Toronto-Dominion: Compelling Valuation, But Risks Linger

Summary

- Similar to many other banks in the United States or Canada, the Toronto-Dominion Bank reported good quarterly results.

- But rising interest rates pose a risk as well as the exposure to real estate in Canada.

- The Toronto-Dominion Bank also terminated its acquisition agreement with First Horizon.

- TD stock is clearly undervalued, but the risks in the next few quarters outweigh any valuation aspects.

Joe Raedle

In the last few months, I published several articles about different banks around the world and although all these banks are trading for extremely low valuation multiples (in many cases in the single digits), I am mostly cautious in my articles. There are only a few exceptions – like Svenska Handelsbanken (OTCPK:SVNLF), which I covered recently.

Aside from Svenska Handelsbanken I am also more optimistic for Canadian banks as these banks are usually well capitalized and Canada has higher financial requirements for its banks than the United States for example. And although I called Toronto-Dominion Bank (NYSE:TD) the best pick among Canada’s major banks in my last article, I still rated the stock as a hold and was rather cautious about an investment. Since the article was published, Toronto-Dominion Bank lost about 15% of its value and being cautious was probably the right call.

Now with the stock trading about 28% below its previous high in Canadian dollar and about 32% below its previous high in U.S. dollar, we should take another look at the stock.

Quarterly Results

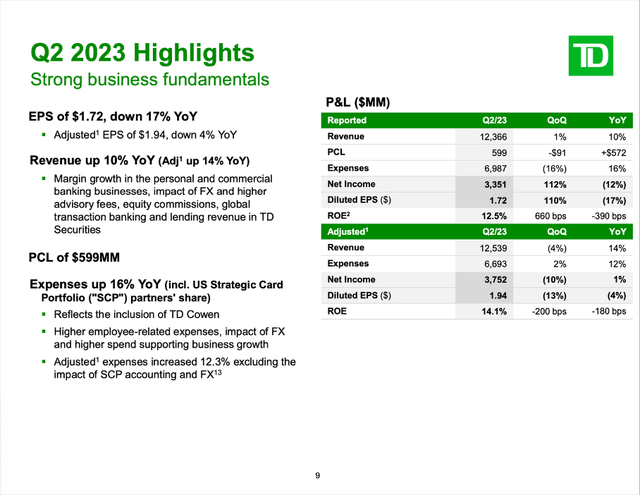

Although Toronto-Dominion bank missed earnings per share estimates by $0.15 in its second quarter results, the company still reported good results – like most other banks in the United States and Canada. Total revenue increased from $11,263 million in Q2/22 to $12,366 million in Q2/23 – resulting in 9.8% year-over-year growth. And while non-interest income increased only slightly from $4,886 million in Q2/22 to $4,938 million in Q2/23 – resulting in 1.1% YoY growth – net interest income increased 16.5% YoY from $6,377 million in the same quarter last year to $7,428 million this quarter. However, non-interest expenses, insurance claims and related expenses as well as provision for credit losses also increased and therefore diluted earnings per share declined from $2.07 in Q2/22 to $1.72 in Q2/23 – reflecting a decline of 16.9% YoY. And adjusted diluted earnings per share declined 4.0% from $2.02 in Q2/22 to $1.94 in Q2/23.

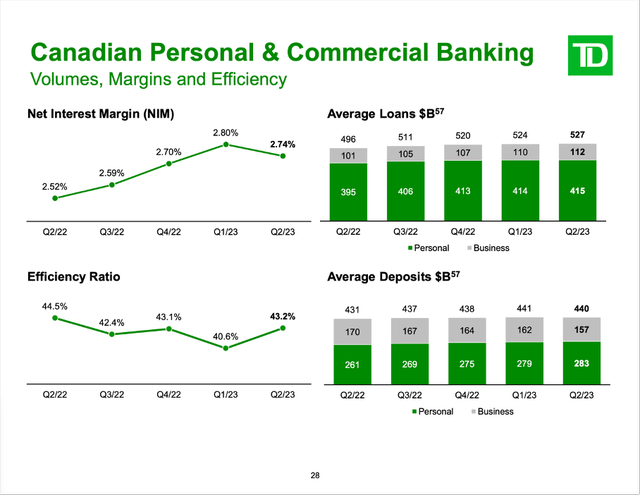

TD Q2/23 Earnings Presentation

When looking at the different segments, all four could contributed to revenue growth. While revenue for Wealth Management & Insurance increased revenue only 2% to $2,735 million, the other three segments increased revenue in the double digits. Wholesale Banking increased revenue 13% YoY to $1,417 million and U.S. Retail increased revenue 14% (in reported numbers) to $2,654 million. However, the only segment that reported top line growth (11% YoY growth) as well as net income growth (4% YoY) was the Canadian P&C Banking segment.

