How The May Inflation Report May Affect Future Fed Rate Decisions

Summary

- The consumer-price index was up 4% YOY. Though elevated, the rate remains well below the peak reported in June 2022.

- On a monthly basis, prices rose a seasonally adjusted 0.1%, in-line with expectations.

- A primary contributor to the rate, shelter costs, represented over 40% of core CPI. Promising trends in this category bode well for further overall declines in future periods.

- Though the report is unlikely to significantly alter the Fed's current path for their upcoming rate decision, it provides confirmation that their actions thus far are having their intended effect.

Spencer Platt/Getty Images News

The Labor Department reported Tuesday that the consumer price index ("CPI") rose 4% in May from a year earlier. This is down from the 4.9% reported in April and well below the recent peak of 9.1% reported in June of 2022.

April marked a milestone of 10 straight months of decline from the peak. Today's reading is a continuation of the positive trend. In fact, the annual rate is now cut more than half from its peak.

More importantly, core CPI, which excludes volatile food and energy prices, was 5.3% in May, down from the 5.5% reported in April. This, too, marks a steady decline from the 6.6% peak last seen in September of 2022.

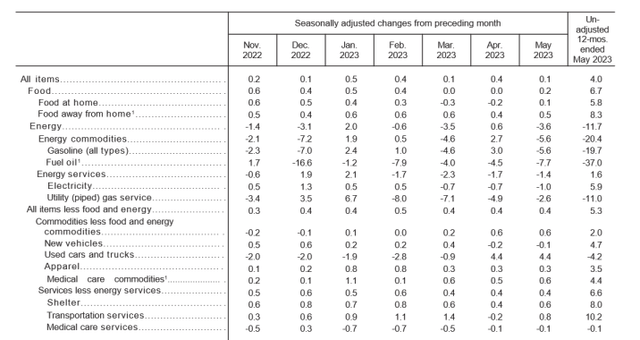

On a monthly basis, consumer prices rose a seasonally adjusted 0.1% in May, matching expectations. In April, prices were up a seasonally adjusted 0.4%, driven primarily by housing, gasoline, and used-car prices. The current month reflects more of the same, with the exception of energy, which registered more pronounced declines.

Stocks rose immediately following the report. The S&P 500 Index (SP500) was more muted, while both the Dow (DJIA) and the Nasdaq (NDX) climbed over 100 points. Bond yields moved lower, with the 10-YR note falling to 3.705%, from 3.763% on Monday.

The current release is unlikely to factor materially into the Federal Reserve's ("Fed") plan for their upcoming decision. But it does provide confirmation that their actions thus far are having their intended effect.

Main Takeaways From The May CPI Report

Consistent with the prior month, the largest YOY declines have been in the gasoline and fuel indexes, which are now down 19.7% and 37%, respectively. On the flip side, transportation services are up 10.2%. It's lower than the 11% YOY increase reported in April. But it tick higher by 0.8% for the month, likely due to holiday travel. The monthly rise is also less significant than the larger gains in February and March.

In May, used vehicle prices increased 4.4% over the month, the second straight increase following the 4.4% surge in April. This is attributable to a lack of inventory. The gains are coming at the expense of new car prices, which were down 0.1%, which is consistent with the prior month.

Consumers didn't receive quite the same reprieve in grocery prices as they did in April. In May, the index rose 0.2% overall, with a 0.1% increases noted in the at-home foods category, which had declined for two consecutive months previously. The gains came in three of the six major grocery categories, with a notable increase in fruits and vegetables, which were up 1.3% following a 0.5% decrease in April.

When excluding shelter along with food and energy, prices were up 3.4% This marks a slowdown from the 3.7% increase noted in both March and April.

Additionally, services inflation, less shelter prices, were 4.2%, the second straight decline following increases of 6.1% and 5.2% in March and April, respectively. The continued cool down here is particularly notable, considering shelter's overall weighting in the index. This could perhaps be one catalyst for an extended pause from the Fed.

