New Sectors Away From AI/Semis/FAANG Joining In The Rally (Technical Analysis)

Summary

- Equity markets have held up well, with leading sectors such as AI and semiconductors maintaining gains.

- Sectors such as industrials, materials, transports, and cybersecurity are showing signs of joining the rally.

- Improved market breadth could alleviate concerns about the rally's sustainability.

Anastasiia Shavshyna

Equity markets have held up remarkably well in the past few weeks, with stocks from leading sectors such as AI and semiconductors giving back very little of their gains.

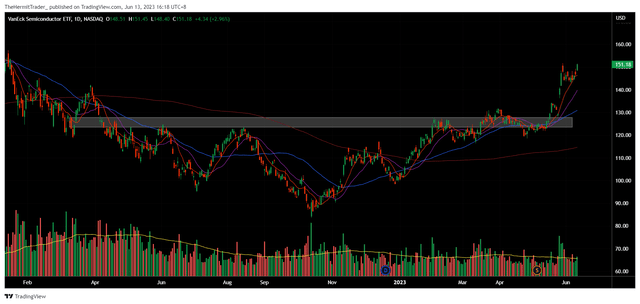

The semiconductor ETF (SMH) is trading near its 52-week highs, even after rising close to 50% since the start of the year, for example.

Daily Chart: SMH

What excites me is that a number of other sectors are awakening from their slumber, and are shaping up to participate in this rally. As the saying goes: "rotation is the lifeblood of a bull market". We could see an improvement in market breadth from here, which would be a healthy development.

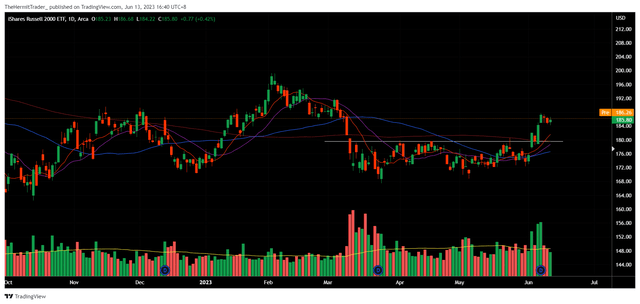

For one, the Russell 2000 (IWM), which is a better proxy for the broad market than the S&P 500 (SPY) or Nasdaq 100 (QQQ), is holding up well after breaking out higher from a 3-month base.

Daily Chart: IWM

The same technical development is observed in microcaps (IWC), which are also holding up well above its key moving averages after breaking out higher from their base.

Daily Chart: IWC

Away from the leading FAANG stocks, AI, and semiconductor names, uranium is showing a lot of upside momentum. On the weekly chart, the sector ETF (URA) has taken out multi-month resistance.

Weekly Chart: URA

Within the sector, my focus stock would be Cameco Corp. (CCJ). The stock is trading near its 52-week highs, showing a great deal of relative strength. It is large cap ($14b) and liquid, which would be favourable for institutional investors to accumulate.

Weekly Chart: CCJ

Industrials (XLI) are on the verge of breaking out from a multi-month base.

Daily Chart: XLI

Within the industrial sector, Boeing (BA) is on the front foot, having already broken out higher from its multi-month base.

Daily Chart: BA

Materials (XLB) have broken out above downtrend resistance, and price is holding up above key moving averages.

Daily Chart: XLB

Transports (IYT) have broken out from their multi-week base.

Daily Chart: IYT

Cybersecurity (HACK) sector is also showing signs of life, first breaking out from a large multi-month base, and now consolidating well above the neckline.

Daily Chart: HACK

Many investors have not trusted the rally due to the lack of broad-based participation across stocks. That was initially true, with strength confined to FAANG, semiconductor, and AI stocks. Now, there are signs that market breadth is improving, which should put to bed these concerns.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.