IDT Corporation: A Decent Q3 2023 Earnings, Positive Long-Term Outlook But Volatility Likely

Summary

- IDT Corporation's 3Q23 results showed a decline in NRS EBITDA due to a significant drop in advertising revenue, causing a negative market reaction.

- Net2Phone's 3 consecutive quarters of positive EBITDA demonstrate self-sustainability, while BOSS Money reports growth in transaction volume.

- The long-term outlook on IDT remains positive, with potential for shareholder compensation if NRS and BOSS Money generate positive EBITDA and spin-off market conditions improve.

- My outlook on IDT’s performance remained positive in the long term, although the stock is likely to be volatile given the fluctuations in NRS EBITDA.

Laurence Dutton

Investment Thesis

My thesis on IDT Corporation (NYSE:IDT) stems primarily from the fact that the company is run by great management that has a track record of creating shareholders' value through spinning-off businesses.

Today, there are 4 business segments: NRS, Boss Money, Net2Phone, and Traditional Communication, which is a legacy business that is generating positive cash flows. These cash flows are being reinvested into the remaining high-growth and higher-margin businesses that are to be spin-offs in the future.

Recently, the company released its 3Q23 results, which were viewed disappointingly by the market as seen in the drop in share price. The main driver of this negative reaction was a result of the fluctuations in NRS EBITDA. My long-term outlook on the business remains positive, and I believe the business continues to be well-run.

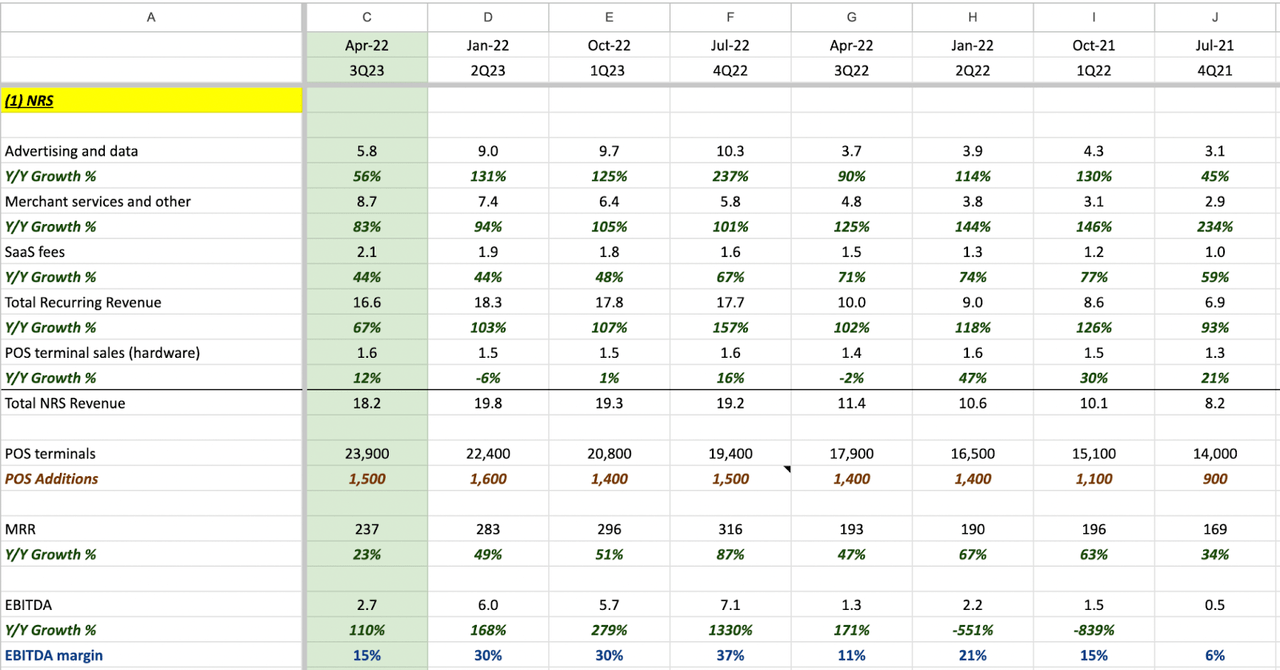

National Retail Solutions (NRS)

Financials Extracted from Quarterly Results

NRS' high-margin advertising revenue ("Advertising and data") declined significantly from last quarter from $9 million to $5.8 million this quarter. As a consequence, this caused its MRR (or ARPU) to decline sequentially, which ultimately, caused the EBITDA (and margins) to decline. Industry headwinds were the main driver of the decline in ad revenue.

The positive take of this quarter was that POS terminal additions continued to accelerate with NRS adding approximately 1,500 new terminals, showing that they continue to onboard more merchants.

