Cellebrite: Driving Efficiency And Effectiveness In Forensics

Summary

- CLBT has established itself as a leader in the field, serving numerous significant customers and gaining a strong market presence.

- The company is focused on expanding its market presence through cross-selling and up-selling.

- The stock has rallied over the past year as the company continues to post results in line with expectations amidst a challenging environment.

- The stock currently trades in line with peers, and I assign a hold rating to the stock.

courtneyk

Investment Thesis

Government agencies, police departments, and businesses involved in investigations are undergoing a digital transformation similar to other industries. They are shifting away from manual processes and individual tools towards comprehensive digital solutions that enhance effectiveness and efficiency throughout the investigative process. Cellebrite DI Ltd. (NASDAQ:CLBT) has emerged as a leader in this field, serving numerous significant customers, and is now focused on expanding its market presence by cross-selling and up-selling. However, the stock is up 36% over the past one year, and although I remain bullish on the company's long-term prospects, I currently keep a hold rating on the CLBT as I remain conservative on the prospect of multiple re-rating given the slowdown in growth and a challenging macro environment.

Q1 2023: Growth in Line with Expectations

In the first quarter, Cellebrite's performance was in line with expectations, with revenue surpassing consensus estimates by approximately 2%. The company also achieved a YOY Annual Recurring Revenue (ARR) growth of 30.3%. Additionally, Cellebrite reported an increase in the number of large deals compared to the previous year, with a Net Dollar Retention Rate (NDRR) of 128%, which is in line with the rate from the previous year.

Despite the outperformance, the management maintained its full-year guidance for ARR, revenue, and EBITDA at the same level as the previous quarter, suggesting a cautious approach for the second half of the year. The company's operating margins expanded by 370 basis points year-over-year, primarily due to prudent spending in general and administrative areas. Furthermore, Cellebrite reduced its headcount by approximately 3% since the fourth quarter, contributing to margin expansion. In addition to the successful introduction of the AI-enabled Pathfinder X, Cellebrite aims to pursue further expansion opportunities to drive growth in ARR. However, it is worth noting that new customer acquisitions over the past four quarters have accounted for less than 10% of the overall incremental growth.

Points of Contention

Cellebrite's projected Annual Recurring Revenue for FY23 remains at $300-310 million, indicating a growth rate of 21-25% year over year. This implies a slight deceleration in growth, primarily due to the completion of the subscriber transition and reduced growth from replacing perpetual licenses. However, the company also took a conservative stance when it comes to factors such as churn rates, logo acquisition, and Premium ES adoption. In the first quarter, gross churn was 10%, with 2% attributed to voluntary churn resulting from customer license reductions and cancellations in certain countries. The company expects this churn rate to remain consistent throughout FY23 and decrease in FY24. Total revenue increased by 14% year over year to $71 million, driven by the strength of subscriptions. However, the projected revenue for FY23 is maintained at $305-$315 million, representing a growth rate of 13-16% year over year. Cellebrite's core Collect and Review product still accounts for over 90% of its Subscription Revenue, while the growth of its Investigative Analytics and Management solution set is expected to be minimal compared to the previous year. Finally, the merger of Magnet Forensics and Grayshift by Thoma Bravo could potentially impact Cellebrite's competitive position.

Leading in a Large Addressable Market

Law enforcement agencies, government entities, and businesses are encountering difficulties in accessing, gathering, and examining digital data stored across diverse platforms, including electronic devices. In the past, these organizations relied on manual procedures and individual solutions. However, they are now undergoing a digital transformation to enhance access and efficiency throughout the investigative process. Cellebrite, renowned for its Collect & Review solutions, has established itself as a leading player in this rapidly expanding market.

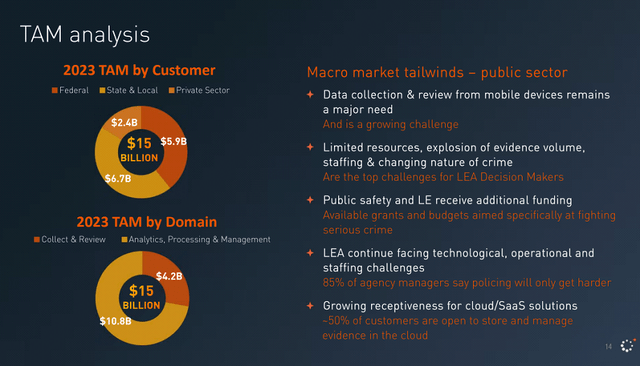

In the company's investor prospectus, Cellebrite's management takes a bottom-up approach to assess the overall market size by considering different customer segments and average prices, which I find reasonable. The company suggests the total addressable market is valued at $15 billion, and Cellebrite and its closest competitors have penetrated less than 10% of this market based on revenue generated. I anticipate that the ongoing digital transformation within the core customer base will significantly increase this penetration rate in the coming years.

