RH: A Diamond Hidden In The Rough, Looks Attractive For The Long Term

Summary

- RH dominates the luxury segment of the US furniture retail market, with a focus on unique designs and high-quality products, and should maintain an operating margin above ~20%.

- We expect the company to continue to grow around 5-7% per year after 2024, leaning on its competitive advantages and gallery conversion strategy.

- Risks to RH's growth include potential downturns in consumer discretionary spending and the housing market, as well as increased competition from e-commerce and new entrants.

Editor's note: Seeking Alpha is proud to welcome Thomas Champer as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

felixmizioznikov

Thesis

We believe the current asking price of RH (NYSE:RH) serves as a great entry point into a company with a history of strong performance and industry defying profit margins. We believe that RH's strategy of gallery conversion will continue to pay off and that the construction of new galleries will be a great opportunity for further growth. The crux of our thesis, however, has to do with RH's sustaining profitability via the power of its brand and local economies of scale. It is our belief that investors are underestimating the staying power of RH's competitiveness. Let us first turn our attention over to the industry as a whole, and then take a deeper look into what makes RH such an attractive pick.

Industry Overview

RH operates in the US Furniture Retail industry. The industry is considered to be in the mature phase, with the total addressable market expected to only grow around 1% CAGR 2017-2027. Technological change is virtually nonexistent and market share is fairly stable. The market exhibits a high level of correlation with the general housing market, particularly new housing starts and renovations.

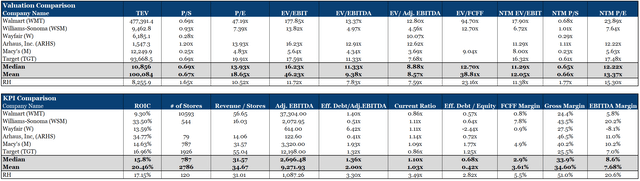

The industry is quite fractured. With low differentiation and high buyer power due to the comparability of prices, companies rely on economies of scale and lower prices to add shareholder value, which has driven returns towards the cost of capital for the majority of firms. The industry does appear to have a number of small niches, however. Players such as Williams-Sonoma (WSM) have been able to identify and scale into these underserved niches and maintain high levels of ROIC.

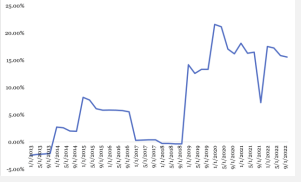

RH returns on invested capital (RH 10K)

Ecommerce as a substitute to traditional furniture retail poses a potential threat to incumbent firms. Players such as Wayfair (W) and Amazon (AMZN) have been able to make inroads into the market space, but have been unable to make a significant dent overall. Brick & mortar furniture retail has demonstrated a considerably higher amount of staying power versus other forms of retail, and shouldn't pose a major threat to incumbents' market share in the coming years.

Comparable Analysis (10Ks, Morningstar, and Macrotrends)

Company Overview

RH operates as the dominant player within the luxury segment of the furniture retail market, whose buyers have entirely different objectives than the rest of the industry. In the luxury segment of the furniture market, buyers are more concerned with finding beautiful furniture to fill up their large home and convenience, while being less concerned with price. RH has been able to capitalize on this and scale into its niche. It has continued to become more profitable as it converts legacy galleries to design galleries and come out with new product lines.

Qualitative and Quantitative Analysis

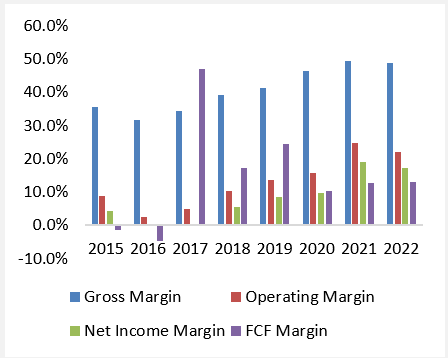

The design galleries, being essentially a higher-end IKEA type store, has been shown to attract considerably more business, allowing RH to cycle through inventory quicker and spread its fixed costs over more units. Its large galleries also create local economies of scale, with other luxury brands being unable to compete with RH's sheer volume and capacity. RH has around 1% of total market share, but is now by far the most dominant player in the luxury furniture niche. This domination of its niche has translated into abnormal levels of profitability with an operating margin of 24.7% in 2021 (see "Margin Expansion" below). While RH saw an abnormal level of volume in 2021 due the pandemic and cheap interest rates boosting the housing market, our expectations, which are in line with management's guidance, are that RH will be able to maintain an operating margin above 20% from here on out. We expect RH to continue to grow its top and bottom lines by converting its legacy galleries into its highly profitable design galleries and by beginning the shift into a new strategy of constructing new galleries, such as RH England.

