Market

Sameet Chavan, Head-Research, Technical and Derivatives at Angel One

After the Reserve Bank of India's (RBI) monetary policy announcement, traders chose to take some money off the table. In the process, all the gains registered earlier in the week were erased, and the week closed with nominal gains. The Nifty closed a tad above the 18,550 mark.

It’s been a lethargic period for the domestic headline indices, but there’s been no shortage of action at the broader end of the spectrum. Individual themes continue to unfold one after another and stocks have been giving mesmerising moves in the meantime. Ideally, traders should focus on this factor. It would be good to stay light in index-specific trades till a range breakout in the key indices takes place.

As far as levels are concerned, 18,500 - 18,450 are to be considered as a cluster of supports, while 18,680 - 18,780 are to be seen as major hurdles.

Hopefully, global bourses will provide the much-needed trigger for our market. The Nifty can then certainly challenge its record highs

Here are two buy calls for short term:

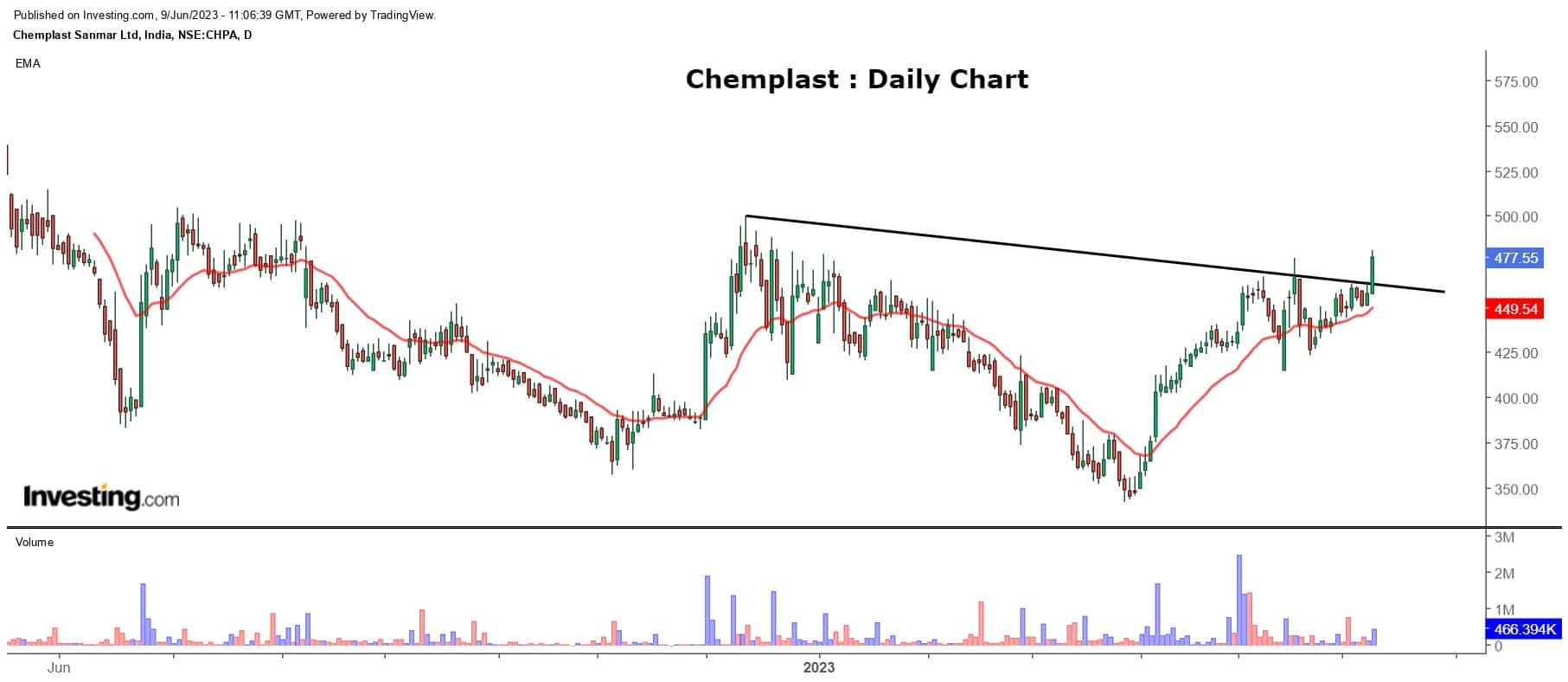

Chemplast Sanmar: Buy | LTP: Rs 477.55 | Stop-Loss: Rs 457 | Target: Rs 516 | Return: 8 percent

This stock has seen a decent run in the current financial year. And in the last couple of trading sessions, the stock has again started gaining good buying traction.

On last Friday, the stock breached its immediate swing high and settled firmly above the same, suggesting inherent strength. Importantly, the upmove is backed by decent volumes, providing credence to the breakout.

On technical parameters, major indicators have seen a positive crossover, adding to the bullish quotient in the counter. Based on the above evidence, we recommend buying for a trading target of Rs 516, and stop-loss at Rs 457.

United Spirits: Buy | LTP: Rs 888.20 | Stop-Loss: Rs 869 | Target: Rs 914 | Return: 3 percent

This liquor giant has been a steady performer in the recent past. A glance at the daily time frame chart shows prices rallying in the last three weeks, which was then followed by consolidation for nearly six trading sessions.

Now, with Friday’s late surge, we can see a ‘Bullish Flag’ pattern getting confirmed on the daily time frame chart. Broadly, the weekly and monthly charts are well poised for a continuation of the upmove in the near to medium term.

We recommend buying for a near-term target of Rs 914, with stop loss at Rs 869.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.