Sprott Focus Trust: Interesting Portfolio Offering A Managed ~6% Distribution Rate

Summary

- Sprott Focus Trust is a unique closed-end fund with a value-oriented portfolio and a focus on the materials sector.

- The fund has outperformed its benchmark, the Russell 3000 Index, in the short and long term, but its current discount is not very appealing.

- Investors should consider FUND for diversification but wait for a better entry point with a wider discount.

- This idea was discussed in more depth with members of my private investing community, CEF/ETF Income Laboratory. Learn More »

Olivier Le Moal

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on May 30th, 2023.

Sprott (SII) offers several closed-end funds, but they generally focus on different metals. There is the Sprott Physical Gold and Silver Trust (CEF), Sprott Physical Gold Trust Unit (PHYS), Sprott Physical Platinum and Palladium Trust (SPPP) and Sprott Physical Silver Trust Unit (PSLV). Each name is representative of what the fund looks to invest in. These are unusual closed-end funds in that they don't provide regular distributions, which makes sense as their underlying holdings produce no cash flows. They also aren't actively traded as they really just set up their portfolio and invest in an individual or dual metal, and that is it.

These funds from Sprott aren't interesting, and they've never caught my attention, which is why I've never really covered these funds before. CEF, PHYS and PSLV are actually quite large funds. When only looking at net assets, PHYS is actually the largest CEF on the market, and PSLV is the third largest closed-end fund. CEF then follows this up as the fourth largest closed-end fund in terms of net asset value. So when these launched, investors really took an interest in them.

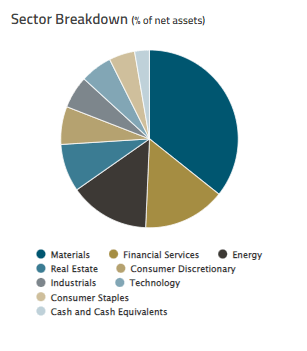

All that said, Sprott also has the Sprott Focus Trust (NASDAQ:FUND), which is a more traditional equity CEF. A reader mentioned it as a suggestion for coverage. This one is interesting as it holds a fairly unique mix of positions not traditionally held by other CEFs, so that caught my attention. This is a more value-oriented portfolio, with tech being less than 6% of the fund. Instead, the largest weighting in this fund is the materials sector, with a sizeable allocation of nearly 36% of assets.

The fund is interesting, but FUND's discount isn't so appealing at this time. Before entering a position, I think investors should be patient and wait for a better entry.

The Basics

- 1-Year Z-score: -0.92

- Discount: -6.61%

- Distribution Yield: 6.57%%

- Expense Ratio: 1.14%

- Leverage: N/A

- Managed Assets: $257.3 million

- Structure: Perpetual

FUND seeks to "deliver superior performance to investors by investing with a long time horizon in high-quality businesses with strong balance sheets that are trading at attractive valuations." The fund has no limit in terms of the market cap of the underlying portfolio. The average market cap weighting of their underlying holdings comes to around $3.43 billion. That would tilt the portfolio to the lower end of the mid-cap range ($2 to $10 billion.)

Unlike Sprott's other CEFs, FUND is actually quite small. At the same time, FUND appears to be the oldest fund that they offer. However, that also depends on where you look. They list that the inception date was November 1, 1996, on the fund's website. Other material states they commenced operations on March 2, 1988.

The fund was also previously the Royce Focus Trust and became the Sprott Focus Trust in March 2015. That's when Sprott Asset Management also took over managing the fund. Royce is a notable smaller-cap investment management group, so it seems they have kept the fund focused on relatively smaller companies.

However, the management really didn't change anyway. Whitney George, the senior portfolio manager for FUND and Sprott's CEO worked at Royce as the co-CIO from 2009 to 2013. He joined Sprott in 2015 when FUND essentially became a Sprott fund. He's also been the portfolio manager since 2000.

With no leverage being utilized by the fund, an investor doesn't have to worry about added volatility or higher interest rates. The fund's expense ratio is normal for a non-leveraged equity CEF.

Performance - Discount Attractive, But Better Opportunities Likely

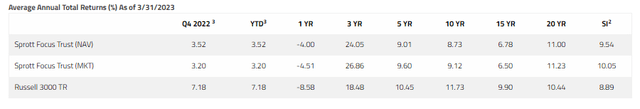

The fund benchmarks against the Russell 3000 Index. Over the short-term standard time frames and longer-term time frames, the fund has been able to beat its benchmarks. It's the 5, 10 and 15-year periods where we see underperformance. The 10 and 15-year periods had underperformed at a fairly material level.

