Baxter International: Hillrom Acquisition Could Be A Tailwind For FCF

Summary

- Baxter International Inc plans to divest its BioPharma Solutions business for $4.25 billion, aiming to pay down its long-term debt and create room for further growth.

- The company's robust margins and cash flows, along with a diverse product portfolio, make it an attractive option for a dividend-oriented portfolio.

- Despite the risks associated with the large amount of debt on the balance sheet, Baxter International Inc is rated as a buy due to its stable dividend yield and potential for share appreciation.

Ignatiev

Investment Rundown

Baxter International Inc (NYSE:BAX) has established itself as a global leader in providing innovative healthcare solutions. Baxter's commitment to advancing healthcare is evident in its diverse offering of products and therapies tailored to address various medical requirements.

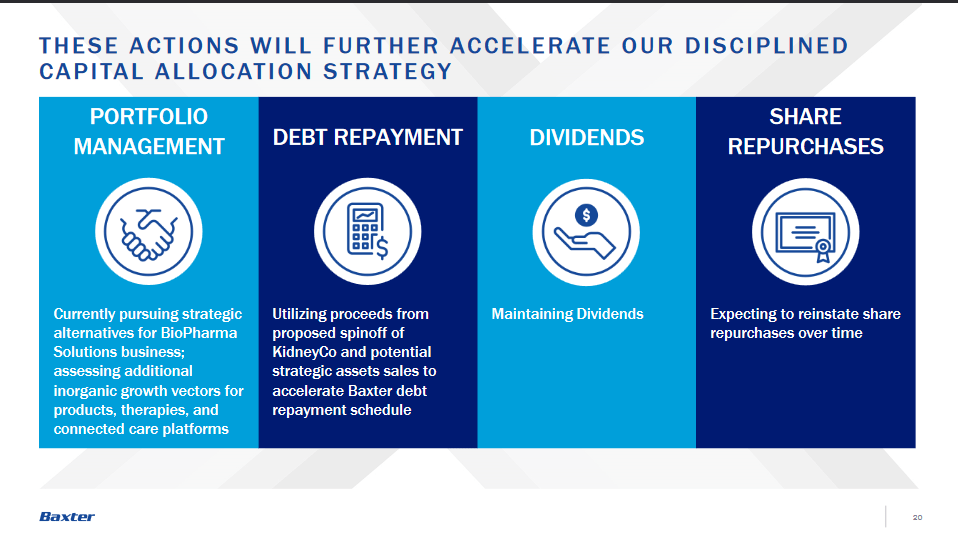

Company Actions (Investor Presentation)

The company recently announced the divestiture of its BioPharma Solutions business for a $4.25 billion deal. This deal is meant to help BAX pay down its debt, which the long-term position has grown up to $15 billion right now. It's a much-needed step that will help make the company further able to invest more freely and bring value to shareholders. The divestiture creates room for further company portfolio investments and in the long run, I see this as a benefit to shareholders as it will hopefully lead to further growth in the FCF resulting in a robust dividend yield and an intriguing share buyback plan for investors. BAX gets a buy rating.

Debt Improvement Thanks To Selling BioPharma

Looking at a recent announcement from the company, they declared they have reached an agreement with Advent International and Warburg Pincus to sell off its BioPharma Solutions business for a $4.25 billion deal paid in cash. The move was made by the company as a way of streamlining their business and leaving room for new investments, but also as a means to pay down long-term debts, which if all cash is used would bring it down by nearly 33%.

The deal is of course expected to hurt the EPS of BAX as the business made up a portion of the revenues for the company. The deal is estimated to close in the second half of 2023, and the sale is expected to have a negative $0.10 EPS impact on the fourth quarter of 2023 for BAX.

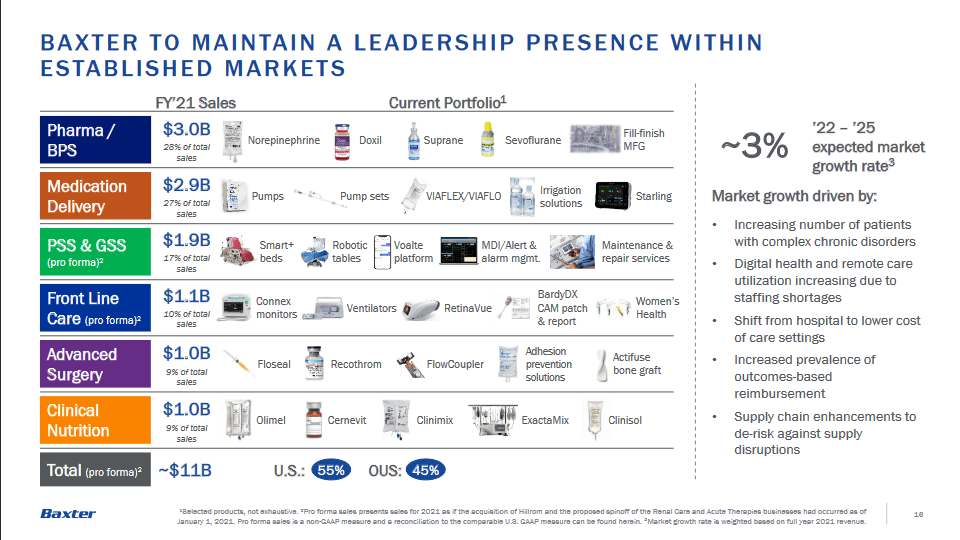

Product Portfolio (Investor Presentation)

