Eaton Corporation: A Growth Opportunity At A Fair Price

Summary

- Eaton Corporation is experiencing strong growth due to demand from megatrends such as vehicle electrification and green energy, with its Electrical Americas and Electrical Global segments making up 75% of total revenue.

- The company has a solid backlog of orders worth $3.9 billion, and its eMobility segment is expected to see significant growth in the near term as the EV market expands.

- Investment risks include a potential slowdown in orders and the impact of increasing interest rates on mega project announcements; however, ETN's strong financials and cash flows make it a viable investment opportunity, earning a "buy" rating.

yangphoto

Investment Rundown

Eaton Corporation (NYSE:ETN) is a company growing thanks to several megatrends which are placing a large demand on the industry ETN is in, and certainly, the products that they make also. As a supplier of a variety of products, all from electric components to wiring devices ETN is seeing demand from several fronts. The share price has seen a surge over the last 12 months as a reflection of the growing optimism the company has about its future earnings. With impressive cash flows I think the company is well suited to invest heavily into themselves to grow their market share and in turn, make for a viable investment opportunity too. I am rating ETN a buy.

Company Segments

Within the company, there are 5 different segments but the most notable ones are the Electrical Americas Segment and the Electrical Global Segment, together they make up around 75% of the total revenue for the business. As stated and presented by ETN they see the global mega projects which seem quite frequently announced playing a huge role in driving growth for the electrical business.

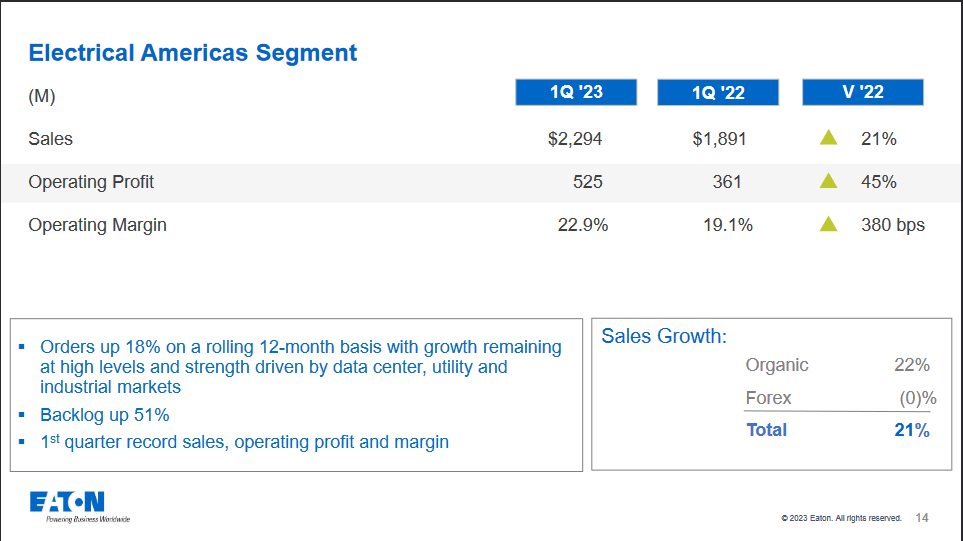

Electrical Segment (Earnings Presentation)

Just looking at the Electrical Americas Segment from the last report they saw revenues grow 21% YoY, whilst margins also heavily improved, growing to 22.9% operating margins. This is a key reason for the share price growth the company has seen over the last months in my opinion. The strong margin expansion ETN has been able to achieve makes them out to be a growing company right now, which translates into a higher p/e too.

The growth in sales across all the segments helped the company raise the guidance for 2023. The EPS is expected to be between $8.3 - $8.5 which makes ETN have an FWD p/e around 22 right now. But with that said, I think the smaller segments of the company are important to highlight also. The eMobility Segment of the business did grow sales, but they did see a 33% decrease in operating profits here. It's a small part of the business, only generating $147 million in the last quarter, compared to the total revenues of $5.4 billion.

