Alphamin: Growing But Undervalued Tin Giant

Summary

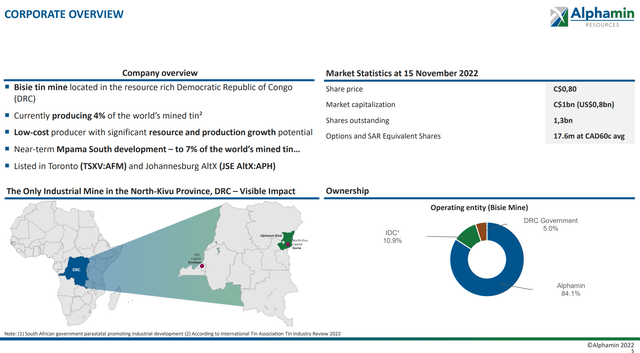

- Alphamin owns the Bisie tin mine, the highest-grade tin mine in operation globally.

- Tin is an often overlooked critical metal that is used as solder. As economies are electrified, demand for tin is expected to soar.

- Alphamin is undervalued based on its current production profile and becomes grossly undervalued once its Mpama South expansion starts producing at the end of 2023.

wattanaphob/iStock via Getty Images

One often overlooked metal that is critical to the low-carbon energy transition is tin. Tin is used in solder that connects electrical components and demand for the metal is set to soar as our economies increasingly becomes electrified.

In my opinion, the best way to play tin is via the Canadian mining company, Alphamin Resources (TSXV:AFM:CA) (OTCPK:AFMJF). Alphamin owns the Bisie tin mine in the Democratic Republic of Congo ("DRC"), producing over 4% of the world's tin. This production is slated to grow to 6.6% by year-end as its Mpama South expansion comes online.

Trading at just 4.25x EV/EBITDA based on my 2023 estimates, Alphamin is cheap based on existing production. Once Mpama South starts producing, Alphamin's valuation becomes a ridiculously cheap 2.5x. I am a shareholder in the company and would look to add on any pullbacks.

Company Overview

Alphamin Resources is a Canadian mining company producing tin from the Democratic Republic of Congo ("DRC"). Its flagship mine, the Bisie Tin Mine ("Bisie"), has the highest known grade of any operating tin mine (Figure 1).

Figure 1 - Alphamin overview (Alphamin investor presentation)

Tin, The Forgotten Critical Metal

When investors think about metals and elements critical to the energy transition, they often list lithium, cobalt, and nickel used in lithium ion batteries, and copper, used in electrical wiring. What they often overlook is that tin may be one of the most important critical metals.