Financial Stability

Similar to all other banks, we should not make the mistake of just looking at the income statement. Especially for banks, it is extremely important to look at the financial health and take into account potential risks. And in principle, the major Canadian banks can be seen as financially stable – and they all weathered the Great Financial Crisis pretty well.

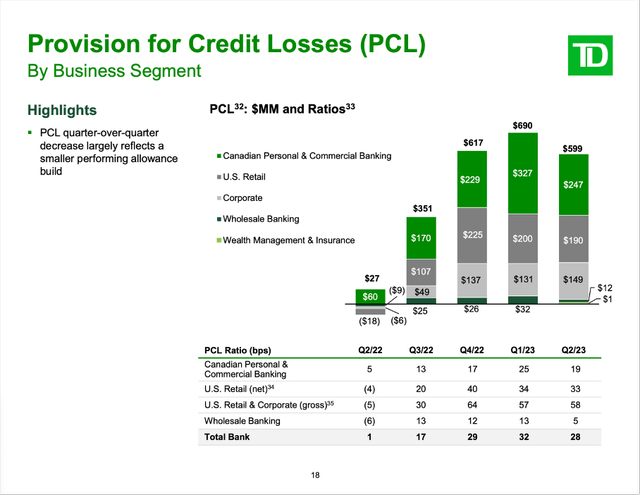

For starters, the Common Equity Tier 1 Capital ratio of Toronto-Dominion improved from 14.7% in Q2/22 to 15.3% in Q2/23. Additionally, provision for credit losses increased from only $27 million in Q2/22 to $599 million in Q2/23. And when keeping in mind that difficult economic times might lie ahead, this makes sense. On the other hand, it is also interesting that provision for credit losses are already lower than in the first quarter of fiscal 2023.

TD Q2/23 Earnings Presentation

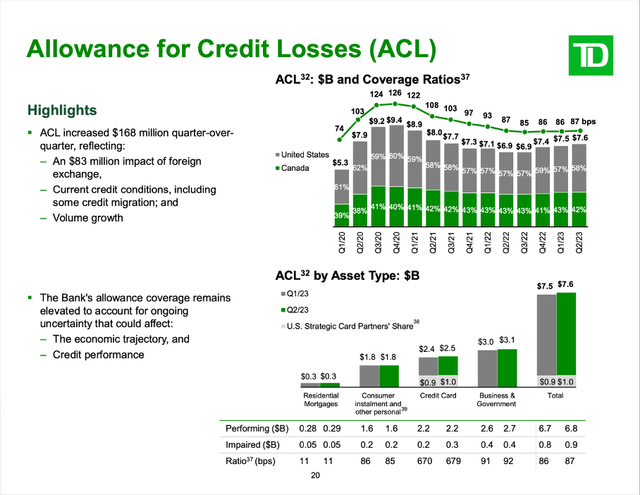

In total, allowance for credit losses increased a little bit in the last few quarters and compared to the last quarter ACL increased $168 million to $7.6 billion right now. However, allowance for credit losses is still lower than in 2020 during the COVID-19 crisis.

TD Q2/23 Earnings Presentation

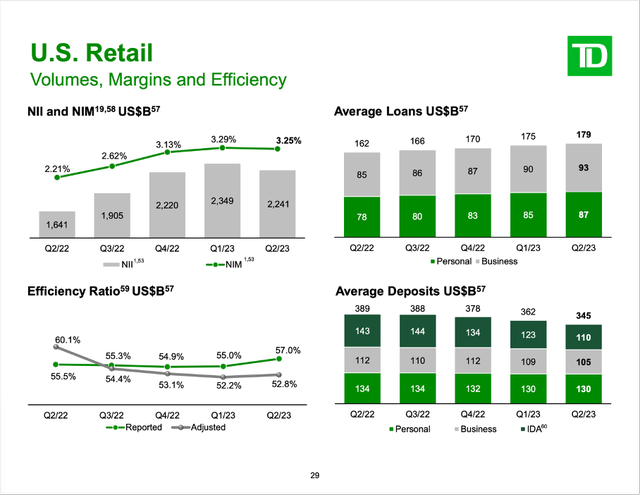

Important metrics to look at are also the total loans a bank has on its balance sheet as well as the total deposits. When looking at the numbers for the U.S. Retail segment, the picture is similar to many other banks in the United States – while loans are often still increasing the total deposits are declining. Compared to the same quarter last year, average deposits declined from $389 billion in Q2/22 to $345 billion in Q2/23. And while this is no reason to panic, these trends are certainly not perfect and weaken the financial stability of a bank.

