American Battery Technology: Unclear Timeline And Little Cash Left

Summary

- American Battery Technology (ABTC) appears to have unclear financing and a lack of secured funding, raising concerns for potential investors.

- The company is involved in both lithium exploration and battery recycling, but the presentation of their plans and timeframes is chaotic and confusing.

- Share dilution is a significant issue, with 20 million new shares issued in the last 12 months, potentially disadvantaging shareholders.

Dima Berlin/iStock via Getty Images

Investment Thesis

American Battery Technology (OTCQX:ABML) sounds on the surface like a promising investment for lithium exploration and battery recycling, but a closer look reveals several red flags. For one, the financing seems unclear and not secured. Furthermore, the share dilution is enormous. Overall, I can't see a clear roadmap and schedule in the strategy.

Short company overview

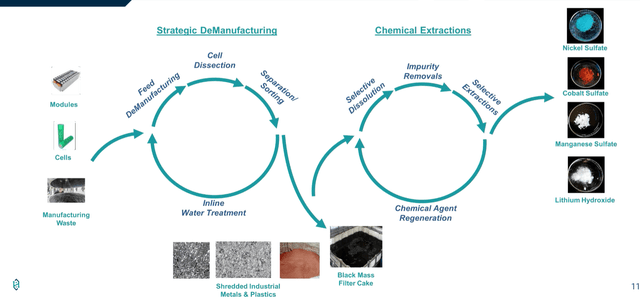

ABTC is an advanced technology, first-mover lithium-ion battery recycling and primary battery metal extraction company that utilizes internally developed proprietary technologies to produce domestically-sourced battery grade critical and strategic metals at substantially lower cost and lower environmental impact than current conventionally sourced battery metals. We’ve Got It All: Recycling, Novel Extraction Technologies, and Primary Resource Development

Source: americanbatterytechnology.com

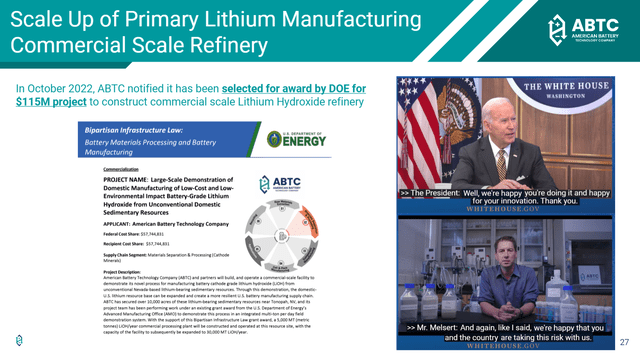

ABML, founded in 2011, plans to use a hydrometallurgical process to extract raw materials from used batteries. In 2019, the company won the BASF’s Battery Recycling Circularity Challenge and is currently building a plant for battery recycling in Fernley, Nevada. Another project is lithium extraction from a claystone resource deposit. In October 2022, the company was selected for a $57 million grant by the Department of Energy to build a commercial-scale facility for manufacturing battery cathode-grade lithium hydroxide from this resource. More on that later.

The importance of battery recycling

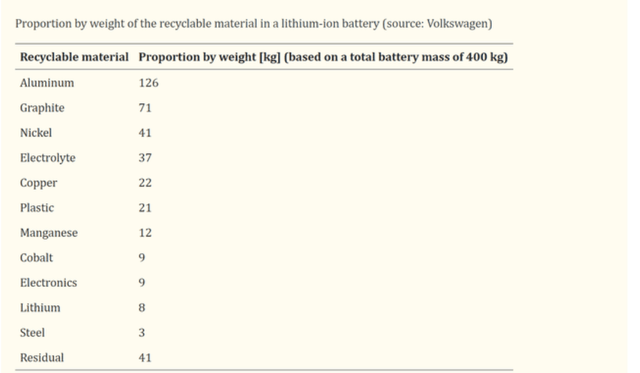

I have already analyzed another company from this sector, Li-Cycle (LICY). Battery recycling is the process of recovering valuable materials from used or discarded batteries, such as lithium, cobalt, nickel, copper, aluminum, and graphite. These materials can then be reused to produce new batteries or other products, reducing the need for mining and refining new raw materials.

Battery recycling is essential for the electrification of road transport, the heating market in the form of heat pumps, and the expansion of renewable energies to work and make sense. The main difference to oil and gas is that nothing or only little material is lost. By recycling, the worldwide available quantities of metals can become constantly larger: what has already been mined is recycled and used again, and the whole system is additionally fed by new mining. With oil, gas, and coal, everything that is extracted is lost when it is used, so there is a constant depletion and need for more.

This dynamic compensates for the disadvantages of, for example, the return on invested energy (EROI) being lower. But the (EROI) will improve over time due to more efficient technology and the fact that the recycling of metals requires less energy than new production. At the same time, the EROI of oil, gas, and coal tends to worsen over time as mankind has already exploited the most profitable and easy-to-extract areas (otherwise, nobody would do fracking today).

At the moment, we are on the way to electrifying the whole road transport, and a single car battery contains hundreds of kilos of essential metals. Not to recycle this amount would be wasteful and also an ecological disaster.

