A 6% Yield You Can Count On - Williams Companies

Summary

- The Williams Companies offers a 6% dividend yield and a C-Corp structure, making it an attractive investment for conservative investors seeking income-generating investments in the oil and gas midstream sector.

- WMB has a healthy balance sheet, sustainable payout ratio, and robust dividend coverage ratio, contributing to its safety and growth prospects despite market challenges such as declining natural gas prices.

- Acquiring WMB shares in the $28 to $29 range offers a favorable risk/reward opportunity for investors, although caution is advised considering potential recession risks.

RL Photography

Introduction

One industry that I cover on a more frequent basis is the oil and gas midstream industry, which covers the companies that connect producers to customers. It's a fascinating industry for a number of reasons, including the importance of efficient midstream operations in the (North American) energy infrastructure and the fact that some of these companies come with stable and juicy dividend income.

One of these companies is The Williams Companies (NYSE:WMB). Headquartered in Tulsa, Oklahoma, this giant offers a 6% dividend yield and a C-Corp structure, which doesn't require investors to deal with K-1 forms. It also makes the company accessible to most foreign investors like myself.

In this article, I will walk you through my thoughts as we assess this top-tier midstream play that might be a suitable buy for conservative investors seeking income-generating investments with favorable risk/rewards.

The Company Behind The Ticker

When people think of oil and gas, they usually think of companies extracting these commodities out of the ground or gas stations. However, most people forget midstream companies. Midstream operations are just as important as upstream companies. After all, without sufficient production, products cannot reach customers. Also, midstream operations need to grow along with upstream volumes, otherwise, overutilized pipelines keep upstream companies from expanding operations. This is still an issue in some natural gas basins in the United States.

Energy Education

With that said, most midstream companies are Master Limited Partnerships, which are tax-favored vehicles that are required to distribute most of their net income to shareholders. While that is great for shareholders, it requires a more complicated tax approach.

Williams is different, as it is a normal C-Corp you can buy like any other stock you may own.

The company has a market cap of $37 billion, which makes it the 6th-largest midstream company in North America.

As this market cap may suggest, Williams is a huge corporation. The company operates in 14 supply areas, providing natural gas gathering, processing, transmission, and marketing services to over 700 customers.

These assets include interest in over 33,000 miles of pipelines in 25 states, 29 natural gas processing facilities, seven NGL fractioning facilities, roughly 24 million barrels of NGL storage capacity, and 290.4 billion cubic feet of natural gas storage capacity.

Williams Companies

Key factors influencing Williams' business include obstacles to expansion, customer retention, revenue growth, and prices affecting commodity-based activities.

The company's interstate natural gas pipelines are regulated by the Federal Energy Regulatory Commission ("FERC"), with rates determined through the rate-making process or negotiated with customers. Most of its transmission businesses have long-term firm contracts, and storage and interruptible transportation services are offered under shorter-term agreements.

WMB's gathering, processing, and treating operations receive natural gas from wells and prepare it for transportation. They also extract natural gas liquids like ethane, propane, butane, and natural gasoline.

Williams Companies

Williams generates revenue through fee-based contracts and non-cash commodity-based contracts. The agreements are generally long-term, with cost-of-service mechanisms to adjust gathering rates. They have significant exposure to producers' drilling activities, which are influenced by the strength of the economy and natural gas demand.

In other words, most midstream companies are very slow-growing enterprises. Mature companies grow along with total volumes from customers and inflation/pricing. While this often leads to high dividend yields that protect investors against inflation, we're not dealing with dividend growth stocks that often come with much lower yields but higher dividend growth.

Also, these stocks tend to underperform the market - often on a total return basis. It is, therefore, important to assess these companies as income vehicles, not necessarily assets used to generate long-term wealth - at least not if investors expect to consume the dividend.

Reinvested dividends often still lead to great returns.

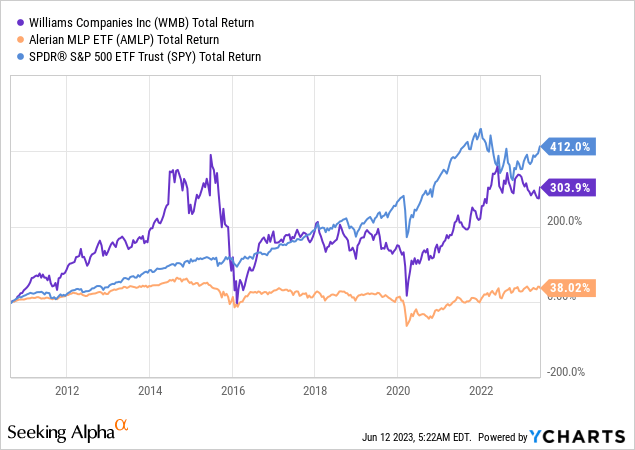

Since 2010, WMB shares have returned 304%, which is based on reinvested dividends. It has underperformed the S&P 500 by roughly 110 points. However, it has outperformed its peers by a very wide margin. Both WMB and its peers have done rather poorly since 2015, which underlines my emphasis on income. Back in 2015, oil and gas prices crashed as a result of rapidly expanding supply and severe demand headwinds. During these years, most midstream companies were not yet free cash flow positive, which caused them to lose billions on top of fears that energy output growth could stall.

