NIO: Another Tremendous Disappointment

Summary

- Chinese electric vehicle maker NIO reported disappointing Q1 revenues of $1.55 billion, missing street estimates by $80 million and showing less than 8% growth YoY.

- Vehicle margins dropped to 5.1%, and the company's operating loss increased by more than 133% over Q1 2022.

- The company's weak guidance and declining working capital position raise concerns about the need for additional debt or equity to fund growth plans.

skynesher

Last Friday, we received first quarter results from Chinese electric vehicle maker NIO (NYSE:NIO). The company, which has continued to forecast a very aggressive future growth plan, has only disappointed time and time again. Unfortunately for investors, the latest report was much of the same, with revenues again missing and guidance being extremely weak, which likely will keep sentiment on the bearish side for now.

For the quarter, the company reported total revenues of $1.55 billion. Not only did this number miss street estimates by about $80 million, but it was less than 8% growth over the prior year period. Despite the company hoping to be around 30,000 deliveries a month in early 2023, NIO only reported a little over 31,000 units for the entire quarter. One must also keep in mind that the average Q1 street revenue estimate had come down by about $1.25 billion since September 7th of last year. Thus, this Q1 revenue print is even worse when you consider just how much expectations had plunged.

With the growth plan not doing well and NIO looking to overhaul its entire lineup, margins have been hit hard. In Q1, total vehicle margins were just 5.1%, down 170 basis points sequentially and 13 full percentage points year over year. Overall gross margins fared even worse, coming in at just 1.5%, and the company's operating loss soared more than 133% over Q1 2022. Even when looking at adjusted numbers, the loss on the bottom line ballooned by nearly 217% compared to the year ago period.

In my most recent article on the name, I talked about the company's launch of several new vehicles during Q2. There is a combination here of refreshed first generation models plus new vehicles based on the next generation platform. These launches were expected to provide tremendous growth throughout 2023, but management's forecast for the current quarter seen below was a major disappointment. As a point of reference, the street was looking for around 45,000 units and revenues of $2.53 billion.

Deliveries of vehicles to be between 23,000 and 25,000 vehicles, representing a decrease of approximately 8.2% to 0.2% from the same quarter of 2022.

Total revenues to be between RMB8,742 million (US$1,273 million) and RMB9,370 million (US$1,364 million), representing a decrease of approximately 15.1% to 9.0% from the same quarter of 2022.

Earlier this year, NIO management stated its goal was to double deliveries over last year's total. That would imply about 245,000 vehicles to be sold this year, but at the high end of Q2's guidance, it means only about 56,000 sales for the first half of 2023. On the conference call, management said the target was to be over 20,000 units every month in the second half of the year. With all of the new products ramping, that could be possible.

However, I should note that this company has never even delivered 16,000 units in any one month, so to get over 20k a month for six straight months requires not only a major production ramp, but for sales and delivery execution to improve quite significantly. On Sunday, NIO made a move to help with sales, by slashing the prices of its entire lineup, but this will only hurt the margin picture moving forward, potentially offsetting some or all of the gains from higher overall production.

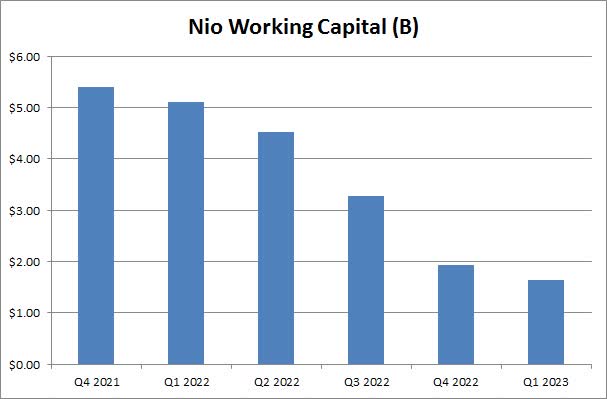

One of the other big issues for NIO in the short term in the balance sheet. The company reported a more than $2 billion decline in its cash and investment pile for 2022, ending at $6.6 billion. In the first quarter of this year, another $1.1 billion decline in that cash balance was reported. As the chart below shows, the company's working capital position continues to decline, increasing the chances that another debt or equity raise is needed to fund growth plans. Management believes operating cash flow will improve as sales ramp, but they don't have a very good history when it comes to longer term guidance.

NIO Working Capital (Company Earnings Reports)

Wall Street analysts overall continue to be very positive on the name. The average price target is now $12.96, which still represents significant upside on a percentage basis, but that comes with a bit of an asterisk. That average valuation figure has come down by another dollar and a half since my previous article, and a year ago it was approaching $40. With guidance being weak, it wouldn't be surprising to see more price target cuts coming.

On Friday, NIO shares opened higher, and were more than 12.3% higher at one point. Unfortunately for investors, those gains faded throughout the day, and shares closed down by six cents. This decline was notable, because the stock could not hold its 50-day moving average, the purple line in the chart below. You can see a number of failures at this key technical level in just the last three months, and each time the stock has gone quite a bit lower afterwards. The 50-day is likely to head lower in the coming weeks if shares can't rally above it, and that could add even more selling pressure.

NIO Last 6 Months (Yahoo! Finance)

In the end, NIO announced another very disappointing quarter last Friday. Despite heavily reduced analyst expectations, the company still missed revenue estimates, and the Q2 forecast for both deliveries and revenues was incredibly bad. Margins continue to remain heavily pressured, resulting in large losses and significant cash burn. While management continues to talk about a lofty growth plan, execution has always been lacking here, and the stock's failure to get above the 50-day moving average only shifts sentiment further towards the bear camp in the near term.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.