Looking at the positives of this deal, BAX boosting their cash position from $1.6 billion to $5.8 billion is a significant move and helps them be in a much better financial position and lends to more flexibility as well. I see the company able now to make strong investments and build out its portfolio even further. BAX operates right now as a cash machine in my view, diverting profits to shareholders through buybacks and dividends, which I find very appealing as the relative stability of the company lends it to be an excellent option for a dividend-oriented portfolio.

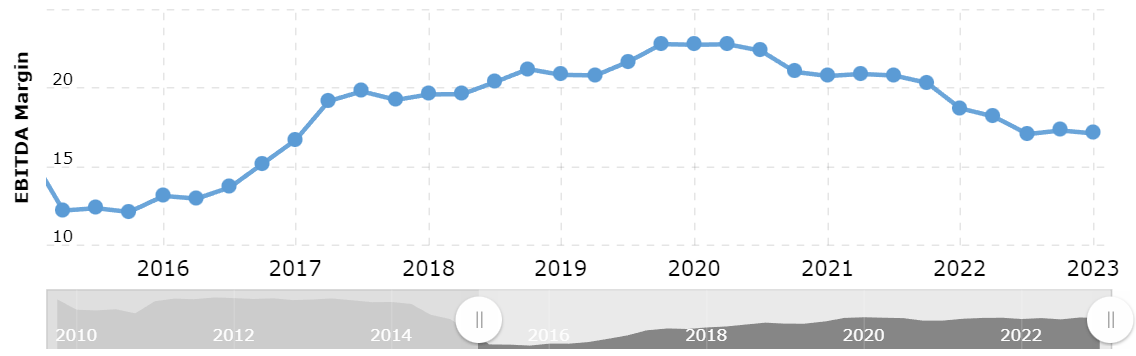

Robust Margins And Cash Flows

Looking at the margins of the business, they remained very solid. BAX has managed to gather up a TTM EBITDA margin of over 20% which has made them able to keep up the dividend and bring value to investors even if the share prices have plummeted. With the share price down 45% in the last 12 months, the 2.81% dividend yield may not help much, but I think there has been a clear shift in where investors are deploying capital. The healthcare sector as a whole has seen a pretty drastic decline, and this has of course affected BAX too. With the sales expected to only rise by 1 - 2% for 2023, the company is not a growth story anymore. But that isn't to say it's not worth investing. The high margins and the relative stability of them as seen below here.

EBITDA Margin (Macrotrends)

The upside and value potential I see here comes from the growing FCF for the company. Estimates suggest nearly $1 billion in FCF for 2023, which would be in line with the last few years the dividend is very likely to still be intact and not under any pressure. The margins are trending down from the highs in 2020 when most healthcare companies saw massive profits, but they are seemingly stabilizing and growing from here, as the chart suggests. If the company is keeping the dividend as it is, the price tag would end up somewhere around $600 million, which can be covered by the estimated cash flows, and the remaining sued to pay down the large portion of debt the company has amounted to over the years. As mentioned, BAX is a bet on a stable dividend payer over the long term, focused on growing with the market as they grow their portfolio and generate cash flows.

Prioritizing The Long-Term

As mentioned, I see the main value shareholders are getting here is from the dividend and the slight share appreciation I expect as the company is growing its bottom line with the rest of the markets, they are in. They have managed to build up a solid portfolio of products. As seen in one of the pictures above, they estimate the market to generate a CAGR of between 3 - 5% between 2022 and 2025, which certainly doesn't make BAX a growth company by any means. But that isn't the appeal of it, it's the stability of the business and the solid cash flows they are able to generate.

