Ovid Therapeutics: Bullish Outlook Strengthened By Positive 2-Year Open-Label Trial Results

Summary

- Ovid Therapeutics' TAK-935 has a high potential for positive Phase 3 clinical trial results for both Dravet Syndrome (DS) and Lennox-Gastaut Syndrome (LGS).

- Significant Revenue Potential. The median annual cost of orphan-designated therapy is approximately $218,000.

- The estimated total addressable market for TAK-935 includes approximately 159,000 patients with DS and LGS across the US, EU, and Japan.

- OVID stock is currently undervalued, with a target price of $5.36 per share compared to the current share price of $3.66, offering substantial upside potential.

Evgenii Kovalev/E+ via Getty Images

Introduction

In my previous analysis of Ovid Therapeutics (NASDAQ:OVID), I evaluated their TAK-935 phase 2 clinical trial (ELEKTRA) and estimated the asset's revenue potential based on various scenarios. In this article, I will delve deeper into the analysis of the ELEKTRA study, with a focus on patients with Lennox-Gastaut Syndrome (LGS) due to the statistically insignificant data observed in the phase 2 study. Additionally, I will assess the probability of obtaining positive clinical trial results for LGS patients, considering that they make up two-thirds of OVID's target market.

Company and market data:

| OVID (NASDAQ) | |

| Closing Price (as of June 6, 2023): | $3.64 |

| Rating: | BUY |

| Price Target: | $7.11 |

| 52-Week Range: | $1.405 - $3.889 |

| Shares Outstanding: | 70.5M |

| Market Capitalization: | $256.7M |

| Cash & cash equivalents: | $63M |

| Fiscal Year End: | DEC |

Table 1: Ovid Therapeutics Key Statistics (seekingalpha.com)

Competitors Analysis

OVID is currently developing a molecule called TAK-935, also known as OV-935 or Soticlestat, for the treatment of rare seizure disorders. Specifically, the company is focusing on addressing the needs of patients with Dravet Syndrome (DS) and Lennox-Gastaut Syndrome, which are two pediatric epilepsies that are characterized by seizures that are often resistant to classical anti-seizure medications. These disorders are extremely rare, with an estimated prevalence of 159,000 (calculation provided in valuation model) patients across the United States, European Union, and Japan. It is worth noting that OVID is entering a highly narrow and competitive market where three established players, namely UCB (Fintepla), Jazz Pharmaceuticals (Epidiolex), and Biocodex (Diacomit), are already present.

Epidiolex, an approved medication for Tuberous Sclerosis Complex (TSC), Dravet Syndrome, and Lennox-Gastaut Syndrome, has achieved significant success in the market. It was launched in 2019, generating sales of $296 million in its first year and serving an estimated 9,000 patients. By 2022 (Year-4), Epidiolex's revenue soared to $736 million serving over 22,000 patients. Overall, Epidiolex has demonstrated impressive market performance, driven by its relatively lower cost (~$32,000/year), broader market coverage including TSC, and early market entry. These factors have contributed to its status as the top-earning medication in this therapeutic segment.

Fintepla, approved for patients with Dravet Syndrome and Lennox-Gastaut Syndrome, entered the market in 2021, achieving sales of $74.7 million and serving approximately 1129 patients. It captured an estimated 0.7% of the total DS and LGS market in its first year in terms of the number of patients treated. Zogenix was then acquired by UCB in March of 2022. In the 9 months ending December 2022, Fintepla generated revenue of $124.6 million and reached over 1,000 patients (UCB 2022 Annual Report p. 202). Fintepla is quite pricey compared to Epidiolex with an estimated annual cost of approximately $126,000. UCB is a prominent player in the epilepsy market serving over 2.6 million patients in 2022 with a range of epilepsy products and generating revenues of $2.7 billion USD.

