Turtle Beach: The Replacement CEO Will Have A Lot Of Work Ahead

Summary

- Turtle Beach has been struggling with shrinking margins, increased competition, and a tough year in 2022, leading to an underperforming stock price.

- The company's financials show a decline in efficiency and profitability, with negative margins and deteriorating return on assets and equity.

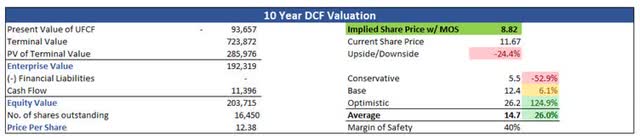

- The intrinsic value of the company is estimated at $8.82 per share, implying a 24% downside from current valuations, making it a risky investment until positive metrics become the norm.

zeljkosantrac

Investment Thesis

I wanted to take a look at Turtle Beach’s (NASDAQ:HEAR) financial performance and how it was affected by a tough year in ’22 and what it can do to reward shareholders in the future. Margins have been destroyed throughout ’22 and if the company doesn’t manage to fix this in the future, the company is not a good investment in the long run. With the departure of the long-standing CEO, investors can only hope the new CEO can turn the ship around and make the company profitable once again.

Financials

I am not surprised that the stock price has underperformed all these years. The company has been losing ground to a lot of other competition in the gaming space. Margins have been contracting, losing profits, and competitive advantage due to competition.

At the end of Q1 ’23, the company had $20.5m in cash and has paid down all its debt, which is fantastic. This gives the company more flexibility. The company has also brought down its inventory levels to a more reasonable amount. I like that the management was focused on paying down debt.

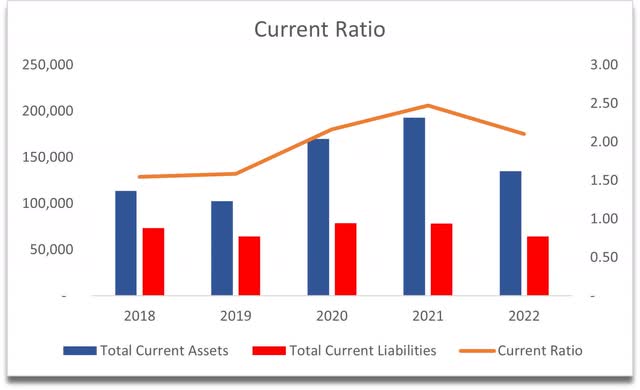

The company’s current ratio is also very healthy, and it has been for quite some time. It will not have any problems covering its short-term obligations anytime soon.

Current Ratio (Own Calculations)

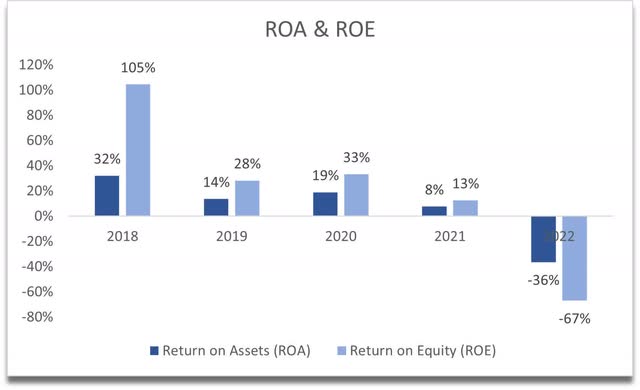

The following metrics tell a different story about how the company has been doing in the past 5 years, which may have led it to underperform. In terms of efficiency and profitability, the company has been losing much of its edge in the last few years. ROA and ROE have been quite healthy pre-pandemic but have since deteriorated massively and because the company lost money in FY22, efficiency, and profitability metrics are well below zero. This suggests that the management is not utilizing the company's assets very efficiently and has not been rewarding its shareholders. It was after all a very tough year for many companies, however, Turtle Beach seems to have been very affected by the slowdown in PC sales, as even the pick-up in console sales has not been very helpful.

