Palantir: Still Undervalued After The Rally

Summary

- Palantir demonstrated a stellar revenue increase over the past five years, and recent quarterly financial statements suggest solid growth momentum is still in place.

- The latest earnings indicated a massive bullish signal because the company delivered its first-ever positive free cash flow quarter and my analysis suggests room for profitability improvement is huge.

- My valuation analysis suggests the stock is more than 20% undervalued.

Sundry Photography

Investment thesis

Palantir Technologies (NYSE:PLTR) is one of the hottest stocks year-to-date. Investing after a massive rally like PLTR demonstrated this year is risky, but my valuation analysis suggests the stock is significantly undervalued. The level of uncertainty regarding underlying assumptions is high, but even under very conservative growth expectations, the stock still looks undervalued. First quarter financial performance was an important milestone and a bullish signal that the company can generate solid free cash flow. My analysis suggests there is still huge room for further margin expansion in the upcoming quarters. The stock is a strong buy even after a 140% year-to-date rally, in my opinion.

Company information

Palantir is a software company specializing in data analysis and integration for clients across different sectors. According to the latest 10-K report, the company offers three software platforms: Gotham, Foundry, and Apollo. Gotham and Foundry enable institutions to transform massive amounts of information into an integrated data asset that reflects their operations. Apollo is a cloud-agnostic layer that coordinates the delivery of new features and security updates, helping to ensure the continuous operation of critical systems and allowing customers to run their software in virtually any environment.

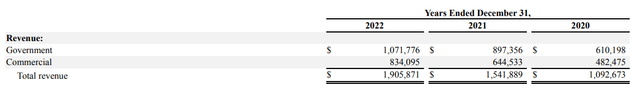

The company's fiscal year ends on December 31. PLTR disaggregates its revenue into two reportable segments: Government [clients] and Commercial. In FY 2022, about 57% of the company's revenue is attributable to the Government segment.

Financials

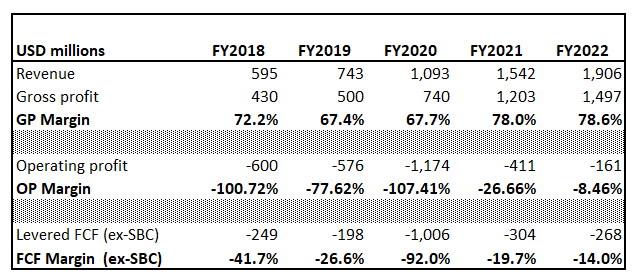

Palantir went public in 2020, so we have just a five year-horizon to analyze the long-term financial performance. The company's revenue increased more than three-fold over the five years. I like that profitability metrics improved significantly as the company's business scaled up.

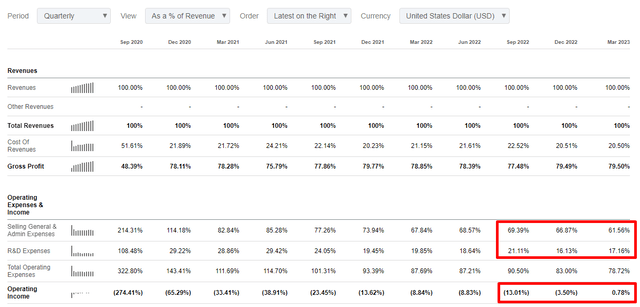

Author's calculations

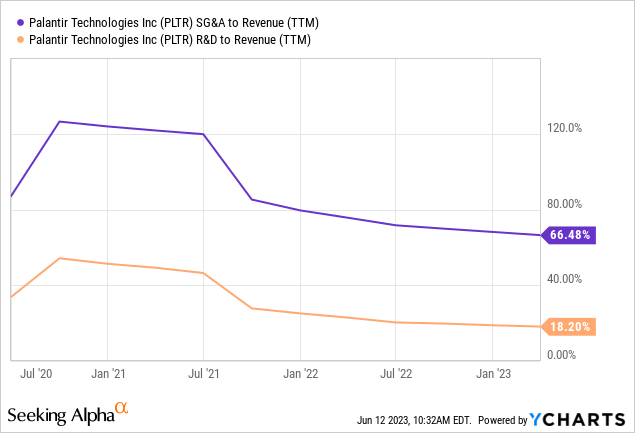

The company's operating expenses are high mainly because of very high SG&A, especially the stock-based compensation [SBC]. During the IPO year, the SBC was massive, about 20% higher than the company's annual revenue. These expenses moderated since then but still represented about 30% of annual revenue in FY 2022. SG&A represented about two-thirds of the company's sales, meaning there is still much room to optimize costs as the business scales up. From the operating expenses perspective, I like that the company allocates a significant portion of its sales to R&D, meaning the management is working on fueling additional revenue growth with new features or products.

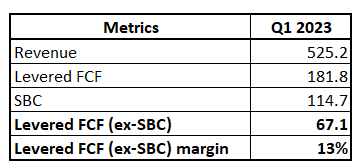

The company's quarterly earnings history is relatively short, but we can see that revenue growth experiences strong momentum and is consistently double-digit. On the other hand, we can see that YoY revenue growth is decelerating. As revenue growth decelerates, the management should be very attentive to managing costs. And they do. In Q1 of FY 2023, the company demonstrated a positive operating margin for the first time. I like that the company did not sacrifice its R&D and optimized SG&A. Gross margin also shows resilience during the harsh environment, which is good for investors.

