PFFA For Income And Price Appreciation

Summary

- The Virtus InfraCap U.S. Preferred Stock ETF has a current dividend yield of 10.4% and has paid a continuous monthly dividend for the past five years.

- PFFA's dividend rate is expected to rise over the next 2-3 years due to 53% of its portfolio holdings being fixed-to-floating rate securities that will convert to higher floating rates.

- The risks to this investment thesis are limited, and investors may see PFFA's dividend distributions rise as the Federal Reserve pivots to a loose monetary policy.

DNY59

Introduction

I recently published an article on Seeking Alpha with a similar thesis covering the InfraCap REIT Preferred ETF (PFFR). Today's article covers the InfraCap U.S. Preferred Stock ETF (NYSEARCA:PFFA), from the same fund family. After reviewing PFFA's portfolio holdings, I've concluded that PFFA has at least the same investment return potential as PFFR over the next two years, and most likely better.

PFFA was launched by Virtus Investment Partners on May 15, 2018. The ETF holds primarily US preferred securities and a few exchange traded bonds (baby bonds). The ETF has $534M in net assets and carries an expense ratio of 1.40%. Roughly a percent of that expense ratio is the cost of leverage (credit). PFFA uses leverage, typically 20-30% to boost the ETF's yield, currently 10.4%. Dividends, currently $0.165 per share, are paid monthly. Investors who have been holding PFFA have seen its share price drop by about 21.5% over the last year. However, PFFA will likely see both its dividend income increase and its share price increase over the next two to three years. The balance of this article explains why income investors should be taking a hard look at PFFA.

Why PFFA?

The current bear market has pushed valuations of most equities lower Almost all REITs as well as most regional banks have taken a heavy beating over the last year to 18 months including their respective preferred securities and exchange traded baby bonds. The price of PFFA, year over year, has dropped 21.5%. Over the last 18 months, it has dropped 24.1%. That drop in price has resulted in the current $0.165 monthly dividend of PFFA producing a yield of 10.4%. The current price and yield of PFFA will move back to more typical values when the Federal Reserve transitions from a tight monetary policy to stable or pivots to a loose monetary policy (lower rates). I'm quite certain this will happen, with the only real question being "when ?". When the Fed does pivot to a more accommodating monetary policy, the net asset value (NAV) of PFFA's portfolio of securities will rise. With almost all preferred stock being perpetual (no maturity date), those securities respond like very long-term bonds to market interest rate changes. When interest rates fall, preferred stock valuations rise.