Financial Outlook & Valuation

Law enforcement and government agencies face a significant challenge due to the increasing digitization and use of data, as they often need to sift through vast amounts of information, including internet traffic, to find evidence and gain case-relevant insights. To address this market need, I anticipate that Cellebrite's revenue will continue to grow at a double-digit rate in the medium term.

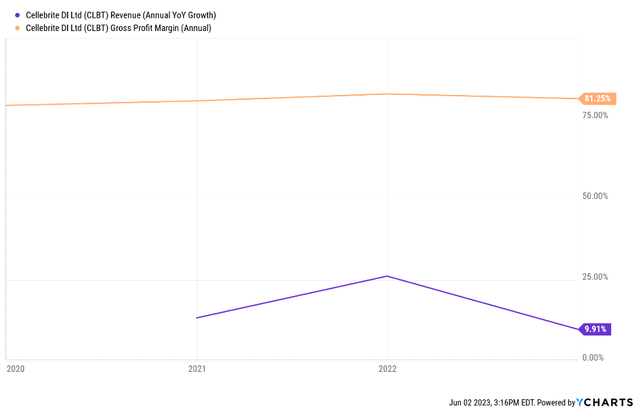

As Cellebrite's revenue mix transitions from a predominantly perpetual licensing model to a more widely adopted subscription-based model, I anticipate that gross margins will remain stable. This shift has been advantageous for the company, as perpetual licenses have yielded gross margins ranging from the high 70s% to low 80s% in recent years, while total subscription revenue averages in the low 90s%. However, the margins for professional services, which enhance the customer utility of the platform, are notably lower, and I expect this segment to generate margins in the low- to mid-teens % in the long run. Overall, I believe that the main driver for Cellebrite's overall margins will be the expansion of their subscription-based platform.

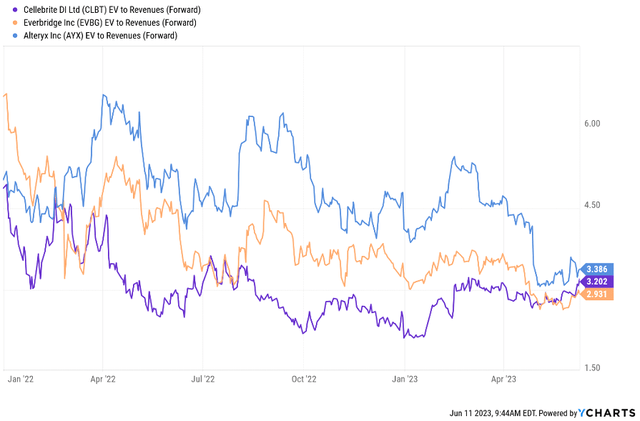

I think an EV/S multiple is the most applicable valuation metric, which captures Cellebrite's topline opportunity in the ~$15 billion+ Digital Intelligence market. The company currently trades in line with peers like Everbridge, Inc. (EVBG) and Alteryx, Inc. (AYX) at an EV/Sales of 3.2x. The stock is up 36% over the past one year, and although I remain bullish on the company's long-term prospects, I currently keep a hold rating on the CLBT stock as I remain conservative on the prospect of multiple re-rating given the slowdown in growth and a challenging macro environment.

Conclusion

Cellebrite is recognized as a frontrunner in digital investigation solutions, and I expect the company to continue to expand revenue growth at a double-digit rate in the medium term. The company holds a dominant position in the field of mobile device forensics, with an established and loyal customer base in the public sector. The stock has rallied over the past year as the company continues to post results in line with expectations amidst a challenging environment; however, I currently remain cautious as the stock currently trades in line with peers, and I see limited chances of upward multiple re-rating in the short term.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.