FWD: Solid Growth, Decent Quality, But Valuation Is A Major Risk

Summary

- Ab Disruptors ETF is a nouveau actively managed fund that debuted on 21 March 2023. As described in its prospectus, the strategy is centered on "disruptive" innovation leaders.

- FWD takes a relatively minimalist approach to portfolio construction, with the number of holdings limited to 80-120 names. U.S., developed, and emerging market companies can qualify.

- Last year was a mere calamity for the innovation-themed ETFs, notable for what I would call the ARKK lesson. The gist is that valuation is never to be ignored.

- In this regard, despite FWD's numerous advantages discussed in the article, I would like to be a skeptic today.

IR_Stone/iStock via Getty Images

Ab Disruptors ETF (NYSEARCA:FWD) is a nouveau actively managed fund debuted on 21 March 2023. As described in its prospectus, the strategy is centered on "disruptive" innovation leaders with "durable growth prospects," which are selected using "top-down evaluation of innovative growth trends with fundamental bottom-up analysis."

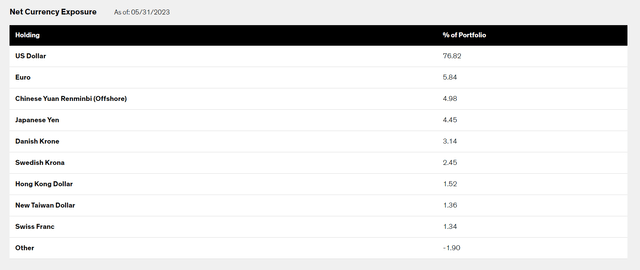

FWD takes a relatively minimalist approach to portfolio construction, with the number of holdings limited to 80-120 names. Its strategy is unconstrained when it comes to international equities. The fund is actively searching for top-growth opportunities not only in the U.S. but in developed markets (e.g., the UK, France, Denmark, and the Netherlands) as well, also venturing into emerging markets not to miss on promising technology plays with exceptional expansion stories ahead. On the negative side, this makes FWD's performance inherently more sensitive to U.S. monetary policy and credit conditions globally overall, as currency fluctuations driven by differences in interest rates will add to the long-duration equities risk that is also intertwined with the credit cycle (via the cost of capital and value of future cash flows). Anyway, the U.S. dollar is its principal currency as shown below.

Amongst emerging market plays it is bullish on is NARI Technology (there is no ADR, Shanghai ticker: 600406), which had a modest 88 bps weight in its portfolio as of June 9. The March article from AllianceBernstein titled "China's Green Enablers Deserve A Place In Equity Funds" has a hint about what might be the possible rationale behind FWD's decision to accumulate NARI's Shanghai-quoted shares. In short, the Nanjing-based company provides "equipment for power grids, supplying technology solutions in areas including system automation, smart grids, renewable energy, and energy conservation," with "a market share of 30%-40% in key product categories," so it stands to benefit from infrastructure expansion connected to electric vehicles, alternative energy, etc., which are instrumental in reducing greenhouse gas emissions straight to zero.

Delving deeper, an interesting fact is that not all FWD holdings are tech or quasi-tech names. The presence of the Paris-quoted shares in LVMH Moët Hennessy - Louis Vuitton (OTCPK:LVMUY), a luxury market behemoth with almost 1% weight in the fund, might be puzzling and counter-intuitive. However, I believe LVMH does deserve a place in a versatile innovation-centered portfolio as the firm is actively investing in the cutting-edge product development, especially when it comes to sustainable materials. A nice example to mention is LVMH's collaboration "with pioneering research labs" in an initiative that "will develop new lab-grown fur fibres for luxury fashion," which was announced last year, and this is just the tip of the iceberg. Regarding fundamentals, the Paris luxury titan also has impressive growth credentials, with a 3-year EBITDA CAGR of 19.8% and forecast forward revenue growth of 12.6%.

