Fortinet: Cybersecurity Vendor Capitalizing On Consolidation Trends

Summary

- Fortinet is one of the few tech stocks trading at all-time highs.

- The company has sustained resilient billings growth in spite of the tough macro environment.

- This is a company generating 20+% revenue growth alongside 25% operating margins.

- Valuation always matters and I discuss my outlook for the stock as of current prices.

- Looking for a portfolio of ideas like this one? Members of Best Of Breed Growth Stocks get exclusive access to our subscriber-only portfolios. Learn More »

Sundry Photography

Fortinet (NASDAQ:FTNT) has been one of the market's biggest winners as of late. FTNT is a highly profitable operator in the cybersecurity sector which continues to show resilient growth rates in spite of a tough macro environment. FTNT is one of many tech companies riding consolidation tailwinds which have only accelerated due to macro environment, and this is evidenced by the company's ability to win large deal sizes even as most tech peers are complaining about lengthening sales cycles. Management has outlined the path for sustained growth through 2025, and Wall Street has rewarded the stock with a premium valuation for its perceived reliable growth story. The stock valuation is quite rich, though it is hard to argue against this story with everything going right for it.

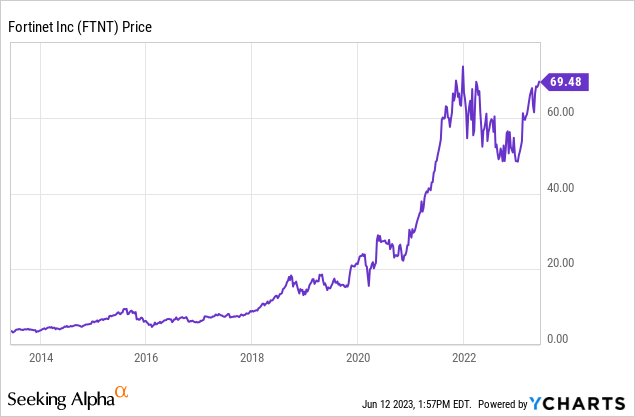

FTNT Stock Price

Even after a strong recovery this year, most tech stocks remain well off their all-time highs. FTNT is the rare exception as the stock is trading at all-time highs and has been a big winner over the past decade.

I caution investors that forward returns are likely to be more muted as it appears that the stock has somehow benefited from the tough macro environment.

FTNT Stock Key Metrics

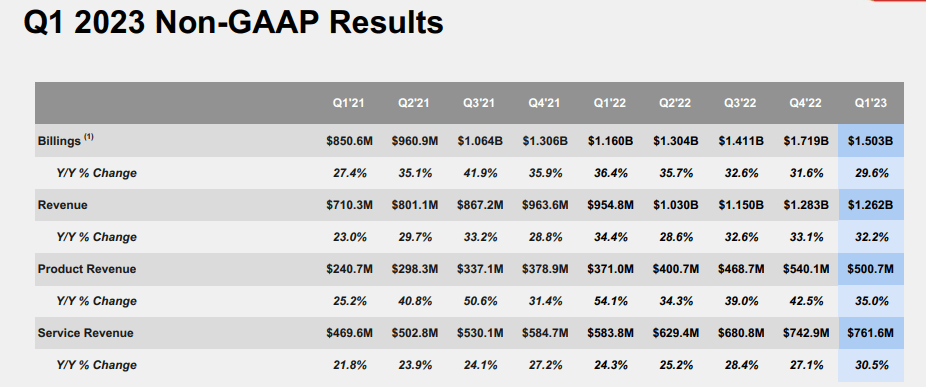

In its most recent quarter, FTNT delivered 32.2% YOY revenue growth to $1.262 billion, ahead of guidance for $1.22 billion. Billings growth remained strong at 29.6% - an impressive feat given many tech peers have seen difficulty on this front due to the tough macro.

2023 Q1 Presentation

FTNT generated a 21.7% GAAP operating margin, up from 15.8% in the prior year. On a non-GAAP basis, operating margin was 26.5%, up from 22% in the prior year.