Competitors | Fintepla | Epidiolex | Diacomit |

Company | Zogenix Inc(UCB) | GW Pharmaceuticals(Jazz Pharmaceuticals) | Biocodex |

Indication | DS / LGS | DS / LGS / TSC | DS |

Reg. Approval Date | June 25, 2020 | June 24, 2018 | August 20, 2018 |

Reached Market(Time to market) | 2022 | 2019 | - |

Year-1 Revenue | $125.9M | $245.59M | - |

Year-1 Number of Patients | 1333 | 7556 | - |

Year-1 Market Grab | 0.83% | N/A | - |

Revenue Per Patient (Annual) | $128,918 | $32,502 | - |

Table 2: TAK-935 Competitors; Abbreviations: DS, Dravet Syndrome; LS, Lennox-Gastaut Syndrome; TSC, Tuberous Sclerosis Complex. (Created by the Author from multiple resources)

There is significant competition in this market with multiple orphan-designated anti-seizure medications already approved. Diacomit stands out for its superior efficacy (Table 3). However, it is currently only approved for use in DS patients on clobazam. Both Epidiolex and Fintepla demonstrate similar clinical efficacy, but Epidiolex holds a significant advantage in terms of cost-effectiveness, being considerably cheaper. As for TAK-935, there is no indication that it will surpass the efficacy of any of the current market players. This lack of superiority in efficacy could diminish Takeda's pricing power which significantly decreases cash flows.

Competitors | TAK-935 | Fintepla FDA Approved | Epidiolex FDA Approved | Diacomit FDA Approved | |

Lennox-Gastaut Syndrome | |||||

Percent reduction in drop seizure frequency | -18.5 1†(n=35) | -26.5 2(n=87) | -43.9 4(n=86) | NA | |

Phase | 2 | 3 | 3 | 3 | |

Dravet Syndrome | |||||

≥50% reduction in convulsive seizure frequency | 41.7% 1(n=24) | 53.5% 3(n=43) | 49.3% 5(n=67) | 71% and 67% 6(n=33) | |

Phase | 2 | 3 | 3 | 3 | |

Table 3: Clinical Efficacy comparison between TAK-935, Fintepla, Epidiolex, and Diacomit; † statistically insignificant (Created by Author)

Clinical Trial Analysis

In my previous article, I noted that the TAK-935's phase 2 clinical trial data showed strong support for efficacy in patients with Dravet syndrome but yielded statistically insignificant results for patients with Lennox-Gastaut syndrome. LGS represents two-thirds of the target market which significantly impacts the potential cashflows of this asset. This article will delve into a comprehensive analysis of the phase 2 clinical trial (ELEKTRA), with a focus on the LGS stratum. The primary objective is to evaluate the probability of positive outcomes in the upcoming phase 3 clinical trial.

Dravet Syndrome:

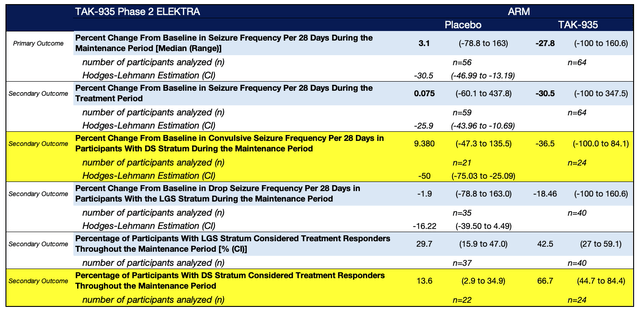

Phase 2 clinical trial data strongly support the efficacy of TAK-935 in patients with DS. The data shows a significant reduction in seizure frequency, with patients in the intervention arm experiencing a median reduction of 36.5% compared to a median increase of 9.3% in the placebo group. The P-value of 0.001 indicates overwhelming evidence and a very low likelihood (1 in 10,000) of obtaining these results if there were no real differences between the groups.

The Hodges-Lehmann Estimation further supports the efficacy of TAK-935, with an estimated difference of -50 between the medians of the intervention and placebo groups. The confidence interval (CI) of -75 to -25 provides additional support, as the lower end of the CI falls below zero. Moreover, 66.6% of participants in the intervention group exhibited a response of ≥25% reduction in seizure frequency, compared to only 13.3% in the placebo group with no overlap in the confidence intervals between both groups, further reinforcing the efficacy of TAK-935 in patients with DS.

