Copper Market Poised For Unprecedented Growth: Citigroup's Insights And Predictions

Summary

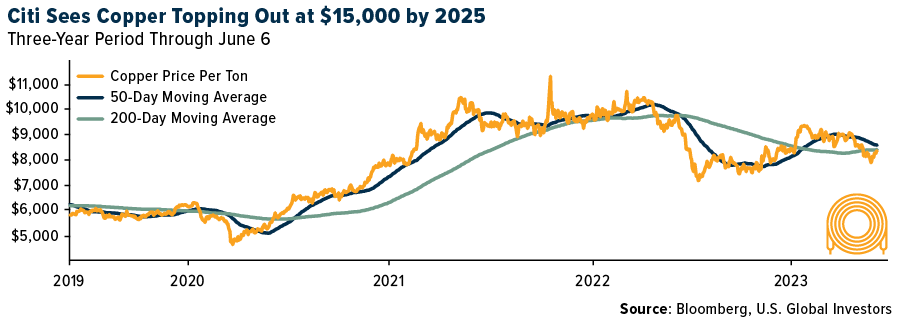

- Citigroup predicts an "unprecedented" inflow into the copper market due to growing demand for electric vehicles (EVs) and renewable energy, potentially reaching $15,000 a ton by 2025.

- EV sales are projected to escalate to around 27 million by 2026, with copper demand increasing as EVs require up to three times more copper than traditional internal combustion engine vehicles.

- Tesla's stock has seen significant growth, and CEO Elon Musk reportedly met with the prime minister of copper-rich Mongolia, possibly hinting at future plans for a metals processing plant in the country.

FactoryTh

The copper market could see an “unprecedented” inflow in the coming years as investors seek to profit from the metal’s anticipated surge in value, driven by growing demand for electric vehicles (EVs) and renewable energy, according to Citigroup.

In an interview with Bloomberg last week, Max Layton, Citi’s managing director for commodities research, said he believes now is an ideal time for investors to buy, as the price of copper is still muted on global recession concerns. The red metal is currently trading around $8,300 a ton, down approximately 26% from its all-time high of nearly $11,300, set in October 2021.

According to Layton, copper could top out at $15,000 a ton by 2025, a jump that would “make oil’s 2008 bull run look like child’s play.”

U.S. Global Investors

Citi also pointed out that copper may dip further in the short-term but could begin to rally in the next six to 12 months as the market fully recognizes the massive imbalance between supply and demand, a gap that’s expected to widen as demand for EVs and renewables expands.

Internal Combustion Vehicle Sales Set To Peak This Decade: BloombergNEF

As I’ve mentioned before, electric vehicles (EVs) require up to three times more copper compared to traditional internal combustion engine (ICE) vehicles. This presents a challenge because the number of newly discovered copper deposits is decreasing, and the time it takes to go from discovery to production has been increasing due to rising costs. According to S&P Global, out of the 224 copper deposits found between 1990 and 2019, only 16 have been discovered in the last decade.

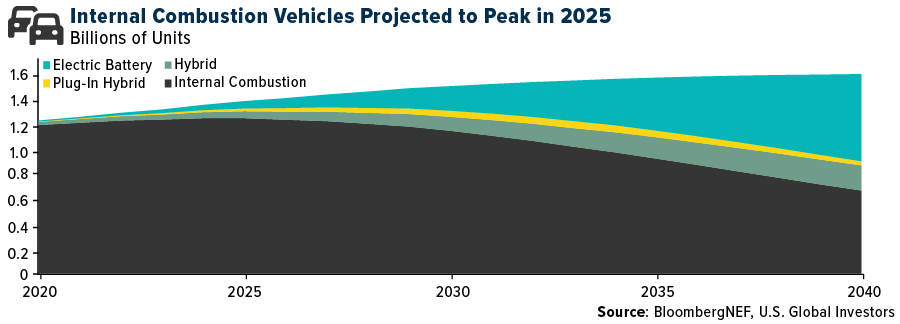

Meanwhile, EV sales continue to rise. Last year, these sales reached a total of 10.5 million, and projections by Bloomberg New Energy Finance (NEF) suggest that they could escalate to around 27 million by 2026. Bloomberg predicts that the global fleet of ICE vehicles will peak in as little as two years, after which the market will be dominated primarily by EVs and, to a lesser extent, hybrids. By 2030, EVs might constitute 44% of all passenger vehicle sales, and by 2040, three could account for three quarters of all vehicle sales.