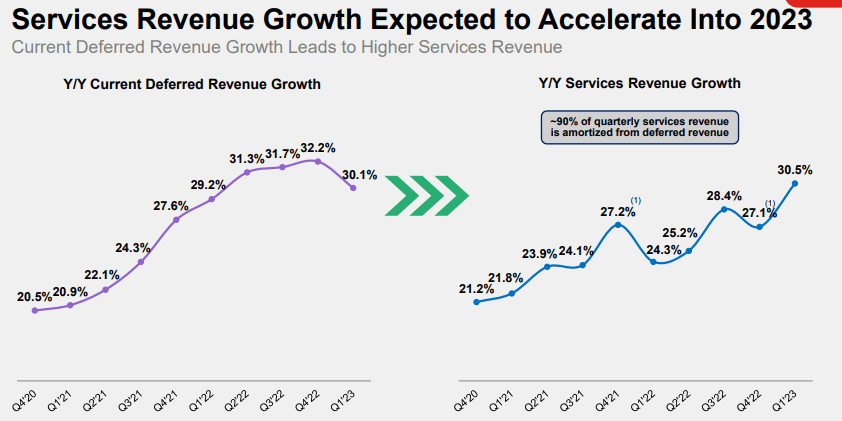

FTNT has somehow managed to see accelerating services revenue growth which was foreshadowed by strong current deferred revenue growth. This is a promising trend given that services revenues have come with stronger gross margins.

June 2023 Presentation

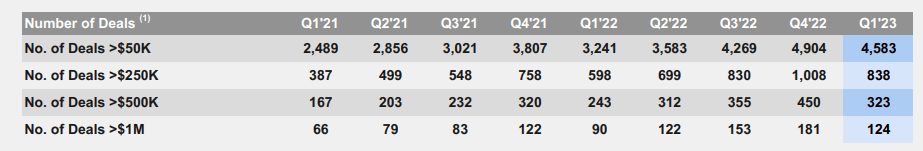

Many tech peers have seen deal sizes compress, but not FTNT. As seen below, the company has seen its deal bands relatively unchanged relative to the past several quarters.

June 2023 Presentation

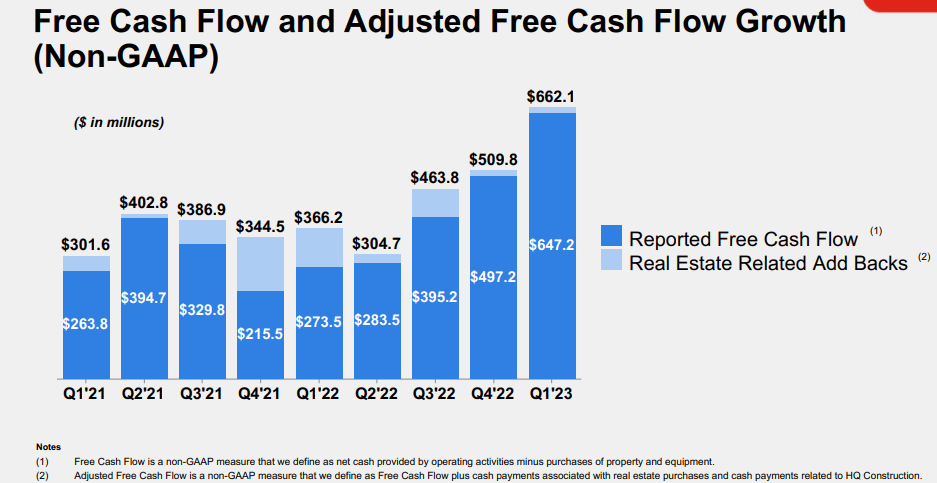

Like many tech companies which have subscription businesses, FTNT has benefited from prepayment of revenues and this has helped the company generate $662 million in free cash flow this past quarter.

2023 Q1 Presentation

FTNT ended the quarter with $2.8 billion of cash versus $991 million in debt.

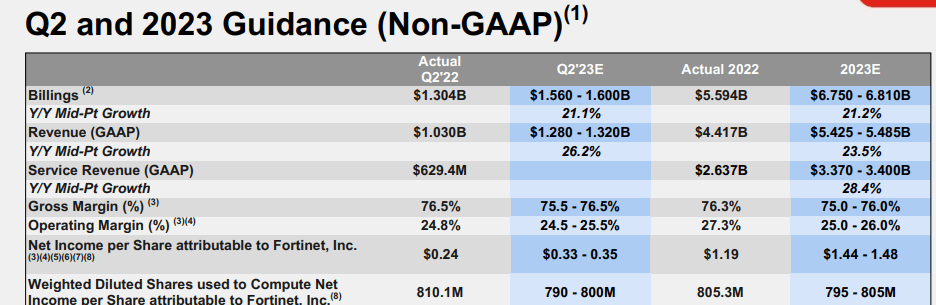

Looking forward, management has guided for 26.2% YOY revenue growth to $1.32 billion in the second quarter and 23.5% YOY growth for the full-year to $5.485 billion (ahead of guidance for $5.43 billion).

