VGT: Low Speculation Numbers Indicate Higher Technology Prices

Summary

- Technology stocks have risen over 20% since our February recommendation, with sentiment and speculation indicators continuing to suggest prices will move higher.

- The current mid-range levels of investor speculation indicate no price top in technology stocks, with the technology "puts to calls" ratio also confirming this.

- The Vanguard technology ETF VGT is recommended for participation in the technology rally, as it is the largest technology fund with over $50 billion in assets and offers broad diversification.

gremlin

This is a follow up to our February 18th article, which recommended technology stocks.

Summary

Since our technology sector buy recommendation in February, technology stocks are up over 20%. Both sentiment and speculation indicators in the technology sector continue to point to even higher prices. To participate in this rally we now recommend the largest technology ETF, VGT.

The Sentiment King

At the Sentiment King we measure investor activity and how bullish or bearish investors are. While economic analysis can tell you “what” to buy, investor sentiment can often tell you “when” to buy it. This is what we focus on.

Low speculation levels point to higher prices

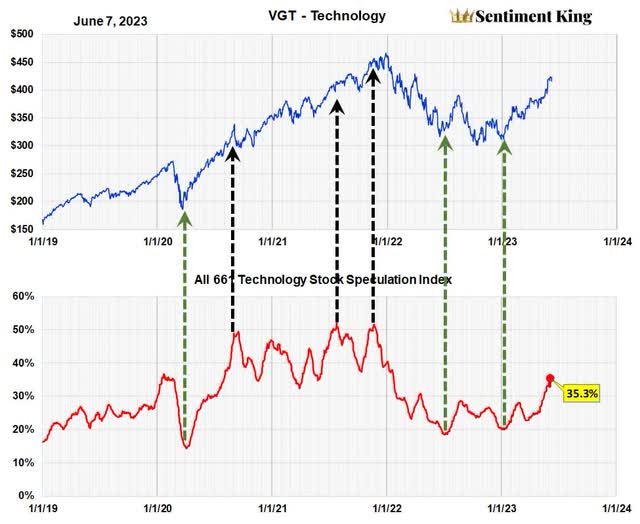

The chart below graphs the speculation index for 661 technology stocks. It compares call volume to actual volume as a percent in all technology stocks. The root of this idea goes back to 1971 with Martin Zweig's option activity ratio. Because option buying is speculative, measuring it against actual buying is a good indicator of the speculative mood of investors.

History shows high levels of speculation occur at price tops and low levels at price lows as the black and green arrows indicate. The current ratio of 35.3% is mid-range. This means current levels of investor speculation indicate no price top in technology stocks.

Technology Speculation Ratio of 661 Technology Stocks (Sentiment King)

The “put to calls” ratio of all 661 technology stocks confirms higher prices

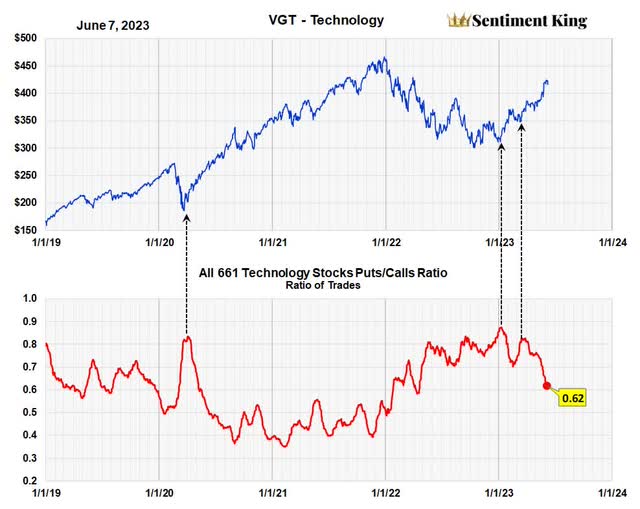

The "puts to calls" ratio is another way to measure investor expectations. The graph below plots the ratio of the number of traders buying “put” options in technology divided by the number of traders buying “call” options. A high ratio represents too many investors expecting prices to decline, and this normally occurs right before they rise.

A low ratio represents the opposite. The third arrow on the right was what prompted us to forecast higher technology prices in the February 18th article. At the time the ratio was over .8 or 80%.

The current ratio is .62 or 62%, which is mid-range. For investors who believe that investor sentiment can help find entry and exit points, the current ratio indicates that bullish sentiment in the technology sector is not excessive.

