Turtle Beach Corporation Has The Volume Turned Way Down

Summary

- Turtle Beach Corporation shares have gained 20.25% since early February but are down about 48% since I sold last year.

- The company's financial performance has improved somewhat, but sustained profitability is uncertain, and the market seems overly optimistic.

- I believe the market is overpaying for the stock and will continue to avoid it until the shares inevitably crash in price.

Maskot/DigitalVision via Getty Images

The shares of Turtle Beach Corporation (NASDAQ:HEAR) have gained about 20.25% against a gain of about 3.8% for the S&P 500 since I wrote my latest cautionary article about the business back in early February. In case you're heading to the comments section to offer condolences about the fact that I missed out on gains, save your virtual ink. In spite of the recent uptick in price, I'm still happy that I took my chips off the table a little over 14 months ago, because I've made a great deal of money trading this stock, and the shares are still down about 48% since I sold. I have obviously bought into and out of this name over the years, and so I thought I'd review the stock again today to see if it makes sense to buy back in or not. After all, thousands of Turtle Beach investors may not be wrong. I'll decide whether or not to buy back in by looking at the most recent financial history, and by looking at the stock as a thing distinct from the actual business.

Before getting into the analysis of Turtle Beach, though, I feel a soapbox growing beneath my chair. I've heard some people complain recently that my approach is rather dull. I can understand that this isn't exactly "The Dark Knight" or "Gone With the Wind" or some other great drama, but I would suggest that investors should never be afraid to be dull in their approach, because dull can offer a fairly decent risk-adjusted return.

I know the weekend is relatively far away at this point, but I imagine the dynamic, super cool, and interesting people who read my stuff are already choosing which of a plethora of amazing experiences they're going to indulge in a few days. Will they leave base camp to try to reach the summit of some mountain, or will they dine with a supermodel? Are they instead going to fly to the Democratic Republic of the Congo to photograph some white rhinos? For my part, I have some very interesting plans involving catching up on some Young and the Restless, and playing Dungeons and Dragons. Anyway, we're all busy, and I'm absolutely obsessed with trying to make your reading experiences as pleasurable as possible. One of the many ways I do that is by offering a "thesis statement' paragraph very near the beginning of each of my articles. In the thesis statement, I give you the gist of what I'm thinking upfront. This allows you to flee the article before you're covered in too much Doyle mojo. You're welcome. I would recommend continuing to avoid Turtle Beach at the moment. The company has improved somewhat from 2022, but it's not like that was a banner year. Additionally, it's not obvious to me that the company is capable of sustained profitability. In spite of this, the market seems to be more optimistic than it was when I last reviewed the name. In my experience, this is not likely to end well for shareholders who buy today. At a time when you can earn nearly 5.2% on risk-free government instruments, why would you buy this? This ends my thesis statement. If you read on from here, that's on you. I don't want to read any comments below about my bad jokes or proper spelling.