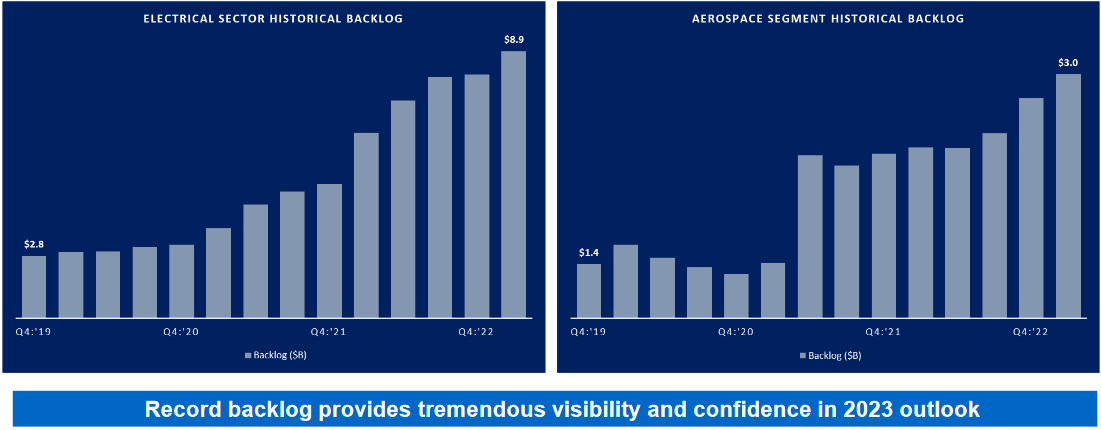

Back Log History (Investor Presentation)

The aerospace segment of the business is also slowly creeping up and becoming a major part of the business. With around $800 million in revenues, the company has also been able to build a strong backlog of orders. I think with $3.9 billion in orders the future is very solid for ETN right now and I am by no means worried they will see a decrease in sales. Not when they have order backlogs like this, which are heavily increasing also. Going into the coming quarters the order backlog will be in the spotlight but also the margins of the segments. Seeing a steady uptrend with them is key in my opinion.

Markets They Are In

ETN is a part of several different markets and gains exposure mostly from a broad selection of industries. Just since January 2021, there has been nearly $600 billion worth of mega projects announced. These projects all place a massive demand on the electrical business as their services play a vital role in even making these projects possible. This can be shown by the growing order backlog ETN has had, as highlighted above here before.

Mega Projects (Investor Presentation)

Mentioning some of the more specific megatrends seen, the electrification of vehicles and the growing need for more green and renewable energy is playing a major part in the demand experience so far for the company.

With the electrical segment of the business being the largest it's nice to see this is also where the company is noting the most tailwinds. ETN estimates there to be an electric content opportunity of between $12 - $20 billion as mega projects are getting announced. With the large presence, ETN has established they should be able to heavily tap into this opportunity and market and drive strong growth for years to come.

The eMobiltiy segment that was mentioned before is not a large contributor to revenues for the company, but it is expected to see strong growth in the near term. ETN sees the market here actually doubling in the short term, driven much by the increasingly larger penetration of EV vehicles.

Investment Risks

The risks facing ETN right now are in my opinion that they see a slowdown in orders. The whole valuation of the company would have to be adjusted to reflect the downturn. Because right now, expectations are that ETN will be able to continually grow its order backlog as a result of the demand from several markets.

But there have also been a lot of mega projects announced over the last few years, one has to wonder how much more can actually be announced. The increasing interest rates will be a headwind against the announcement of mega projects in my mind. From 2021 until quite recently capital was circulating freely and with much more optimism. With slowing spending would also come a slowing order backlog for ETN, and then paying 22x FWD earnings might not be so appealing anymore.