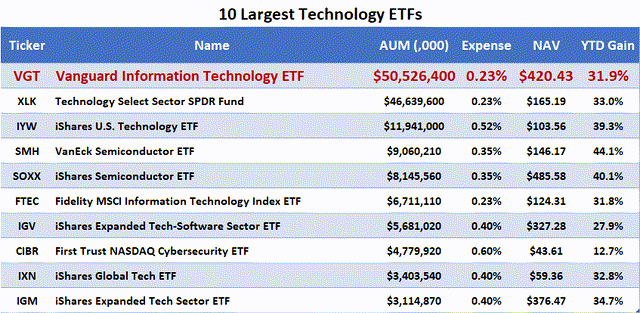

In February we recommended the technology ETF XLK to participate in a technology sector rally, and it has performed well. However, if investors want to add to their technology investments, or buy for the first time, we now recommend VGT.

Puts to Calls Ratio of 661 Technology Stocks (Sentiment King)

We recommend VGT to participate in the technology rally

These sentiment metrics measure sentiment for the entire technology sector and not to any particular stock. Just like you would invest in SPY if you received a buy signal for the entire market, you want the largest will diversified technology ETF to invest in the technology sector.

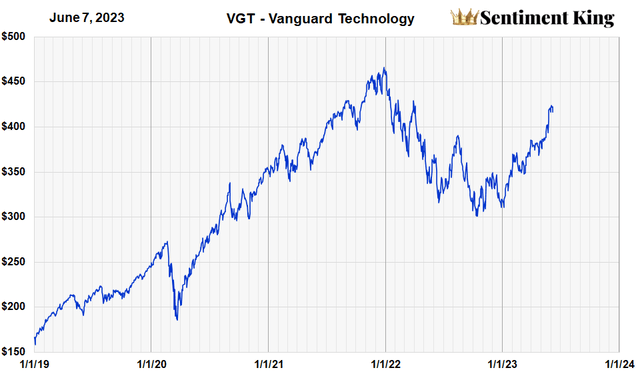

Because of that we prefer to use the Vanguard technology ETF VGT to participate in technology sector rallies. The chart below is VGT. It has a year to date return of 31.9%.

Price History of VGT (Sentiment King)

We are conservative by nature and will give away upside potential for size and broad diversification. VGT is the largest technology fund with over $50 billion in assets and provides those features.

Note: as the table shows there are smaller, more speculative technology ETFs for those so inclined. For example, both SOXX and SMH are more focused on the semiconductor part of the technology sector and have benefited from all the interest in AI. We, however, prefer the lower risk of large, well-diversified funds.

List of largest Technology ETFs (Sentiment King)

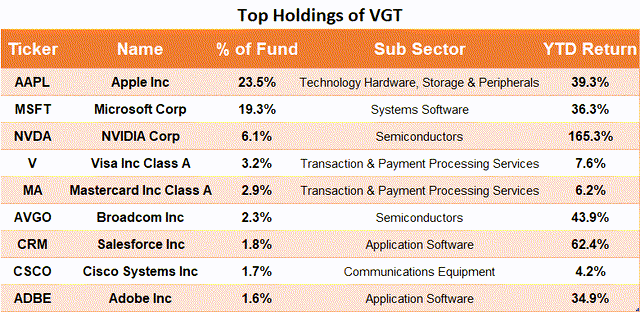

Top holdings of VGT

The table below shows the top holdings in VGT. Even though it’s well diversified with over 367 technology stocks, the fund, just like the entire stock market, is becoming overbalanced in just a few issues. For example, three stocks – Apple (AAPL), Microsoft (MSFT) and NVIDIA (NVDA) – now account for 49% of the portfolio.

While both ETFs are well diversified with over 300 issues and have almost identical portfolios, we prefer VGT over XLK since it's slightly less focused. In XLK over 71% of the fund is concentrated in the top ten investments while only 63% of VGT is.

Top Holding in VGT (Sentiment King)

Conclusion

Both the "puts to calls" ratio of all technology stocks, plus the mid-range of the technology speculation index, point to a continuation of the technology sector rally we forecast in our February article.

While some investors might like to try for larger gains using more focused technology ETFs with higher risk, we feel it best to use the Vanguard technology ETF, which has a portfolio of over 367 stocks and is the largest technology ETF with over $50 billion in assets.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.