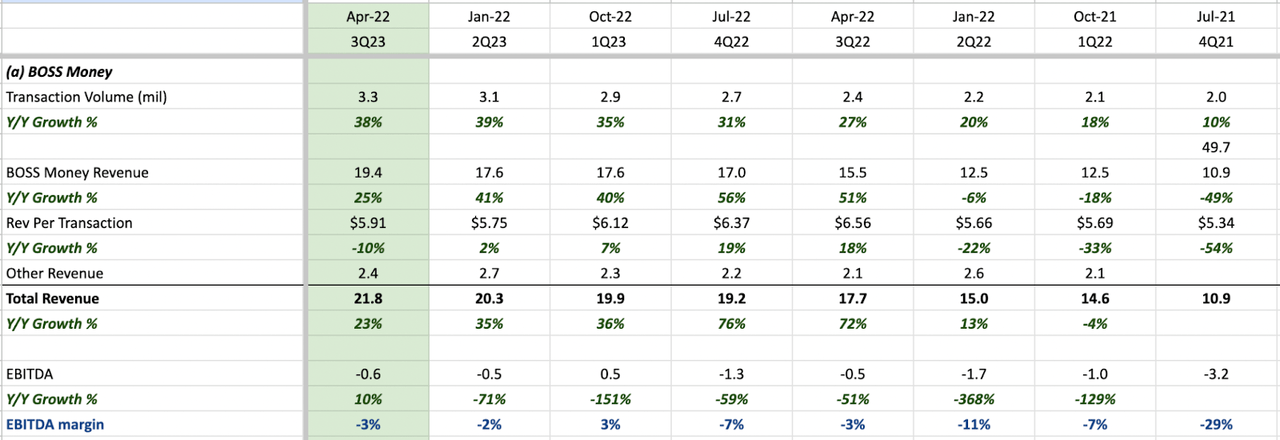

BOSS Money

Financials Extracted from Quarterly Results

BOSS Money had a decent quarter as transaction volume grew 38% YoY, an acceleration from the previous year. This caused revenue to increase 25% YoY. The only negative was that the business has yet to attain profitability and EBITDA loss has increased both sequentially and YoY.

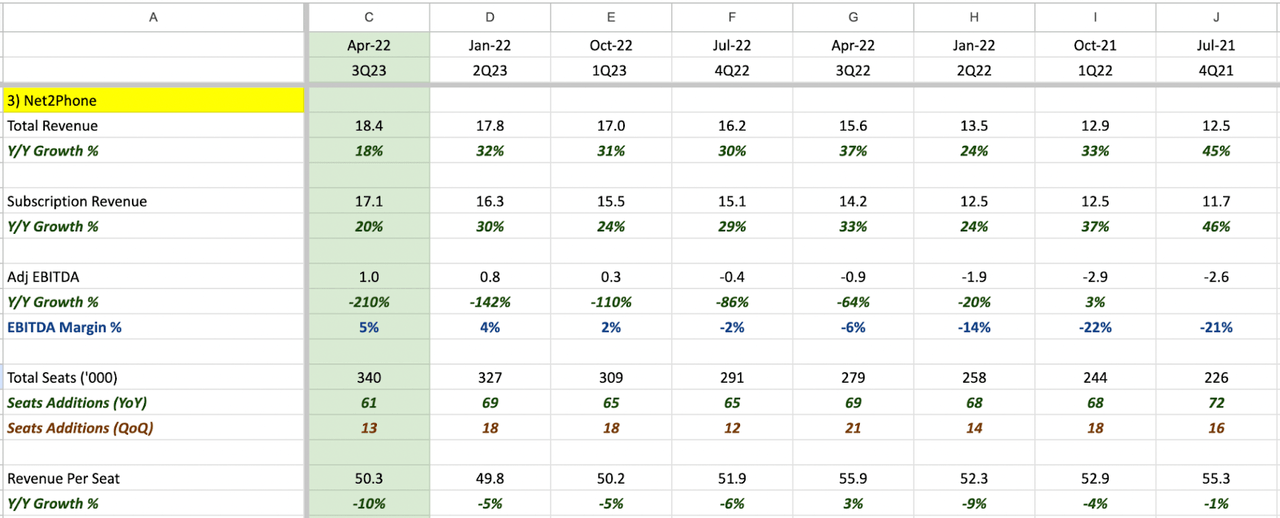

Net2Phone (N2P)

Financials Extracted from Quarterly Results

N2P was the highlight of the quarter as revenue, and EBITDA both increased. Total revenue and subscription revenue grew 18% and 20%, respectively, on a YoY basis. This was driven by the increase in the number of seats added at 13,000 this quarter. Its ARPU, or "Revenue per Seat" increased as a result. Adjusted EBITDA increased to $1m and EBITDA margin was 5% this quarter.