Thankfully, most midstream companies have recovered.

Now, most are free cash flow positive thanks to lower growth capital requirements and steady energy flows.

This brings me to the next part of this article.

High Income, Safety & Growth

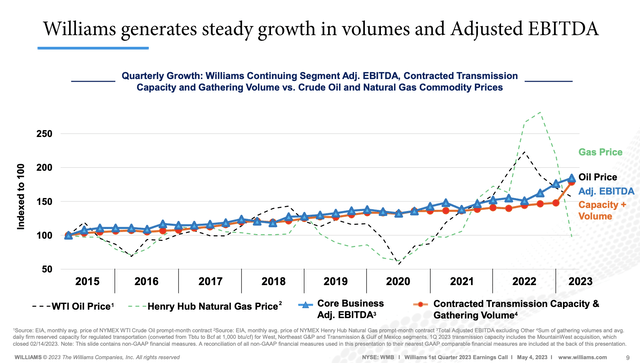

In this case, safety is relative. Despite the fact that midstream companies are not directly impacted by the price of the commodities (like oil or gas) that they ship, they tend to be cyclical.

After all, there are two major risks:

- Slower economic growth expectations cause investors to price in a potential decline in pipeline volumes, as end-users require less energy and chemicals.

- Severely depressed energy prices can lead to drillers reducing output, which reduces the need for pipeline capacities.

However, as the first risk is often temporary and risk number two relies on a low-probability event, companies like WMB tend to come with safety and a more stable yield than upstream drillers whose revenues are directly tied to the price of oil and gas.

The EBITDA to natural gas prices comparison in the chart below confirms this.

Williams Companies

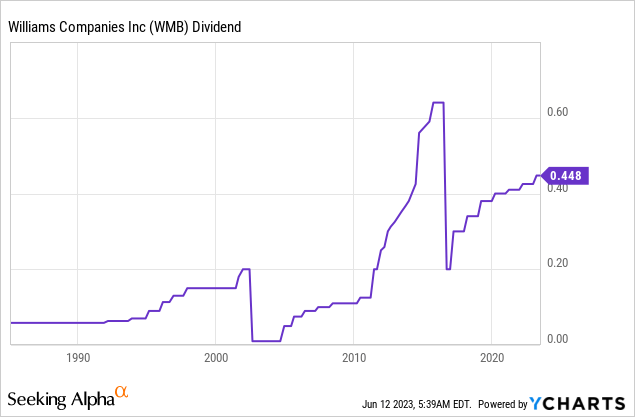

Hence, since cutting its dividend during the aforementioned 2015 commodity crash, the company has consistently hiked its payout.

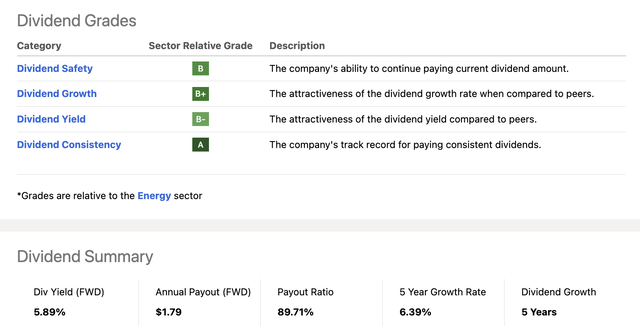

Looking at the dividend scorecard below, we see that the company scores high on safety, growth, yield, and consistency.

Seeking Alpha

- The company pays a quarterly dividend of $0.4475 per share. This translates to a yield of 5.9%.

- Over the past five years, the average annual dividend growth rate was 6.4%, which is decent, yet it will take a very long time until dividends are back at their all-time high.

- The most recent hike was approved on March 9, when the board declared a 5.3% dividend hike.

Furthermore, this dividend is backed by a sustainable payout ratio.

