consider securing and locking rates at a loss-making level? This is not the intention of the company. So we are not doing that, and this is also maybe what explains why we are not yet at this time of the year fully finalized when it comes to agreeing with our customers, the volume commitment and the rate commitment for the next 12 months, precisely because some of our customers have been pushing for rate reduction or our expectation is below the minimum level where we are willing to go. And that explains why it takes a little bit longer. So I think by and large, the answer to your second question, we do not intend to lock ourselves on revenue that would mean loss-making cargo for us.

My interpretation of that response is that while management obviously does not want to enter unprofitable arrangements, they can not guarantee that they will be able to determine that such arrangements can be profitable for any future fluctuations in freight rates.

Is ZIM Stock A Buy, Sell, or Hold?

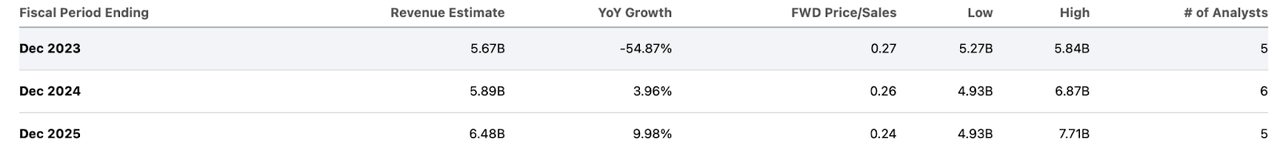

There was a time when investors valued ZIM on the basis of dividend yield. Consensus estimates do not anticipate the company generating any positive net income over the next 3 years.

The company is expected to see only a slight recovery on the top line starting next year.

The problem is as follows. As seen below, freight rates have completed a retracement to pre-pandemic levels after peaking during the pandemic.

Management and investors had previously given various arguments why freight rates would not drop down to these levels - it appears that the tough macro environment has won out in the end.

