VNET Group: Mixed Signals From Peer's Takeover Offer (Rating Downgrade)

Summary

- Bain Capital's takeover offer for VNET Group's peer Chindata lends support to the argument that worldwide and Chinese data center markets have significant growth potential.

- However, the implied EV/EBITDA valuation multiple relating to Bain Capital's offer price isn't that appealing, and this limits the valuation expansion potential for other listed data center companies like VNET Group.

- I am lowering my rating for VNET Group stock to a hold, in view of the mixed signals emerging from the proposed buyout offer for its peer.

- Looking for more investing ideas like this one? Get them exclusively at Asia Value & Moat Stocks. Learn More »

imaginima

Elevator Pitch

My investment rating for VNET Group, Inc. (NASDAQ:VNET) stock is a hold.

Previously, I wrote about VNET's collaboration with a Chinese SOE (State Owned Enterprise) and the stock's valuations in my January 14, 2023 initiation article.

In this latest update, I discuss the recent takeover offer for VNET Group's Chinese data center peer, Chindata Group Holdings Limited (CD). I decide to downgrade VNET's rating from a buy previously to a hold now, after considering the mixed signals that the proposed deal sends in relation to VNET Group's future prospects.

All Eyes On The Growth Potential Of Data Centers

Seeking Alpha News reported on June 7, 2023, that private equity firm Bain Capital, LP and its affiliates have made a proposal to buy out the "remaining (58%) stake (which they don't currently own) in Chindata for $8/ADS." In my earlier mid-January write-up for VNET, I also cited news articles which mentioned about rumored or speculated buyout offers for VNET Group. It is clear that many astute investors have a positive view of the growth runway for data center assets in the long run, which is one of VNET's key investment merits.

As per Jones Lang LaSalle's (JLL) research report titled "Data Centers 2023 Global Outlook," the size of the worldwide colocation data center market is projected to increase by a +11% CAGR for the 2021-2026 time period. Separately, Technavio's estimates point to China's data center market growing at a 2022-2027 CAGR of +27%. Another research firm, Mordor Intelligence, forecasts that the Internet data center market in China will expand by a +36% CAGR between 2023 and 2028.

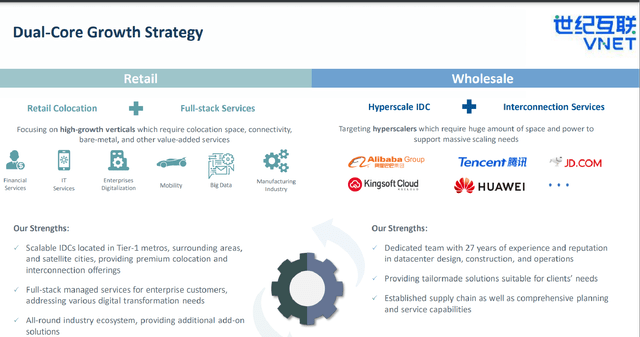

For VNET specifically, the company's approach of focusing on both the retail and wholesale markets allows it to have exposure to the faster-growing areas within the broader data center market.

VNET Group's Growth Strategy

VNET's May 2023 Investor Presentation

Referring back to JLL's "Data Centers 2023 Global Outlook" report mentioned above, Jones Lang LaSalle predicts that the global hyperscale market will expand by a 2021-2026 CAGR of +20% (versus +11% for colocation data center market as a whole). In VNET's May 2023 investor presentation, VNET specifically emphasized that its wholesale business is "targeting hyperscalers which require a huge amount of space and power to support massive scaling needs." Notably, VNET shared at its Q1 2023 results briefing on May 25 that the growth in its utilized cabinets from 48,016 as of end-2022 to 49,316 as of end-Q1 2023 was largely attributable to its wholesale business.

In summary, Bain Capital's recent acquisition offer for Chindata provides support for the view that the growth outlook for global and Chinese data center businesses, including VNET, is reasonably favorable.

Data Center Assets' Valuations Are In The Spotlight

Bain Capital's $8 per ADS buyout offer for Chindata's shares isn't as attractive as what it appears to be on paper.

On the surface, Bain Capital's takeover offer price is equivalent to a 38% premium "to the volume-weighted average price during the last 30 trading days" as indicated in CD's 6-K filing. But the implied deal multiple isn't that attractive.

According to Jefferies' June 7, 2023 research report (not publicly available) titled "Privatization Makes Sense," the $8 per ADS acquisition offer for Chindata only translates into a forward FY 2023 EV/EBITDA ratio of 8.8 times based on its estimates. As a comparison, Chindata's historical mean EV/EBITDA multiple is much higher at around 16 times as per S&P Capital IQ data. Also, VNET is now trading at a similar consensus forward EV/EBITDA metric of 8.4 times as per Seeking Alpha data.

In a nutshell, it seems that prospective buyers of data center businesses or assets are unwilling to value their potential targets at high valuation multiples in the current market environment. This puts downward pressure on the share prices and valuations of listed data center companies such as VNET for two key reasons. Firstly, takeover offers are less likely to be accepted if the implied valuations are viewed as reasonable by the company's shareholders. Secondly, the upside for shareholders is limited to a certain extent by prospective acquirors' "lowball offers," even if such buyouts do eventually materialize.

Bottom Line

There are mixed read-throughs from Bain Capital's recently announced proposed takeover of Chinese data center operator Chindata. On the positive side of things, the interest shown by private equity players validates the growth potential of data center businesses and assets, which is a favorable sign for VNET. On the negative side of things, buyers are not assigning a high valuation to data centers for now, as seen with Bain Capital's offer price and implied EV/EBITDA valuation multiple for CD's shares. As such, while VNET Group, Inc. is operating in an industry with good growth prospects, the potential valuation upside for VNET isn't that significant. Therefore, I have decided to rate VNET Group, Inc. stock as a hold.

Asia Value & Moat Stocks is a research service for value investors seeking Asia-listed stocks with a huge gap between price and intrinsic value, leaning towards deep value balance sheet bargains (i.e., buying assets at a discount, e.g., net cash stocks, net-nets, low P/B stocks, sum-of-the-parts discounts) and wide moat stocks (i.e., buying earnings power at a discount in great companies like "Magic Formula" stocks, high-quality businesses, hidden champions and wide moat compounders). Sign up here to get started today!

This article was written by

Those who believe that the pendulum will move in one direction forever or reside at an extreme forever eventually will lose huge sums. Those who understand the pendulum's behavior can benefit enormously. ~ Howard Marks

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.