Betterware de Mexico: Sales Decline Slowing, Turning The Corner?

Summary

- Betterware de Mexico, a direct-to-consumer selling company of home and beauty products, has shown signs of a turnaround, with consolidated net revenue increasing by 74.9% in Q1'23.

- The company's core business, Betterware, is struggling post-Covid, while the recently acquired Jafra segment is expected to drive growth in the beauty and care products market.

- Despite the positive trend, BWMX faces numerous challenges, including a highly competitive market, integration risks with Jafra, inherent risks in the DTC business model, and country risks in Mexico.

JackF/iStock via Getty Images

Betterware de Mexico Overview

Betterware de Mexico, S.A.P.I. de CV. (NASDAQ:BWMX) is a direct-to-consumer selling company of home and beauty products in Mexico and the US. It was founded in 1995 and became the first Mexican company to list directly on the NASDAQ in March 2020.

Betterware de Mexico

The company operates two segments, the home organization products (Betterware segment) and the beauty and personal care products (JAFRA segment). Betterware's segment is divided into six subcategories of home organization: i) Kitchen and food preservation, ii) Home solutions, iii) Bedroom, iv) Bathroom, v) Laundry and Cleaning, and vi) Tech and mobility. The JAFRA's segment is divided into four subcategories of beauty and personal care: i) fragrance, ii) color, iii) skincare, and iv) toiletries. The company's segment products are sold in twelve catalogs published annually. The company operates mainly in Mexico and the United States.

Betterware is the core and struggling segment as post-covid people shy away from buying home products. In contrast, the Jafra segment was acquired a year ago and is expected to be the main growth driver as consumers’ appetite for beauty and care products grows.

We look at the recent results, which indicate signs of a turnaround and are paired with a cheap valuation. However, upon a deeper look, we see a complex business with too many structural flaws and the risks of operating in a highly competitive market with no product differentiations. We rate BWMX a HOLD.

Q1’23 - A turnaround?

BWMX produced an excellent turnaround. Consolidated net revenue increased 74.9% to Ps. 3,268.9M from Ps. 1,869.1M in 1Q2022. This is an acceleration from 46% YoY growth in Q4’22.

Quarter | Q1’22 | Q2’22 | Q3’22 | Q4’22 | Q1’23 |

Revenue YoY | -35.58% | 24.99% | 33.72% | 46.49% | 74.89% |

Source: BWMX's financials

Consolidated gross profit grew over 100% for the second quarter consecutively. The consolidated margin for 1Q2023 expanded to 72.8%, compared to 63.6% in 1Q2022, and improved sequentially from 72%.

Quarter | Q1’22 | Q2’22 | Q3’22 | Q4’22 | Q1’23 |

Gross Margin | 63.6% | 69.05% | 68.35% | 72.34% | 72.79% |

Gross Profit YoY | -28.75% | 52.08% | 62.46% | 112.8% | 100.2% |

Source: BWMX's financials

Looking at the bottom line, we see the same trend. Consolidated EBITDA also increased by 20.3% to Ps. 659.0M from Ps. 547.8M in 1Q2022, the second quarter of growth.

However, the key drivers of the positive trend were mainly attributed to Jafra Mexico and Jafra USA results, which accounted for 51% and 7% of consolidated net revenue, respectively.

Without Jafra’s inclusion (acquired a year ago), BWMX’s core business - Betterware’s organic growth decreased by 25.4% YoY, primarily due to a lower average associates and distributors base, partially offset by a higher average associate order. Accounting for inflation at around 6% for 2022/3, the existing business (Betterware) is contracting at a 30%+ rate.

Additionally, comparable EBITDA decreased by 23.9% in Q1’23 (42.2% in Q4’22), and comparable EBITDA margin improved slightly by 59 basis points showing little operating leverage.

It’s a worrying picture for the core business. However, things are stabilizing for Betterware sequentially as the decline rate slows. Additionally, BWMX’s sales decrease was smaller than the market; thus, the company believes its market share has increased from 4% in 2019 to 8% in 2022.

In the long-term, BMWX has grown revenue per share by 50% CAGR since available financials in 2017. Backing out Jafra’s revenue contribution, it would be roughly 25% CAGR, which is still very good.

Cash flow & Capital Allocation

Free cash flow for the quarter was strong, with an increase of more than 300% attributed to Betterware and JAFRA’s cash flow generation, lower CAPEX, and efficient working capital management.

For the quarter, free cash flow increased to Ps. 679M from (Ps. 141M) in Q1’22, boosted by the inclusion of Jafra Mexico and partially offset by Jafra USA operations.

Capital allocation

BMWX allocates

Ps. 10M to CAPEX, lower than quarterly figures in the last three years, and going forward, the management aims to allocate 1% of net revenue to CAPEX (due to the significant capacity installed).

With the acquisition of Jafra for Ps. 4.7B, which was partly funded by the net debt issuance of Ps. 4.6B, increasing the leverage ratio to 2.6x Net Debt/EBITDA. The company aims to reduce to below 2.0x by the end of 2023. Therefore, in the near term, BWMX will focus most of the cash flow on reducing debts.

Nevertheless, the Board of Directors has proposed to pay a Ps. 150M dividend to shareholders for the quarter, and intend to grow the payments if results are expected.

