Etsy: No Heroics Are Needed Here (Rating Upgrade)

Summary

- Etsy, Inc.'s near-term growth has slowed down, but its low valuation already reflects market pessimism.

- Etsy aims to overcome barriers that have limited its appeal and attract more buyers to start their e-commerce journeys with Etsy.

- Etsy's revenue growth rates have been slow, but it has increased its take rate, resulting in revenue growth from improved economics.

- Despite slow growth, Etsy has a strong profitability profile with consistent free cash flow generation. The key to success lies in curating the best items, enhancing buyer personalization, and improving the overall shopping experience.

- Deep Value Returns members get exclusive access to our real-world portfolio. See all our investments here »

Jovanmandic/iStock via Getty Images

Investment Thesis

Etsy, Inc. (NASDAQ:ETSY) near-term prospects have slowed down. However, its multiple has already significantly compressed and is reflective of substantial pessimism.

In the analysis that follows, I'm going to describe what Etsy does. Then, I'm going to highlight some negative elements that investors should think about, followed by what I believe is the bull case, namely its strong free cash flows.

I then discuss some areas where I believe there's low-hanging fruit for Etsy to improve its revenue growth rates.

Why Etsy? Why Now?

Etsy is a two side-marketplace where individuals can sell their products, ranging from handmade crafts to vintage decor. The core premise is that it's a platform where you can buy distinctive products.

Simply put, Etsy provides a platform for creative artisans to grow their businesses.

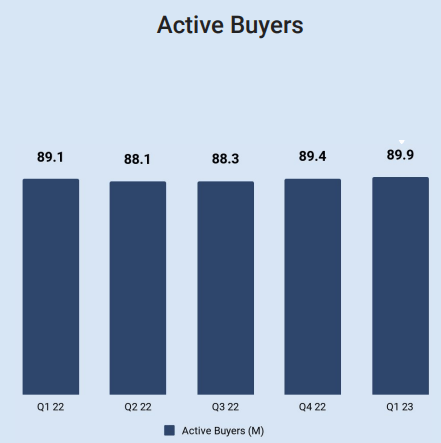

If you've read my work before, you'll have seen me highlight that the growth in users/customers/buyers of any platform directly echoes the value that customers put on the platform.

During Q1 2023, Etsy's marketplace grew active buyers by 1% y/y. The first time in five quarters that Etsy's active buyers grew.

ETSY Q1 2023

For me, this describes the essence of my investment thesis. Etsy's prospects may not be as enticing as they once were, but the fact of the matter remains that Etsy's marketplace is stable.

With that context in mind, consider the critical issue presently facing Etsy. The quote that follows is from the Q1 2023 earnings call:

[W]e'll work hard to knock down barriers that have historically made Etsy or once in a while rather than your every day. These barriers can be summarized in three main areas. First, buyers too often think of us only for very specific needs or at the end of their shopping journey when they can't find the item somewhere else. Second, it simply takes too much time and effort to find the best things among our over 100 million items. And third, buyers worry about the post-purchase experience.

Essentially, Etsy aims to knock down barriers that have limited its appeal, such as being seen as a niche platform or being difficult to navigate. The company wants to entice more buyers to start their e-commerce journeys with Etsy, rather than consider Etsy as an afterthought; if at all. Will Etsy succeed in this endeavor?

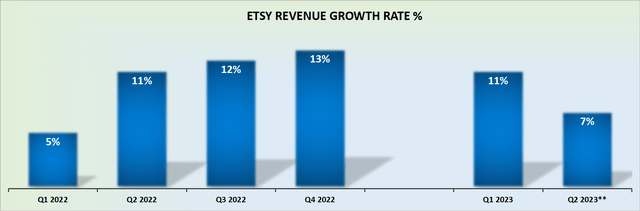

Etsy is Growing at Mid-Single Digits

Etsy is evidently growing. The problem is that its growth rates are too slow. On the other hand, as we've alluded to already, the revenue growth Etsy experienced in the recent past has come from improving the economics of each user. More specifically, Etsy has rapidly increased its take rate from approximately 17.8% in last year's Q1 2022 to 20.7% this time around, a jump in its take rate of nearly 300 basis points in a period of twelve months.

Furthermore, looking ahead to Q2 2023, the transaction fee for the Etsy marketplace is expected to lap the increase to 6.5% Etsy had in Q2 2022.

Here's a quote from Etsy's earnings call that describes this dynamic,

So the guide we gave for Q2 implies a sort of flat sequential take rate. We have seen growth in take rate coming a lot from Etsy Ads because we keep on making the product better.

Simply put, the growth in Etsy's revenues have from its increases in its take rates (pricing power), rather than the growth in its user base.

In sum, Etsy can succeed in growing its revenues, by increasing its transaction fees, but it will need to bring some other drivers to the table because those aspects will soon end up delivering diminishing returns.

Indeed, as you know, Etsy can only grow its take rate so high, before it's competing with other platforms with healthier active buyers and better tools for sellers too.

Now, let's turn our focus to the bull case.

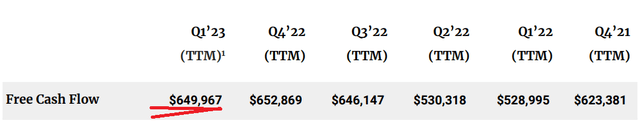

Profitability Profile: Printing Free Cash Flows

I highlight Etsy's trailing twelve months free cash flow profile. As you can see, on a trailing basis, the stock is priced at about 17x trailing free cash flows.

Furthermore, I would assert that unless Etsy figures out some way to reignite its growth rates, investors will not be overly keen to pay high teens multiples to free cash flows for a business that is only growing its revenues in the single digits on the top line.

That being said, I believe that, unlike countless other e-commerce businesses, that have been operated as unprofitable first, with a view to becoming profitable later, Etsy has already been reporting strong free cash flows for a number of years.

So, this is my core argument. Etsy has already figured out a way to be profitable and highly cash-flow generative.

So, Etsy's task is a lot easier than many of its peers. All that Etsy now has to do is curate the best items on the platform, deploy better buyer personalization, and make the overall shopping experience more organized, including reducing the payment friction and improving shipping timelines. None of these efforts require any heroics from Etsy. It's just a case of doing small improvements on each of these matters.

The Bottom Line

My investment thesis focuses on Etsy company's current prospects, both positive and negative.

While Etsy's near-term growth has slowed down, its low valuation reflects market pessimism. The thesis highlights Etsy's role as a two-sided marketplace for unique products and emphasizes the importance of user growth.

Despite slow revenue growth, Etsy has improved its economics by increasing its take rate. However, relying solely on increased transaction fees will eventually lead to diminishing returns.

On the positive side, Etsy, Inc. has a strong profitability profile with consistent free cash flow generation. My thesis suggests that Etsy's path to success lies in curating the best items and enhancing buyer personalization. These efforts are seen as achievable improvements rather than requiring major strategic shifts.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

DEEP VALUE RETURNS: The only Marketplace with real performance. No gimmicks. I provide a hand-holding service. Plus regular stock updates.

We are all working together to compound returns.

WARNING: Any stocks that you feel like buying after discussions with me are your responsibility.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.