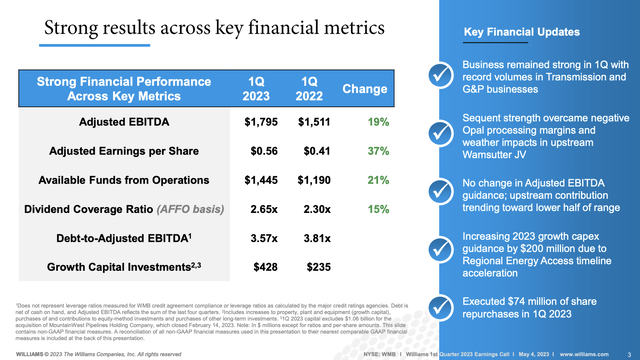

During its first-quarter earnings call, the company highlighted the dividend and its relation to available funds from operations ("AFFO"), which is an important dividend coverage metric in this industry. It's way more important than net income, as net income excludes huge non-cash financial items like depreciation.

The dividend coverage based on AFFO was reported to be a robust 2.65x, which is an improvement of 15% versus the first quarter of 2022.

Williams Companies

On a full-year basis, the company expects the dividend coverage ratio to remain 2.3x, which is based on a $200 million increase in CapEx.

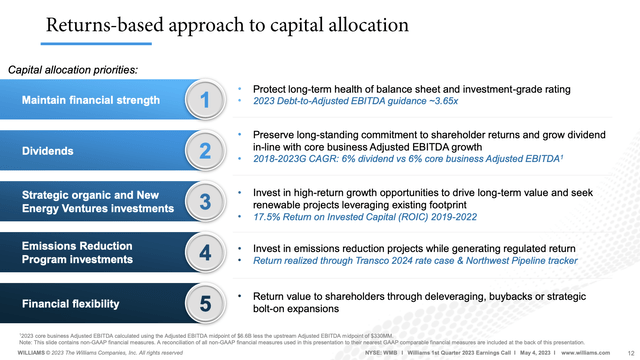

With that said, the company's dividend is also backed by a healthy balance sheet, which is the company's number one financial priority.

As dividend growth may suggest, the company maintains a healthy balance sheet. According to the company:

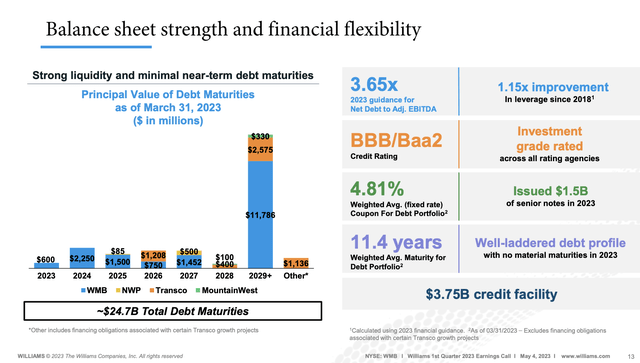

Our balance sheet continues to strengthen with debt to adjusted EBITDA now reaching 3.57x versus last year’s 3.81x. And that’s even after closing the trade, NorTex and MountainWest acquisitions and also repurchasing $83 million of shares since last year.

Williams Companies

Not only that, but the company has a BBB/Baa2 credit rating, it has an average weighted maturity of 11.4 years, and no meaningful maturities in 2023.

Williams Companies

Hence, the company has financial room to use its cash flow for dividends.

Additionally, the company uses opportunistic buybacks to distribute cash to shareholders. In this case, opportunistic means that a company repurchases shares whenever it believes that its shares are undervalued. Some companies buy shares back in any environment, as it boosts their earnings per share.

In the quote I just showed, the company said that it bought back $83 million worth of shares in the first quarter.

During the same earnings call, the company was asked to elaborate on the decision to buy back stock. Its answer is quite interesting in light of ongoing market woes.

[...] since the beginning of the year, we’ve seen a pretty sharp decline in our valuation as natural gas prices dropped. And we saw our dividend yield expand to 6%, even while we continue to have a lot of confidence in our long-term 5% to 7% growth rate. So that looked like a pretty attractive investment opportunity relative to all of our options. So we took action to utilize some of that financial flexibility for share repurchase. And I think going forward, it will be a similar approach. We will just monitor conditions and weigh that investment opportunity up against the other investment opportunities that we have.

Within a few sentences, the company highlights a number of things that I want to address:

- Natural gas prices have dropped sharply. That is correct, and caused by a very mild winter in the Northern Hemisphere, which caused massive bullish bets to be unwound. However, as I have discussed in a number of natural gas articles (like this one), prices further down the futures curve are elevated, and producers see strong demand tailwinds and only subdued supply growth.

- The dividend has risen to 6%, indicating a favorable valuation.

- WMB sticks to its long-term dividend growth rate, as it has support from major tailwinds.

With regard to growth, the company is in a good spot.

During the 1Q23 earnings call, CEO Alan Armstrong highlighted the company's strong growth.

The company's natural gas-focused strategy contributed to a nearly 20% increase in adjusted EBITDA compared to 1Q22. This growth was driven by several key accomplishments that will continue to fuel growth in 2024 and beyond.