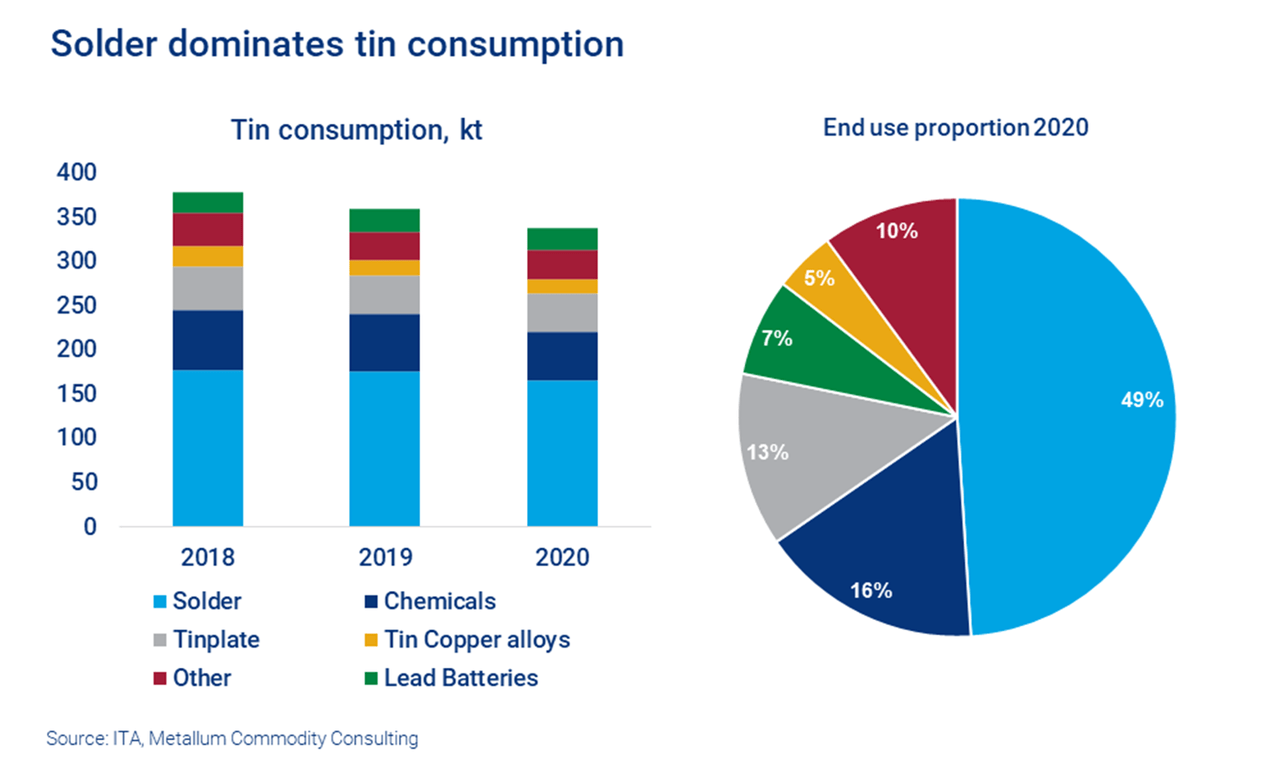

Historically, tin was used to coat other metals to prevent corrosion, hence the terms 'tin cans' and 'tin foil'. Tin is also critical in the manufacture of pane glass, as molten glass is floated on molten tin to produce a flat surface. However, in the modern age, tin's biggest use is in electrical solder, the 'glue' that joins electrical components together. Solder is actually the biggest use of tin, consuming roughly half of the global supply of tin per annum (Figure 2).

Figure 2 - Tin consumption by use (Wood Mackenzie)

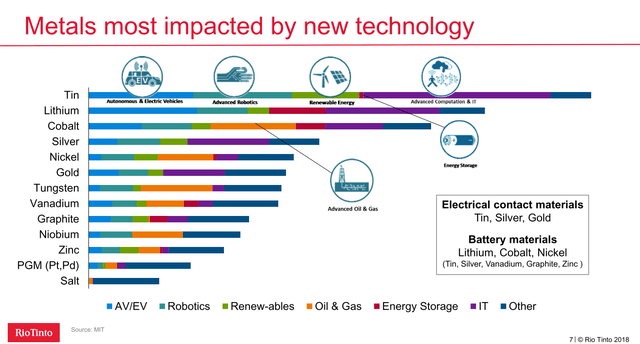

According to a 2018 MIT study commissioned by Rio Tinto (RIO), tin may actually be the metal most impacted by new technology (Figure 3).

Figure 3 - Tin may be most impacted metal (Rio Tinto / MIT)

Simply put, the electrification of the global economy will consume increasingly more tin, as every piece of electronics or electrical component will need tin-based solder, or the electrons won't flow.

While other metals can theoretically be used for solder, given the abundance and effectiveness of tin, there really is no economic substitute. Furthermore, tin's unique properties are finding homes in new places. For example, tin is being added to the anodes of lithium-ion batteries to slow degradation, and lithium-ion batteries made of tin alloys may dramatically improve battery densities.