In a separately released report on Wednesday, the Labor Department reported that real hourly earnings were up 0.3% for the month and 0.2% YOY. Earlier in June, the Labor Department reported monthly and YOY nominal wage growth in May of 0.3% and 4.3%, respectively. Preferably, the Fed would like to see softening wage pressure. But at least from a nominal perspective, there is still some way to go on this front.

In another note, the New York Fed's monthly Survey of Consumer Expectations for May showed one-year expectations at 4.1%, right around where the figure currently stands. The declining expectations could be a further positive for future rate policy.

The Impact Of Shelter On May CPI

Housing's contribution to inflation is among the most important variables on the monthly release, as it is the largest component of the CPI.

In May, tenants' rent made up about 7.6% of CPI, while owners' equivalent rent ("OER"), which is a more reflective measure of ownership, made up about 25.4%. As a share of core CPI, shelter's representation was even higher, at about 43.5%

At peak inflation in June of 2022, housing accounted for approximately 20% of overall inflation and contributed approximately 1.7% to the rate. At present, it makes up about half of the annual CPI and is contributing about 2.5 percentage points. Historically, the contribution would be just 1 percentage point. The increasing share is directly relatable to the declines seen elsewhere.

Looking ahead, housing's contribution is likely to decrease, given that the calculation of the CPI metric is based on both new and existing leases. But since tenants' rents typically change just once a year, the exclusion of existing leases creates a lagged effect in the data. From a timing perspective, it could be about six months before this is seen in the CPI report.

Though sticky, the data appears on track. According to Zillow's (Z) Observed Rent Index, asking rents climbed 0.6% from April to May, in-line with that reported in the CPI shelter index. It's also worth noting that the monthly increase noted by Zillow is smaller than the typical may increase of 0.7%. The reading also marked the 8th consecutive month of below-average monthly growth.

And for its part, the CPI reading reported annual growth of 8.7%. This is virtually unchanged from the prior month. In fact, it's actually down by 10bps. With the cooling already in place, it's likely that this will ultimately be reflected more clearly in the monthly report sooner rather than later.

U.S. Bureau of Labor Statistics, Consumer Price Index for All Urban Consumers: Rent of Primary Residence in U.S. City Average [CUUR0000SEHA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CUUR0000SEHA, June 13, 2023.![U.S. Bureau of Labor Statistics, Consumer Price Index for All Urban Consumers: Rent of Primary Residence in U.S. City Average [CUUR0000SEHA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CUUR0000SEHA, June 13, 2023.](https://static.seekingalpha.com/uploads/2023/6/13/49921492-16866605108520188.png)

Does The May CPI Report Change The Outlook?

The Fed is currently on track to initiate a pause on their rate campaign at their Wednesday meeting. The May inflation report adds an element of support if this is in fact the ultimate decision. For one, the current reading noted a continued decline from the June 2022 peak. The core rate has also steadily declined from levels last seen in September 2022.

Housing costs remain sticky, but this is due almost exclusively to the lagged effect of the metric. Based on current readings on Zillow's Observed Rent Index, as well as the overall flatlining of housing's YOY growth for the CPI's part, shelter costs appear to be on track for a steady decline in the second half of the year.

It should also be noted that the Fed's 2% target is based on the Commerce Department's index for personal-consumption expenditures ("PCE"). And in this index, shelter is assigned half of the weight that it commands in the CPI. The probable decline in housing costs on the CPI report, then, will likely translate to more meaningful reductions in their preferred index.

Cutting against the likely decline in housing, however, is the labor market, whose strength continues unabated. A surplus in job openings and positive nominal wage growth compound these complexities. In addition, prices continue to increase in several categories outside of shelter.

By backing off, the Fed runs the risk of aggravating the inflationary impacts in these key variables. But if housing's impact proves more significant than expected, they could be caught flat-footed once again if they find themselves having to pivot into a rate cutting cycle. A pause/skip in June, therefore, appears justified. The Fed, nevertheless, still faces a dicey road ahead, given the multitude of outstanding variables.

Overall, the May report was indicative of the path forward but, by no means, definitive.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.