CME: The Main Beneficiary Of Market Volatility

Summary

- CME operates a derivatives exchange with a monopoly position in the exchange trading of most derivatives products and offers a wide range of futures contracts and options.

- The futures exchange business is attractive due to its scalable business model, high profitability, and limited competition, with CME benefiting from market uncertainty and volatility.

- Despite its monopoly position, CME has faced pricing pressure and lags behind peers in terms of revenue and earnings growth, with valuation multiples not providing a significant margin of safety.

JHVEPhoto

Company overview

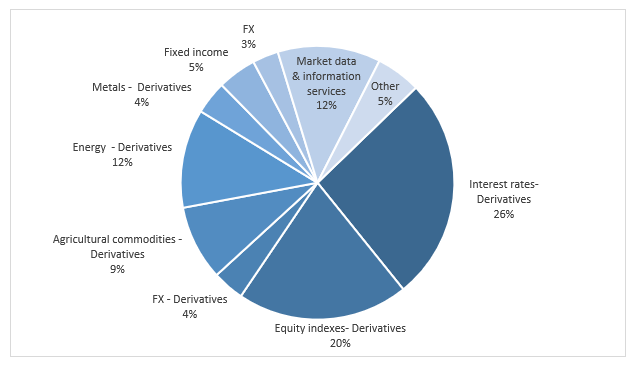

CME (NASDAQ:CME) operates derivatives exchanges that provide futures contracts and options on interest rates, equity indices, FX, agricultural commodities, energy, and metals. In addition, it also offers cash and repo fixed income trading via BrokerTec, and cash and OTC FX trading via EBS. Revenues are split as follows:

(Source: Company annual report)

CME has a strong derivatives business (≈ 75% of total revenues) that provides a very large product offering. It enjoys a monopoly position in the exchange trading of US interest rate derivatives products with its Eurodollar, SOFR, US treasury (covering the entire curve) and FED funds futures and options. Besides, the equity business owns exclusive licensing agreements for e-mini products on S&P 500, Nasdaq 100, and Russell 2000 indices among others. It also offers derivatives products covering the most widespread agricultural commodities (corn, soybean wheat…), energy (natural gas, WTI crude oil), and metals (gold, copper, silver…). Finally, it offers also futures on cryptocurrencies (Bitcoin, Ether…), weather options or carbon credit offset futures and options.

Futures exchange is an attractive business

Derivatives exchanges are very attractive businesses. They are very profitable because they have a scalable business model with highly profitable incremental revenues (fixed-cost expense structure) and limited capital investment requirements. Exchanges can then gather and package their own data in order to create new revenue streams.

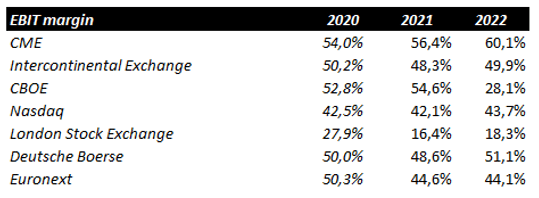

CME displays industry-leading margins (>60% operating margin) resulting from its exposure to the high-margin trading business as well as a strong focus on costs.

(Source: Bloomberg)

Unlike equities, futures contracts can be traded on only one exchange, creating natural monopoly. As a result, the competition from alternative trading venues and others exchanges is non-existent. In addition, potential competitors do not have licensing agreements and the liquidity pool, which make futures exchanges one of most competitively-advantaged businesses. Besides, futures exchanges (through their clearinghouses) collect margin requirements and invest the proceeds overnight. As a result, they enjoy attractive business economics.

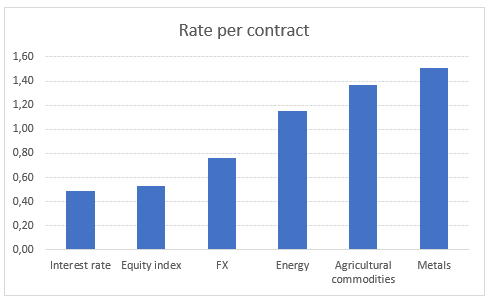

Moreover, the commodity and FX futures businesses (accounting for 28% of total revenues) are even more attractive than the interest rate and equity indices futures businesses because they enjoy stronger growth prospects. Indeed, regulators push OTC trading volume towards on-exchange trading (also true for interest rate swaps) in order to reduce system-wide risks (clearinghouses net trades and payments among its participants on a daily basis, reducing counterparty risk) and increase transparency. Besides, in addition to offer premium pricing, these categories benefit from the on-going shift to electronic execution and from the increasing buy-side usage (increase need for hedging, better product awareness, and easier-to-use solutions).

(Source: Company annual report)

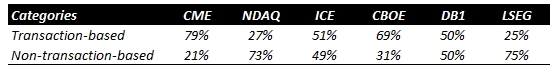

A transaction-driven business

Transactional revenues account for≈ 80% of total revenues, which is the highest exposure to transaction-based revenues among US exchanges. As a result, CME is a key beneficiary of market uncertainty and volatility, which is the key growth driver in the short-term.

(Source: 2021 annual reports)

In addition to short-term market volatility, trading volume can grow over time driven by an increasing user participation (broader usage of derivative products for risk management purposes, increasing participation…) and innovation (micro-futures and options, cryptocurrency futures, carbon credit offsets…). For instance, CME’s management team highlights the need for smaller banks to hedge their interest rate exposure following the banking crisis. These banks will most likely use interest-rate swaps with large investment banks, that will then trade CME's future products to hedge their own risks. These structural opportunities take time to play out but are clearly supportive of the long-term growth of trading volume as shown by the 5.5% CAGR increase in volume since 2010.