FUND Annualized Performance (Sprott)

The Russell 3000 is one of the broadest based indexes in tracking U.S. equity performance, as it invests in just about everything. The latest fact sheet for the Russell 3000 Index noted that it represents "approximately 96% of the investable US equity market, as of the most recent constitution."

That seems to be a fairly appropriate benchmark, except FUND doesn't represent nearly that many companies. In fact, they only invest in 34 total equity holdings. However, it is the representation of being able to invest anywhere and at any company size that is reflected. Most CEFs invest primarily in the largest market cap companies.

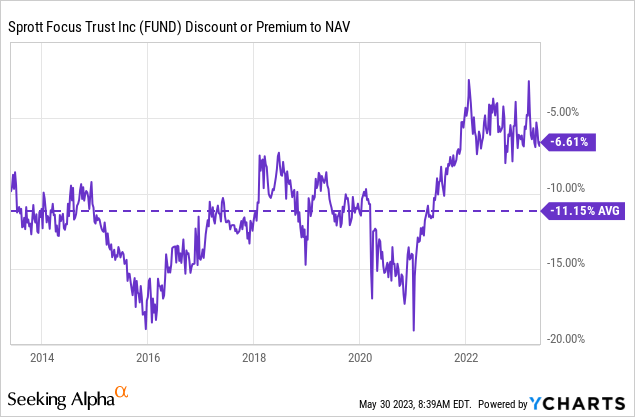

When a CEF is trading at a discount, that's generally a good thing. However, the fund's current discount is trading higher than its longer-term average. That generally indicates that now wouldn't be the best time to consider this fund. An exception would be if there was some material change to the fund that makes it particularly attractive.

YCharts

Going back to talking about Whitney George, it is worth noting that he has a huge stake in FUND. He was doing some serious buying last year and pushed his ownership stake up to 38.5%, according to the last 13D. That filing showed that his wife owned another 9.2%.

This isn't really a new development, though, and they've owned a sizeable stake for quite some time.

Distribution - Managed 6% Rate

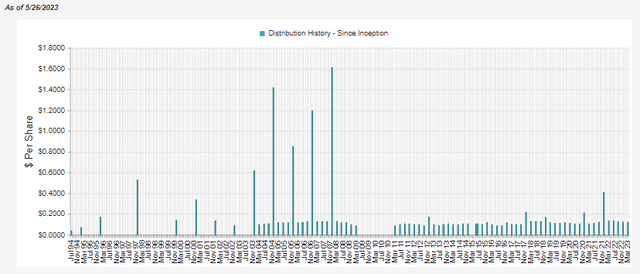

The fund pays a managed distribution plan that is equal to 1.5% of the fund's NAV paid out each quarter. This makes it a predictable payout in terms of knowing what you're going to get. If the fund is doing well and NAV is heading higher, then the distribution is higher. If the fund performs weakly and the NAV slides lower, then the distribution slides lower.

FUND Distribution History (CEFConnect)

What might be interesting is that the risk-free rate is getting quite close to this 6% managed distribution plan. At the same time, we can see that the fund's discount has narrowed. That seems to be about the opposite of what one might expect to be occurring. In fact, the argument could be made that the fund's discount should be even wider now than it previously was.

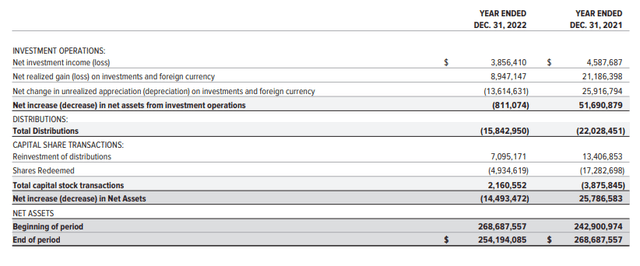

As is the case with most equity funds, the fund's distribution won't be covered via net investment income alone. The fund's NII even slid lower in the last annual report from the prior year.

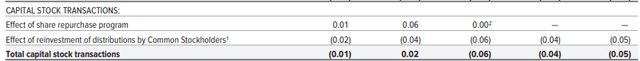

FUND Annual Report (Sprott)

The fund has a repurchase program in place. That can generally help provide further support for discount narrowing and, when done at a discount, is accretive to NAV. Last year this worked out to a fairly small $0.01 accretion, while the prior 2021 year showed an accretion of $0.06. Generally speaking, this is positive, even if it's a small amount.

However, this gets offset by the fund's reinvestment plan. The fund creates new shares when investors DRIP, even when trading at a discount. When shares are created at a discount, that's dilutive to NAV. This isn't the only fund to do this, but it certainly is in the minority. When trading at a discount, most funds will utilize reinvestments through open market purchases instead of creating new shares. That means no dilution for current shareholders, and it creates a buyer in the market. This dilutive effect for FUND offsets the small positive impact of the repurchases.

