Raiffeisen: Looks Materially Undervalued Even Without Russia

Summary

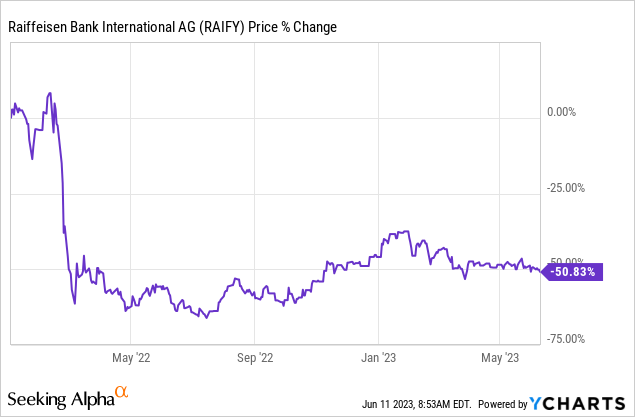

- Raiffeisen shares are still down sharply due to the bank's high exposure to Russia and the impact of sanctions on operations there.

- The bank will be much diminished in any post-Russia scenario, both in size and profitability.

- Even so, these shares trade for an unduly steep discount to book value, even after completely discounting its operations there.

Anne Czichos/iStock Editorial via Getty Images

The last 18 months have been tough for shareholders of European bank Raiffeisen (OTCPK:RAIFF)(OTCPK:RAIFY), which has one of the highest exposures to Russia in its peer group. With operations there isolated due to sanctions, this has led to a substantial share price decline compared to its pre-war levels.

Raiffeisen's continuing presence in the country throws up plenty of uncertainty, but a cursory glance at the stock price chart tells you that the market has been viewing it on an "ex-Russia" basis for some time now. While an exit from the country would result in a much diminished bank, every stock has its price, and Raiffeisen looks too cheap at its current level even accounting for a smaller and structurally less profitable bank post-Russia. Buy.

Significant Russia Exposure

With over 17 million customers and a presence in around a dozen of the region's national markets, Raiffeisen is a major player in Central, Eastern & Southeastern Europe. Total assets were around €210 billion at the end of Q1 2023.

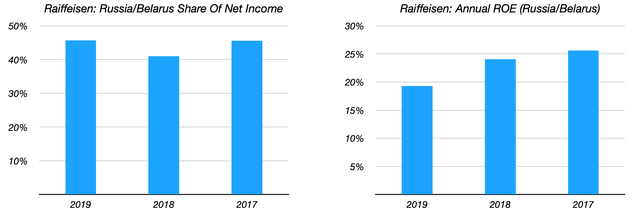

Raiffeisen's business in Russia is a major contributor to group results. In 2022, Russia/Belarus contributed a massive 65% to group profit before tax ("PBT") of €4.1B. The geographical segment that houses the Russian businesses, Eastern Europe, generated a whopping 70% return on equity ("ROE") in 2022. In turn, that helped power last year's very attractive group-wide ROE of 26.8%.

Now, 2022 was an unusually good year for earnings, but the general point still stands: Raiffeisen's Russia business is very valuable to the firm. Even in the more 'normal' pre-COVID and pre-conflict years of 2017-2019, the Russia business generated an average annual ROE of over 20% and contributed circa 40% to group net profit.

Data Source: Raiffeisen Annual Reports, Author Calculations

Currently, Raiffeisen's Russia/Belarus business exists almost in total isolation as the bank cannot extract the profits it generates there. A sale is also not a panacea for two reasons. Firstly, because Raiffeisen is in such a weak position any transaction would almost certainly be at a very unattractive multiple of book value, certainly relative to the historical ROE of the Russian business. Moreover, even on completion of a deal Raiffeisen would still face issues in relation to getting sale proceeds out of the country.

Diminished, But Cheap Even Without Russia

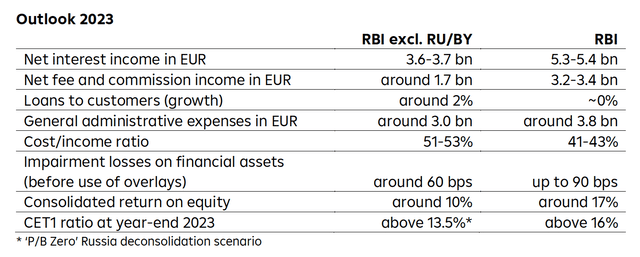

As per above, Raiffeisen without Russia is a much diminished bank. It would lose a big chunk of its earnings, while group-wide ROE would also be lower. This year management is guiding for a consolidated ROE of 17%, but that falls to 10% on an ex-Russia/Belarus basis.

Nonetheless, the bullish case for Raiffeisen is that the stock is just too cheap even if you totally discount Russia/Belarus. In Q1 2023 alone the bank earned €330m in net income on that basis. Call that EPS of just over €1 based on 328m shares outstanding. The share price in Vienna trading is €13.66 at time of writing. So, based on Q1 alone Raiffeisen shares post an earnings yield of 7.3% without Russia/Belarus.