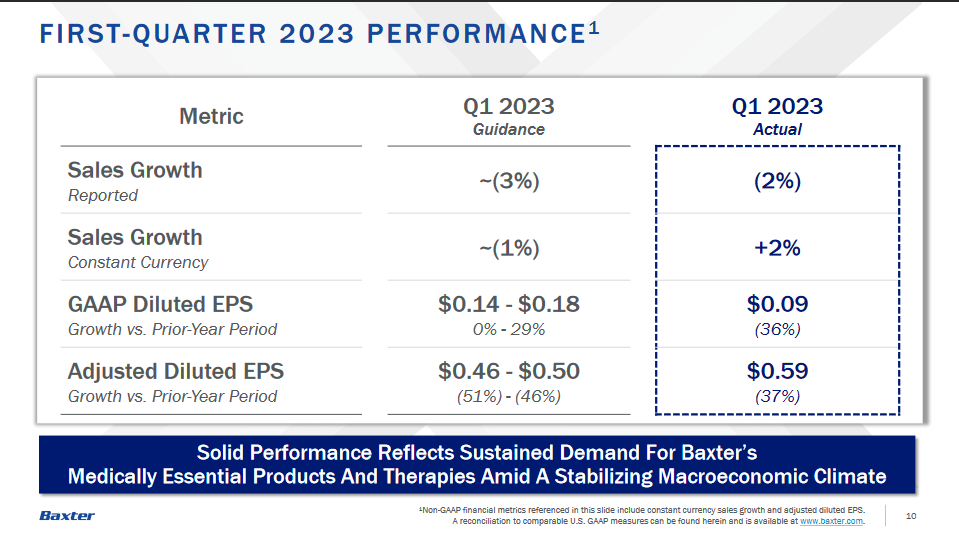

Q1 Highlights (Q1 Presentation)

Quickly looking at the last quarter as well from the company, they seem to be outperforming their own guidance, which makes for a more comforting outlook in my opinion. If they are able to grow their EPS like this continuously then the cash flows will follow and so will a raise in dividends too. With solid QoQ like that, then I think there is a case to be made that the $1.6 billion authorized funds for share repurchases can be used. If all were used, it would bring down the outstanding shares by almost 8%. Which of course would be beneficial to shareholders as the value of their holdings increases.

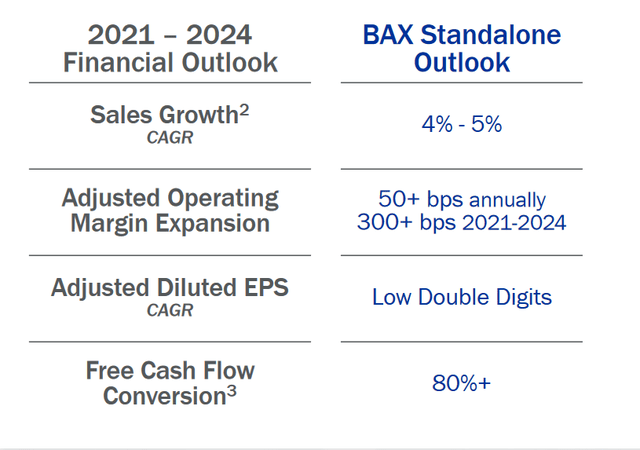

Company Targets (Investor Presentation)

One of the many bonuses of the acquisition of Hillrom was the expanded reach that BAX is now receiving. Hillrom has 68% of its revenues from the US, whereas BAX previously only had 42%. This increased exposure to this massive market should play out very well for BAX in the long term. Looking above, the strong FCF conversion rate the company expects is because of the addition of Hillrom to the portfolio. The integration of Hillrom into BAX is expected to really start showing its potential after around 3 years as the EBITDA margins are estimated to grow by 20%, and at the 5-year mark, the free cash flow generation will be robust following the closing of the deal and the successful undertaking of the company. Estimates are that by 2025 the FCF for BAX would be above $2 billion, and I think this is reasonable given that Hillrom had around $400 million cash flows TTM before the closing of the deal. But estimates suggest a FCF conversion rate of around 53%, and I think the optimistic target that BAX maintains 80% of the FCF will see strong improvements as efforts are made to grow them.

Investment Risks

Looking at the risks facing the company right now, I think the most prominent one is the large portion of debt the company has gathered up. With the acquisition of Hillrom, Baxter took on all the debt they had and paid $10.5 billion for the shares, resulting in a transaction value of $12.5 billion in total. The company noted they expect the deal to help generate strong cash flows and high single-digit ROIC from the deal. Completed in 2021, the cash flows haven't yet seen the growth they estimated, but according to the company won't be clearly visible until 5 years after the deal as they manage the company and aims to grow the business. I, for one, see this as a major risk for the company. If the deal turns out to not be as successful as the company predicted, then the amount of debt now sitting on the balance sheet will be a major anchor in the coming years.

Final Words

Baxter International Inc is not a growing company and shouldn't be viewed as such either. The company boasts a decent dividend yield at around 2.7% currently, and I don't see enough of a risk here that it would be cut anytime soon. The company should be able to cross the $1 billion mark in FCF for 2023 and help pay the dividend, and if there is a positive surprise the management might even raise the dividend too.

Right now, BAX is trading a fair bit under the rest of the sector as a result of some of the risk presented on the balance sheet, primarily a large amount of debt. This will continue to weigh on the valuation until the acquisition of Hillrom shows itself very successful in my opinion, but as mentioned, that could take another 3 - 4 years to fully show the potential of it. Until then, I see no solid reason that would deter an investment in BAX, and will be rating it a buy as a result. Collecting a dividend nearing 3% with a company also authorized to buy back nearly 8% of the shares is good enough for me.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.