Financial Snapshot

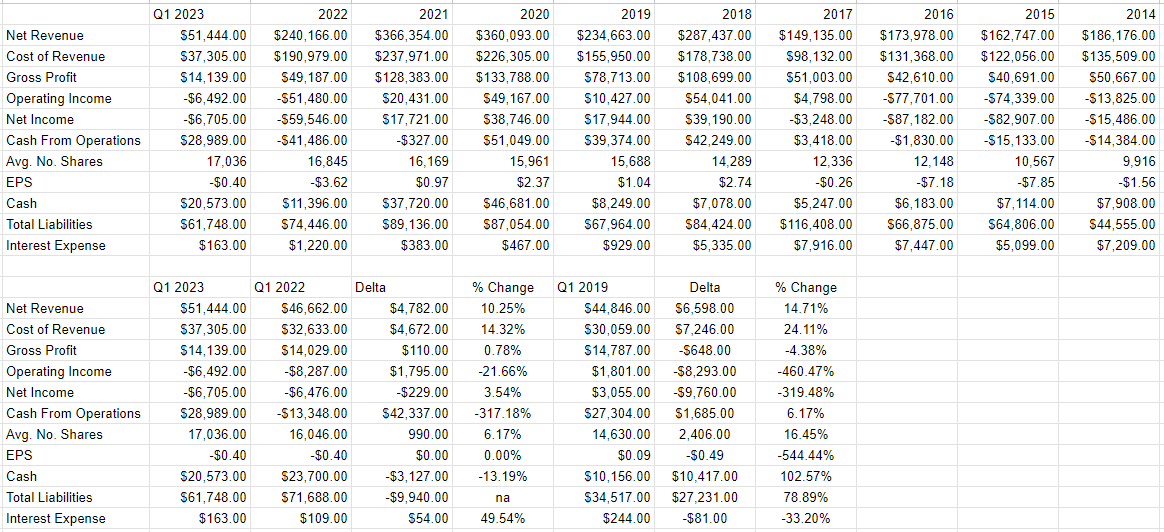

I'd characterise the financial performance here as being a bit of a turnaround story. Here's what I mean by that. In 2022, we saw revenue crash by something like 34% from the prior year and was down to levels last seen in 2018. Additionally, net income in 2022 came in at a loss of about $59.5 million, down from about $17.7 million in 2021. The first quarter of 2023 has, in some ways, reversed that negative trend. Revenue for the first quarter of 2023 was up by about 10.25% compared to the same period in 2022. Although the latter was hardly a banner year, an uptick is an uptick. Additionally, it must be said that the company made some heroic efforts to boost profitability, by reducing some of the biggest costs. Selling and marketing, and R&D expenses were down by 12% and 23% respectively, for a total savings between them of about $2.45 million from the same quarter last year. The problem is that heroic efforts are sometimes not enough. Net income for the first quarter of this year was slightly lower than the same period last year, largely as a result of a $4.6 million uptick in the cost of revenue. More disturbing, in my estimation, is the fact that net income for the most recent quarter was about $9.7 million lower than the same period in 2019, in spite of a 14.7% uptick in revenue from then to now.

On the bright side, the company remains very well capitalised in my view, since cash represents about a third of the company's total liabilities. Thus, I consider this to be a going concern and don't anticipate any problems with the firm being able to survive a potential credit crunch. Given all of the above, I remain skeptical of this company's ability to generate a consistent profit, but I'd be happy to buy back in if the valuation is reasonable.

Turtle Beach Financials (Turtle Beach investor relations)

The Stock

If you're one of those people who subject yourself to my ramblings frequently, you know that I consider the stock and the business to be very different things. The business sells gaming headsets. The stock, on the other hand, is a slip of virtual paper that gets traded around by a crowd that can be capricious. A stock may be bid up in price simply because it's part of a basket that makes up an index. A stock may be bid up or down simply because of what's happening to interest rates. A stock may be bid up or down as a function of changes in taste for "stocks" as an asset class. A stock may be affected by failed attempts by the company to sell itself. So, the stock is sometimes a poor proxy for the underlying business, and it can be quite volatile as expectations about the business become more or less optimistic.

In my experience, the only way to profitably trade stocks is by spotting discrepancies between expectations and subsequent reality. If the market is unreasonably optimistic, you avoid the stock, and if the market is overly pessimistic, you buy. Additionally, another way of writing "overly pessimistic" is "cheap." I like cheap shares because they have that great combination of lower risk and higher potential reward. They're lower risk because much of the bad news has already been "priced in." They're higher potential reward because a small bit of good news has the potential to send the shares skyward.

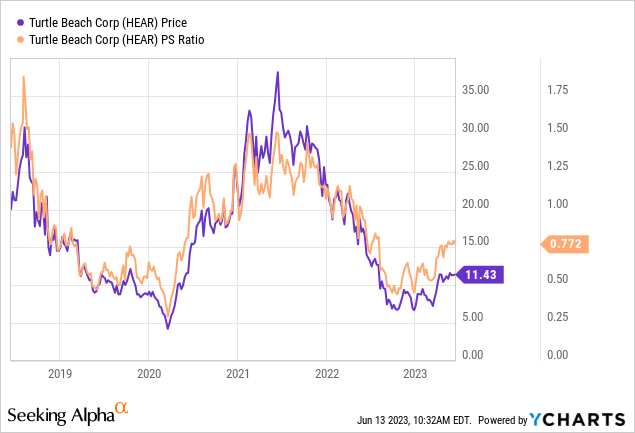

I measure the market's expectations in a few ways, ranging from the simple to the more complex. On the simple side, I like to look at the ratio of price to some measure of economic value, like earnings, sales, book value, and the like. I want to see the company trading at a discount to both the overall market and its own history. In my previous missives on this name, I eschewed the shares on one occasion because the market was paying a price to sales ratio of about 0.44, and then again when the market was paying a price to sales ratio of 0.65. The market is even more optimistic today, paying 18% more for this company whose sales growth might be described as "uncertain." In my view, that is a sign of a market that has high hopes, and those hopes may be misplaced.

In keeping with my theme of unpacking the difference between expectations and subsequent reality, it's time to put some numbers to this effort. Specifically, I want to try to quantify exactly what the market is assuming about a given company. To do this, I use the stock price itself as a source of information. I'm able to use the stock price as a source of information by adopting the approach taken by Professor Stephen Penman in his book "Accounting for Value." Additionally, Mauboussin and Rappaport's "Expectations Investing" is helpful in this regard. Both of these works assume that you can infer what the market is "thinking" about the future based on the current price. The last time I took a look at Turtle Beach, the market was assuming a growth rate of about 12%, which I considered to be wildly optimistic. Fast-forward to the present, and it seems that the market is now assuming a growth rate of about 15% out of this business. It shouldn't come as a shock that I consider this to be a wildly optimistic forecast. In spite of the strength of the balance sheet, I think the market is massively overpaying for this stock. For that reason, I'm going to continue to avoid. I think it's inevitable that the shares will crash in price from here. When that finally happens, I'll reconsider my perspective. Until that time, though, I'm going to remain on the sidelines.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.