Figure 1: TAK-935 Phase 2 clinical trial (ELEKTRA) (clinicaltrials.gov)

Lennox-Gastaut Syndrome:

Unfortunately, TAK-935 did not demonstrate effectiveness in treating seizures in patients with LGS. If TAK-935 is not approved for LGS treatment, it would result in a two-thirds reduction in the total addressable market. Now, the key question is the likelihood of positive outcomes in the upcoming phase 3 clinical trials led by Takeda for LGS patients. To address this question, I will go through the etiologies of both disorders followed by an analysis of the recent interim data provided by the Open Label Extension (ENDYMION1) and finally, I will benchmark TAK-935's phase 2 data against other phase 3 clinical trials to see how it compares in terms of efficacy.

The first question I asked myself is why these two pathologies are targeted together. Both Dravet syndrome and Lennox-Gastaut syndrome have different etiologies, with DS having a relatively straightforward etiology while LGS displays a more heterogeneous etiology. The etiologies do not overlap, which means that a medication effective for one syndrome may or may not be effective for the other. Both these pathologies are targeted together probably due to the pharmaco-resistance that often develops in both these pediatric epilepsies.

Takeda recently published an interim analysis of the ENDYMION 1 Open-Label Extension (OLE), shedding light on the therapeutic efficacy of TAK-935 in patients with LGS. The data shows a sustained reduction in seizure frequency over the 2-year extension study. However, it's important to note that the absence of a placebo group and a significant dropout rate introduce uncertainty, necessitating a cautious interpretation of these results.

Dravet Syndrome | Lennox-Gastaut Syndrome | |

Weeks 1 - 12 | -33.7% (n=46) | -29.3% (n=79) |

Weeks 49 - 60 | -47.8% (n=28) | -14.1% (n=49) |

Weeks 97 - 108 | -58.2% (n=22) | -36.6% (n=35) |

Table 4: TAK-935 2-year Open-Label Extension (OLE)

The absence of a statistically significant reduction in seizure frequency among LGS patients in the ELEKTRA trial can be attributed, in part, to the considerable variability in seizure frequency observed between the intervention and placebo groups. LGS is characterized by a diverse range of underlying causes and notable volatility in seizure patterns. This is evident from the substantial variation in baseline seizure frequency observed between the intervention and placebo arms of the study, as highlighted in Table 2. This high variability makes it challenging to detect statistically significant effects.

Baseline Seizure frequency | DS | LGS | ||

Characteristic | Soticlestat, n=26 | Placebo, n=25 | Soticlestat, n=43 | Placebo, n=45 |

Mean (SD) | 13.77(11.0) | 13.19(23.914) | 440.98(1133.5) | 150.02(203.8) |

Median | 9.05 | 6.00 | 67.30 | 89.80 |

Minimum, maximum | 2.6, 40.3 | 2.5, 125.0 | 8.1, 5187.7 | 4.0, 1040.1 |

Table 5: Baseline Seizure Frequency in TAK-935 Phase 2 Clinical Trial (Source:clinicaltrials.gov)

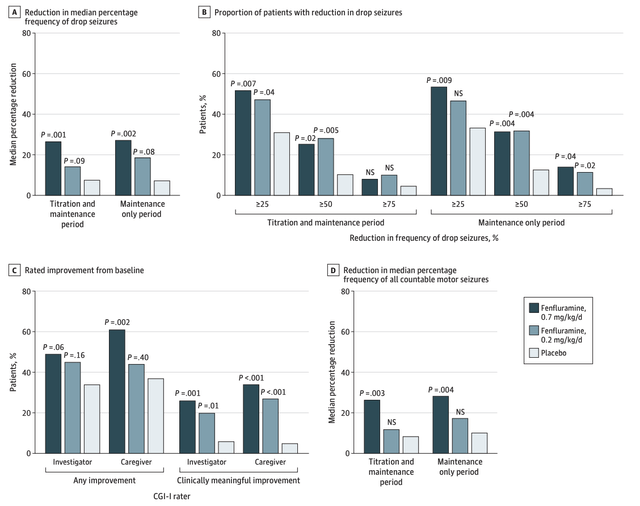

The phase 3 clinical trial of Fintepla in patients with LGS also demonstrated this pattern. Specifically, the 0.2 mg/kg/day group showed statistically insignificant results, of Fintepla's efficacy (Figure 2). A possible explanation for this could be the notable variability in baseline seizure frequency between the 0.2 mg/kg/day group and the placebo group (Table 6). In contrast, the 0.7 mg/kg/day group, which presented overwhelming evidence supporting Fintepla's effectiveness, did not exhibit the same level of variability in baseline seizure frequency.

