XBIL: Constant Maturity 6 Months T-Bills

Summary

- The UST 6 Month Bill Fund aims to achieve investment results corresponding to the price and yield performance of the ICE BofA US 6-Month Treasury Bill Index.

- The US Treasury auctions a new 6-Month Treasury bill weekly, determining the rate for each new on-the-run T-Bill.

- XBIL aims to replicate the return profile of the Index by rolling every week into the newly issued security.

- The fund has a synthetic dividend yield build, since T-Bills are discount instruments.

- XBIL is a good building block for correlation trades or curve steepeners/flatteners.

Montes-Bradley

Thesis

The US Treasury 6 Month Bill ETF (NASDAQ:XBIL) is a new offering in the short dated treasury fund space. As per its literature:

The investment objective of the US Treasury 6 Month Bill ETF (the “UST 6 Month Bill Fund”) is to seek investment results that correspond (before fees and expenses) generally to the price and yield performance of the ICE BofA US 6-Month Treasury Bill Index (G0O2).

In effect this fund looks to track the performance of 6-month treasury bills on a constant maturity basis. There is a difference between purchasing a 6-months treasury outright and buying XBIL. If you buy a treasury outright, you basically lock-in the yield and experience a pull to par as you approach the maturity date. As a reminder T-Bills are discount securities, and the difference between the purchase price and the par amount is the accrued interest, usually realized upon maturity (unless you sell the security earlier). Conversely, via XBIL one is subject to the prevailing yield for the respective tenor:

The US Treasury auctions a new 6-Month Treasury bill each week. The auction will determine the coupon rate of each new on-the-run1 note. Once the auction is complete and can be settled, XBIL will sell the currently held, old 6-Month US Treasury and roll into the newly issued 6-Month US Treasury.

The fund does not hold on to the 6-months bill until maturity, or construct a ladder with securities that give the fund a duration that is equivalent, but just rolls every week the on the run 6-months T-Bill:

On-The-Run refers to the periodic transition to the most-recently auctioned Treasury bill, note, or bond of a stated maturity, which is referred to as the "on-the-run" or "OTR" security of that maturity, occurs on one day. An OTR security is the most recently issued of a periodically issued security (as opposed to an off-the-run security, which is a security that has been issued before the most recent issue and is still outstanding).

The 'On-the-Run' concept is very important for longer dated Treasury bonds, but less so for T-Bills. It is important for Treasury bonds because corporate bonds with certain tenors get priced off treasuries. So let's say IBM (IBM) prices a new 10-year corporate bond. The mechanics of the investment grade market is to quote a spread for the new corporate bond versus the 'On-the-Run' Treasury. So IBM might theoretically price its bond at T+150bps, meaning the on the run 10-year treasury yield plus 150 bps. By pricing this way, the syndication process ensures buyers haggle around the credit spread the deal should pay (i.e. the 150 bps) rather the risk free rates component which will fluctuate. However, no bonds price on 6-months T-Bills.

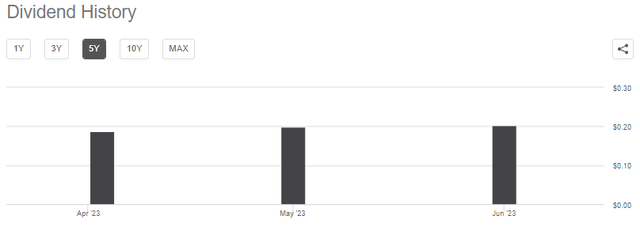

Synthetic Dividend

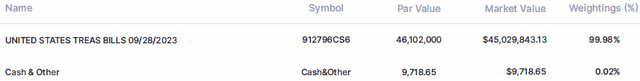

Although the fund technically does not receive a dividend (remember T-Bills are discount instruments), it manages to create a synthetic one:

Dividend History (Seeking Alpha)

The exchange traded fund holds some cash to manage inflows and outflows, and the same pool of capital is utilized to disburse a monthly dividend that closely resembles prevailing 6-months yields:

The cash does not come out of thin air however, since the structure realizes mark to market gains every time it rolls into new on-the-run T-Bills. Think about it this way - absent any changes in prevailing rates, the fund holds a 6 months T-Bill for a week. When it gets sold there is a pull to par effect since the instrument only has 5 months and 3 weeks left in terms of tenor. That pull to par is reflected in a higher price obtained for the instrument.

While it is hard to segregate that effect given the constant fluctuation in interest rates, over time the effect of the weekly pull to par gets reflected in the fund's NAV.

Performance

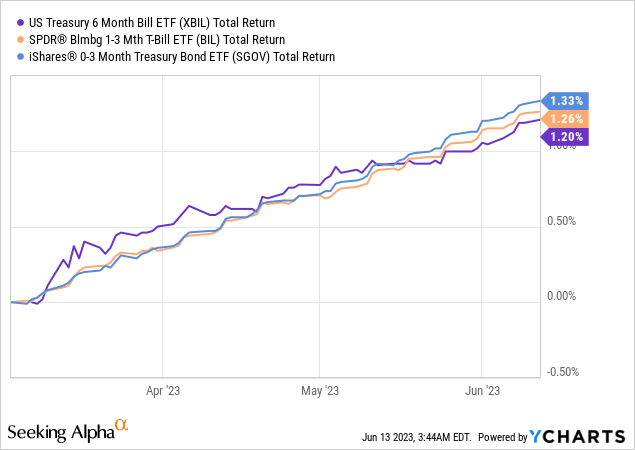

In its short lifespan the fund compares favorably with other short term instruments:

We can see from the above graph how the total return for XBIL matches what we extract from funds such as the SPDR Bloomberg 1-3 Month T-Bill ETF (BIL) or the iShares 0-3 Month Treasury Bond ETF (SGOV).

Use Cases

In our mind this fund has more of an institutional use rather than a retail use. Or to word it differently, this is not necessarily an ideal clip the yield buy and hold instrument. In our mind it is more of a building block for various trades or trade ideas. What the fund does very well versus its peers is isolate the 6-months point in the yield curve (given its constant maturity feature). So if an investor wants to build a steepener of flattener for various points in the curve (let's say 6-months versus 2-year), it can use XBIL since it is a constant maturity take on the point in the curve. Similarly, if there is an observed correlation with a particular market sector or individual stock, the investor can use XBIL to create a relationship (long TSLA and short XBIL as a pair trade for example - theoretical trade, not a trade idea).

Similarly, once an options market develops around XBIL, packaging the 6-months point in an ETF format allows investors to use options in order to speculate moves in the front end of the curve.

Conclusion

XBIL is a new fund in the treasuries space. The vehicle aims to isolate and track the price and yield performance of the ICE BofA US 6-Month Treasury Bill Index. This basically represents an exposure to constant maturity 6-months treasury bills. The vehicle achieves its purpose by rolling every week into the newly issued 6-months T-Bill. The fund has built a synthetic dividend, since T-Bills are discount instruments and thus do not pay any distributions until maturity. We consider this fund more of a building block for correlation trades or options trades rather than a pure buy and hold instrument, although it compares favorably from a total return perspective to SGOV and BIL in 2023.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.