Hersha Hospitality Trust: Resilient Portfolio With A Promising Future

Summary

- Hersha Hospitality Trust is a real estate investment trust specializing in upscale and luxury hotels.

- The company has been recovering well after Covid and has been increasing its revenue.

- After analyzing this company, I believe it is worth investing in.

Astronaut Images

Hersha Hospitality Trust (NYSE:HT) is a leading real estate investment trust specializing in owning and operating upscale and luxury hotels in key U.S. regions. The global hospitality real estate market is estimated to grow by $75.36 billion from 2022 to 2027. The company's main objective as a REIT is to acquire, develop, and manage a diverse portfolio of hotel properties. Economic conditions, consumer spending, corporate travel trends, and leisure trends all have a significant effect on the industry.

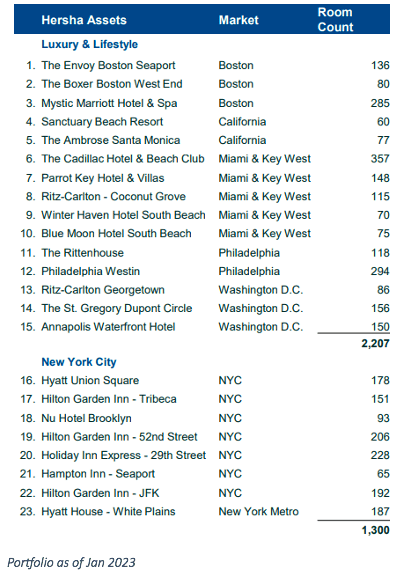

Hersha Hospitality Trust operates in the upscale and luxury hotel segment, targeting business and leisure travelers seeking premium accommodations and personalized experiences. The company's 25 hotels totaling over 3,800 rooms are in New York, Philadelphia, South Florida, Washington, DC, Boston, and California. In this article, I analyze its continued growth and financial stability in the hospitality industry, as I think this will be a worthwhile investment for the foreseeable future.

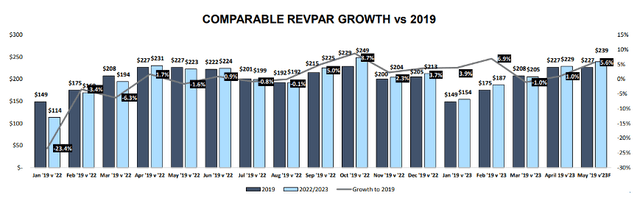

HT's 25 hotel portfolio crept at a 67.9% occupancy rate this year, with the average Revenue per Available Room (RevPAR) hitting $182 along with the streamlined growth in the first half of this year. The revenue per available room increased upwards of 30% from January 2023 to March 2023.

HT

HT is committed to optimizing its portfolio through strategic initiatives to enhance property performance, guest satisfaction, and overall shareholder value. The company focuses on comprehensive asset management, including targeted capital investments to renovate and upgrade properties, implement technology solutions, and improve operational efficiencies. By leveraging data analytics and market insights, Hersha Hospitality Trust aims to drive revenue growth and maximize returns for investors.

Covid hit every primary REIT market in the world, and Hersha Hospitality Trust wasn't far from the tree; however, this May's peak RevPAR of $239 is the highest since 2019, indicating their fund's troubling time with the pandemic is coming to an end. Here's how the RevPAR compares this year to 2019:

New York is on course to bring 61.7 million visitors by the end of 2023, up 9% from last year. The growing metropolis is one of Hersha's most profitable investments, taking into account hotels such as Hilton Garden Inn and Holiday Inn Express. As NYC luxury hotel closures are on the rise, with permanent 10% of the hotel room supply diminished, Hersha's humble hotel selections have the potential to utilize a flexible operational model to ensure higher profitability at lower operating costs. This reduced net supply can lead to an increase in RevPAR growth in future fiscal cycles.