Figure 2: Fintepla Phase-3 Clinical trials for Lennox-Gastaut Syndrome (LGS) (Source: JAMA Neurology)

| Placebo | 0.2 mg/kg/d | 0.7 mg/kg/d | |

| Median (Range) | 53 (2-1761) | 85 (4-2943) | 83 (7-1803) |

Table 6: LGS Baseline seizure frequency in Fintepla Phase 3 Clinical Trial

In conclusion, I believe there is a high likelihood of observing statistical efficacy in patients with DS and LGS during the phase 3 clinical trial for TAK-935. This conclusion is supported by the data from the phase 2 clinical trial and the sustained reduction in seizure frequency observed during the Open-Label Extension (OLE) study. Although no statistically significant measures were found between LGS patients and the placebo group, I attributed this to the high variability in baseline seizure frequency between the two groups. The increased power of the phase 3 clinical trial design will address this risk.

Valuation

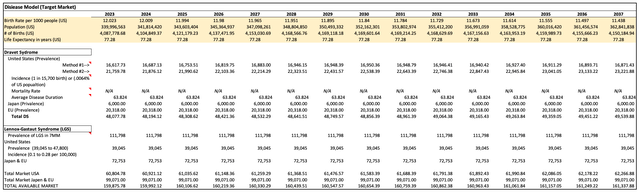

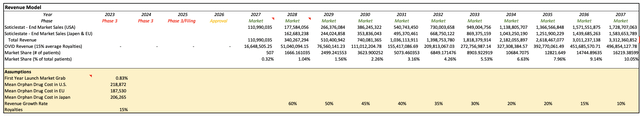

In the valuation model, a Discounted Cash Flow (DCF) analysis was conducted. The first step involved estimating the total addressable market by utilizing incidence and prevalence data for patients with both DS and LGS. The primary focus was on key global markets, including the US, EU, and Japan. The estimated total addressable market encompassed approximately 159,000 patients, with around 99,000 representing LGS patients and the remaining 60,000 comprising DS patients. (assumptions made are found in each cell of the Excel model provided)

Calculation of the prevalence of Dravet Syndrome (DS) and Lennox-Gastaut Syndrome (LGS) in the US, EU, and Japan (Created by the Author)

Revenue model:

To forecast the revenue potential, I assumed that TAK-935 would capture a comparable market share as Fintepla did in its initial year, which was estimated at 0.7%. I also assumed TAK-935 to become available in the United States in the first year, followed by Japan and the European Union in subsequent years. To determine the pricing strategy, I used the median cost of orphan-designated drugs in the United States, Japan, and the European Union. Lastly, I assumed an 80% probability of receiving FDA approval and discounted the projected revenues accordingly.

The figure below shows Takeda's (NYSE:TAK) projected revenue from TAK-935. According to my model, I estimate that by 2037, TAK-935 would capture approximately 10% of the target market, provide treatment for approximately 16,000 patients, and reach revenues of $3.3 billion.

TAK-935 Revenue Projections (Created by the Author)

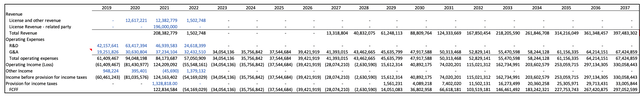

Free Cash Flows and DCF Model:

The calculation of Free Cash Flows to Firm (FCFF) for OVID was performed considering the company's receipt of royalties from Takeda, without any involvement in additional research and development (R&D) or manufacturing activities related to the asset (10-Q P.18). Consequently, line items such as R&D, depreciation, and amortization were assumed to be zero. The analysis centers on the cash flows directly associated with the royalties from Takeda.

