RAPT Therapeutics: Major Catalysts Are A Long Way Off

Summary

- RAPT Therapeutics has solid data from early trials but has a habit of going down on good data.

- One reason could be that the stock is heavily institution-owned.

- Their next major catalyst is one year away.

- Looking for more investing ideas like this one? Get them exclusively at The Total Pharma Tracker. Learn More »

CIPhotos

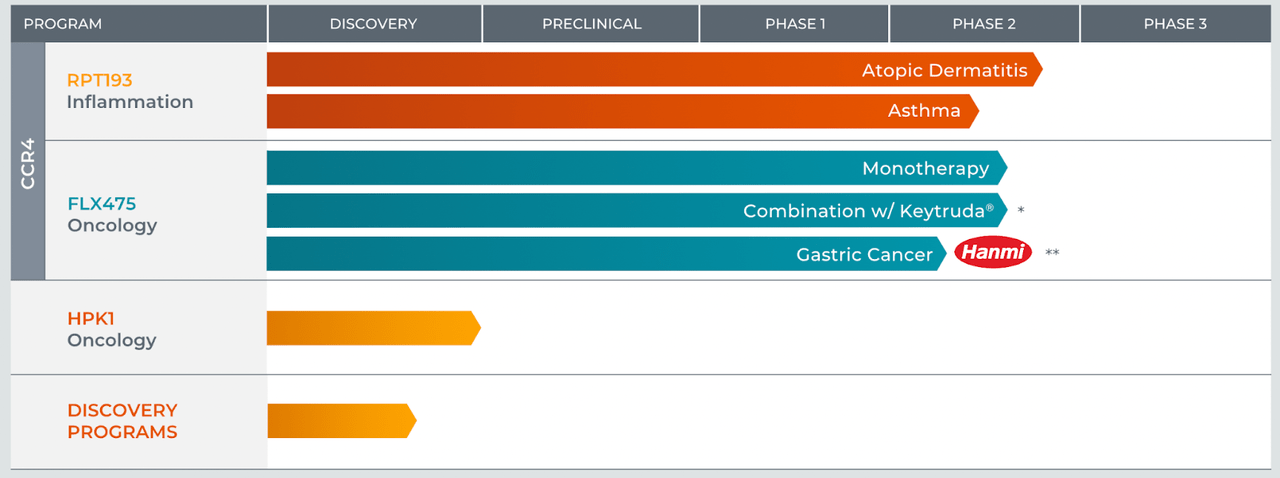

I covered RAPT Therapeutics, Inc. (NASDAQ:RAPT) 2.5 years ago, when I discussed their earlier history and pipeline. 30 months later, the stock is right at the same price it was back then, after having jumped up to twice those figures last year. Lead candidate has now changed, and the current lead is RPT193 targeting atopic dermatitis or eczema. FLX475, the asset from its previous company, Flexus, is still around, targeting various cancer indications. Here's the pipeline:

In that previous article, we had some early glimpse of what happened with FLX475. FLX475 is a small molecule CCR4 antagonist. It is the last remaining asset from the original company called Flexus, part of which was sold to BMS, but these assets ultimately failed in the clinic. In 2020, RAPT stock tumbled after they published phase 1 data from FLX475.

The date they published this data was October 16, and the stock fell from $32 to $16 that day. If you read the company material, the trial was a success. However, the market clearly thought otherwise. I discussed this in my previous article, and I wondered why it fell so much on apparently positive data. One plausible explanation in these scenarios is profit taking, but I have not seen a 50% fall on mere profit taking, and that too, a sustained fall from which the stock took 6-8 months to recover.

Therefore, the explanation needs to be in the data, vis-à-vis market expectations. I identified the issue to be a lack of strong clinical efficacy. There were many stable diseases, an increase in the ratio of killing T-cells to Tregs which improves safety, and so on. However, there were no complete responses and only one unconfirmed partial response in a patient with nasopharyngeal carcinoma who had been heavily pretreated with both chemo and radiation.

The molecule has recently done better in a different indication, as we saw in data presented at ASCO:

FLX475 monotherapy induced complete responses in two of the six evaluable subjects enrolled with EBV+ NK/T cell lymphoma.

