Analog Devices: Why I Am Not Investing In This High-Quality Business

Summary

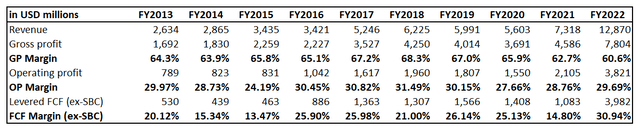

- Analog Devices demonstrates strong financial performance with fivefold revenue growth over the past decade and robust profitability metrics.

- The company is well-positioned for continued growth, but the current stock price offers almost no upside potential, and the dividend yield is below 2%.

- Risks to consider include cyclicality in end markets, foreign exchange risk, and geopolitical tensions between the U.S. and China.

THEPALMER/E+ via Getty Images

Investment thesis

Analog Devices (NASDAQ:ADI) demonstrated a stellar dynamic in its financial performance. Revenue grew almost fivefold over the past decade with staggering profitability metrics. The company is well-positioned to continue revenue growth with solid margins. But, my valuation analysis suggests almost no upside potential from the current stock price level. Moreover, the below 2% dividend yield also needs to look more attractive in my opinion considering the current inflation rate.

Company information

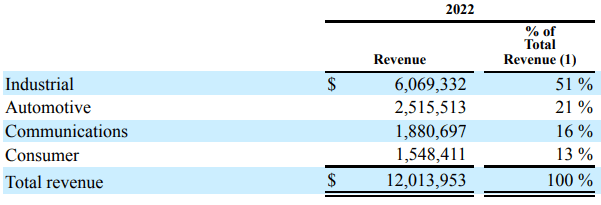

Analog Devices is a semiconductor manufacturer specializing in high-performance analog and digital signal processor [DSP] semiconductors. The company's fiscal year ends at the end of October. ADI operates as a single reportable segment. The company disaggregates its sales by the end markets and by geographic areas. Industrial is leading among end markets with a 51% share, according to the latest 10-K report.

ADI's latest 10-K report

About two-thirds of the company's sales were generated outside the U.S. in FY 2022.

Financials

Analog Devices is a profitability star. Even at a relatively small scale ten years ago, the company generated a 20% levered free cash flow [FCF] margin with stock-based compensation [SBC] deducted. Since then, the company's revenue has increased about fivefold, and the same solid double-digit levered FCF ex-SBC margin remains.

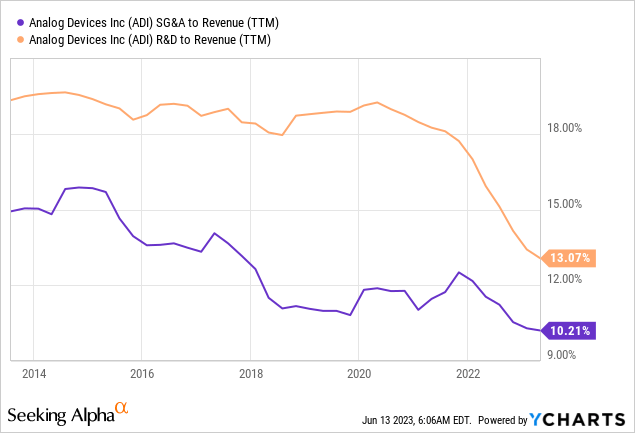

I like that the management has been very attentive to the costs side of the company's P&L. The chart below shows that the operating expenses portion of revenue has been moderating as the business scaled up. This is called the "economies of scale" effect, and for me, it is an apparent bullish sign when the management can deliver it.

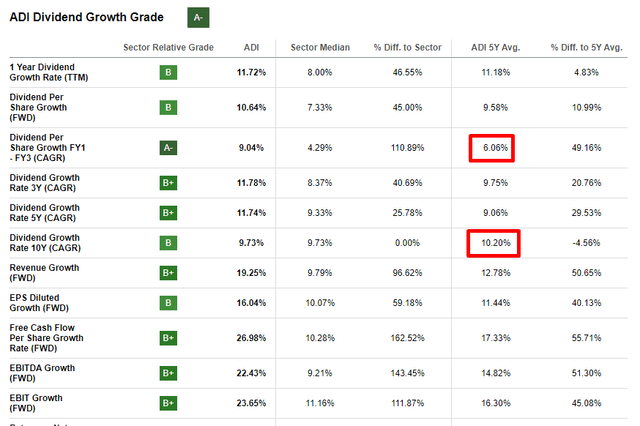

Such a stellar financial performance enabled the company to return money to shareholders via share repurchases and dividends. Over FY 2021-2022, the company bought back shares with a total value above $5.5 billion. ADI is not a dividend aristocrat yet, but for me, it seems to be just a matter of time. The company's history of consistent dividend hikes over almost two decades has been highly appreciated by the Seeking Alpha Quant dividend consistency grades.

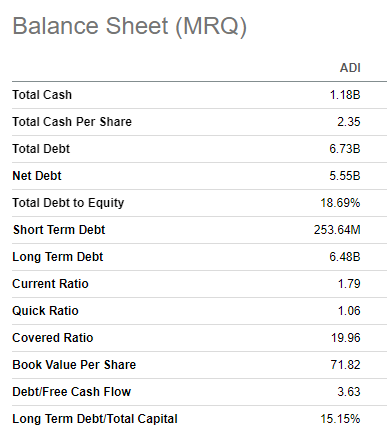

Overall, the company's capital allocation looks very robust to me. ADI has consistently paid out the company's free cash to shareholders, and the balance sheet is in good shape. ADI has a relatively small short-term debt, and the overall debt-to-equity ratio looks sound. The company's liquidity is also solid, even with inventory deducted.