From 2019 to 2023, the company's stock price exhibited volatility. In 2019, the stock had a relatively strong start, reaching its peak in mid-2019. However, it experienced a decline towards the end of the year and into early 2020, primarily due to the impact of the COVID-19 pandemic on the hospitality industry. The pandemic significantly affected the hotel and lodging sector, as travel restrictions and reduced demand resulted in lower occupancy rates and revenue for companies like Hersha. Consequently, the stock price experienced a significant decline during this period. As the effects of the pandemic began to subside, the stock showed signs of recovery in the latter half of 2020 and into 2021. With the gradual reopening of the economy and the resumption of travel, investor sentiment improved, leading to an uptick in the stock price.

Hersha declared a special dividend of $0.50 last December, using some of the cash from hotel sales. It currently pays $0.05 quarterly after the reinstatement of the quarterly dividend last September and, based on the latest price of $6.87, yields 2.3%.

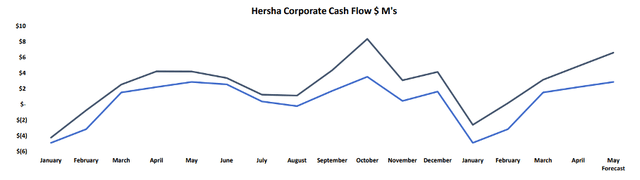

A potential stock's forecast can only be satiated with looking at the balance sheet. We see in 2023 that in terms of assets, their hotel evaluation dropped from $1,189 million to $1,186 million. The company's cash position has decreased, and there is a decline in accounts receivable and other assets. Most obligations have remained stable on the liability side, except for a significant decrease in dividends and distributions payable from $31 million to $8 million. Shareholders' equity shows stability, with no substantial changes in preferred and common shares. However, in its corporate cash flow HT is overtaking last year's by $2.9 million in the same period due to a reduced corporate footprint, best business practices, and a refinanced credit facility.

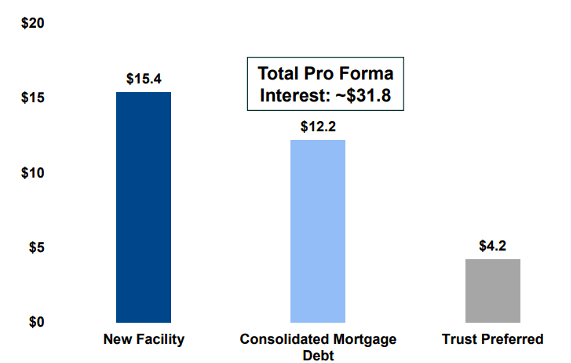

A $20 million reduction in annual cash interest expense was achieved thanks to the 2022 sales, the new credit facility, the paydown of the St. Gregory mortgage, and other factors. A down payment of $24 million of St. Gregory saved them an accruing interest of 9.5% while also securing a low-risk, future-proof investment. I observed an existing swap enabled them to fix their debt up to 78%.

HT

While the company has demonstrated resilience in the Covid era and success in the hospitality industry, it is essential to consider the potential risks and challenges that the company may face. These risks include:

- Economic Downturn: The hospitality industry is susceptible to economic cycles. A downturn in the economy could lead to decreased travel. This in turn demands discretionary spending, affecting Hersha's occupancy rates, RevPAR, and overall financial performance.

- Market Competition: The upscale and luxury hotel market is highly competitive, with numerous players vying for guests and market share. Increased competition, new entrants, or aggressive pricing strategies by competitors could impact their ability to attract guests and maintain its market position.

- Regulatory and Legal Factors: Compliance with various regulatory requirements, including building codes, zoning laws, permits, and licensing, is essential for operating hotels. Law changes such as New York's special permit for construction in zoning districts along with other changes in regulations, labor laws, or legal disputes could result in increased costs or disruptions to the company's operations.

The P/FFO currently stands at 5.15x, with a historical average of 10.53x. In comparison, Chatham Lodging Trust (CLDT) trades at 8.44x and Summit Hotel Properties (INN) trades at 7.25x. So I consider HT a bit undervalued here.

I believe Hersha's 2023 results underscore its resilience and ability to generate robust financial performance amidst challenging market conditions. The company's impressive revenue growth, increased net income, and commitment to enhancing shareholder value position it favorably for future success. With a resilient portfolio, strategic initiatives, and a positive industry outlook, Hersha Hospitality Trust is poised to navigate through the recovery phase and continue delivering long-term value to its stakeholders. For all of those reasons, I rate the stock a buy here.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.