In a CPI-naive NSCLC trial, there was a 38% ORR observed with combo therapy of Pembro+FLX475. Historically, pembrolizumab monotherapy has an 18% ORR in this indication, and pembro+TIGITs have a 31% ORR.

Their lead asset now is RPT193, a selective once-daily oral CCR4 antagonist designed to reduce Th2-inflammation in a broad range of allergic disorders. The molecule completed a phase 1 trial in Moderate To-Severe Atopic Dermatitis, and although it was not powered for any specific endpoints, exploratory endpoints included EASI, Pruritus Numerical Rating Scale (NRS), SCORAD, and vIGA. In some of these endpoints, RPT193 differentiated from placebo with statistical significance.

Key data:

Patients treated with RPT193 achieved a 36.3% improvement in EASI score from baseline compared with a 17.0% improvement in the placebo group.

4.8% of RPT193-treated patients achieved a vIGA score of 0/1 and at least a two-point improvement over baseline compared to 0.0% in the placebo group.

45.0% of patients treated with RPT193 achieved at least a four-point reduction in the pruritus NRS score, compared with 22.2% in the placebo group.

Patients were also evaluated for exploratory endpoints at six weeks (two weeks after the end of treatment).

Patients treated with RPT193 achieved a 53.2% improvement in EASI score compared with a 9.6% in placebo.

14.3% of patients treated with RPT193 achieved a vIGA score of 0/1 and at least a two-point improvement over baseline compared with 0.0% in the placebo group.

RPT193 was well tolerated and no serious adverse events were reported. The overall safety profile suggests RPT193 would not require any laboratory safety monitoring.

The stock doubled on this data in 2021. A phase 2 study is ongoing, which will yield data in 2024, and a pivotal study will commence in 2025. Things are good, but good things are a long way off. The phase 2 eczema trial readout was expected earlier, but enrollment glitches pushed it out to mid-2024.

Financials

RAPT has a market cap of $707mn and a cash balance of $231mn. Research and development expenses for the first quarter of 2023 were $25.6 million, while general and administrative expenses were $6.0 million. That gives them a cash runway of nearly 8 quarters, or more than enough for them to run through their next major data catalyst.

RAPT stock has a very high percentage of institutional and PE/VC ownership, with very little retail ownership. Keyholders are Column Group, FMR, T. Rowe Price, and so on. Insider transactions are a good mix of buys and sells, although, in the last 6 months, it has been mostly sells.

RAPT has a licensing deal with Hanmi in China and certain other Asian countries, whence they received a small upfront fee of $10mn, and may receive milestone fees of $110mn more, of which $48mn will come after first patient dosing in a phase 3 trial. Rapt also has a collaboration deal with Merck - but that is just a supply agreement.

Bottom Line

RAPT Therapeutics, Inc. has shown that it has the potential to move up, and it is now nearly halfway to its all-time high price. Thus, if anything good happens, this is the benchmark price, discounting dilutions that have happened in the past and which may be skewing my math. RAPT Therapeutics' problem is that nothing much is going to happen until mid-2024, and there's no pivotal data for at least 2 more years. So things are going to be stagnant, and RAPT's past history is not exactly helpful in understanding its strength. I am going to sit this one out for the time being.

About the TPT service

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

This article was written by

Dr Dutta is a retired veterinary surgeon. He has over 40 years experience in the industry. Dr Maiya is a well-known oncologist who has 30 years in the medical field, including as Medical Director of various healthcare institutions. Both doctors are also avid private investors. They are assisted by a number of finance professionals in developing this service.

If you want to check out our service, go here - https://seekingalpha.com/author/avisol-capital-partners/research

Disclaimer - we are not investment advisors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Important: My Hold rating only means "I will not Buy now." I am not telling *you* to hold, because I see some risks here. But I am also not telling you to *sell*, because, a) the risks are not insurmountable, and b) you may have bought at such a low price that your risk-benefit ratio is acceptable to you. Thus, my “Hold” is a bearish rating, but it is not as bearish as a “Sell” rating.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.