A racy start

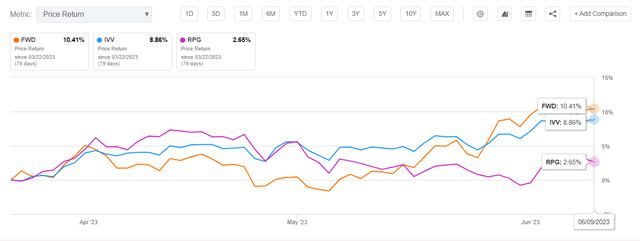

With the rebound of high-growth plays and the innovation/disruption theme seemingly back in vogue amid the weakening inflation narrative, with the much-hyped AI revolution also grossly contributing to the recovery, FWD has seen strong gains in the previous months since its inception, beating the iShares Core S&P 500 ETF (IVV), as well as the cohort of its high-growth portion tracked by Invesco S&P 500 Pure Growth ETF (RPG).

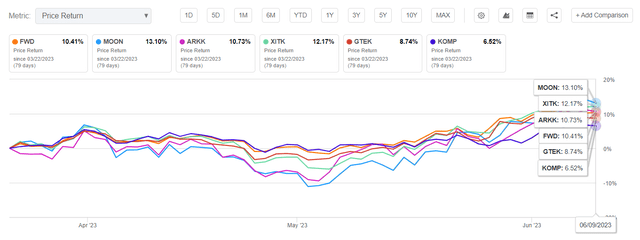

However, besting peers from the innovation & disruption cohort has been much more challenging. For example, it has underperformed the ARK Innovation (ARKK), Direxion Moonshot Innovators (MOON), and SPDR FactSet Innovative Technology ETFs (XITK) but outmaneuvered the Goldman Sachs Future Tech Leaders Equity ETF (GTEK) and SPDR S&P Kensho New Economies Composite ETF (KOMP).

Nevertheless, the tech-heavy Invesco QQQ ETF (QQQ) following a simpler market-cap-driven strategy has demonstrated a much better performance, beating the entire peer group.

Overall, it is worth understanding that the period is fairly short, and the performance delivered over a few months should not be extrapolated.

FWD high-growth mix is a value investor's nightmare

Growth and quality

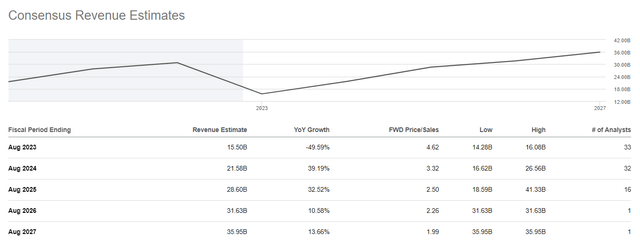

Delving deeper, the primary conclusion that could be drawn from the analysis of the FWD holdings dataset available on its website is that at least at this stage, the fund has managed to create an equity mix with exemplary growth characteristics. With around 34.5% of the net assets allocated to companies with a forward revenue growth rate of 20% or higher (my calculations based on pundits' estimates), portfolio-wise figures look exceptionally alluring, as a weighted-average forward sales growth is at 17.5% and EPS growth is at 18.5%; the EBITDA growth rate is a bit weaker, at only 16%. However, a due remark here is that for ~9.5% of the holdings the EPS is forecast to contract, while for almost 21% data were not available (including those unable to turn even a thin profit). There are sales contraction stories as well, like Micron Technology (MU), a semiconductor name with ~77 bps weight in the portfolio. Nevertheless, despite anticipated softness in the next two fiscal years, the longer-term picture looks much rosier for the company.

MU revenue estimates (Seeking Alpha)

Next, potential holdings' "current profitability, projected future profitability, growth prospects, competitive position, pricing power, technological advantage, and strength of management" are said to be considered by the fund's adviser when looking for opportunities. And here, I should acknowledge that FWD has constructed a mix of solid quality.

- First, ~71.7% of net assets are allocated to stocks with a B- Quant Profitability rating or higher.

