Procter & Gamble: Price Dependence Makes It Vulnerable To Recession (Rating Downgrade)

Summary

- Procter & Gamble has performed well during challenging times, leveraging its strong brands and pricing power to offset rising costs without losing market share.

- Procter & Gamble's reliance on price increases and vulnerability to forex moves make it more susceptible to a recession and currency fluctuations.

- PG stock is now considered fairly valued, and the rating has been changed from a buy to a hold.

sharrocks

Hard times often bring out the best and worst in individuals and companies. Making decisions in comfortable situations is usually fairly easy, but adversity often forces tough choices. With Covid hitting in 2020, prices rising rapidly in early 2021, and now growing signs of an economic slowdown, the operating environment has become much more challenging for most corporations.

One company that performed fairly well during these difficult times is the Procter & Gamble Company (NYSE:PG). This leading retailer has been able to leverage the company's strong brands and pricing power to offset rising costs without compromising market share even in the current inflationary environment. This company's shares have performed reasonably during the recent inflationary period that started in early 2021 as well.

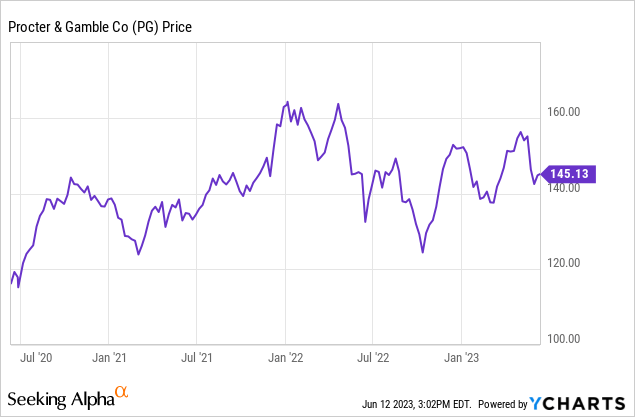

Procter & Gamble performed decently over the last 3 years, rising 35.12%. Still, the S&P 500 (SPY) was up 42% during this same time frame.

Today, I am changing my rating of The Procter & Gamble Company from a buy to a hold. I rated this company a buy in my article in early March, but since then the economic data has deteriorated significantly. Procter & Gamble is more susceptible to a recession today than in normal times because the company has relied heavily on price increases to offset rising costs over the last three years. The leading retailer is also very vulnerable to even modest forex moves since the majority of the company's revenues come from outside of North America, and the dollar is obviously likely to strengthen against most major currencies if even a moderate recession were to occur.

Procter & Gamble operates in five main segments; beauty, grooming, health care, fabric and home care, and baby feminine and family care. The company's fabric and home care division is the largest division of the business, and comprises nearly 30% of the industry leader's overall revenues. The home care and feminine and family segments of the business comprise nearly 60% of the company's overall revenues.

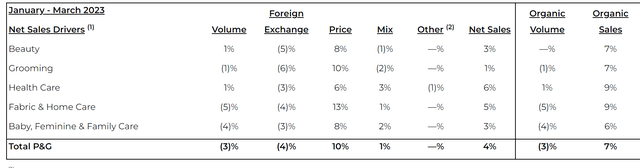

The Procter & Gamble Company's recent third quarter earnings report makes clear how dependent the current business model of the corporation is on price increases.

A chart showing the sales of Procter & Gamble's 5 main divisions (pginvestor.com)

The company's organic volume growth in these five core divisions was on net down 3%, but overall sales growth was still 7%, since price increases drove 10% sales growth overall, and more than offset a slight decline in demand. Management is relying on the pricing power of the company to offset rising prices and a slight drop in demand, but the current brands are clearly not increasing their market share.

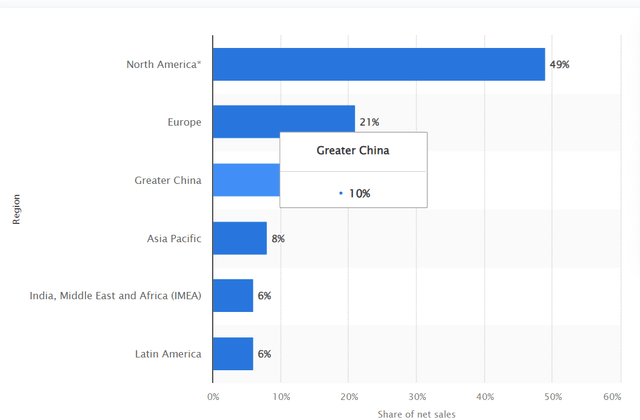

The Procter & Gamble Company is also more vulnerable to forex moves because the majority of the leading retailer's revenues are coming from overseas. The company's operating margins for the third quarter increased by 150 bases on a currency neutral basis, but just forty points adjusted for forex moves. The retailer's current net margin is at close to a ten year high of 17.34%.

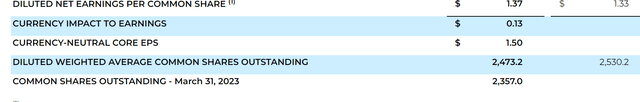

Currency moves also had .13 impact to earnings per share for the quarter, which is significant, since the company currency neutral earnings per share was 1.50, but diluted net earnings per share were $1.37. Management is guiding to just 1% of all sales growth for the upcoming fiscal year.

A chart showing the impact of currency moves on PG's earnings (pginvestor.com)

Procter & Gamble got nearly 51% of the company's revenues from overseas in 2022, the retailer's current business model is vulnerable to even slight moves in currencies, and the dollar has historically risen at least 3% against most major currencies during a recession.

A chart showing the different regions where PG's revenues come from (statisa.com)

This is why given the new economic data and the company's recent earnings report, the stock looks fairly valued today. The Procter & Gamble Company currently trades at 24.85x likely forward earnings, 17.91x forecasted forward EBITDA, and 4.24x expected forward sales. The company's average five-year valuation was 23.97x forecasted forward earnings, 16.90x projected forward EBITDA, and 4.18x likely forward sales, but the economy appears likely to enter a recession, earnings revisions are likely to continue to come down.

The Procter & Gamble Company has done reasonably well over the last three year, but management's dependency on price increases make the company's current business model more vulnerable to an economic slowdown, and the retailer's international revenues also make this company more susceptible to currency moves as well. While The Procter & Gamble Company's brand power should prevent the share price from selling off hard even if there is a recession, the stock looks fairly valued at the current price given the recent data.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.