Altria Might Be A Value Trap

Summary

- I recommend buying British American Tobacco and Philip Morris stocks due to their global diversification and heated tobacco and e-cigarette portfolios.

- I consider Altria a value trap due to its declining volumes and lack of investment in reduced-risk products.

- Both Altria and British American Tobacco have high dividend yields, but I suggest Altria should cut its dividend and invest in alternative products.

urfinguss/iStock via Getty Images

Introduction

While everyone is talking about AI and Nvidia (NVDA) it is best to go to places where there is less noise. During the last twelve months, the three most mentioned tobacco companies have brought investors a bad return compared to the market. While Philip Morris (PM) and Altria (NYSE:MO) have held up comparatively quite well, with losses of ~9.0% and 7.1%, British American Tobacco (BTI) has been worse and lost ~24.5% due to the current market sentiment. Now might seem like a good time to buy if you’re still looking for a robust high-dividend stock, which can help outperform inflation. However, while I am bullish on tobacco in general, I do not recommend investing in MO and will actually give it a “SELL”-rating.

As MO is a popular dividend stock and also well-covered on Seeking Alpha, I will skip the introduction as everyone knows the business of the company. When analyzing tobacco stocks, there is more than just looking at cash flows, multiples, and dividend yields. As a relatively young investor, I want my companies to be able to generate those cash flows and pay dividends in the long term, even if that means going for a currently lower yield. I recently published an article, giving PM a “HOLD”-rating, stating that, although the company is by far best positioned in RRPs the current valuation does not provide an attractive risk-reward-ratio. However, the share price has depreciated since then and the operating performance has been better than I anticipated thus, I update it to a “BUY”. It is difficult to compare PM with MO, as they don’t share the same geographic region and follow completely different approaches. PM has been heavily investing in its future growth in the form of high capex and strategic acquisitions, while MO, frankly speaking, has not done much of anything to transform its company, other than acquisitions, which so far have arguably been a failure (Cronos and JUUL). Therefore, in my eyes, Altria is a value trap because although the valuation is cheap I do not see any potential why this would change soon if Altria holds onto its current strategy not investing in its own R&D. In this context, the slogan "Moving beyond smoking" seems to be hypocritical in my view.

Although PM's transition needed, and still needs, high capital expenditures the operating margin has been at a steady level due to higher margins of heat not burn products. Altria was the last of the big tobacco companies to realize that change is necessary upon tightening regulations and declining volumes that cannot forever be outpaced by price hikes. I believe a panicked and overhasty buy of a majority stake in JUUL was the outcome. But instead of doing its own R&D like BAT and PM, the American market leader continues to rely on acquisitions. It's recent purchase of NJOY was Valued at $2.8 billion and this investment seems even more desperate than JUUL in my opinion.

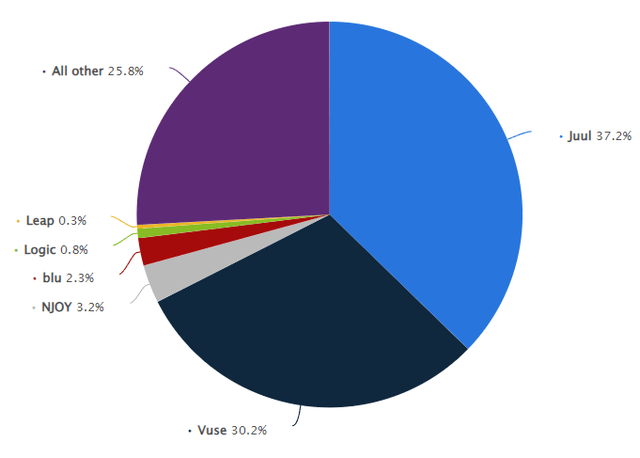

Market shares of e-cigarettes in the US (Statista)

According to Statista over two third of the current e-cigarette market is under the control of JUUL and Vuse, which is a BAT-proprietary brand. Compared to NJOY’s 3.2%, the $2.8 bn seems to be ridiculously expensive.