Margin Expansion (RH 10K)

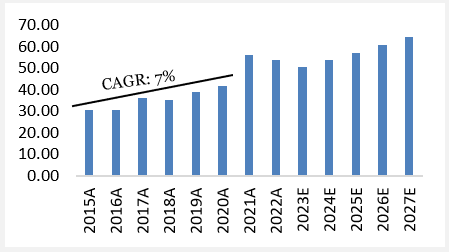

Revenue Per Gallery (RH 10K)

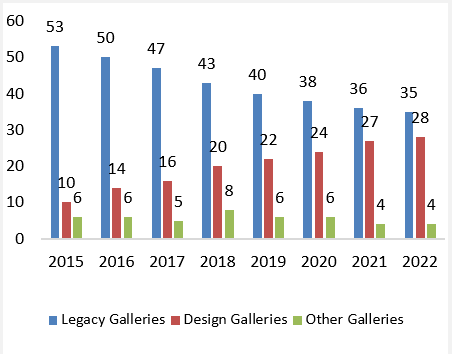

Gallery Conversion (RH 10K)

RH's product lines are a vital source of its competitive advantage. RH designs its own furniture and then outsources the manufacturing to suppliers under contract. In juxtaposition to the rest of the industry, RH's product lines are quite unique and sell at a high premium. Officers have even been quoted in interviews (Sign-in required) that their design is "proprietary" because their design is so unique and differentiated. Managers at competitors, such as a Senior Director at Crate & Barrel and a VP at West Elm (a subsidiary to Williams-Sonoma), even admit that RH is in an entirely different league than Williams-Sonoma and its other competitors when it comes to its niche. As such, we expect RH to continue to grow its top line at 5-7% each year as it continues to leverage its brand, open new galleries, and convert legacy galleries into new design galleries (see "Revenue & Net Income" below).

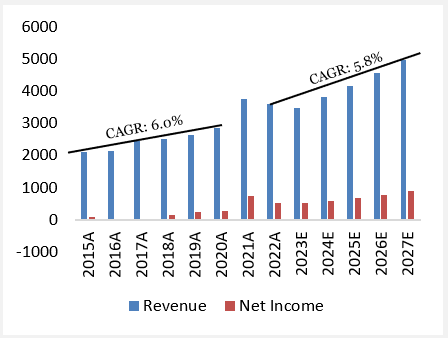

Revenue and Net Income (RH 10K)

The introduction of new product lines and galleries will continue to strengthen RH's operating leverage and economies of scale. Due to the general competitiveness, a lack of customer loyalty and small barriers to entry, it is understandably why the market is skeptical of the economic effects of RH's brand. Nevertheless, RH spends only 5-7% of sales on advertising, on par with the marketing-powerhouse Williams-Sonoma and well below the 10-12% industry average (IBIS World and RH's & Williams-Sonoma 10-K). We see this as evidence of consumer preference and RH's brand having real economic weight. Many entrants have tried to take market share from RH, but have failed to even keep pace with RH's growth. Further evidence of RH's enduring competitive advantage is its ROIC being abnormally high for the furniture retail industry. Typically a furniture retailer can expect to earn 7-9% per year on its capital employed. RH has been able to earn much higher returns on its capital (see "RH return on invested capital" above). Alongside RH's savings in advertisement, we see this as quantifiable evidence of RH's pricing power and competitive advantage.

Valuation

While we believe profitability to continue to improve and for sales to continue to grow, it is uncertain how well new product lines will perform and how many new galleries will be constructed. In the past, management has stated that it would build 5-7 galleries a year, but it is unclear how realistic this goal could be.