Seeking Alpha

Now let me narrow it down to the latest quarterly performance. As you can see below, revenue growth momentum softened in the latest quarter. But I like that the top line still significantly outpaced the growth of costs. Primarily this relates to operating expenses, meaning the management is closely monitoring profitability. When the company performs like this in weak economic conditions, as we see now, the management's performance is stellar.

Overall, I think that the company is very focused on maximizing shareholders' wealth. Even under the current harsh environment, the company strives to maximize profitability and increase shareholder payouts. But let me now move on to the valuation analysis to understand whether this wonderful business is attractively valued or not.

Valuation

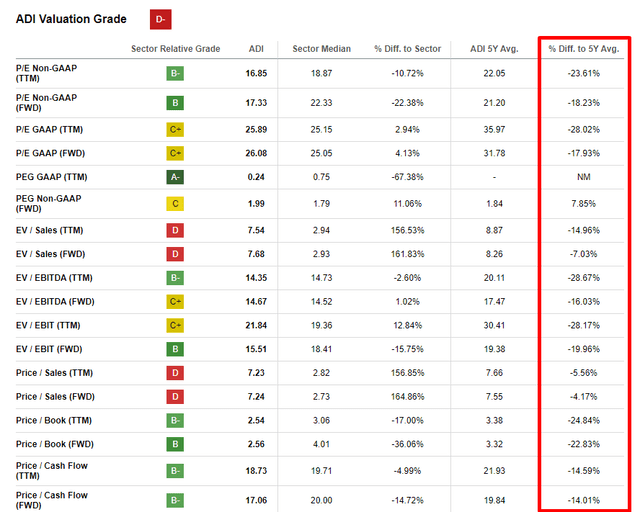

ADI rallied more than 15% year to date, which means the stock outperformed the broad market. Seeking Alpha Quant suggests the valuation is not attractive since the stock has a "D-" valuation grade. On the other hand, current valuation ratios are mainly substantially lower than the company's 5-year averages.

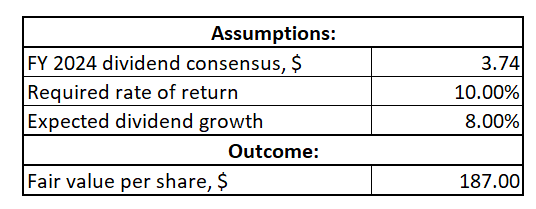

Analog Devices has a solid dividend consistency with nineteen straight years of dividend hikes. Therefore, I start my valuation calculations with the discounted dividend model [DDM] approach. I use a 10% WACC as a discount rate suggested by valueinvesting.io. I use FY 2024 dividend consensus estimate for the current dividend, which is at $3.74. I use the average between the FY1-FY3 CAGR and the 10-year CAGR over the past decade for dividend growth. This is rounded to 8%.

Incorporating all the above assumptions into the DDM formula returns a fair stock price of $187, almost equal to the current stock price. It indicates no upside potential for the stock under the given assumptions.

Author's calculations

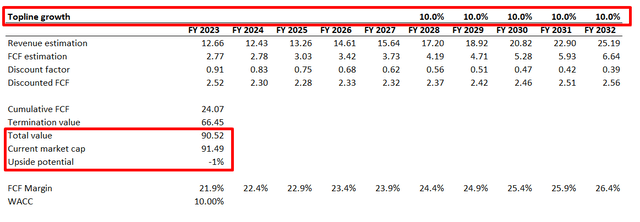

To cross-check the DDM, I also want to exercise the discounted cash flow [DCF] approach. I use the same 10% discount rate. I have revenue consensus estimates available up to FY 2027. For the years beyond, I have implemented a 10% revenue CAGR. For FY 2023 FCF margin, I use the previous decade's average of close to 22%. I expect the FCF margin to expand by 50 basis points yearly.

When I implement all the above assumptions into the DCF model, you can see that the fair value almost exactly matches the current market cap, meaning there is almost no room for upside potential. The stock is fairly valued, but I cannot call the current valuation attractive.

Risks to consider

ADI's end markets are vulnerable to cyclicality. The demand for the company's products can significantly fluctuate with economic cycles and even industry-specific trends. From a broader economic cycle perspective, reduced capital spending by businesses or reduced consumer spending can lead to lower demand for ADI's offerings. This will ultimately affect both sales and profitability. The company's business is also vulnerable to industry-specific swings. For example, the Industrial end market's spending heavily depends on infrastructure spending, which may not overlap with broader economic cycles. The company mitigates the risk of cyclicality by diversifying its end markets.

As we know, ADI generates almost 70% of its sales outside of the U.S. When the company operates in different countries, the first risk I think about is the foreign exchange risk. ADI's significant international sales expose the company to a significant risk of unfavorable fluctuations in foreign exchange rates. Exchange rate volatility is out of the company's control due to macro factors like economic conditions, interest rates, and geopolitical events. Therefore, the management should ensure proper hedging instruments are used to mitigate foreign exchange risk.

Last but not least, the company generates more than 20% of its sales in China. Therefore, ADI faces significant geopolitical risks as tensions between the U.S. and China might escalate. This might lead to new "trade wars" resulting in increased tariffs, trade restrictions, or other regulatory measures.

Bottom line

To conclude, I like companies like ADI. The top line has been compounding at a solid double-digit CAGR over the past decade, and the company looks like a money-printing machine due to its robust profitability metrics. The company was successful in capturing its piece of a growing market. But, the valuation could look more attractive. Given the risks, the dividend yield of about 1.8% also does not look like a good return. Therefore, I assign the stock a "Hold" rating.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.