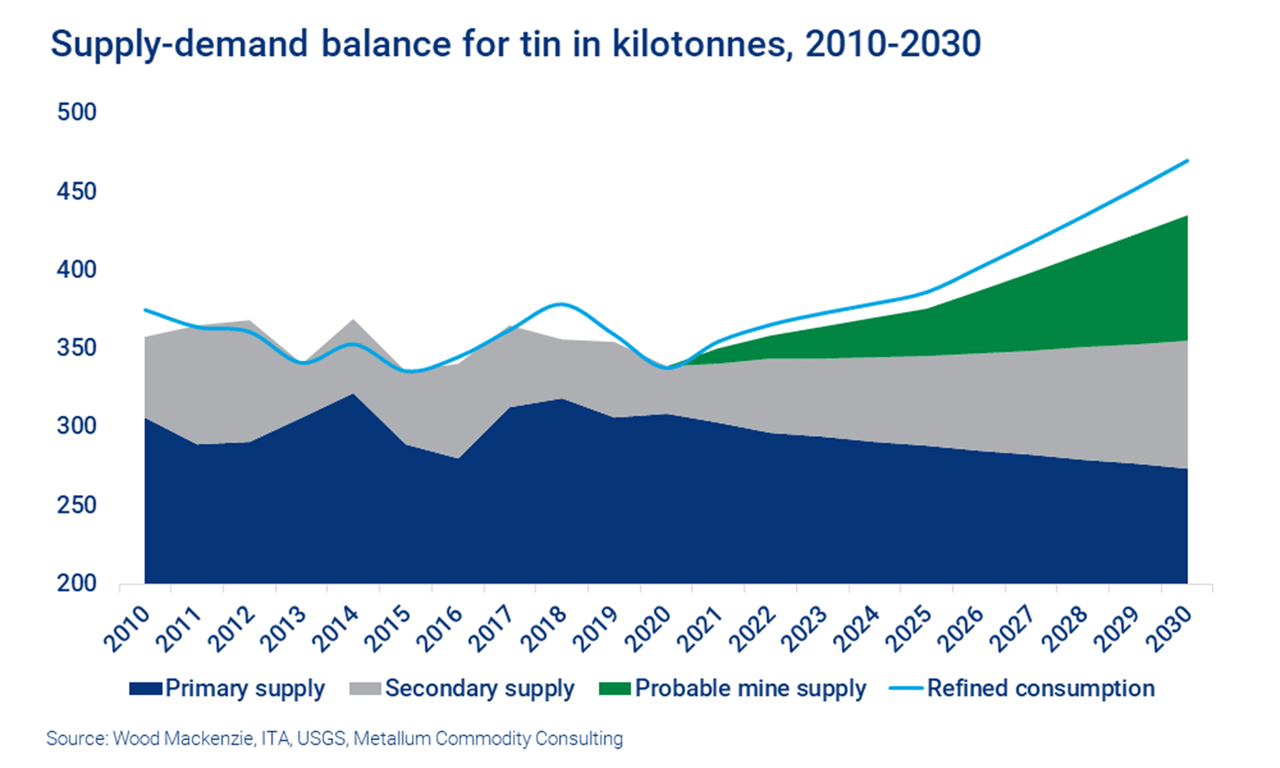

According to Wood Mackenzie, a market research firm for the metals industry, global tin demand is expected to outstrip supply for the foreseeable future (Figure 4).

Figure 4 - Tin demand is expected to outstrip supply (Wood Mackenzie)

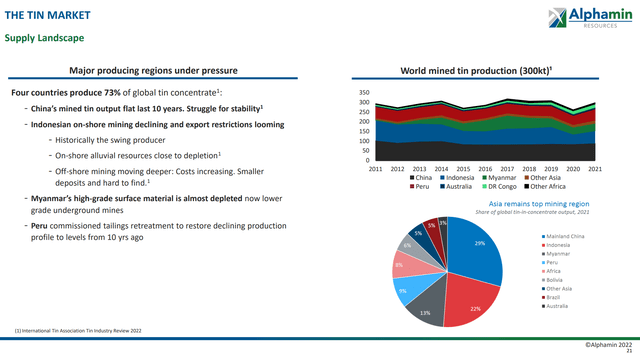

Supply Dominated By Four Countries With New Mines Constrained

The tin market is dominated by 4 countries, China, Indonesia, Myanmar, and Peru, that collectively produce almost 3/4 of the world's primary supply of ~300kta (Figure 5).

Figure 5 - World tin primary supply (Alphamin investor presentation)

However, existing supply may struggle to meet increasing demand as China's mined output has been flat for the past decade while Indonesia is running out of easy to mine alluvial deposits and Myanmar's high grade surface deposits are being depleted.