- Second, even though loss-making names account for over 19%, cash flow-negative companies have much lower weight, just ~7.3%. This is a strong result for any growth-centered strategy which typically has to tolerate exposure to cash-burning names as innovation is intimately intertwined with massive R&D outlays which, in turn, dent operating profitability.

- Also, the weighted-average Return on Equity and Return on Total Capital also appear fairly attractive, at 16.2% and 9.3%, as per my calculations, with a caveat that the latter was impacted by ~16.8% of the holdings having negative figures.

Valuation

As it is said in the prospectus, FWD's strategy has no market cap constraints. In reality, most holdings are either mega or large caps, with three $1 trillion league members present, namely Microsoft (MSFT), Alphabet (GOOGL), and Amazon (AMZN), together accounting for 7.2%. At the same time, only ~10% of the holdings are mid-capitalization companies. Portfolio-wise, this implies a weighted-average market cap of over $295 billion as per my calculations. And there are numerous valuation considerations beneath the surface.

First, I discovered that its weighted-average earnings yield is only ~1.5%. This might look adequate for top-growth play, but as data from respective funds illustrate, XITK has a much higher EY of 3.2%, while QQQ comes with 3.6%.

Next, using data from Seeking Alpha, I calculated FWD's EV/EBITDA, which is approaching 40x, while Price/Sales is at 9.4x. Certainly, the fund holds NVIDIA (NVDA), a phenomenon with triple-digit gains this year amid the AI hype, and this stock is one of the top contributors to the P/S ratio.

| Symbol | NVIDIA (NVDA) | Snowflake (SNOW) | The Trade Desk (TTD) | Samsara (IOT) | MongoDB (MDB) |

| Weight, % | 4.62 | 0.71 | 1.00 | 0.74 | 1.28 |

| Price | 387.7 | 170.65 | 74.58 | 28.98 | 374.51 |

| Market Cap, $ billion | 952.4 | 56.8 | 36.44 | 14.68 | 26.44 |

| EV, $ billion | 949.16 | 52.04 | 35.36 | 14.06 | 25.77 |

| Valuation Grade | F | F | F | D- | D |

| Profitability Grade | A+ | B+ | A- | C- | C |

| EY | 0.5% | -1.5% | 0.2% | -1.7% | -1.2% |

| P/E TTM | 201.02 | NM | 472.32 | NM | NM |

| P/E FWD | 49.53 | 302.89 | 61.66 | NM | 243.70 |

| Price / Sales | 36.88 | 24.70 | 22.12 | 20.18 | 18.98 |

| EV / Sales | 36.68 | 22.96 | 21.49 | 19.68 | 18.86 |

| EV / EBITDA | 155.86 | NM | 218.60 | NM | NM |

The five key contributors to FWD's P/S. Created using data from Seeking Alpha and the fund

In sum, the risks associated with overstretched multiples are not to be ignored.

Final thoughts

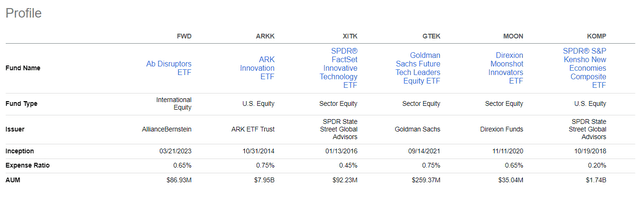

Owing most likely to its complex active strategy and exposure to global equities, the fund has a rather burdensome expense ratio of 65 bps. However, it does not look that burdensome if juxtaposed with peers.

FWD has joined a relatively large cohort of the funds that are seeking to capitalize on innovation plays, with a footprint in themes having long-term secular growth potential like AI, robotics, EVs, cloud services, cleantech, etc. Last year was a mere calamity for the cohort, notable for what I would call the ARKK lesson as this pandemic era market darling lost ~67%. The gist is that valuation is never to be ignored, even with the innovation/disruption concerned. In this regard, despite FWD's numerous advantages discussed above, I would like to be a skeptic today. Since I see no justification for a strong bear thesis, and the bullish thesis is also implausible, a Hold rating would be a golden mean.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.