Ascend Has Become The Cheapest MSO

Summary

- Ascend Wellness is a strong but cheap Tier 2 MSO.

- While the 2024 revenue and adjusted EBITDA estimates have been stable since the company reported its Q4 in March, AAWH stock has sunk sharply to a new all-time low.

- I have boosted exposure in my model portfolios and think the stock can more than double over the balance of the year.

- Looking for a helping hand in the market? Members of 420 Investor get exclusive ideas and guidance to navigate any climate. Learn More »

DNY59

In mid-March, I wrote about Ascend Wellness (OTCQX:AAWH) after its Q4 call and called it a stock that could double from the $1.15 where it was trading. Since then, it has reported its Q1, and the outlook has been stable. The price, though, has plunged to an all-time low near $0.70. I have added it to both of my model portfolios and have boosted the position to more than 5% of my Beat the Global Cannabis Stock Index model portfolio and more than 22% of my Beat the American Cannabis Operator Index model portfolio.

In today's look, I evaluate its Q1 and the 2023 and 2024 outlooks, I assess the stock chart, I compare its valuation to its peers, I examine management changes, and I share why I think it is more likely to be acquired by another MSO.

Q1 Results

Revenue grew 34% to $114.2 million. Gross profit expanded 52%, with a gross margin of 31.3% relative to the 27.6% a year ago. Operating expenses fell 7%. Excluding a $5 million settlement expense included a year ago, they increased just 7%. The start of adult-use in New Jersey helped to drive the growth as did increased wholesaling of its products to other MSOs.

Adjusted EBITDA of $23.3 million grew 42.4% from the prior year. One part of the results that I liked was that the company moved from cash-flow use to generation during the quarter. In fact, the $5.8 million cash flow from operations exceeded the $3.4 million in capital expenditures.

Financial Outlook

The analysts expect the company to grow revenue in 2023 by 18% to $478 million. Adjusted EBITDA is expected to be $98 million. In 2024, six analysts forecast revenue will increase 16% to $554 million with adjusted EBITDA of $135 million.

These estimates are a bit better than what was expected ahead of the Q1 report for 2024. Analysts had been forecasting revenue of $550 million with adjusted EBITDA of $136 million. Ahead of the Q4 report, numbers had been much higher. Then, analysts were looking for revenue of $604 million and adjusted EBITDA of $155 million in 2024.

The Chart

AAWH posted a new all-time closing low of $0.684 on Thursday, and it rallied to $0.70 on Friday while setting a new all-time intraday low of $0.61. It dropped 13.6% last week and is down 39.1% in 2023. It dropped 82.5% in 2022.

Charles Schwab StreetSmart edge

The stock has sold off on light volume, and there is no clear sign that the bottom is in yet.

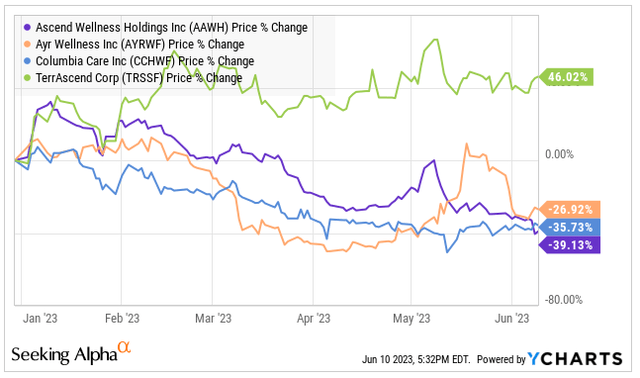

Here is the year-to-date chart relative to the Tier 2 peers:

The stock has dropped the most of the four and almost twice as much as the New Cannabis Ventures Global Cannabis Stock Index, which is down 21.1%.

The Valuation

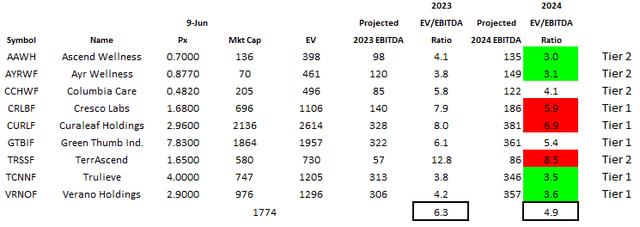

Ascend has a very low valuation at just 3X enterprise value to projected adjusted EBITDA in 2024, the lowest among the top MSOs:

In that last piece, I shared a year-end target of $2.24 based on achieving a 5X enterprise value to projected 2024 adjusted EBITDA. I was assuming then that the adjusted EBITDA would be lower than the analysts were forecasting at the time and be $134 million. They currently are lower but near my forecast. Using their estimate of $135 million and my target multiple yields an enterprise value of $675 million. Subtracting net debt of $263 million results in a stock price of $2.04, which is lower than my prior target but still 191% higher. The 5X multiple is a big discount to what I use for the Tier 1 names.