Outlook

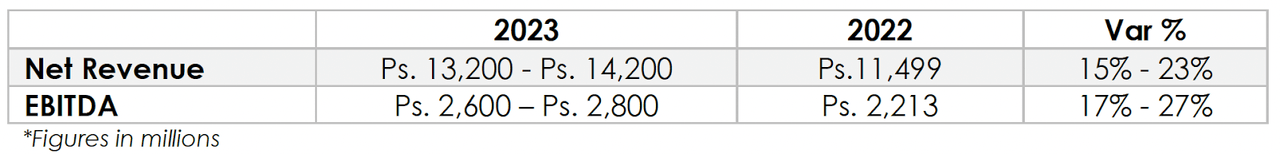

BMWX guided growth for both revenue and EBITDA in FY2023.

BWMX's financials

Backing out Jafra’s contribution (estimated at Ps. 6B or annualized Q1’23 figures), sales for Betterware for FY23 would be Ps. 7.5B at the mid-point, indicating a 25% decline in organic growth YoY, showing a slower decline, but it appears the Betterware segment would still perform terribly in FY2023. Per my calculation, a 25% decline in sales differs greatly from what management said at the Q4’22 calls, indicating modest growth for FY2023. I am not sure how to reconcile the gap.

In the case of Betterware, as you remember, the curve is for this year is basically no growth in the first and second quarter, and we will begin growing in the third and fourth quarter in terms of revenues. In terms of EBITDA, I think we have strong EBITDA margins since we will have reductions from the first quarter. And will remain basically the same all over the year.

I believe FY2023 growth will come from the Jafra segment (more from Mexico than the US) and that Betterware will see a slow recovery but not enough to come back to growth the 25% CAGR growth level of the past five years (2017-2022).

Negatives

I find a lot of negatives in BMWX as a long-term investment.

(-) It’s not a straightforward business that is highly competitive and cyclical. Additionally, BWMX has made a big acquisition recently to enter a new market, issued large debts to fund it, changed corporate names in the past years, and formed by merging with DD3 and Forteza in 2020.

2022, Jafra - entry to skincare

2021, Changed name

2021, Issued large debts

2021, Acquired 70% of Innova Catálogos, S.A. de C.V., for Ps.5,000. Innova Catálogos is dedicated to purchasing and selling clothing, footwear, and accessories.

2020, the Merger with DD3 was closed and consummated.

2020, the Forteza Merger was closed and consummated

2017, Betterware entered into a merger agreement with Betterware Controladora, S.A. de C.V. (“BWC”) and Strevo Holding, S.A. de C.V. (controlling company of BWC and, in turn, a subsidiary of Campalier). Betterware was the surviving entity of such a merger, and the merged companies ceased to exist.

It’s a lot of changes from when founded in 1995 as a space-saving and hygiene household reseller.

(-) ‘Pyramid DTC sales schemes’ often have a bad name and are under stricter government rules in terms of

i. operations, such as order cancellations, product returns, inventory buy-backs, and cooling-off rights for consumers and distributors, as well as

ii. legal treatments as self-employed or as employees, which has implications on costs and social benefits liabilities.

(-) Retention risks - Recent quarters showed a higher-than-average churn rate for associates at 3.7 % a week, a sequential increase from 3.4%, and vs. historical average rate of 2.8% a week. BWMX also experienced high turnover at 2% among distributors since they can terminate their services anytime, although normalizing from the peak Covid churn rate at 3.4%.

(-) Competition risks - no real differentiation from other products

The market for BWM’s products is competitive. They compete directly with branded, premium retail products with no real differentiation and low entry barriers. Some competitors are Mercado Libre, Home Depot, and IKEA, among others.

(-) Integration risks, no clear synergies

There are financial, managerial, and operational challenges with integrating JAFRA, and management has not disclosed much about synergies.

(-) Ownership risks - Campalier owns approximately 53.38% of the outstanding common stock of Betterware.

(-) Supplier risks

BWMX has limited control over the manufacturing process. BWMX has outsourced product manufacturing functions to third-party contractors mainly located in China. In 2022, products supplied by Chinese manufacturers accounted for approximately 94% of BWM’s revenues.

(-) Delayed in the filing of the FY2022 annual report due to immaterial adjustments/errors -

The expected impact of these adjustments will be to lower net income for the fiscal year ending December 31, 2021, by approximately 5% and to increase the net income for the fiscal year ending December 31, 2022, by approximately 6%. These estimates are subject to change based on the final analysis and audit.

(-) Country risk - Mexico is currently experiencing high levels of violence and crime due to, among others, the activities of organized crime. The presence of violence among drug cartels, and between these and the Mexican law enforcement and armed forces, or an increase in other types of crime, pose a risk to BWMX.

Summary

The management has underestimated the challenge of retaining the sales force - associates and distributors - and the integration of Jafra. However, they were candid about the mistakes. They sounded hopeful as they laid out initiatives to improve the struggling segment - Betterware by (i) redesigning the catalog to increase SKUs to 370 and make them available online and (ii) improving sales operations by simplifying commission structure, introducing Betterware App, and employing 80 field managers.

They also make positive steps towards easing inventory levels and aim to diversify their reliance on manufacturers in China to 70% of total production from 94% this quarter.

However, I prefer a simpler business with a clearer competitive advantage and a longer track record of performance. BWMX doesn't qualify as a sleep-well investment, which I am looking for.

At the moment, there are a lot of risks around BWMX’s business that will take a long time to transform. Nevertheless, the last two quarters have shown that things are stabilizing.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.