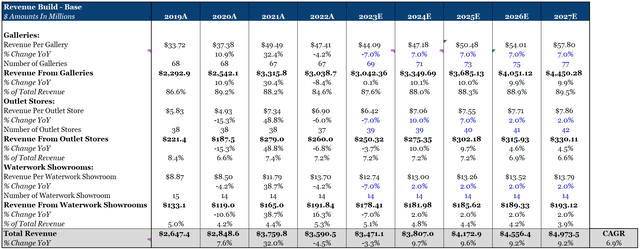

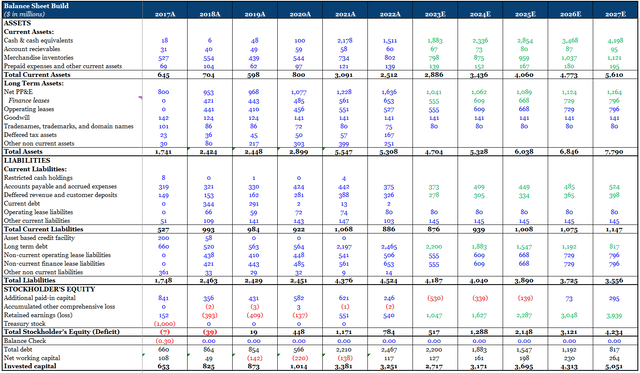

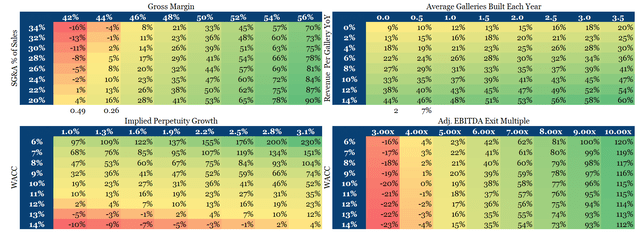

- Projecting Revenues (2022-2027): We project a modest gallery growth rate of 2 galleries per year beginning 2023 and a 7% revenue per gallery growth rate beginning 2024. In 2023 we account for the anticipated hit to discretionary spending and housing starts with a 7% decrease in sales per gallery for 2023, which is below general expectations and management guidance. In our revenue build, sales per gallery does not regain 2021 levels until 2025. Outlet stores add little to the bottom line and generally serve as a venue to test out new products, and so we just assume a moderate growth rate in that regard. Waterwork Showrooms could potentially see a major bump in growth in the coming years, but without clear guidance from management and only making up 4% of revenue, we apply a similarly conservative assumption to that segment. See our sensitivity analysis for how different gallery and revenue per gallery growth rate assumptions affect valuation.

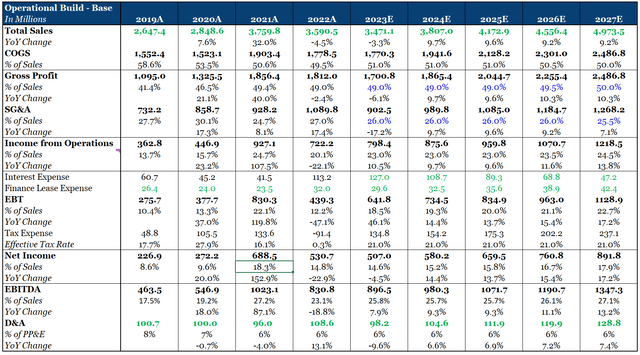

- Projecting Expenses (2022-2027): RH's consolidated income statement is vague. We project gross profit and EBIT based on historic margins, management guidance, and a conservative expectation of future profitability, based on the assumption of operating leverage and reducing expenses. See our sensitivity analysis for how different margin assumptions affect valuation.

Projecting Interest, Operating and Finance Leases, and Taxes (2022- 2026): RH's management is quite opportunistic in its approach to raising capital, and so without any end in sight to the current interest rate hikes, we assume that RH will not be taking on any additional debt. We project Operating and Finance Leases as a function of revenue and then calculate their expenses via their current discount rate. We assume a 21% tax rate, in line with management expectations.