Management Changes

In mid-May, the former President of BuyBuy Baby and CEO of True Value Company, John Hartmann, became CEO. He didn't speak on the Q1 conference call. Russel Reynolds led the search. Recall that founder Abner Kurtin resigned his position of CEO and became Executive Chairman in late 2022. The company also appointed Sam Brill to the Board of Directors. Brill has a background in cannabis debt investing.

I am not yet excited by these changes, as I realize that the CEO comes from outside of industry, but I also don't see anything besides a potentially challenging learning curve. The two executives who were serving on an interim basis as co-CEOs are remaining with the company as is Executive Chairman Kurtin. I think that the compensation for the new CEO was quite high. Hartmann will receive a salary of $950K per year with a bonus potential of that much annually too. He received 6 million restricted stock units too. 4 million of those RSUs are tied to performance.

Potential M&A Target

Cannabis M&A is challenging at this time. The combined companies must meet the criteria of regulators in many states. One thing that is nice about Ascend is that it operates in just a few states. The two that can be a regulatory challenge are Illinois, which limits the number of dispensaries, and Massachusetts, which limits both the number of dispensaries and the size of the production facilities. Its other states are Maryland, Michigan and New Jersey.

I have never counted on a quick acquisition of the company, but the moves made by Trulieve (OTCQX:TCNNF) to get out of Massachusetts open the door to a potential Trulieve purchase of Ascend. Trulieve doesn't operate in Illinois, and Ascend isn't in Pennsylvania, a big state for Trulieve. Trulieve isn't in New Jersey either. One factor that argues against a move in the near-term is that Trulieve stock is very beaten up. I said last week that it offers an excellent entry for investors in cannabis companies. So, this is something to watch if perhaps Trulieve recovers and Ascend doesn't.

There could be other potential buyers too, especially if Canopy Growth (CGC)(WEED:CA) pulls off its plan to retain its NASDAQ listing while acquiring American cannabis companies. This would open the door to some cash-rich debt-free Canadian LPs to enter the U.S. with an acquisition.

Conclusion

I find Ascend very attractive relative to its peers. One thing that I really like is that the AdvisorShares Pure US Cannabis ETF (MSOS), which has been seeing redemptions in shares over the past six months, owns none. So, continued redemptions could weigh on other stocks, primarily the six names that make up 86% of the holdings. I also think that it could be acquired, potentially by Trulieve, though M&A activity is pretty constrained right now. My target, though, without an acquisition, is nearly three times higher than the current depressed price of $0.70.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

420 Investor launched in 2013, just ahead of Colorado legalizing for adult-use. We are moving to Seeking Alpha and will let our followers know when that occurs. Historically, we have provided great coverage of the sector with model portfolios, videos and written material to help investors learn about cannabis stocks.

This article was written by

Alan Brochstein, CFA, was one of the first investment professionals to focus exclusively on the cannabis industry. He has run 420 Investor, a subscription-based due diligence platform for investors interested in the publicly-traded cannabis stocks that he has moved to Seeking Alpha, since 2013, and he is also the managing partner of New Cannabis Ventures, a leading provider of relevant financial information in the cannabis industry since 2015. Alan is based in Houston. He and his wife have two adult children.

Before focusing exclusively on the cannabis industry in early 2014, Alan had worked in the securities industry since 1986, primarily with the responsibility for managing investments in institutional environments until he founded AB Analytical Services in 2007 in order to provide independent research and consulting to registered investment advisors. In addition to advising several different hedge funds and investment managers, including Friedberg Investment Management, where he participated as a member of its investment management committee, Alan was also a senior analyst for the independent research firm Management CV. In 2008, he began providing a first-of-its-kind subscription-based service for individual investors, Invest By Model, which offered two different portfolios that investors could replicate in their own accounts. Alan also offered The Analytical Trader at Marketfy, where he used fundamental and technical analysis in a disciplined process to offer specific trade ideas geared towards swing traders.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.