2023 Q1 Presentation

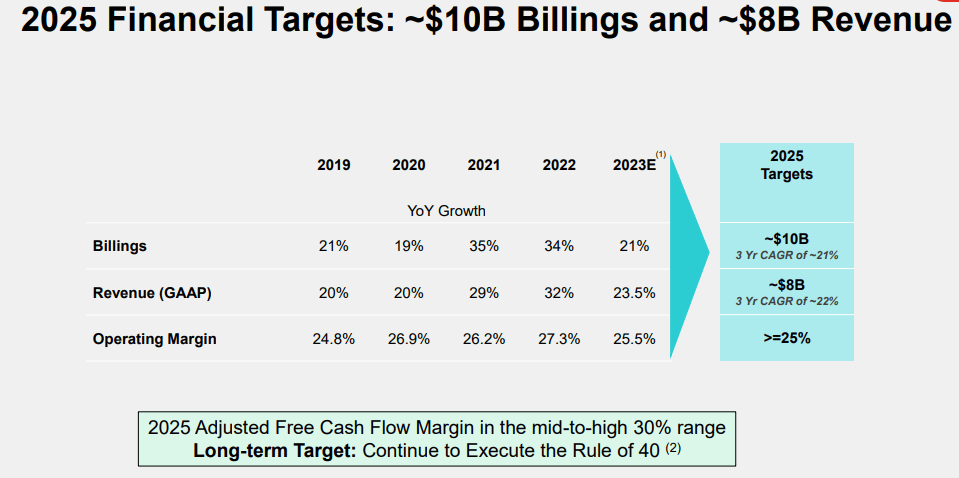

At its June presentation, management outlined the path for $10 billion in billings and $8 billion in revenue by 2025.

June Presentation

On the conference call, management hinted at increasing the aggressiveness of its share repurchase program. While the company has not repurchased any shares for several quarters, the board of directors increased the authorization by $1 billion to $1.5 billion. I would not be surprised to see the company resume repurchasing stock given the net cash balance sheet and strong cash flow generation. Management cautioned that it is possible for cancellations to increase as the year went on, but noted that the backlog cancellation rate was "lower than we had forecasted in our model." That said, the strong billings growth helps support the narrative that the company should be able to sustain elevated revenue growth and hit near term revenue guidance.

Is FTNT Stock A Buy, Sell, or Hold?