Financials

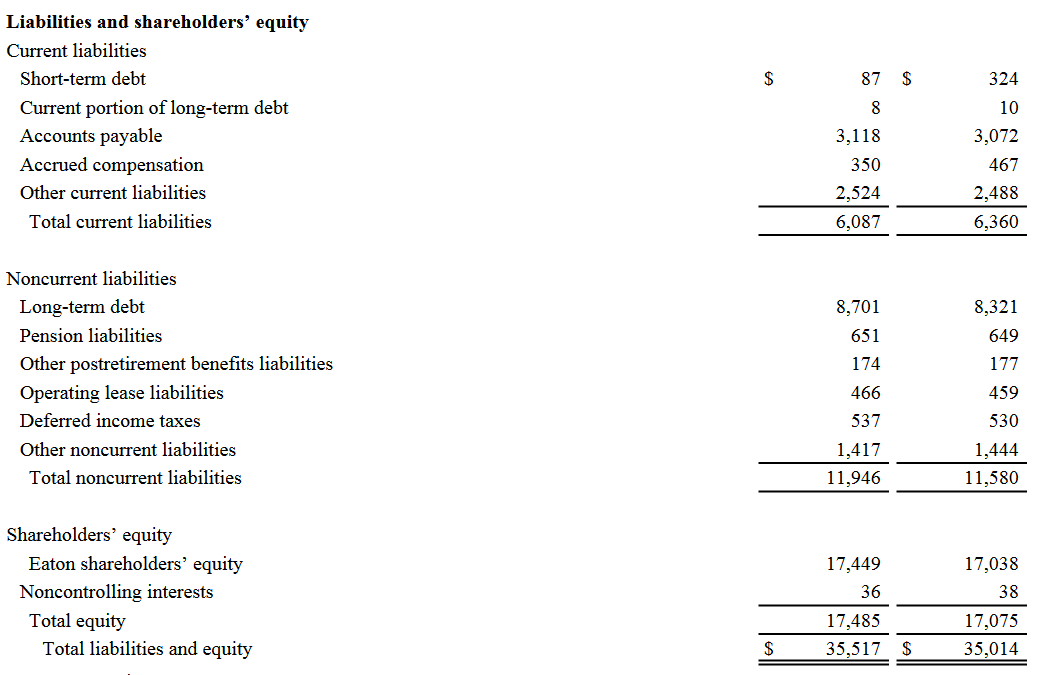

Eaton has managed to over the last years build a very strong balance sheet. The cash position might not have increased that much and sits around $235 million, but ETN can heavily leverage its strong cash flows to handle any liabilities it might face. With over $2 billion in levered FCF ETN could in just over 4 years become entirely debt-free if they diverted all of it for that cause. With growing margins across several segments of the business the FCF is ripe to continue to increase and going into the rest of the quarters for the year a decrease in the long-term debts would be a nice thing to see.

Assets (Q1 Report) Liabilities (Q1 Report)

Looking at the liabilities further I don't see the current liabilities being that worrying. The current portion of long term debt is just $8 million and ENT seems to be in a strong position to still buy back shares and distribute a dividend. Over just the last 5 years the company has bought back nearly 10% of the outstanding shares. For 2023 ETN is expecting they will deploy between $300 - $600 million for buying back shares heavily supported by the FCF of $2.6 - $3 billion for the year. With not a major part of the FCF diverted for buybacks I think the company is well suited to begin paying off debts at a faster rate, bringing the cash/long-term debt ratio down a little.

Final Words

Eaton Corporation is growing at a strong rate thanks to many major tailwinds seen across key markets like vehicle electrification and the buildout of the electrical grid and infrastructure around it in the US. With plenty of megatrends being announced in just the last few years, ETN has seen a surge in the order backlog as a result of it.

I think that ETN isn't trading that richly given the growth they have, the solid margins, and high expectations of a near 50% increase in FCF for 2023 compared to 2022. That will translate into plenty of capital distributed to shareholders through both buybacks and dividends. The long-term outlook for ETN couldn't be stronger in my opinion and I will as a result of it rate ETN a buy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.