Some of these second and third-tier banks who did not hedge some of their portfolios. I think what is important here is we talked about some of the second and third-tier banks mostly will be doing swaps, which we think is fine for us because they are normally going to be doing a swap against a larger bank, and that larger bank will be doing the layoff in CME Group.

(Source: Q1 2023 Earnings Call Transcript)

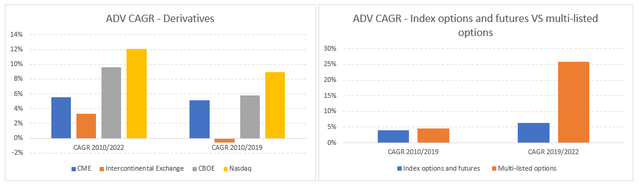

Unlike futures trading volume, the volume of cash equity and single-stock equity options surged during the pandemic. Given CME has no exposure to such businesses, volume growth of its derivatives business lagged most peers’ derivatives businesses over the period 2010/2022. Nevertheless, derivatives volume also lagged peers once adjusted for years of strong equity options volume growth (equivalent to a 2010/2019 CAGR). On the positive side, CME is less at risk of an eventual trading volume normalization over the coming quarters.

(Source: Company annual reports and author calculations)

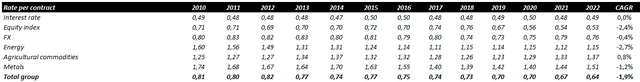

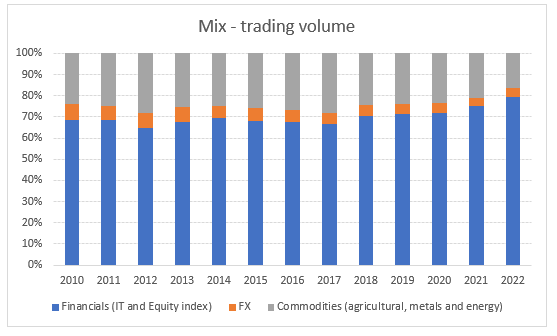

Unfortunately, despite enjoying a monopoly position, the company faced declining rate per contract at the group level (1%/2% per year) because of a mix shift towards Micro e-minis products and more financials products. This negative pricing mix enables to support volume growth as it enables traders to trade smaller size.

(Source: Company annual reports)

(Source: Company annual reports)

Non-transactional revenues (≈ 20% of revenues) are comprised of the market data and information services business and other revenues (including access and communication fees, fees for collateral management and equity membership subscription fees). In addition to benefit from the increasing demand for data and analytics, product innovation will also play a role. For instance, the company has developed cryptocurrency indices. We believe non-transactional revenue can grow mid-single digit over the coming years. As a result, we think that total revenues will grow around 5% if trading volumes maintain their historical trend and that pricing remains stable.

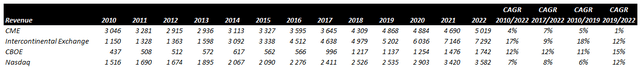

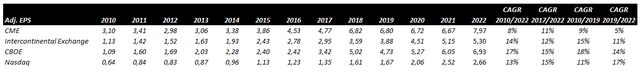

CME lagged peers in terms of revenues and earnings growth over the full 2010/2022 period. Breaking the period into two sub-periods, 2010/2019 and 2019/2022, we still see below-peers revenue and EPS growth for both periods.

(Source: Company annual reports) (Source: Company annual reports)

Valuations

CME has an appealing dividend policy consisting of a regular quarterly dividend (targeting a 50%/60% payout ratio) combined with an annual special dividend, which is somehow based on excess cash. Given the current cash position, the special dividend should remain USD >4, which lead to roughly USD >8,5 total dividend (≈ 4.7% dividend yield).

(Source: Company website and annual reports)

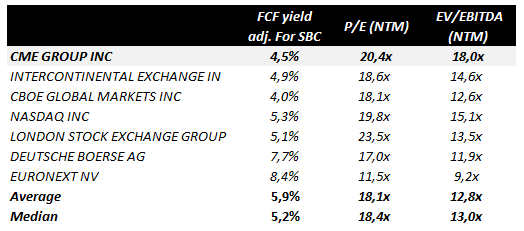

In terms of valuations, CME is trading at 20.4x NTM earnings, 18x EBITDA and 4.5% FCF yield. These valuation metrics are all above peers’ valuation even though we do not believe that the company should be valued at higher multiples than peers (it remains more cyclical than peers and does not have an above-average growth profile). From an historical perspective, CME is trading roughly in-line with its long-term historical average of 20x. Besides, it is trading at a 11% premium to the S&P 500 while it used to trade at an average 15% premium over the last ten years.

(Source: Bloomberg)

As a result, we do not believe that valuation multiples provide significant margin of safety. In addition to offering a 4%/5% dividend yield, earnings have the potential to grow at a high-single digit CAGR (assuming mid-single digit revenue growth, stable pricing, and positive operating leverage) which is not enough given our limited level of confidence (it remains a cyclical business). We prefer to remain on the side-line for now and wait for a potential correction for revisiting the stock. We prefer Nasdaq among US exchanges. The full investment thesis on Nasdaq (NDAQ) is available here.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.