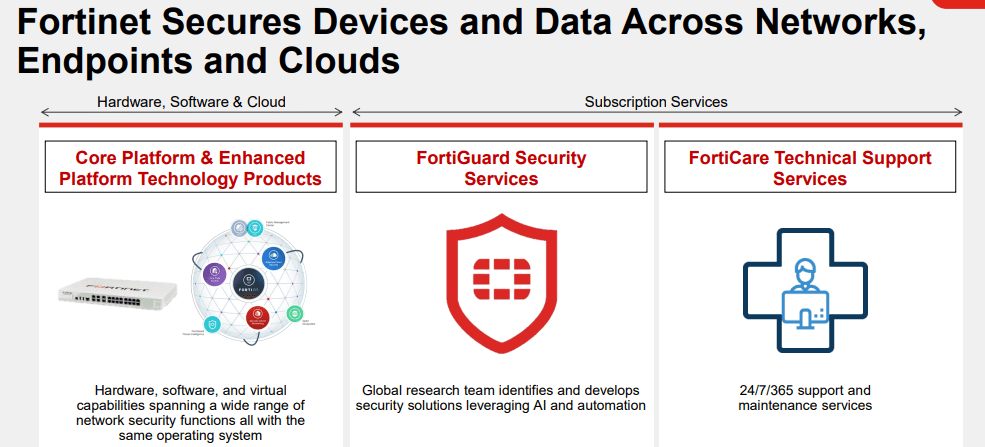

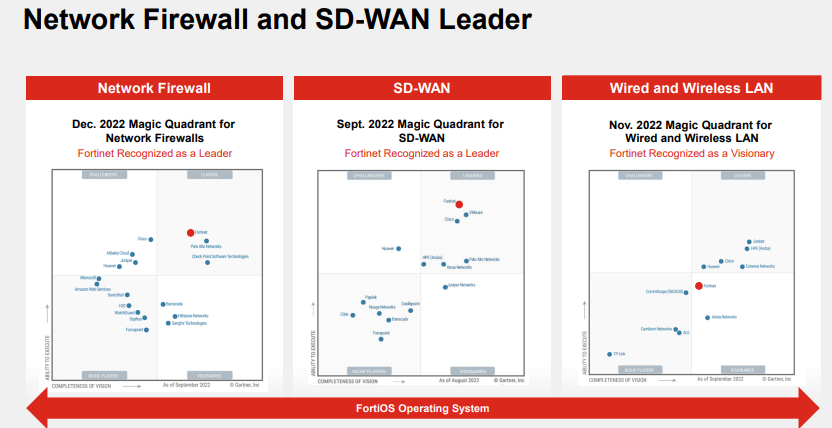

FTNT is most known for its firewall products but it has since expanded to offer a more complete cybersecurity offering including endpoint protection.

2023 Q1 Presentation

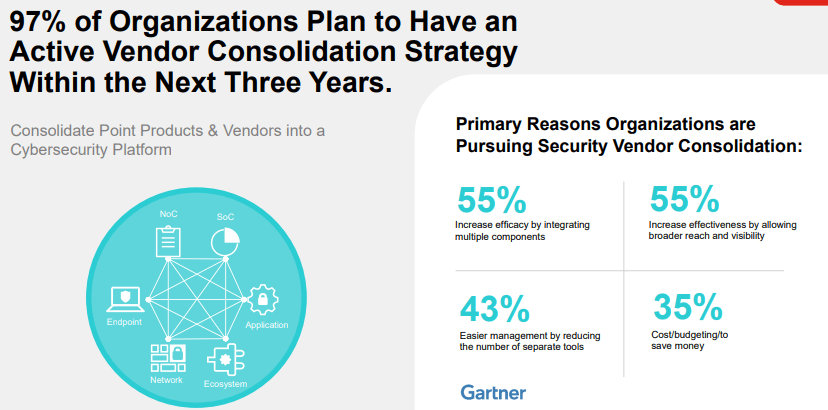

Like cybersecurity peer Palo Alto Networks (PANW), FTNT has been a surprise beneficiary of the rising interest rate environment. Customers have shown greater scrutiny in investment projects but those headwinds have been more moderate for enterprise tech companies which have deeper product portfolios. FTNT believes that 97% of organizations plan to consolidate point products into one platform over the next 3 years. While that estimate may prove high, this trend is undoubtedly helping to drive the company's outperformance relative to smaller peers.

June Presentation

This consolidation trend has helped power strong growth at FTNT even though it is not necessarily the clear leader in all of its product categories.

June Presentation

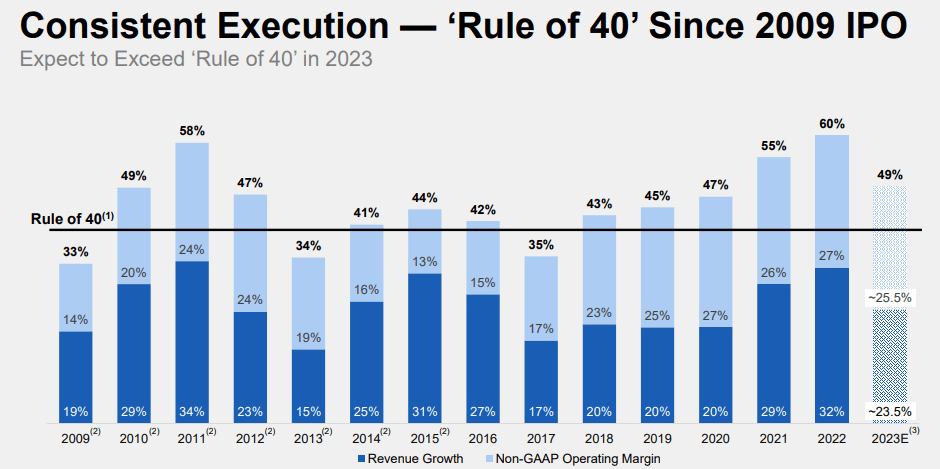

FTNT has also been a consistently profitable operator with resilient revenue growth even after lapping tough pandemic comps.