U.S. Global Investors

Tesla Stock Supported By String Of Positive News

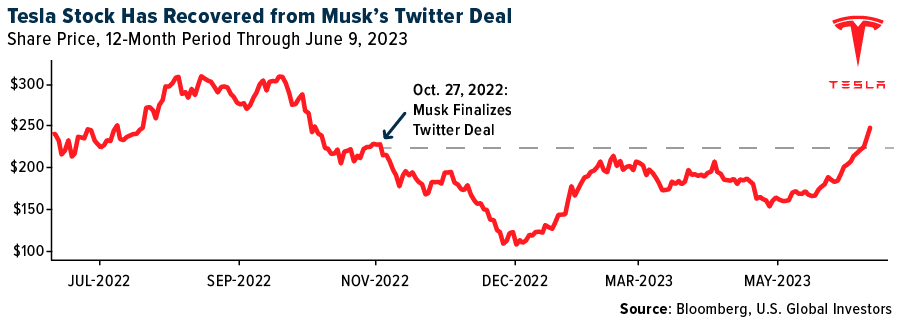

Tesla, which remains the world’s largest EV manufacturer, has seen its stock increase over 100% year-to-date in 2023, making it the third best performer in the S&P 500, following NVIDIA (+166%) and Meta (120%). In fact, shares of Tesla have now fully recovered (and then some) from October 2022, when CEO Elon Musk purchased Twitter for $44 billion. This raised concerns among investors about Musk’s ability to run the EV manufacturer while taking on a new, time-intensive project, not to mention also juggling SpaceX.

U.S. Global Investors

Friday marked the 12th straight day that shares of Tesla have advanced, representing a remarkable winning streak that we haven’t seen since January 2021.

The Austin-based carmaker got a huge boost last week after it announced that its popular Model 3 now qualifies for a $7,500 EV consumer tax credit. This action means that in California, which applies its own $7,500 tax rebate for EV purchases, a brand new Tesla Model S is cheaper than a Toyota Camry.

To qualify for the U.S. tax credit, Tesla had to make changes to how it sourced materials for its batteries in accordance with the Inflation Reduction Act (IRA), signed into law in August 2022. The IRA stipulates that 40% of electric vehicle battery materials and components must be extracted or processed in the U.S. or in a country that has a free trade agreement with the U.S. This manufacturing threshold will increase annually, and by 2027, 80% of the battery must be produced in the U.S. or a partner country to qualify for the full rebate.

Tesla stock also benefited from last Thursday’s announcement that drivers of EVs made by rival General Motors (GM) would be able to use Tesla’s North American supercharger network starting next year. The deal not only gives GM customers access to an additional 12,000 charging stations across the continent, but it also vastly increases Tesla’s market share of the essential charging infrastructure.

Musk’s Copper Quest

Thinking ahead, Musk reportedly met virtually last month with L. Oyun-Erdene, prime minister of Mongolia. The details of their discussion were not fully disclosed, but it’s worth pointing out that Mongolia is a copper-rich country, home to the world’s fourth-largest copper mine, operated jointly by Rio Tinto and the Mongolian government. In May, Rio Tinto announced that production had finally begun at the mine, which sits 1.3 kilometers (0.8 miles) below the Gobi Desert.

With access to this copper, perhaps Tesla is planning to build a metals processing plant in Mongolia? This would make sense, as the company maintains a factory in Shanghai, China.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.