TD Q2/23 Earnings Presentation

When looking at the situation in Canada however, the picture is a little different. Total loans could also increase in the last few quarters, but deposits also increased slightly. Average deposits increased from $431 billion in Q2/22 to $440 billion in Q2/23.

TD Q2/23 Earnings Presentation

Additionally, we can look at the loan-to-deposit ratio again. Toronto-Dominion Bank has $1,189.4 billion in total deposits (average number for Q2/23) and $849.6 billion in total loans (net of allowance for loan losses). This is leading to a loan-to-deposit ratio of 0.71. Usually, a ratio below 0.8 is seen as acceptable and compared to my last article in January 2023, the ratio got a little worse – it was 0.68 back then. We can also look at the loan-to-asset ratio and with $1.926.5 billion in total assets we get a ratio of 0.44. In my last article, the ratio was a little better (0.43) but numbers below 0.6 are usually seen as acceptable and therefore we don’t have any reason to worry.

Trust and bonds

Despite these solid metrics, banks are facing constant risks other businesses are not. The role trust plays for banks is completely different for companies in other industries. I wrote about this in my article “Banking Crisis: The Next Domino Is Falling”:

A huge problem with banks (and similar institutions) is the role trust and confidence are playing - and especially many people (including investors) misunderstanding how important trust and confidence are. While trust is crucial for the question if people will deposit money at a bank or withdraw funds, it is hard to measure confidence.

It is especially problematic as the situation can change within a few days: Panic can spread quickly throughout a country (or all over the world) and savers that trusted their bank last week will suddenly panic and try to withdraw funds. And therefore, it is not enough to just look at the balance sheet as many banks can be brought to their knees by a bank run and by people losing trust. A few institutions collapsing and several major headlines and reports on national television could be enough to create a panic.

And since the collapse of Silicon Valley Bank, the risk of eroding trust in combination with large amounts of bonds and other fixed-yield securities on the balance sheet bought in times of lower interest rates got a lot of attention. Silicon Valley Bank was brought to its knees as the bank bought huge amounts of bonds with extremely low yields and as the FED started raising rates, these low interest rate bonds began losing value and as customers started to withdraw money (as trust was eroding) the bank had to start selling its bonds leading to huge losses (see also Howard Marks’ memo about SVB).

And when looking at Toronto-Dominion Bank’s assets we also see a huge part of assets with a maturity either 2 to 5 years into the future or a maturity over 5 years. And these debt securities are probably also trading for a lower value than the price Toronto-Dominion Bank bought them for. As long as Toronto-Dominion Bank is not forced to sell these assets, it is not a problem.

TD Q2/23 Supplemental Financial Information

However, if customers and especially depositors are losing trust and start pulling funds, Toronto-Dominion Bank might be forced to sell assets, and this could create problems rather quick. And of course, Toronto-Dominion Bank has about $108 billion in very liquid assets and could meet quite some demand. However, with $1,189 billion in total deposits, the bank could run out quickly. In fact, only about 10% of customers must pull funds and Toronto-Dominion Bank would be forced to sell other assets. And in such a scenario it might be forced to sell debt securities it has on its balance sheet and the biggest part (marked in yellow) are debt securities due in two to five years or even over five years and these securities might have lost value in the last few quarters (due to the FED raising interest rates).

Real Estate

A second issue that is remaining is Toronto-Dominion Bank’s huge exposure to real estate. Right now, Toronto-Dominion Bank has $310.8 billion in residential mortgages loans (the biggest part of residential mortgages loans – about $250 billion – is in Canada). Additionally, out of $314.3 billion in business and government loans, $90.7 billion are also in residential and non-residential real estate. In total, Toronto-Dominion Bank’s exposure to real estate is about $400 billion.