June Presentation

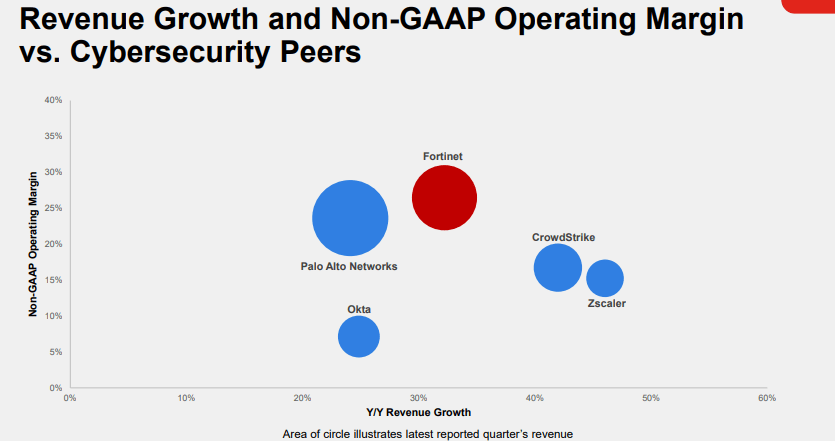

Relative to cybersecurity peers, FTNT offers a strong balance between revenue growth and operating margins.

June Presentation

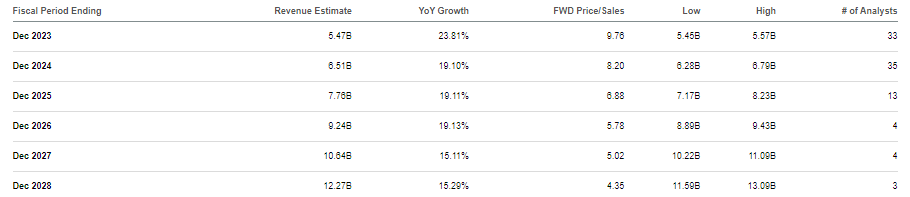

The company's strong secular growth and profitability amidst the tough macro environment have earned it a premium valuation. As of recent prices, FTNT was trading at just under 10x sales. For reference, many tech stocks are trading at around 5x to 6x sales with similar forward growth rates - FTNT is not expected to trade at such valuations until 3 to 4 years later.

Seeking Alpha

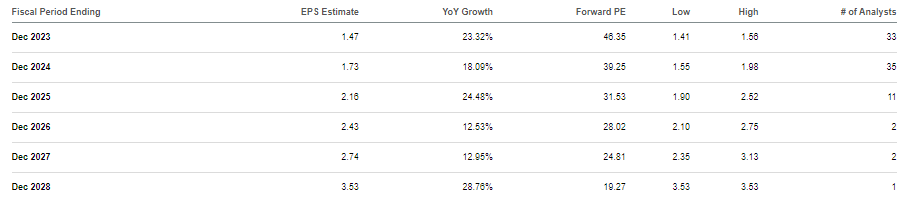

FTNT looks reasonably valued on a price to earnings basis but even here, the stock does not look obviously cheap until 5 years later.

Seeking Alpha

Condensers estimates have the company falling just short of the guidance for $8 billion and revenue by 2025. The stock is currently trading at 7x 2025e sales. Based on my projections for 20% growth, 25% long-term net margins, and a 1.5x price to earnings growth ratio ('PEG ratio'), I can see the stock trading at around 7.5x sales by then. That implies minimal upside over the next 3 years - clearly the stock is pricing in many years of growth. It is possible that the stock can maintain an ultra-premium multiple, but that should not form the base case scenarios. There are many risks to the bullish pieces, the most important being that of valuation. The stock trades at a very rich premium even to tech peers and that premium seems ironically due to the tough macroenvironment. This may mean that if the macro improves, then the stock may underperform tech peers as it does not have the same catch up recovery. What's more, I am wondering if this business is really capable of operating leverage over the long term given that the company is not projecting material operating leverage over the next several years in spite of very strong top line growth. It is also possible that the growth rate decelerates meaningfully given that the company has already sustained above market growth rates for many years. It appears to me that Wall Street seems skeptical of the average tech stock's ability to drive profitability but has more faith here. I have you that skepticism to be misplaced, and normalization of that view may again lead to some underperformance relative to peers.

Because the stock price is not offering a favorable risk reward profile, I must resist rating the stock a buy, and I must stick with a neutral rating.

Sign Up For My Premium Service "Best of Breed Growth Stocks"

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 10 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!

This article was written by

Julian Lin is a top ranked financial analyst. Julian Lin runs Best Of Breed Growth Stocks, a research service uncovering high conviction ideas in the winners of tomorrow.

Get access to his highest conviction ideas here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.