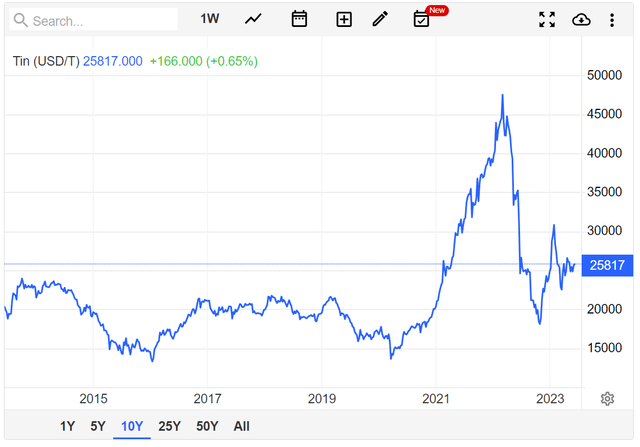

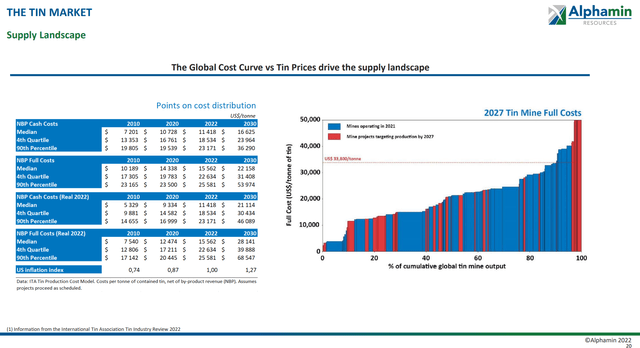

Furthermore, at current tin prices of ~$25,000 / t (Figure 6), mine developers may not have enough incentive to bring new mines to production as many existing mines are operating at below cost (Figure 7).

Figure 6 - Tin prices have been volatile (tradingeconomics.com) Figure 7 - Tin production cost curve (Alphamin investor presentation)

Bisie Is King Of Grade

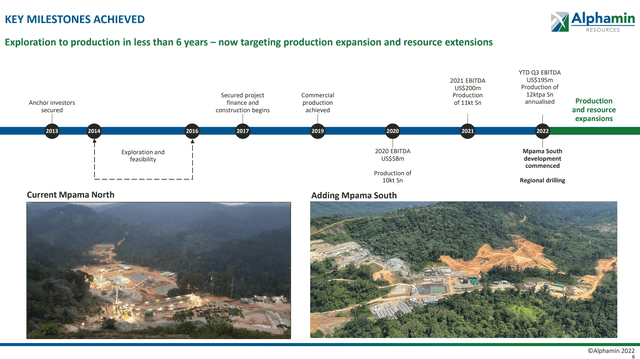

Alphamin Resources acquired the Bisie project in 2011 and recognizing the exceptional quality and grade of the Mpama North deposit, fast tracked development of the Bisie mine. The mine went from exploration to production in under 6 years - an unheard of pace of development within the mining industry (Figure 8).

Figure 8 - Bisie historical milestones (Alphamin investor presentation)

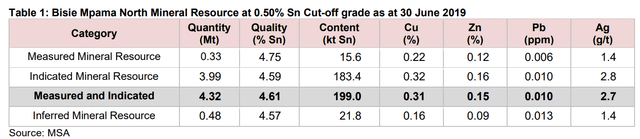

The main feature of the Bisie mine is its exceptional grade. The Mpama North deposit, on which the mine is built, has a 4.3 Mt resource with ore grading 4.6% tin, or almost 200kt of contained metal (Figure 9).

Figure 9 - Mpama North resource (Alphamin 2019 technical report)

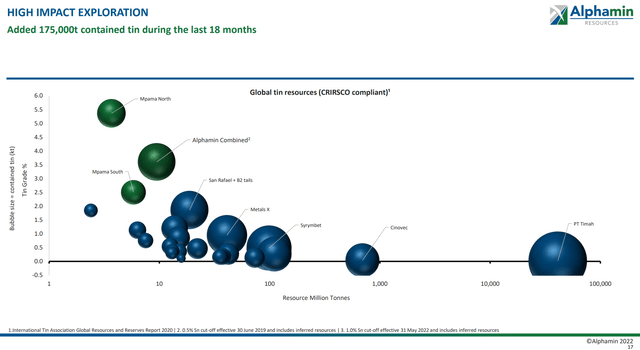

In fact, Mpama North is the highest grading tin deposit currently producing (Figure 10).