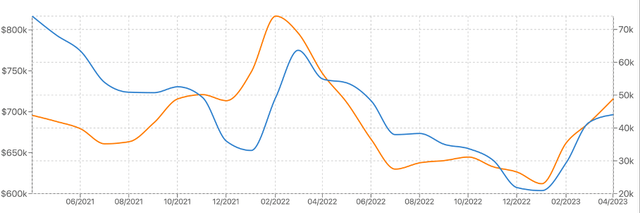

And the Canadian real estate market is often seen as problematic as prices are seen completely decoupled from fundamentals. When looking at the developments in the last few quarters, we see the average price a house was sold for declined from $817k in February 2022 to $612k in January 2023, but in the last few months the price was increasing again (to $716k in April 2023).

Average Price Sold (yellow) and Transactions (blue) (WOWA)

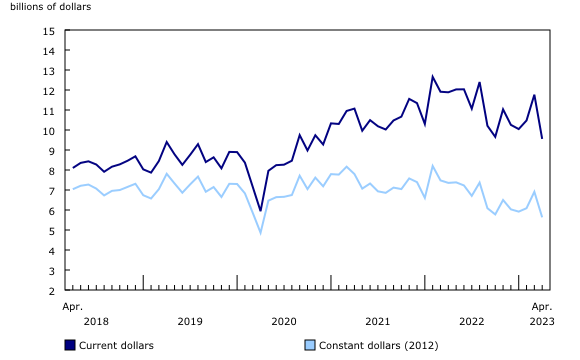

We can also look at the total value of building permits and the volume declined a bit in the last few quarters, but it is not really a steep decline. On the other hand, last month the volume declined 18.8% which was a steep month-over-month decline and the lowest reported level since December 2020.

Building permits total volume in Canada (Statistics Canada)

I honestly don’t know if this correction was enough – I would still argue that the Canadian housing market is extremely expensive and posing a major risk for all Canadian banks – including Toronto-Dominion.

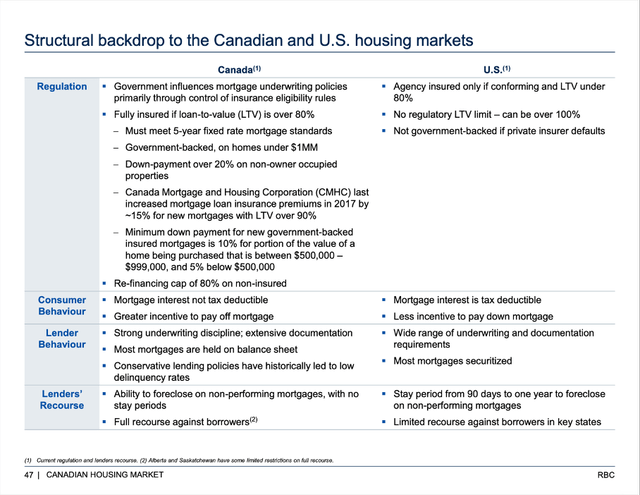

And while the Canadian housing market might be seen as extremely expensive, the Canadian housing market is also structured in a way that is providing additional security – to lenders and banks – and is therefore stabilizing the system. In my last article about the Royal Bank of Canada (RY) I wrote:

While fixing mortgages rates for 5-years on average is not a long time, it is good to know that every mortgage with less than 20% down payment must be insured by a mortgage loan insurance. And this is only one aspect of the different regulations making the Canadian housing market more resilient to crisis. And knowing that any mortgage with loan-to-value above 80% is not only insured but backed by the government (for homes under $1 million) is leading to stability. It seems like declines in housing prices up to at least 20% should not lead to any major risks.

RY Investor Presentation November 2022

Overall, I don't think the Toronto-Dominion Bank will run into major troubles. However, the situation is complex and a bit incomprehensible and making major investments during these time can pay off, but is extremely risky.

First Horizon Bank

A few weeks ago, it was also announced that the Toronto-Dominion Bank will terminate the acquisition agreement of First Horizon (FHN). Under the termination agreement, Toronto-Dominion Bank will make a $200 million cash payment to First Horizon in addition to the $25 million fee reimbursement.

Although there was a possibility to try and get a lower purchase price for the bank, the termination of the acquisition might have been a good choice. For Toronto-Dominion Bank it probably won’t make a huge difference that the acquisition failed (and if money laundering practices played a role, the termination was the right choice). But the acquisition certainly would have led to lower financial stability metrics as First Horizon can’t report a similar CET 1 ratio as Toronto-Dominion Bank (just one metric among many). In the current market environment, it might be a good idea not to acquire any businesses. Maybe TD can acquire businesses in a few quarters from now – and probably for much lower prices.