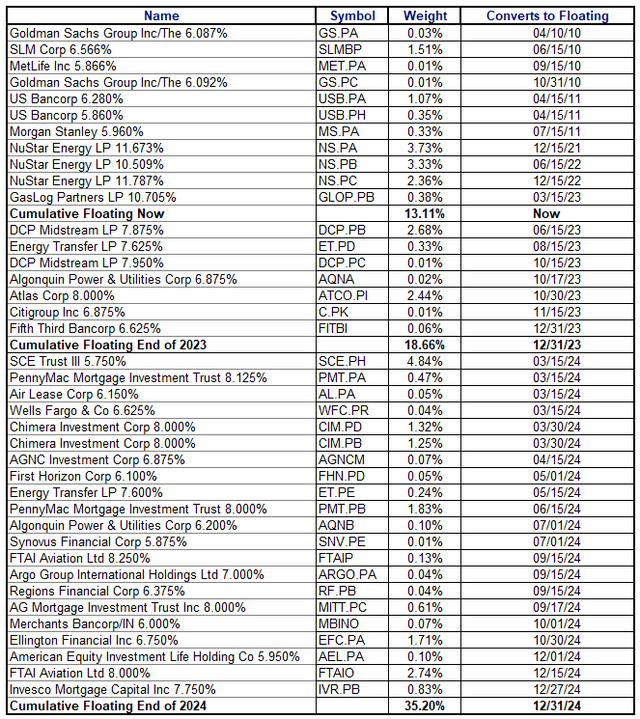

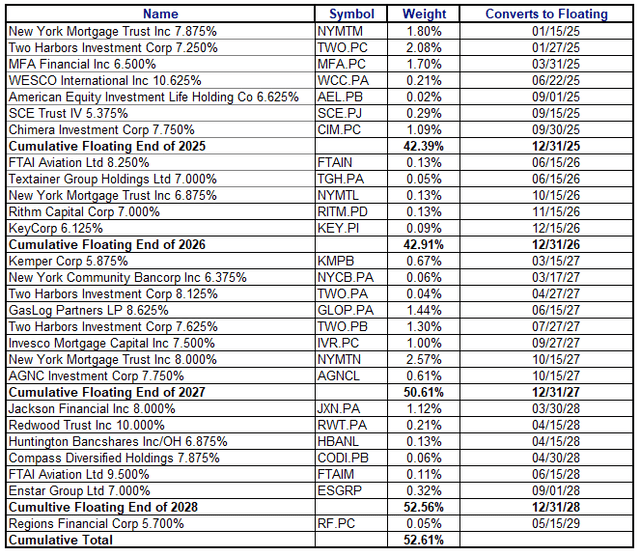

In addition to the Federal Reserve monetary policy stance driving the price and yield of PFFA, there is another driver within the PFFA holdings that will increase the dividend income PFFA receives from its portfolio of securities over the next 2-3 years. Approximately 53% of the value of the securities held by PFFA are fixed to floating (FTF), variable floating, or reset rate preferred securities. While not technically correct, for the balance of this article, I'm going to refer to all three types of variable interest rate securities as FTF rate securities. These FTF rate securities will convert/reset to higher rates over the next roughly 4 years, with 80% of those FTF rate securities converting to floating rates by the end of 2025. The two EXCEL tables below show the FTF rate securities held as a share of the total net asset value as of 6/09/2023. For complete and full disclosure, I did leave out three preferred securities from the tables below. Those three securities each represented less than 0.01% of the PFFA portfolio NAV, which is below the significant figure limit of the downloaded file (less than the rounding error). For those interested, the entire list of securities held by PFFA can be downloaded from the Virtus website.

I already hold shares of ET.PD, AGNCM, RF.PB, and MBINO individually in my own portfolio because of the FTF rate provisions and the near-term conversion to a floating rate. To date, this strategy of holding near term FTF securities has worked out well with the individual securities I hold that have already converted to a floating rate or will do so shortly. The FTF rate securities that I hold which have already converted to floating rate or will convert in the next 2-3 months have all tethered closely to their $25 par value, giving me a healthy capital gain as well as an increased dividend after conversion to the floating rate. Those securities are ALL.PB, AGNCN, ET.PC, ET.PD, and WFC.PQ.

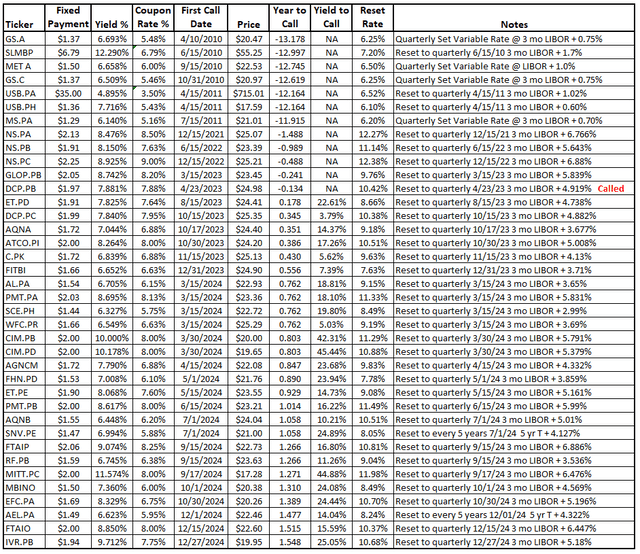

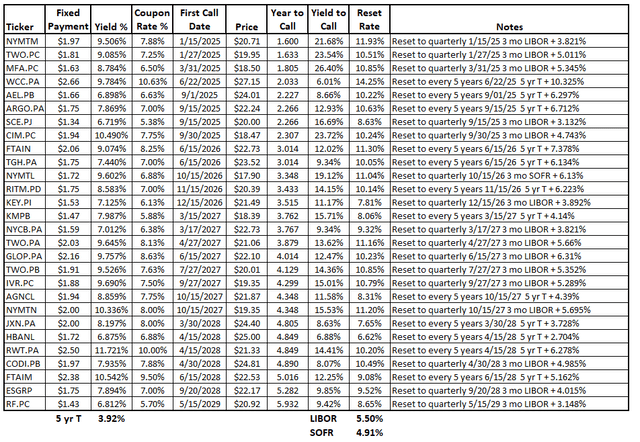

The two EXCEL tables below provide a summary of the important metrics for the FTF rate securities held by PFFA ordered by time to first call/conversion date.