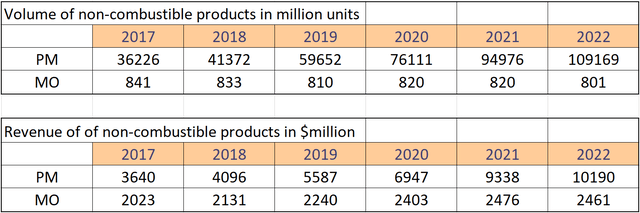

However, you have to consider the global tobacco market is still dominated by conventional cigarettes, which (combined with cigars and cigarillos) take close to 90% market share, and Altria, in particular its premium flagship brand Marlboro, clearly dominates the US market with 42.5% in 2022 (Altria in total had a market share of 47.9%). So if cigarettes dominate in the US and Altria dominates cigarettes why bother and invest in alternatives like heated tobacco products, some may ask. Well, it is simple. The volume of Altria’s cigarettes is declining at an accelerating pace of almost 6% since 2017 (table below) and price increases are the only way to keep cash flows on a steady level.

The recent purchase of Altria’s right to sell IQOS in the US for $2.7 bn was the final straw in my view. In the European Union, IQOS has high popularity and has been growing at a CAGR of an unbelievable 62.2% (at constant currency) to now $4.907 bn over the last five years. This is already 40.5% of its total revenue in the European Union and IQOS was launched just six years ago. Altria's smokeless/non-combustible revenue mainly consists of traditional orals products and has no growth dynamics.

Graphic made by the author using data from annual reports (PM & MO annual reports)

Developed countries hate tobacco and therefore almost every year taxes, restrictions, and bans are making it more difficult for these companies to keep going. However, I assume that too much negativity has already been priced in the tobacco industry. BAT and PM could provide a reasonable entry at current valuations due to being globally diversified and having a reasonable heated tobacco and e-cigarette portfolio. This diversification is extremely important because emerging countries like India (4.72%), Nigeria (12.40%), and Vietnam (4.51%) have attractive growth rates for traditional cigarettes. BAT generates 31.4% of its revenue in emerging countries and is on track to have a profitable “new categories” business by the end of next year. The same goes for Philip Morris, which is in an even better position and generates 48.3% of its revenue in emerging markets (including Eastern Europe; excluding Swedish Match) while being the sole market leader of reduced-risk products in Europe.

The tobacco market in the United States is similar to the European market, and it is likely that if IQOS is relaunched in 2024 growth can be on a comparable level. I assume that this poses a big risk to Altria as many smokers will switch to the advantageous heated tobacco alternative. Philip Morris calls it cannibalization because many of the company's customers switch from the most popular brands like Marlboro or L&M to IQOS, which therefore temporarily does not increase earnings, but strengthens the bond between customers and brand. If you buy an IQOS device to use the proprietary HEETS it is likely you stick to the brand because of your initial investment. Therefore, as soon as IQOS will be relaunched in the US, I believe Philip Morris will be able to eat up Altria’s market share.

It should be clear why Philip Morris deserves a higher valuation than Altria. So why is the company so popular among Seeking Alpha analysts? Well, the answer is simple: Yield.

Don’t get me wrong, high yield does not bother me, but in this case, I believe it is the epitome of a value trap, and for its foreseeable future of declining volumes with the eventually following decline of cash flows, the valuation is not even cheap.

Valuation

The 2022 P/E ratio is at ~14.4 and the EV/EBITDA is at 8.1. BAT, which is the much better choice in my opinion, has a P/E ratio of ~9.1, but a similar EV/EBITDA of ~8.2 due to its high debt. As an investor, you have to pay roughly the same price for MO and BAT, although the latter is by far better in terms of diversification, volume, RRPs, and dividend safety.