As a conservative investor, I pay much attention to the free cash flow [FCF] margin. During Q1, the company generated a positive levered FCF ex-SBC with a solid about 13% FCF margin. It is a massive bullish sign because we saw above that SG&A still represented more than 60% of the company's sales. Therefore, there is vast room for profitability improvement as the business scales up in my opinion.

Author's calculations

The company's balance sheet is in excellent shape, with about $3 billion in cash and a solid net cash position. Overall, leverage ratios are very modest, and liquidity looks like a fortress. Based on the balance sheet, I believe the company has enough financial strength to weather any storm.

Valuation

The stock rallied more than 140% year-to-date, significantly outperforming the broad market. The company's strong Q1 earnings report with its first-ever positive operating profit triggered the stock price. The chart below shows that the major part of the rally began after the Q1 earnings release in early May.

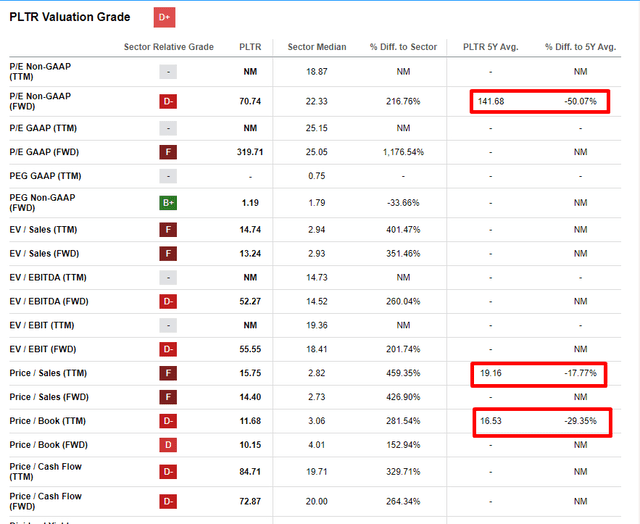

Seeking Alpha Quant assigns PLTR a relatively low "D+" valuation grade meaning there is tiny, if any, upside potential. This is because the valuation multiples of Palantir are very high. On the other hand, we can see that valuation ratios are moderating if compared to 5-year averages.

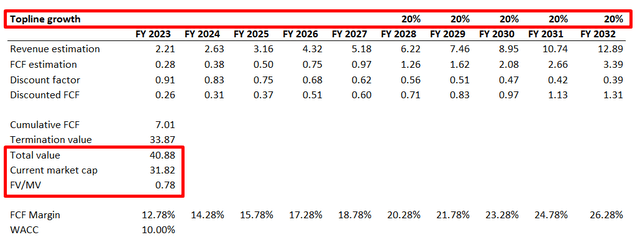

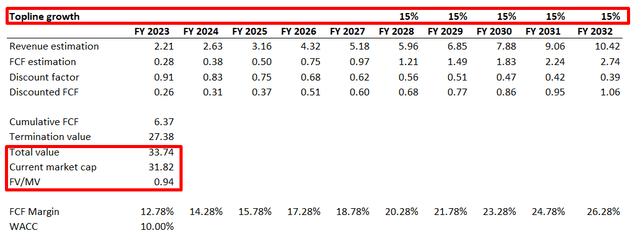

Multiples analysis is unfair for a growth company like Palantir, in my view, which just recently started delivering positive FCF. In my opinion, a discounted cash flow [DCF] approach is the best option for a growth company like Palantir. Valueinvesting.io suggests Palantir's WACC is 10%, which I use as a discount rate. I have revenue consensus estimates up to FY 2027 and project a 20% revenue growth after it. Overall, over a decade, revenue is expected to compound at 22% CAGR. This might look way too aggressive. On the other hand, the company is a pioneer and its opportunities are a blue ocean with vast growth opportunities. Moreover, we are currently at the beginning of the AI era, which is considered a Fifth Industrial Revolution by many. The company has a solid track record of revenue growth over the past five years, and it continues to invest substantial resources in R&D. Therefore, I consider a 22% revenue CAGR reasonable. For FCF margin, I start with 12.78% for FY 2023, which is Q1's levered FCF margin ex-SBC. I expect the FCF margin to expand by 150 basis points early as the revenue increases rapidly.

As you can see above, the fair value is about $41 billion under the given assumptions. This means the stock is more than 20% undervalued even after a massive year-to-date rally. PLTR bears might argue that a 20% revenue CAGR might be too optimistic. For more conservative potential investors, let me simulate the second scenario with a 15% revenue CAGR for the years beyond FY 2027.

According to my calculations, the stock is still undervalued even with a substantially slower revenue growth estimation. Therefore, the margin of safety looks solid.

Risks to consider

As an aggressive growth company, Palantir faces significant risks of failing to deliver expected revenue growth. Revenue demonstrating deceleration signals will significantly adversely affect the company's market capitalization. Failing to achieve sustainability in FCF margin expansion will also hit the stock price. Therefore, investors should remember that changes in underlying assumptions can massively move the fair stock price.

Palantir technology operates in a highly technologically sophisticated industry. The company has to sustain its competitive advantages over competitors to ensure the market share is safe. The company mitigates this risk by substantial investments in R&D. But investing in R&D is also risky since some of the bets might not pay off. Therefore, the company should continue to keep its brightest engineers.

Bottom line

To conclude, I believe that PLTR stock is a strong buy. The upside potential outweighs the potential risks. I believe that the last quarter was a significant pivot since the company delivered its first positive operating profit and levered FCF. Palantir's cost structure also suggests there is still massive room for increasing profitability margins.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PLTR over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.