Readers should note that the 5 yr Treasury rate and the 3-month LIBOR/SOFR shown at the bottom of the table are current rates. Those rates will most likely change over the next 2-3 years. The pertinent rate comparison in the charts above is the original Coupon Rate versus the Reset Rate. For example: The original Coupon Rate for CIM.PD (CIM-D) is 8% ($2.00/$25). The Reset Rate when the security converts to a floating rate would be 10.88% (5.50% + 5.379%) after rounding, resulting in a new dividend rate of $2.72 ($25 x 10.88%). If 3 mo LIBOR, or the LIBOR replacement SOFR + 0.26%, drops by 50 basis points over the next 10 months, the CIM.PD Reset Rate would be 10.38%, still well above the 8% original Coupon Rate.

If it hasn't become clear at this point in the article, I believe PFFA's dividend rate will rise over at the next 2-3 years and possibly the next 4 years depending how fast the Federal Reserve lowers the Federal Funds Rate. Since my investing horizon is longer term, I don't mind at all if it takes 4 years, as I'll be collecting a 10.4% (likely rising) yield from PFFA while I wait.

I should also mention that, last Friday, I spoke with Jay Hatfield, CEO of Infrastructure Capital Advisors and the Portfolio Manager of the PFFA and PFFR ETFs. The focus of the discussion centered on the FTF rate securities in the PFFA and PFFR portfolios, the potential for positive income and capital returns from PFFA and PFFR, and expectations for Federal Reserve monetary policy actions going forward. I found the discussion with Jay to be very helpful in focusing the investment thesis for this article.

What Are The Risks?

Interest rate risk is still with us. While the consensus thinking of those who make a living opining on such subjects appears to be to expect the FED to pause, it may be that the Federal Reserve will determine they need to continue to raise interest rates in the upcoming June meeting. If so, we could see another 25-basis point increase in short rates, which could push the valuations of PFFA's holdings down and the price of PFFA would drop a bit more. However, there is another effect to consider if the Fed again bumps short rates. The 3-month LIBOR/SOFR will also rise, pushing the future Reset Rates for the near term FTF rate securities higher. Investors would have the opportunity to pick up shares of PFFA at a slightly reduced price, with yet additional upward pressure on dividends due to the increase in future Reset Rates.

If the Federal Reserve aggressively raises rates over the next 2-3 meetings, it is possible that a couple of the weaker PFFA holdings curtail their common and preferred dividends. I am not intimately familiar with all 214 securities held by PFFA. I did not spend the time to analyze all the individual holdings in PFFA. However, there are a small number (6-8) securities with very low valuations and, consequently, very high yields that may indicate material weakness in the company's financial standing. This type of risk is mitigated by PFFA holding a diverse portfolio of preferred securities. If a couple of holdings curtail their preferred dividend payments, the overall impact will be limited. Readers should also keep in mind that preferred stock is a step above the common for priority of dividend payments.

Overall, I consider the risks to be limited, particularly in comparison to the potential return.

Conclusion

Equity valuations of regional banks, equity and mortgage REITs, and other financial institutions including the preferred shares held by PFFA have been hammered over the last 18 months. This has pushed up the yield from PFFA to healthy 10.4%. The valuation/price of PFFA is unlikely to stay low, and the yield is unlikely to stay this high going forward. The Federal Reserve will eventually pivot to a loose monetary policy, which will put upward pressure on PFFA's price/valuation. In addition, 53% of PFFA's portfolio holdings are FTF rate securities, which will convert to higher floating rates over the next 4 years. As those coupon rates float upward, PFFA's dividend income stream will rise and investors will likely see PFFA's dividend distributions rise in kind. The risks to this investment thesis are limited. I'm accumulating shares of PFFA to hold for at least the next two years and potentially the next 3-5 years depending on Federal Reserve interest rate policy decisions going forward.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFFA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: This article is not investment advice. This article is intended to provide my opinion to interested readers and to serve as a vehicle to generate informed discussion in the comment posting. I have no knowledge of individual investor circumstances, goals, portfolio concentration or diversification. Readers are strongly encouraged to complete their own due diligence on any stock, bond, fund or other investment vehicle mentioned in this article before investing.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.