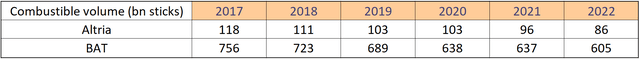

Graphic made by the author using data from annual reports (BAT & MO annual reports)

BAT sold over 7x more cigarettes than Altria in 2022 but earns less revenue per cigarette because they sell a large percentage in emerging markets. However, this is also BAT’s advantage: There is still more room for long-term price increases (as wealth increases), and the volumes in those regions do even still grow in some countries. Therefore, since 2017, BAT’s volume only fell at a CAGR of 4.36%, while Altria sold on average 6.13% fewer cigarettes than the previous year. BAT is also on the verge of profitability for the “New Categories” segment, which is set to reach a volume of £5 billion ($6.23 billion). Currently, there are no heat-not-burn products available in the United States due to regulatory hurdles. I expect this to become a high-growth market for BAT and PM from 2025 on.

Financial situation

Altria’s total debt load was at $26.7 bn (interest rate of 4.19%). The average maturity until 2027 is between $1.1 bn to $1.6 bn per annum. At the end of 2022 cash and cash equivalents were at $4.1 bn and the company held 197 million shares of Anheuser-Busch InBev worth around $10.9 bn. The net debt after selling its stake could be $11.7 bn. EBITDA to net debt is at 2.1, which is a healthy ratio. BAT holds a much higher total debt at £43.3 bn (interest rate of 3.6%) and has cash and cash equivalents (including current investments) of £4.0 bn. Its ITC stake of 29.19% is worth £15.5 bn. I am aware that BAT cannot easily sell its stake due to government regulations, but in theory, net debt could be reduced to £23.8 bn ($29.9 bn). Altria seems more stable at first sight and BAT’s financial situation has been tight for the recent years after its Reynolds takeover. However, BAT’s low payout ratio gives it more flexibility on future investments and allows faster deleveraging, which is necessary at an EBITDA/net debt of 3.1.

Dividend

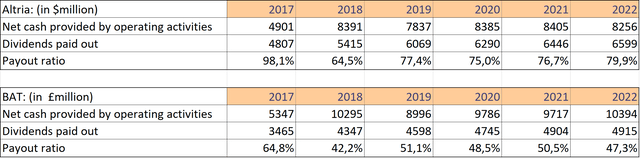

Both Altria and BAT yield roughly the same at a FWD yield of 8.34% and 8.28%. At constant currency, Altria grew its dividend by 6.5% CAGR since 2017, while BAT’s dividend grew at 7.2%. However, as an American investor you have to be aware that it is subject to FX fluctuations and a strong dollar or weak sterling can mask or even reverse dividend growth.

Graphic made by the author using data from annual reports (BAT & MO annual reports)

Based on its operating cash flows both companies have currently no problem covering their dividends. This is especially important for BAT because the spare cash can be used for buybacks and deleveraging. I think the company should postpone unnecessary repayment of the debt as long as the share price is on such a depressing level and instead opportunistically buy back shares, which yield more than the current interest rate. Altria has a high payout ratio and is therefore limited in future investments. Many won’t like to hear it, but I think the best thing Altria can do now is to cut its dividend and invest continuously in RRPs before it is too late.

Risks

Altria is the market leader in combustible cigarettes in the United States. The company has a huge network and customers trust its products. NJOY and other future acquisitions can be easily scaled up and profit from Altria's superior distribution network and expertise. This can potentially translate into an accelerated smokeless transformation in the near future.

Although volumes have been declining for years, the cash flows were not affected, yet. I believe the elasticity of price increases is at its peak and might translate into increasingly lower sales. However, I could be wrong and Altria manages to continue growing its revenue in addition to further acquisitions to transform its business. If Altria is able to build a proper smokeless portfolio in this growing market, the current multiple might be too cheap.

Conclusion

If you are bullish on tobacco in the long term, I recommend considering Philip Morris and BAT as they are superior to Altria. Altria's stolidity and late realization of the need to change is the main reason why I think the current upside might be limited in the mid-term future. If you believe in the management's plan of becoming a smokeless company I suggest putting Altria on your watchlist and following the development of its smokeless portfolio. The only disadvantage I see for American investors is the FX risk you have to be aware of.

Thank you for reading and I already look forward to constructive criticism and further discussion in the comments.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PM, BTI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Although I thoroughly analyzed this stock and checked every metric, I cannot guarantee that all the information provided in this article is correct. This article only reflects my opinion. Do your own research before investing in a company.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.