FUND Capital Transactions (FUND Annual Report)

Small dilution over the years can add up, and it also means reducing the fund's NAV - which we know is important for figuring out the distribution that is paid out to investors.

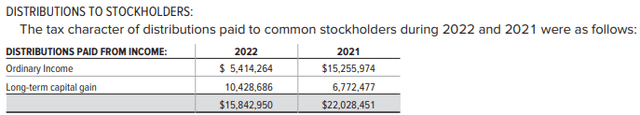

The distribution tax classifications for the fund in the last two years showed a big difference.

FUND Distribution Tax Classifications (Sprott)

Generally, we'd expect long-term capital gains representing most of the tax classifications. In 2021, ordinary income was a large portion of the distribution to shareholders. If you are a tax-sensitive investor, that could have come with a bit of a shock if holding in a taxable account.

FUND's Portfolio

As noted, the fund skews towards companies on the lower end of the mid-cap scale. The fund also carries a fairly narrow 34 holdings, which means each position they have to be more right on. That can end up creating significant outperformance or significant underperformance. The greater the number of holdings and the more spread out the weightings on those holdings, the more you generally have a more limited chance to underperform. The reverse of that means you also have a more limited chance to outperform.

I'm always looking for interesting funds that don't form the mold of what is considered traditional. So when I started to look at the holdings and the fund's sector breakdown, it immediately piqued my interest. The fund's largest sector weighting is the materials sector at 35.7%. The financial sector then follows this at 15% and energy at 14.6%.

FUND Sector Breakdown (Sprott)

Tech's weighting in this fund comes to just 5.8%. That meant a really strong relative performance in 2022, though with growth taking off again in 2023, it has meant some general underperformance. However, besides those mega-cap growth names, most other asset classes and positions aren't having a great year either. The 2022 performance for the fund was essentially flat, which they noted in the manager's letter.

We never thought we would be pleased to report that Sprott Focus Trust’s performance was unchanged for the year, but here we are. Sprott Focus Trust was up 0.08% on a Net Asset Value ("NAV") basis and down 0.91% in total market return in 2022 due to a very modest widening of the market price discount to NAV. We are proud of this performance, given that 2022 represented one of the worst years in four decades for traditionally balanced investors. Equity markets were broadly down, with the S&P 500 Index losing 18.11% and many popular asset sectors faring even worse. Fixed Income markets suffered their worst performance on record, with bonds declining 13.01% as measured by Bloomberg Barclays US Agg Total Return Value Unhedged USD Index.

To be able to achieve that, it was this more value-oriented sector exposure that limited the fund's downside. Staying true to the fund's focus on its value approach, the fund's portfolio is trading at a weighted average P/E ratio of only 9.48x. That's about half of the S&P 500 Indexes' forward P/E of 18.33x currently.

YCharts

The fund is primarily invested in U.S. companies, at around 75% of the fund. This adds another dimension to the fund to invest anywhere around the globe and adds more flexibility.

Despite the fairly concentrated portfolio, the top ten represent a fairly balanced approach. The weightings between each position aren't drastically different. That said, the top ten still represent around 44.5% of the portfolio. That's an added layer of concentration that an investor should consider before investing in the fund.

FUND Top Holdings (Sprott)

Reliance Steel & Aluminum (RS), Westlake Corporation (WLK), Nucor Corporation (NUE) and Steel Dynamics (STLD) are representations of their material sector exposure. This is an area of the market that is generally given significant exposure in the CEF world. Along with Pason Systems (OTCPK:PSYTF) and Helmerich & Payne (HP) as energy plays, this represents cyclical names that should be sensitive to recessions. These positions are also representations of companies that are trading at mid to upper single-digit P/E ratios. The exception is WLK at around a 10x P/E. These valuations should reflect some of the forward uncertainty with a recession expected.

Conclusion

FUND carries a unique portfolio. This can make it more attractive for investors that are potentially looking for greater diversification than what they can get from most other CEFs. That being said, the fund's discount isn't necessarily the most attractive. More patient investors could probably find a much better deal in the future. Should the fund go back closer to a double-digit discount, that could represent a better time to consider this name.

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

This article was written by

---------------------------------------------------------------------------------------------------------------

I provide my work regularly to CEF/ETF Income Laboratory with articles that have an exclusivity period, this is noted in such articles. CEF/ETF Income Laboratory is a Marketplace Service provided by Stanford Chemist, right here on Seeking Alpha.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.