Volkswagen

Li-Cycle Has Enormous Potential In A Multi-Billion Dollar Market

Valuation & Outlook

The company is currently valued at an enterprise value of $526M. The market cap is $538.31M, and the company has about $12M cash left. The cash burn in the trailing twelve months was about $21M.

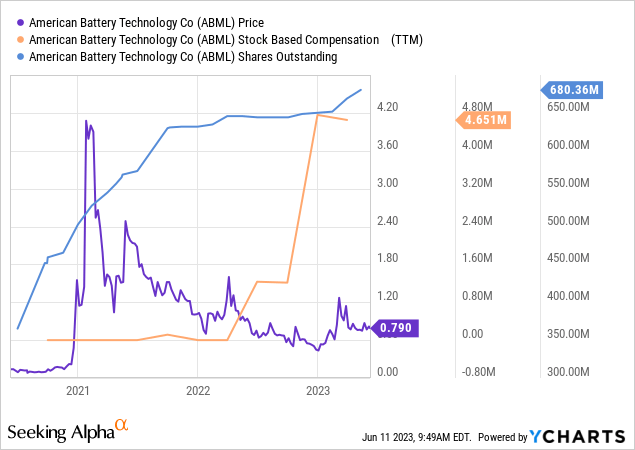

Accordingly, the company will soon need new money, and looking at the past, we can see a very rapid expansion of the outstanding shares (see below). However, given the now low share price, it is doubtful that this will be enough. In the last 12 months, about 20M new shares have been issued. This would bring in just about $16M at the current share price.

So what´s the plan for financing? Do they want to take on debt? The latest quarterly report mentions how much cash is left but not how future funding will be secured. As a public company that wants to attract investors, I think the information should be more detailed and precise. The investor presentation says on the slide about the facility that there is an "agreement to purchase", not that it is already purchased. However, elsewhere it is mentioned that this facility is already being set up and converted. All in all, a bit confusing.

Unfortunately, investor presentations are often structured more like advertising brochures than actual sources of information. In this case, most slides are about the future lithium demand or recycling chemistry. The only slide that is at all about finance is this one.

Even here, it says $115M in bold and underlined letters on the top, and only in the fine print "recipient cost share $57M". So this grant is not for the recycling facility but for another project about the lithium extraction from clay, or as they call it, "manufacturing of battery cathode grade from lithium hydroxide from unconventional lithium bearing sedimentary resources". Overall, the investor presentation seems to me quite chaotic and with little detail. Here are some more details about this lithium reserve.

ABTC controls 517 lithium-bearing claystone lode claims encompassing 10,340 acres near Tonopah, Nevada. ABTC has conducted geological mapping, sampling, drilling, geochemical analysis, and proprietary extraction trials to characterize these resources and quantify the performance of the lithium extraction and manufacturing operations. Report published in February 2023 identified Tonopah Flats Project as an Inferred Resource with one of the USA’s largest known lithium deposits, including 15.8 million tons of lithium carbonate equivalent.

-Source: IR page

So, on the one hand, there is an exploration project (Tonopah Flats), and on the other hand, there is a plan to do battery recycling. Both sound very expensive, and there's no timeframe given for either. I wonder if they are not getting ahead of themselves here. Why not start with one project first and then begin a second? If I understand the company correctly, it has more of its chemistry expertise, so battery recycling would be obvious. But two projects simultaneously, although the money runs out and the company has only 45 employees?

The recycling plant has a section on the website, but the last update was almost a year ago. So we don´t really know what´s going on.

On the lithium exploration project, some more details are given on the project website, but it doesn't sound like a clear in-progress plan yet, and the timeframe is still unclear. Or in other words, it sounds like a project that still requires an enormous amount of work.

In October 2022, we received a federal grant in the amount of $57M as part of the Bipartisan Infrastructure Law to design, construct, commission, and operate a $115M commercial-scale facility to demonstrate ABTC’s novel process for the manufacturing of battery grade lithium hydroxide monohydrate from Nevada-based lithium-bearing sedimentary resources.

Building off the work completed under a previous grant award from the U.S. Department of Energy’s Advanced Manufacturing Office (AMO), this grant will fund the construction of a 5,000 mt (metric tonnes) LiOH*H2O/year commercial processing plant to be operated at the resource site, with the capacity of the facility to subsequently be expanded to an anticipated 30,000 mt LiOH*H2O/year.

Share dilution, insider trades & SBCs

There are three things are standard checks I make in every article, regarding:

- shareholder dilution

- insider trades

- stock-based compensation

Excessive stock dilution and stock-based compensation can put us, shareholders, at a disadvantage. I have not found any information about insider trades.

Conclusion

I generally have a very positive attitude toward lithium and battery recycling. Despite this positive mindset, the company, in its current state, does not manage to convince me. I can't see a clear strategy in the approach, and everything the company is up to will cost many, if not hundreds, of millions. However, it appears that the money will run out soon, and further share dilution is almost certain. The company may become interesting at some point, but I am not willing to invest my money here at this stage.

| Investor's Checklist | Check | Description |

|---|---|---|

| Sufficient cash reserves? | No | Vital for the survival & growth especially of unprofitable companies |

| Shareholder negatives? | Yes | Actions that disadvantage shareholders |

| Stock in uptrend? | No | Trading above its 200-day moving average? |

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.