- First, the acquisition of the MountainWest Natural Gas Transmission and Storage business enhanced the company's position in the Western US and expanded its services to key Rockies markets.

- Additionally, the company accelerated the timing of key deliverables for fixed fee-based projects and executed agreements with Chevron (CVX) to facilitate natural gas production growth.

- Williams also placed several large-scale gathering expansions into service, increasing its capacity and contributing to the growth.

Also, the company's visibility to growth on the transmission side of the business is strong, reflecting the strength and resilience of its assets.

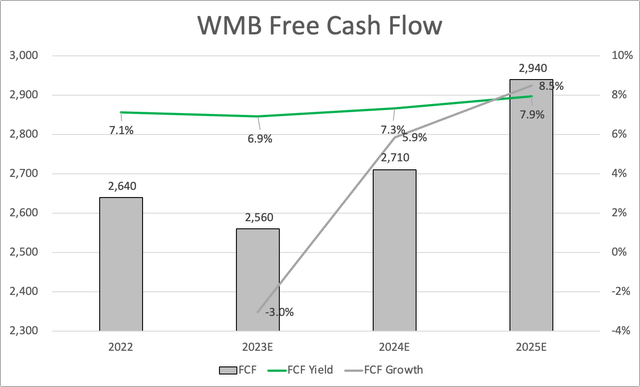

Sell-side free cash flow expectations support these comments. Next year, free cash flow is expected to grow by 5.9%. That number is expected to rise to 8.5% in 2025. In that year, free cash flow is expected to exceed $2.9 billion, paving the way for a 7.9% free cash flow yield. This supports the dividend and future dividend growth in the mid-single-digit range.

Leo Nelissen

So, what about the valuation?

Valuation

As we already briefly discussed, WMB management believes its shares are undervalued. I agree with that.

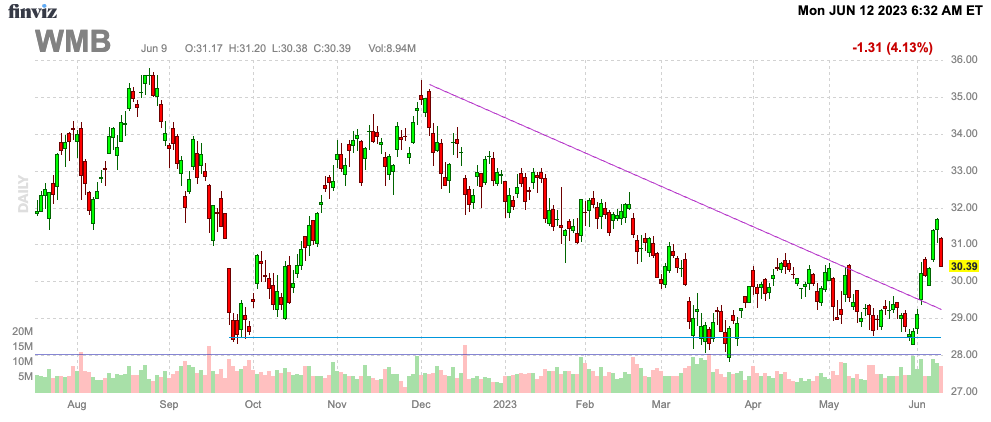

Year-to-date, WMB shares are down 7.6%. Shares are 18% below their 52-week high.

FINVIZ

The company's consensus price target is $37, which indicates a 20% upside.

I agree with that and would make the case that when incorporating a 14x free cash flow multiple and a gradual increase to $3 billion in free cash flow, the company deserves a 15% to 20% higher price.

Investors looking for high-quality midstream exposure might try to buy this company for close to $29. I believe the $28 to $29 range offers a great risk/reward.

Nonetheless, investors need to be aware that we're dealing with elevated recession risks. This could potentially trigger a steeper sell-off to $27 (or lower) if demand fears hit the midstream market again.

However, as a long-term investor, I'm not worried, as all I do is buy companies that I like at valuations that, I believe, make sense.

Takeaway

The Williams Companies presents a compelling opportunity for conservative investors seeking stable income-generating investments in the oil and gas midstream sector.

With its 6% dividend yield and C-Corp structure, WMB stands out among midstream companies, providing accessibility to foreign investors as well.

The company's solid financials, healthy balance sheet, sustainable payout ratio, and robust dividend coverage ratio contribute to its safety and growth prospects.

Despite recent market challenges, including declining natural gas prices, WMB remains confident in its long-term growth rate. With an attractive valuation and a consensus price target indicating a 20% upside, acquiring WMB shares in the $28 to $29 range offers a favorable risk/reward opportunity for investors, although caution is advised considering potential recession risks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CVX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.