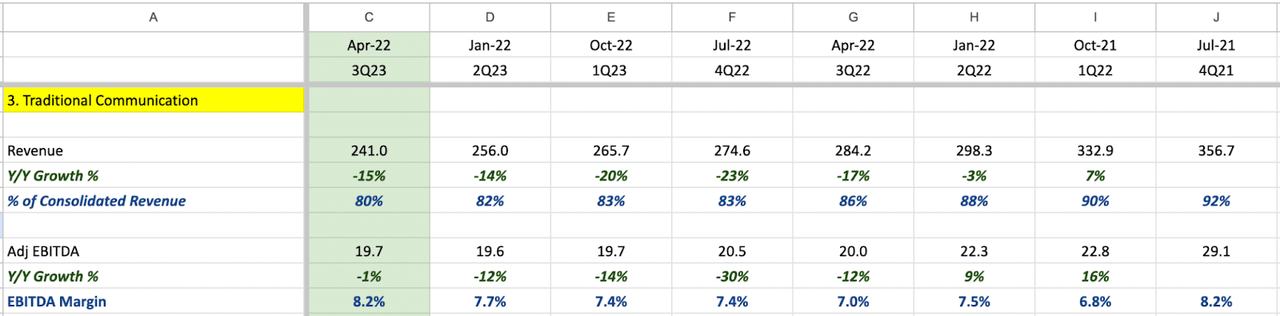

Traditional Communication

Financials Extracted from Quarterly Results

Total revenue continued to decline, adjusted EBITDA has remained relatively stable at $19.7 million. Although both N2P has reported increased income and Traditional Communication EBITDA has held up well, they were not enough to offset the decline in NRS EBITDA.

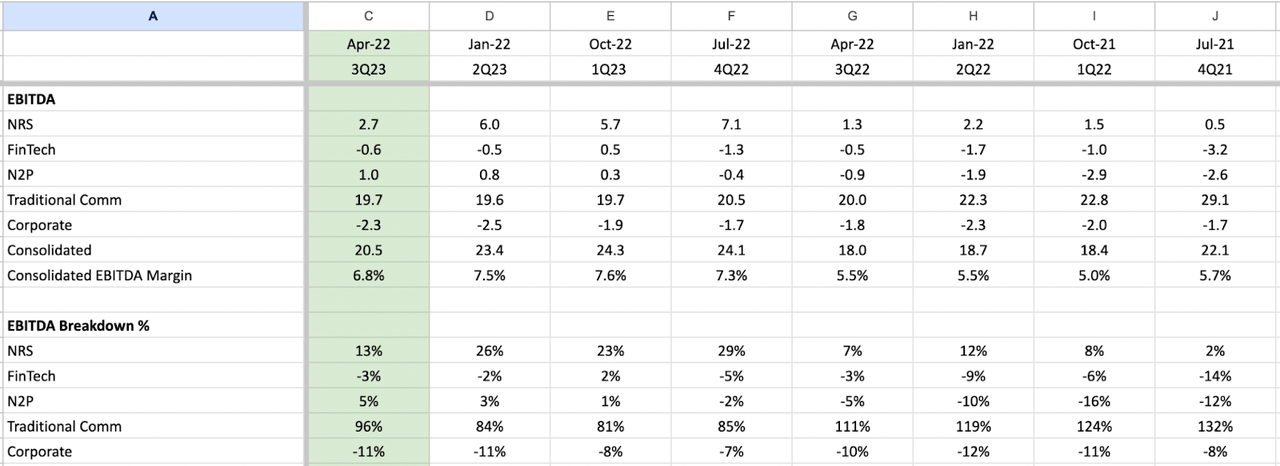

Overview of EBITDA Contribution From Each Business Segment

Financials Extracted from Quarterly Results

Looking at the overall contribution from each segment, the decline in NRS EBITDA was obviously a huge driver of the decline in the company's consolidated EBITDA. Previously, NRS was making up approximately a mid-20s percentage of total EBITDA, which declined to 13% this quarter. This explains the negative reaction in stock price, which has probably caught analysts by surprise.

Concluding Thoughts

Despite the decline in NRS EBITDA, my long-term outlook on the business continues to be positive. This is due to NRS's ongoing acceleration of total POS terminals, the self-sustainability demonstrated by N2P, which further contributes to the company's EBITDA, and the notable growth in transaction volume reported by BOSS Money as it continues its path toward profitability.

If the market conditions for spin-offs improve and management demonstrates that NRS can consistently achieve revenue growth and favorable margins, along with NRS and BOSS Money generating positive EBITDA, I am confident that long-term shareholders can be reasonably compensated, although, the share price is going to be noisy and volatile in the short run.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of IDT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.