Figure 10 - Alphamin is the highest grade producer (Alphamin investor presentation)

Alphamin Still Profitable Despite Tin Price Declines

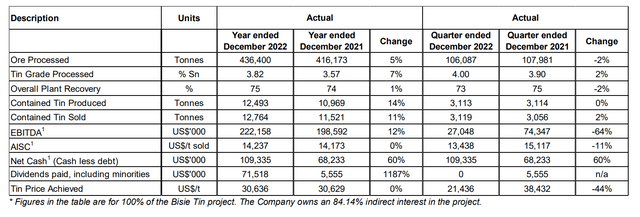

This has allowed Alphamin to produce ~12,000 tpa of tin at all in sustaining costs ("AISC") of approximately $14,000, placing Alphamin near first quartile production costs (Figure 11).

Figure 11 - Alphamin 2022 financial summary (Alphamin 2022 MD&A report)

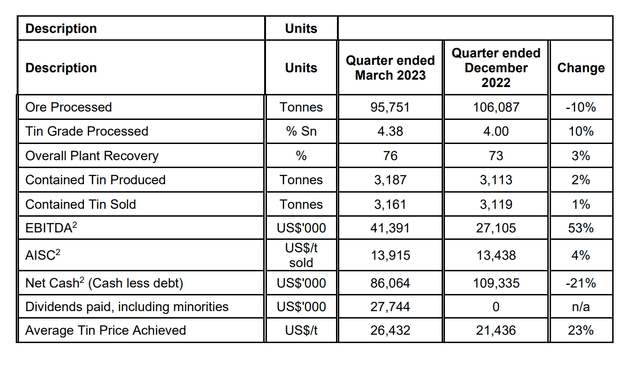

Even though tin prices fell precipitously in 2022 to an average of $21,436 per ton in Q4/2022, Alphamin was still able to generate positive $27 million in EBITDA. In the most recent quarter ended March 31, 2023, Alphamin produced 3,187 tons of tin and was able to achieve $41 million in EBITDA as tin prices rebounded to $26k per ton (Figure 12).

Figure 12 - Alphamin Q1/23 financial summary (Alphamin Q1/23 MD&A report)

Excellent Resource Replacement Extends Mine Life

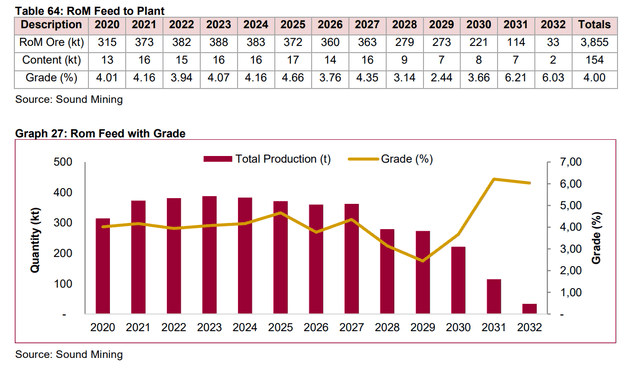

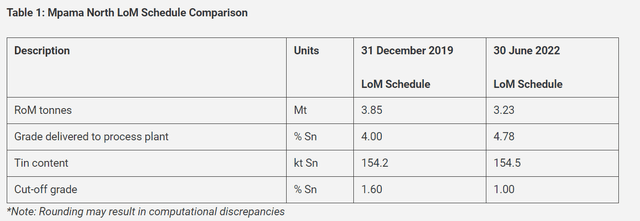

As with all mines, one of the key challenges is that mineral resources deplete over time. For example, in the company's 2019 technical report, the Bisie mine is envisioned as having a 13-year mine life producing a total of 154k tons of tin grading from processing 3.8 million tons of ore grading 4.0% (Figure 13).

Figure 13 - Mpama North mine plan (Alphamin 2019 technical report)

However, from a resource update dated August 2022, we learn that the Mpama North Life of Mine ("LoM") schedule still shows 154k tons of remaining resources, despite Alphamin having extracted close to 1 million tons of ore since operations began (Figure 14).

Figure 14 - Mpama North LoM Schedule (Alphamin 2022 resource update)

The replacement of depleted resources is from a combination of factors. First, actual mine performance has exceeded the original plan, with ore grades delivered to the processing plant now expected to be 4.78% vs. the original 4.0%. Exploration success have also added to high grade areas. Finally, updated tin price assumptions have also allowed the mine to include previously uneconomic ores, lowering the cut-off grade to 1.0% vs. the initial 1.6%.