ROA and ROE (Own Calculations)

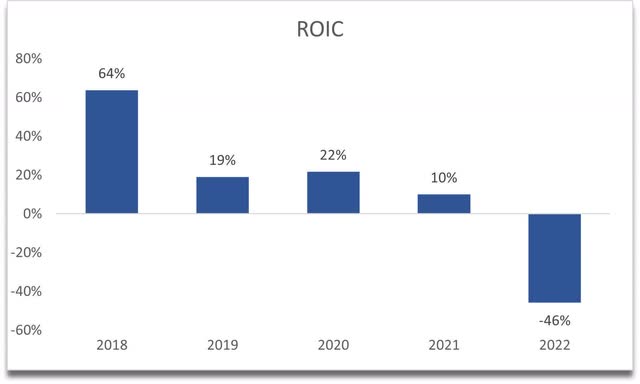

A very similar story can be seen in the company’s ROIC or return on invested capital. Back in FY18, the company was enjoying a massive competitive edge and a strong moat in the sector of headphones. Over the next couple of years, the company saw competition moving into its turf and underpricing to get ahead, which led to Turtle Beach starting to lose its competitive moat and its advantage, and now with all that's happened in '22, the company has a lot to prove that it can become the leader in its sector because it is not looking good right now. The company is going to get back into the ultra-high premium headsets segment with the release of the Stealth Pro headset which has been received quite well and may provide good margins if it is going to sell well in the future. As of right now, ROIC has taken a big hit in '22. I would like to see the company come back to profitability at the end of '23 and find a way to stay profitable.

Return on invested capital (Own Calculations)

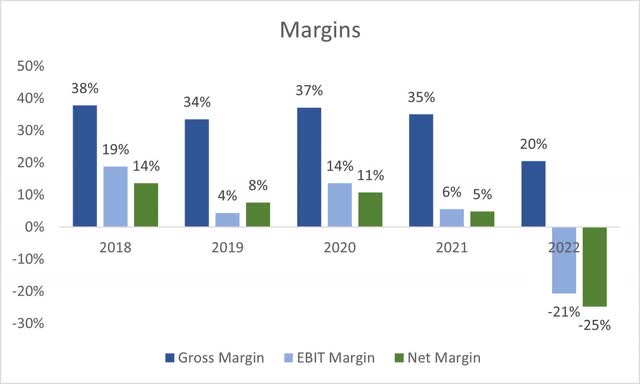

In terms of margins, these have also contracted quite massively, with the tough environment that was created since the pandemic hit and supply chain issues, and everything else that happened. The company lost a lot of money on its products this year as margins went well below 0 and even gross margins contracted 15% from last year. It would be too early to jump in here because I see no signs of recovery yet.

Overall, it’s not looking good for Turtle Beach. The above graphs show that the company has been losing its competitive edge as more and more competition comes in to underprice and offer better quality for the same or lower price point that ate into the company’s margins quite considerably. In the last five years, it looks like the company just kept going down, and with no apparent turnaround yet, I would be very cautious in investing in the company right now. I would like to see better progress in the next couple of quarters.

Valuation

I wanted to be a little more optimistic in my model because I knew that in relative value terms the company is too expensive right now.

In the base case, revenue growth is quite generous, I would think. It will be around 9.1% CAGR over the next decade. On the optimistic case, I went with 13% CAGR, while on the conservative, I went with 7%.

On the margins side, I can see that the company was profitable in previous years. At the end of FY22, the company’s COGS and Operating expenses exploded which led to negative margins. I decided that I will improve these linearly over the next decade. Gross margins will eventually reach 40% by '32, operating margins will reach 15%, and net margins will reach 11% by the same time. It does seem to me that the effects of the tough year are not going to last too long and over time, the company will be able to come back to profitability and better efficiency because if they don’t, then I don’t know how long it will stay in business.

On top of these assumptions, I will add a 40% margin of safety because the financials were not getting any better over time which warrants a much higher MoS than my minimum of 25%. There is a lot of risk here and I rather have a better cushion.

That said, the company's intrinsic value is $8.82 a share, implying a 24% downside from current valuations.

Intrinsic Value (Own Calculations)

Closing Comments

My model shows that the company, if it's not going to improve drastically over the next couple of years, will be losing money for the next 5 until it finally turns around and starts to make money. With such a drop in all the metrics mentioned in the article above, it is hard to be optimistic in this situation. I won't touch the company just yet until at least we see positive metrics being the norm as was the case in the past. The cyclicality of the business and the potential upcoming macroeconomic headwinds may mean that we are not out of the woods yet and further pain is in store for many companies, including Turtle Beach.

The new CEO will have to prove that he/she is capable of turning the ship around whenever they do find a replacement, which we will know by the 30th of June if they do find one.

In the last decade, the company has lost over 80% of its value. Some may say it can’t go any lower, but I think it is very likely that it will come down further because the financials have only deteriorated further in the last few years and if this continues, I can see the share price reaching new lows. I would avoid the stock for now.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.