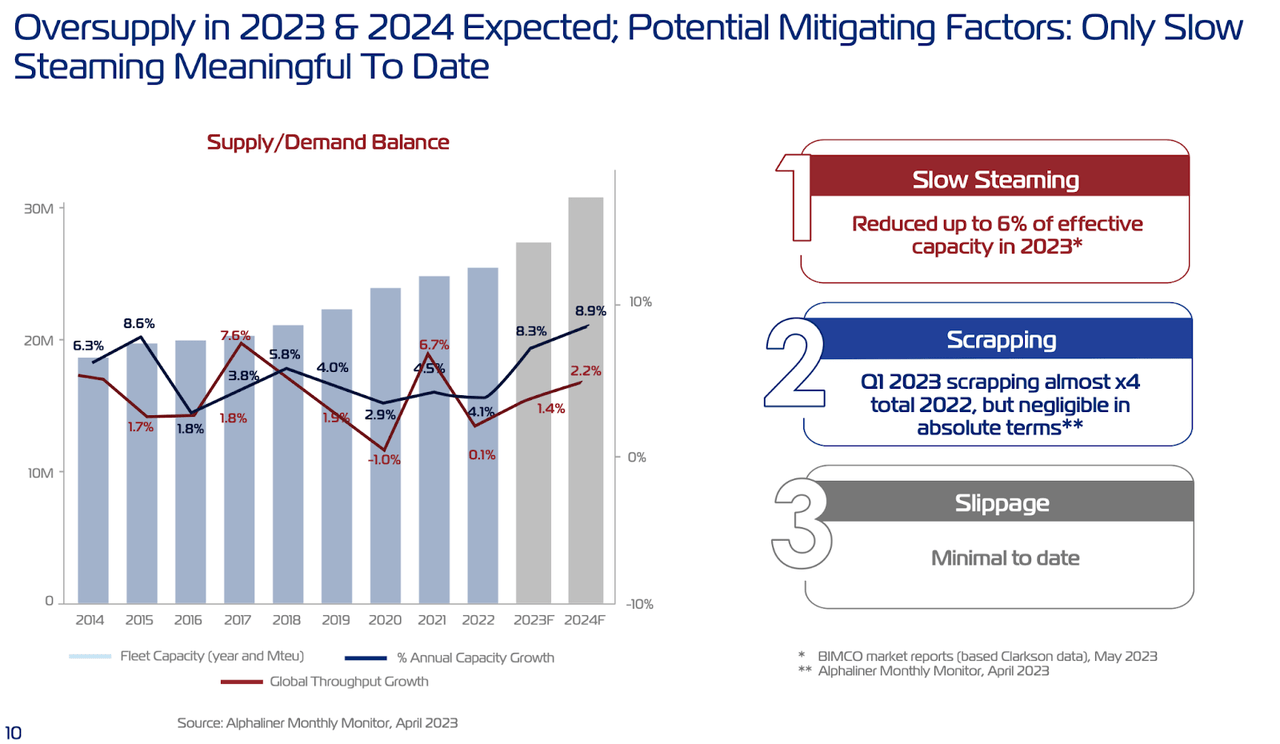

Making matters worse, supply is expected to increase greatly over the coming years as newbuilds come online - this should not be so surprising given the strong business fundamentals seen over the past several years.

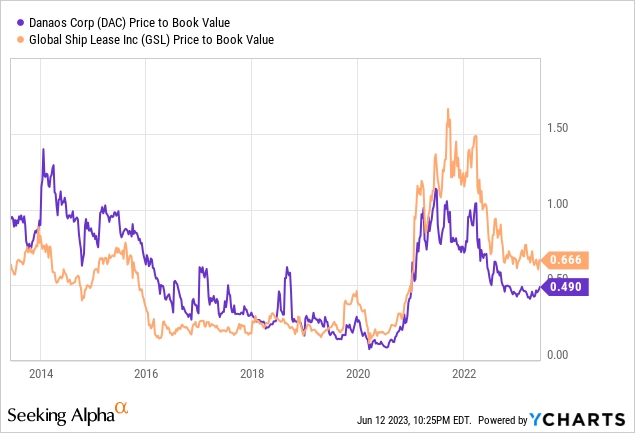

Barring another pandemic (knock on wood), it seems highly unlikely that freight rates will rise to the levels seen just several quarters ago. And that is a big problem. It may be tempting to believe otherwise due to recency bias, but we must look longer term. Consider that the stocks of lessors Danaos Corporation (DAC) and Global Ship Lease (GSL) have historically traded at very pessimistic valuations prior to the pandemic.

The favorable market conditions may have made the shipping sector appear highly investible during the pandemic, but the reality is anything but. Shipping is a highly cyclical sector and it is clear that winter is coming. Until freight rates recover, ZIM may see cash flow generation turn negative. If this persists over a long period of time, its strong balance sheet position may suffer as a result.

In my prior report of DAC, I discussed how leverage previously stood as high as 7x debt to EBITDA just several years ago. One mustn't underestimate the possibility that in several years, this too may happen to ZIM. However, unlike DAC, which is higher up on the capital structure due to being a lessor, there is little justification for ZIM to take on so much leverage. This means that the company may need to tap the equity markets for dilutive secondary offerings to shore up the balance sheet. With no profits and no real secular growth drivers, there are no catalysts for investors to hope for.

I do not mean to sound like a party pooper - that setup has important ramifications for the stock price. ZIM stock essentially has little downside support, and I can see the stock moving lower as pessimism truly moves across the sector. Yes, ZIM can offer stunning return potential if freight rates suddenly shoot up, but historical precedence indicates that current market conditions are the norm. It is possible that cash flow generation might improve over time as the company eventually renews charters at lower charter rates, but the balance sheet is likely to suffer between now and then. Due to the poor risk-reward proposition, I must downgrade ZIM Integrated stock to a neutral rating, and I have sold my tiny position.

Sign Up For My Premium Service "Best of Breed Growth Stocks"

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 10 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!

This article was written by

Julian Lin is a top ranked financial analyst. Julian Lin runs Best Of Breed Growth Stocks, a research service uncovering high conviction ideas in the winners of tomorrow.

Get access to his highest conviction ideas here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.