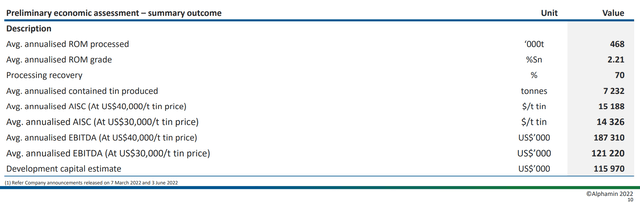

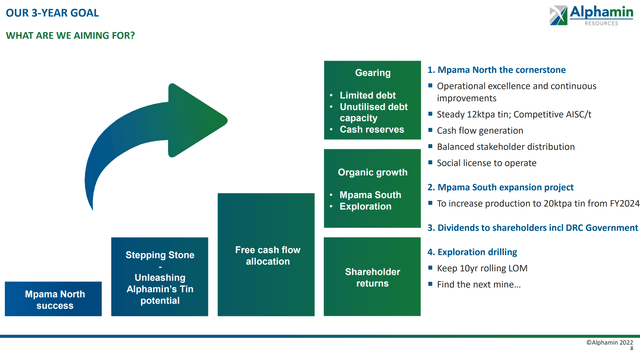

Mpama South Will Further Boost Production

Looking forward, Alphamin is currently working on an expansion project that will connect the Mpama South deposit with the existing Mpama North mine. At an estimated $116 million in capex, Mpama South will boost overall Alphamin production to ~20,000 tpa or approximately 6.6% of the world's mined supply (Figure 15).

Figure 15 - Mpama South will add 8000 tpa to Alphamin's production (Alphamin investor presentation)

Building A Free Cash Flow Machine

Once the Mpama South deposit enters production at the end of 2023, Alphamin will become a free cash flow machine.

Figure 16 - Alphamin is transitioning from expansion to free cash flow generation (Alphamin investor presentation)

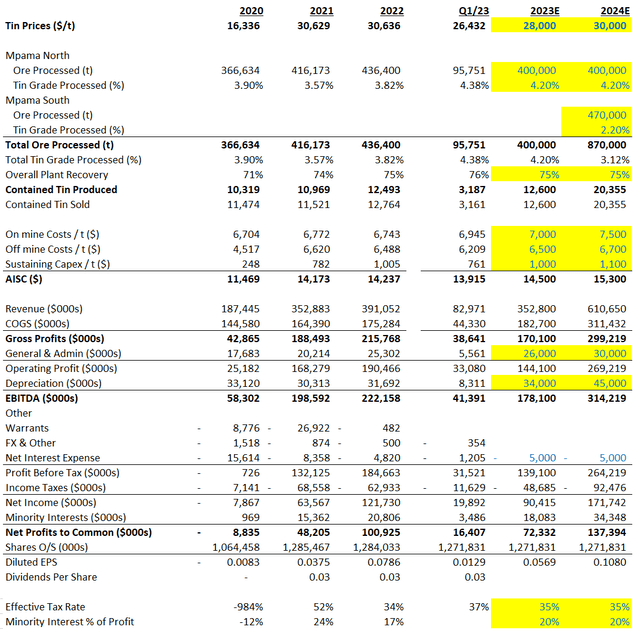

Using simple assumptions such as a modest recovery to $30,000 / t tin prices in 2024 (similar to average levels achieved in 2022) and an increase in AISC to $15,300 / t (from $14,237 / t in 2022), I believe the addition of Mpama South can boost Alphamin's 2024 EBITDA to $314 million and dil. EPS to 10.8 cents / share (Figure 17).

Figure 17 - Mpama South can boost EBITDA to $314 million in 2024 (Author created)

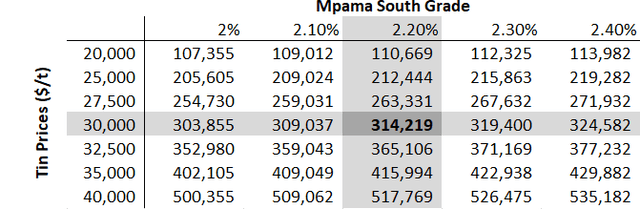

In the event of a stronger recovery in tin prices, we may see significant operating leverage in Alphamin's business model. At $40,000 / t tin prices, I estimate EBITDA can reach over $500 million (Figure 18).