Ovid Therapeutics Free Cash Flows (FCF) (Created by the Author)

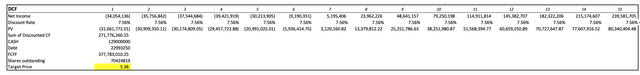

I estimated a target price of $7.14 per share compared to the current share price of $3.66. I calculated a WACC of 7.56% based on the Capital asset pricing model (CAPM). Based on my assumptions the stock is undervalued with a target price of $5.36 and a potential upside of 46%.

Ovid Therapeutics Discounted Cash Flow (DCF) Model (Created by Author)

Limitations:

No valuation model is without limitations. I provide the DCF model here for readers to input their own assumptions.

- To accurately determine the specific percentage of patients falling within the target market, further narrowing of the market is required, particularly by estimating the number of patients who have failed classical Anti-seizure medication.

- The model is sensitive to the initial market penetration assumption. Fintepla's year-1 market penetration was used as a proxy. However, alternative, and potentially more accurate approaches might exist to estimate initial market penetration.

- I assumed the patent will end in 2037. According to the Takeda-Ovid collaboration agreement, royalties end with patent expiration (10-Q P.18-19).

- I assumed an 80% probability of a positive outcome in the phase-3 clinical trial for both Dravet Syndrome and Lennox-Gastaut Syndrome patients. Comparing this probability to historical FDA approval data for neurology drugs shows a probability of 46% of obtaining FDA approval, I considered the 80% probability to be a reasonable assumption considering the positive phase 2 clinical trials.

- The annual revenue per patient was estimated at $218,872/year based on a 2023 study. It is unlikely that TAK-935 can demand this price considering the alternatives. The model is also sensitive to this assumption. Multiple peer-reviewed research publications provide a range of estimates for the median orphan price. In this case, I utilized the most recent estimate.

Catalyst:

Catalysts for the next 2 years will mainly focus on clinical trial results and interactions with regulatory authorities.

- Positive Interim/Phase 3 clinical trial results: Both the LGS and DS studies are expected to be completed in Mid FY2024.

- Filing and acceptance of NDA, approval, or other interactions with regulator authorities: Expected to take place in late FY2024 and FY2025.

Risks

- Clinical Trial Risk: Statistical inference cannot replace the inherent risks associated with clinical trials. It is important to note that Phase 3 clinical trials may not always yield statistically significant results, even after promising Phase 2 trials. The complex etiology of patients with LGS and the high variability in seizure frequency further contribute to these risks.

- Competition: The existence of three approved orphan-designated therapies for patients with DS and LGS, all vying for a limited market share.

- Pricing Power: This competition greatly affects Takeda's Pricing Power.

- Target Market Limitations: TAK-935 being approved for only DS patients shrinks the total addressable market by two-thirds.

- Product differentiation: Given that all currently approved therapies for treating patients with DS and LGS demonstrate comparable efficacy, the lack of differentiation in efficacy or tolerability may adversely affect the sales potential of TAK-935.

Financials

As of June 6th, 2023, OVID's share price was $3.64. The 52-week range was $1.41 - $3.89. OVID has 70.5 million outstanding shares and a market capitalization of $256.7M. Based on the latest 10Q report for the 3-month period ending on March 30, 2023, OVID has a solid financial standing.

Shares Outstanding and Diluted Shares both stood at 70.5 million, indicating no risk of stock dilution. The net operating cash flows for the three months ending March 31, 2023, amounted to -$12.1 million. However, the company maintains a healthy cash and marketable securities balance of $117.1 million, projected to sustain operations until Q2 of 2025, given the current quarterly cash burn rate. OVID has financed its capital needs through licensing revenue and equity, and based on its current cash balance, it will likely not require additional equity or debt financing in the near future.

Conclusion

I upgrade by rating to a buy for OVID. Given the data available (i.e., Phase 2 Trial, OLE study), I believe there is a good chance of positive Phase 3 clinical data for DS and LGS patients. The DCF valuation model shows the stock is undervalued at $3.66 per share with a target price of $5.36 per share (46% upside). The buy recommendation aligns with Wall Street's mean target price of $5.50. Nevertheless, it is important to note that considerable risks remain concerning clinical trials, competition, and pricing, which could significantly diminish potential cash flows. I have provided my Excel model so that readers can input their own assumptions.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.