Now, looking ahead it does appear that Q1 earnings mark a high point. I say that for two reasons. Firstly, management's FY23 ex-Russia/Belarus net interest income ("NII") guidance is for €3.6-3.7B, yet NII in Q1 was already €1B, implying a contraction in the coming quarters. Furthermore, FY23 guidance also sees ex-Russia/Belarus impairment charges of around 60 basis points. In Q1, this only came in at 4 basis points, implying an uptick through the rest of the year. Along with FY23 fee income guidance (~€1.7B) and OpEx guidance (~€3B), that gets me to a tentative FY23 net income of around €1.15B (€3.50 per share). Although this represents a slowdown on the Q1 run rate, this still implies an FY23 P/E ratio of 4, ex-Russia/Belarus, which looks very cheap.

Raiffeisen Q1 2023 Earnings Release

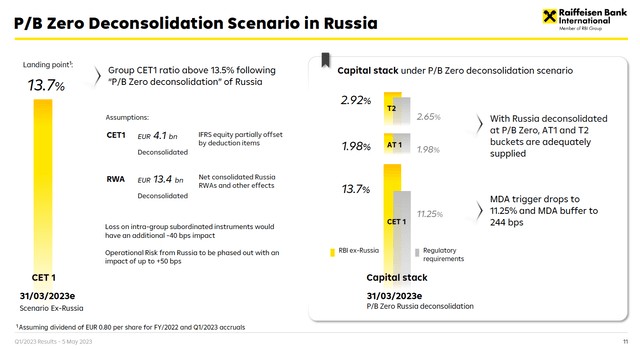

In the past, Raiffeisen targeted a very wide dividend payout ratio of between 20-50%. I believe this was to give it flexibility in terms of, for example, M&A. Dividends have been suspended due to the situation in Eastern Europe, but even at the lower-end of that payout ratio spending around €250 per annum on a cash dividend would yield around 5-6%. That's how cheap the bank currently is. Note that Raiffeisen's Q1 CET1 capital ratio of 13.7% (ex-Russia/Belarus) was inclusive of a €0.80 per share dividend in respect of FY22, although the timing of this payout is still uncertain and wasn't put forward at the AGM.

Source: Raiffeisen Q1 2023 Results Presentation

Raiffeisen also looks very cheap on a price/book basis. Consolidated equity at the end of Q1 was around €16.4B, equal to a little over €50 per share. As it stands, that means the stock is trading on a P/B multiple of less than 0.3x. Stripping out Russia/Belarus equity lowers book value per share ("BVPS") to around the €35 mark by my count, so on that basis the stock is on a P/B of 0.4x. That is still very cheap considering management is guiding for a 10% ex-Russia/Belarus ROE this year.

Is Raiffeisen Overearning?

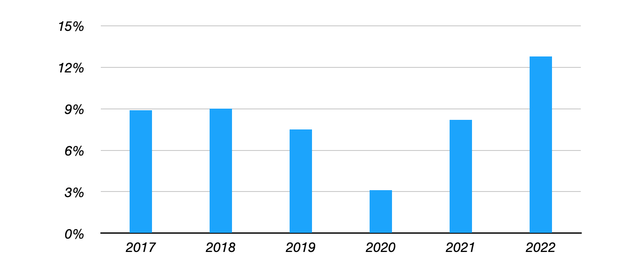

One explanation for this disconnect is that Raiffeisen could be overearning in the current macro environment due to higher interest rates and still benign asset quality. Or said differently, a 10% ROE is not reflective of the bank's profitability across the cycle. That is a fair point. By my calculation Raiffeisen ex-Russia/Belarus only averaged a circa 7.5% ROE over the 2017-2021 period. It would therefore be prudent not to assume it can hit a double-digit ROE year in, year out:

Raiffeisen: Annual ROE Ex-Russia/Belarus

Data Source: Raiffeisen Annual Report Supplementary Data, Author Calculation

That said, even assuming a structurally lower level of profitability still leaves the shares cheap. On a 7-8% through-the-cycle ROE I'd be looking for a P/B in the 0.6-0.7x area, implying considerable upside from the current share price.

Comparison To Erste Also Points To Upside

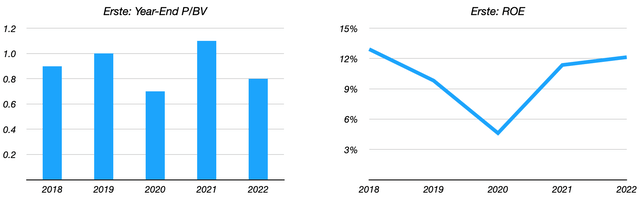

Finally, a useful benchmark for Raiffeisen in terms of valuation is fellow Austrian bank Erste (OTCPK:EBKOF)(OTCPK:EBKDY). Now, there are some notable differences between the two: Erste is more of a household lender and relies more on NII to generate income, but nonetheless it has considerable geographic overlap with Raiffeisen once you strip out the latter's Russia/Belarus operations.

Erste trades for €31.40 per share in Vienna trading as I type, putting it around 0.7x Q1 2023 BVPS of around €44. That is a substantial premium to Raiffeisen. Now, over the past five years Erste has traded on a P/B of around 0.9x on average. That makes sense given it averaged a ROE of around 10% over the same period.

Data Source: Erste Group Annual Reports

Some of Erste's premium to Raiffeisen can therefore be explained by its higher profitability, but there is still a substantial gap left over even after taking this into account. On a fair 0.6x BV for Raiffeisen, which would correspond to its ex-Russia/Belarus earnings generation, I get a fair value in the €20 per share area (~$5.40 per ADR), implying circa 50% upside from the current price. Buy.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RAIFF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.