Charles Schwab

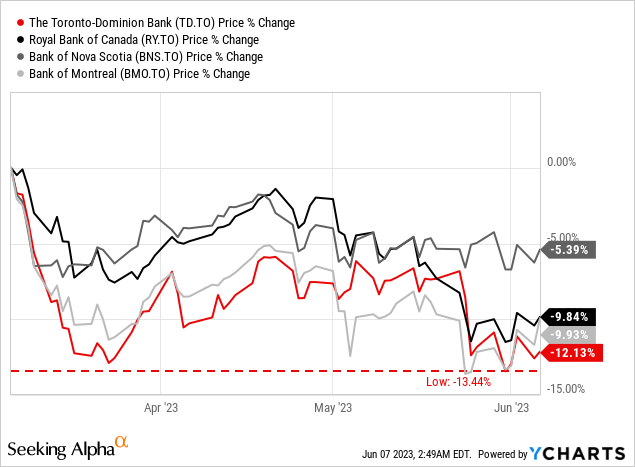

When looking at the performance of the major Canadian banks in the last three months, we can see that the Toronto-Dominion Bank underperformed its Canadian peers. Especially in March 2023 when many regional banks in the United States ran into troubles, the Toronto-Dominion Bank clearly underperformed.

The main reason for this underperformance is probably the investment in The Charles Schwab Corporation (SCHW) and Toronto-Domino Bank is holding about 12.0% of the shares (although it trimmed the position a little bit in 2022). And Charles Schwab was one of the stocks hit hard in March 2023 when the Signature Bank and the Silicon Valley Bank collapsed. Charles Schwab also had to report higher outflows, but it seems like the outflows are slowing down. I don’t have the time to also take a closer look at Charles Schwab, but the bank also has a large bond portfolio and almost 60% of its total assets are invested in debt securities. And as I have mentioned above, with the rising interest rates in the United States these securities might have lost value and when forced to sell, the company could run quickly into problems.

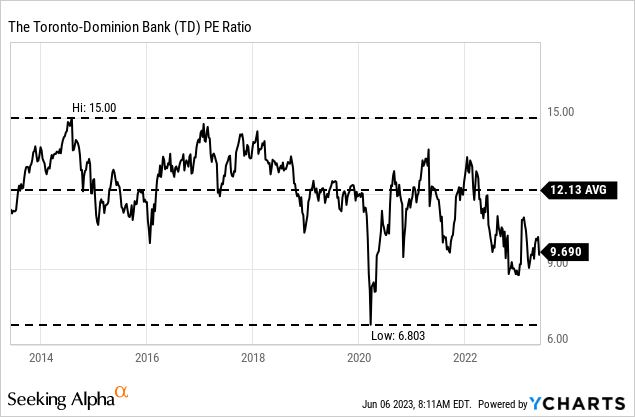

Valuation and Long-Term Picture

Despite all these risks and reasons to be cautious, the Toronto-Dominion Bank is trading for single digit valuation multiples. And we should not forget that we are talking about a great business that was not only able to withstand several crises in the last few decades, but also able to grow with a stable pace in the past. In the last ten years, the Toronto-Dominion Bank grew its revenue at a CAGR of 7.36% and earnings per share at a CAGR of 10.85%.

And under normal circumstances a single digit valuation multiple is not justified for such a great business. But for the next one or two years I would be rather cautious about banks (for reasons I explained countless times in different articles). Simply put, the risk of a recession with collapsing businesses, higher unemployment rates and lower disposable income is quite high. And this is creating an environment that is dangerous for banks and the already failed banks could have ripple effects within the banking systems that are rather difficult to predict.

However, over the mid-to-long term horizon, I would be bullish about many major banks – including the big Canadian banks (with the Toronto-Dominion Bank being one of the best picks in Canada). I expect interest rates to rise again over the next few decades (of course, this is extremely speculative) as this would go in line with the long-term debt cycle and we can already see higher interest rates having positive effects on the revenue banks can generate. And after lower interest rates in the next few years (I expect rate cuts in late 2023 or 2024), we will see higher interest rates in the coming decades.

Conclusion

Toronto-Dominion Bank certainly seems like a bargain – in line with most other banks. But in my opinion, we are still in the midst of a perfect storm, and nobody knows if we will see another major banking crisis. As long as the risk of further banks collapsing is rather high, I like to wait before I am investing in banks. And this is also the case for Canadian banks, although I'd see Canadian banks as rather stable.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SVNLF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.