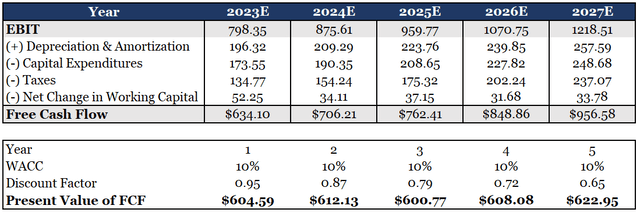

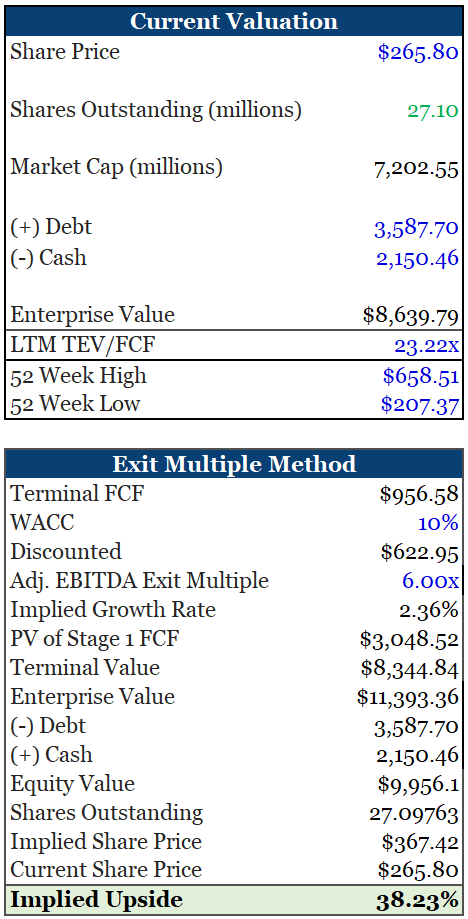

Terminal Value: RH is currently trading at a 7.59x EV/Adj. EBITDA multiple. We assume a 6.00x Adj. EBITDA exit multiple, which comes with a 2.8% implied perpetuity growth assumption. To be on the safe side, we use the perpetuity growth rate method, with a perpetuity growth rate of 2%, to calculate our terminal value. Our terminal discount rate and growth period discount rate are both 10%. See our sensitivity analysis to see how different discount rates and terminal assumptions affect valuation.

Revenue Build (RH 10K) Operation Build (RH 10K) Balance Sheet Projections (RH 10K) Sensitivity Tables (RH 10K) FCF Projections (RH) Valuations (RH 10K, Yahoo Finance)

Risks & Uncertainty

Consumer discretionary and the housing market could take a greater than anticipated hit, causing RH to have worse than expected results in the coming years. However, we believe that RH will be able to weather the storm and that its target demographic within the luxury furniture space, while being sensitive to market conditions, will recover its demand quickly. RH also has a large debt burden of $2.5B. While we believe that RH will be able to pay down this debt without issue, it may serve as a potential obstacle in raising additional capital further down the line.

New entrants could also drive down RH's profitability. Ecommerce could also begin to seriously threaten RH's business model. In the event that RH's profitability and market share is bogged down for multiple years (i.e., not just a bad quarter), it may be a good time to abandon ship. Given RH's current competitive position, we believe this is unlikely to happen in the coming years.

There are many risks to the upside as well. Gallery conversion could prove to have greater than anticipated value. RH Contemporary, the firms new product line, could outperform expectations as so many of its brands have in the past. RH's entrance in the hotel industry and general hospitality could prove to be materially significant business venture. Given the current levels the stock is trading at, RH's share buyback program, already totaling to more than 1 million shares repurchased, could end up being larger than expected.

Conclusion

We believe we have more than compensated for the downturn in the housing market and the weakening of discretionary spending in our valuation. Uncertainty in the market often serves as the best entry points into quality businesses, and we believe that this is the case with RH. Regardless of what comes RH's way over the next two years, the company should be able to maintain its competitive position and shouldn't suffer massive losses in revenue. We maintain a steady Buy rating with a price target of $367.42.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.