Figure 18 - Alphamin EBITDA sensitivity (Author created)

Undervalued On Current Production; Mpama South For 'Free'

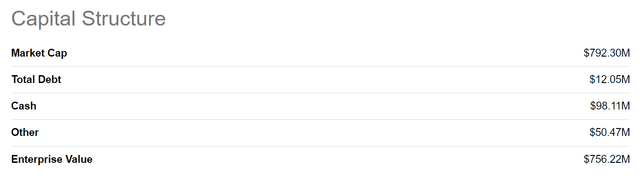

At current market cap of $792 million and enterprise value of $756 million, Alphamin is trading at 4.25x EV/EBITDA on my 2023 estimate of $178 million (Figure 19).

Figure 19 - Alphamin enterprise value (Seeking Alpha)

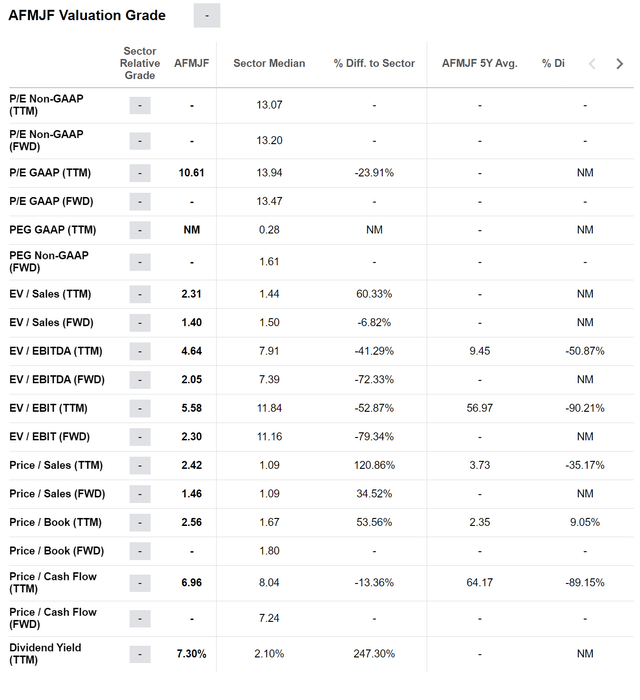

This is already undervalued relative to the Materials Sector, which trades at an average Fwd EV/EBITDA of 7.4x (Figure 20).

Figure 20 - Alphamin valuation (Seeking Alpha)

However, what is truly outstanding about the investment opportunity in Alphamin is that the company is self-financing the Mpama South expansion project ($116 million capital cost) without having to seek additional equity or debt capital. Hence, once Mpama South enters production and EBITDA takes a step change to over $300 million, the company can be considered trading at only 2.5x 2024 EV/EBITDA!

Risks To Alphamin

The biggest risk to Alphamin is tin prices, which have been volatile of late. Since peaking at over $45,000 / t in 2022, tin prices have plunged to a low of $18,000 in Q4/2022 before recovering recently to $25,000. However, for low cost producers like Alphamin, volatile commodity prices can actually be a blessing in disguise as it discourages new entrants. Therefore, during periodic boom periods, low cost producers like Alphamin can reap extraordinary returns.

Another risk to Alphamin is the Bisie mine's location in the DRC. The DRC is known as one of the toughest jurisdictions to operate in as the country is politically unstable and corruption is rife. However, to date, Alphamin has been able to manage its social license well, spending 4% of operating costs back into its local community.

Conclusion

Alphamin owns the Bisie tin mine, one of the highest grade mines developed in the past few years focused on the often forgotten critical metal, tin. For those knowledgeable about the low-carbon energy transition, tin is regarded as one of the most impacted metals as it is used in all electronics as solder. Demand for tin is expected to outstrip supply for the foreseeable future.

I believe Alphamin is undervalued based on its existing production profile and becomes grossly undervalued if we model in the Mpama South expansion project that will come into production at the end of 2023. I am a shareholder of Alphamin and would be a buyer of the company's shares on any price declines. I think long-term investors will be richly rewarded from both production expansion and tin price recovery.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AFM:CA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.