Why Every Dividend Portfolio Needs A Tim Duncan Stock Like NNN REIT

Summary

- NNN REIT is compared to NBA player Tim Duncan due to its consistency and conservative nature, with a diversified portfolio of 3,449 properties and a history of increasing annual dividends for 33 consecutive years.

- The company has a strong balance sheet, experienced management, and a focus on non-investment grade tenants, allowing for better pricing and rent growth over lease terms.

- NNN is a suitable addition to an investor's portfolio looking for a stable, steady stream of income, with a 5% yield and potential for capital appreciation.

efks/iStock via Getty Images

Introduction

In this article I compare one of the most, in my opinion, underrated and conservative REITs - NNN REIT (NYSE:NNN) - to one of the most conservative and underrated big men to ever play in the NBA - Tim Duncan. I like to use analogies in my articles when writing to make them fun and easier for readers to understand. You can also read my prior article where I compare Realty Income (O) - Michael Jordan - versus Agree Realty (ADC) - Kobe Bryant - here.

Tim Duncan was one of the NBA’s best big men to ever play the game of basketball, and could be regarded as the greatest power forward of all time. But his name rarely mentioned amongst the all-time greats. But along with the legends Larry Bird & Michael Jordan, he's one of only three players to win the Wooden award, NBA Rookie of the year, MVP, Finals MVP, and All-star MVP.

NNN REIT Synopsis

NNN REIT is a real estate investment trust that primarily invests in high-quality properties subject to long-term leases. They have a diversified portfolio of 3,449 properties in 49 states with a total gross leasable area of approximately 35 million square feet. These properties are leased to more than 380 tenants in 37 industry classifications. They are one of only 78 (out of more than 10,000 publicly-traded companies) that have increased their annual dividends for 33 or more consecutive years. Talk about consistency! Nothing fancy or flashy, just consistent dividends! That’s why I consider them the Tim Duncan of REITS. Tim Duncan wasn’t always the most exciting to watch, but one thing, he was always consistent and efficient. The Big Fundamental. He was listed at 6’11 and weighed approximately 250 pounds. Every investor wants a Tim Duncan stock in their portfolio, a stock that's consistent, and fundamentally sound in leadership and financials. A consistent payer who you can count on day in and day out.

Why NNN REIT/Tim Duncan

NNN reported earnings on May 2nd. Their Q1 funds from operations were $0.80 and an AFFO of $0.82, up $0.03 or 3.9% from $0.77 the prior year. AFFO was also up $0.03 or 3.8% over Q1 2022 results. The company reported revenue of $204.11M, besting analysts’ estimates by $4.01M for the quarter. They reported an occupancy rating of 99.4%, above the long-term average of 98%. NNN has a BBB+ rated balance sheet and has increased its dividend since 1990. Their expansive portfolio's top tenants include the likes of Walgreens (WBA), AMC Entertainment Holdings, Inc. (AMC), and Mister Car Wash (MCW). They currently pay a quarterly dividend of $0.55. Their quality and longevity ranks amongst the best in the business but is seldom mentioned with the likes of Realty Income (O).

Valuation

Year-to-date, the stock is down about 7%. Analysts have an average price target of nearly $50, and a high of $54. This translates to an upside in the range of 14-25% not including dividends. Furthermore, considering a very comfortable payout ratio of only 67%, this allows management ample room for dividend raises to continue rewarding shareholders in the future.

Due to the Fed's rapid increase in interest rates, many blue-chip REITs, like NNN, have been battered. Some are down more than 30% from their all-time highs. When looking at undervalued stocks, share prices tend to follow ones whose fundamentals are intact, like NNN. And with the whisperings of a bull market in the near future, you don't want to miss this bargain. So not only do you get consistent dividends, you also get the potential for capital appreciation as well.

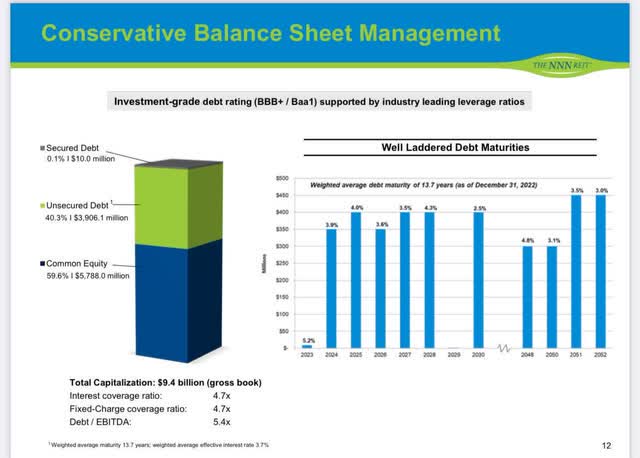

Conservative Balance Sheet

Investor presentation NNNreit.com

It's apparent that due to NNN's long history of a fiscally responsible balance sheet, management is very experienced in turbulent times. With the average tenure of senior leadership being 21 years and 12 years for an NNN employee, it’s evident this isn't management's first go around when it comes to economic uncertainties. Tim Duncan also spent a long tenure (19 years) with one team. NNN also has minimal debt maturing in 2023. In fact, their debt is well-laddered all the way until year 2052, making the “higher for longer” interest rates impact on the company very minimal. They had roughly $900 million of liquidity during Q1, according to their CFO. He also stated that the company started to use a bit of their $1.1 billion bank line of credit in 2023, as part of their plan to navigate the current high interest rate and capital market environment. I'm excited to see what management does with their liquidity as inflation starts to cool. I like the idea of waiting on the sidelines for an opportune moment. With great patience brings great opportunities.

Long-Term Dividend Growth

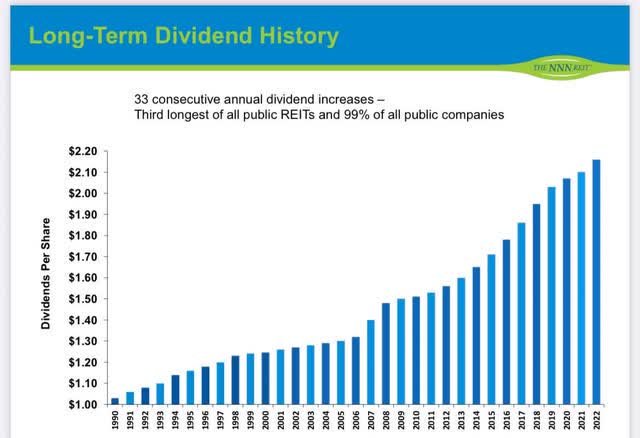

Investor presentation NNNreit.com

Since I only invest in dividend stocks, my goal is to look for a stock of high-quality, who has been through some ups and downs. Tough times never last, tough people do, or in this case, tough management. How well did they perform during the tech bubble crash? GFC? Or even, most recently, the COVID-19 Pandemic? Did they pause or cut the dividend? NNN has never cut the dividend since going public in 1990; showing how management stayed true to their fundamentals and were consistent year after year like Duncan, allowing them to reward shareholders. Tim Duncan's focus on the fundamentals also resulted in his team's success of winning 5 NBA championships and winning the finals MVP three of those times.

NNN is great REIT to own during economic uncertainties, and a dividend aristocrat, having raised their dividend for 33 consecutive years. The third longest of all public REITs. The company raised their dividend by 3.8% to $0.55 from $0.53 back in July 2022. With the company's trend of raising the dividend in July, they're expected to conduct another raise next month. My expectations are a 3.6% increase in the dividend. But due to the environment, it is also possible shareholders could see a more moderate increase of 1.8%.

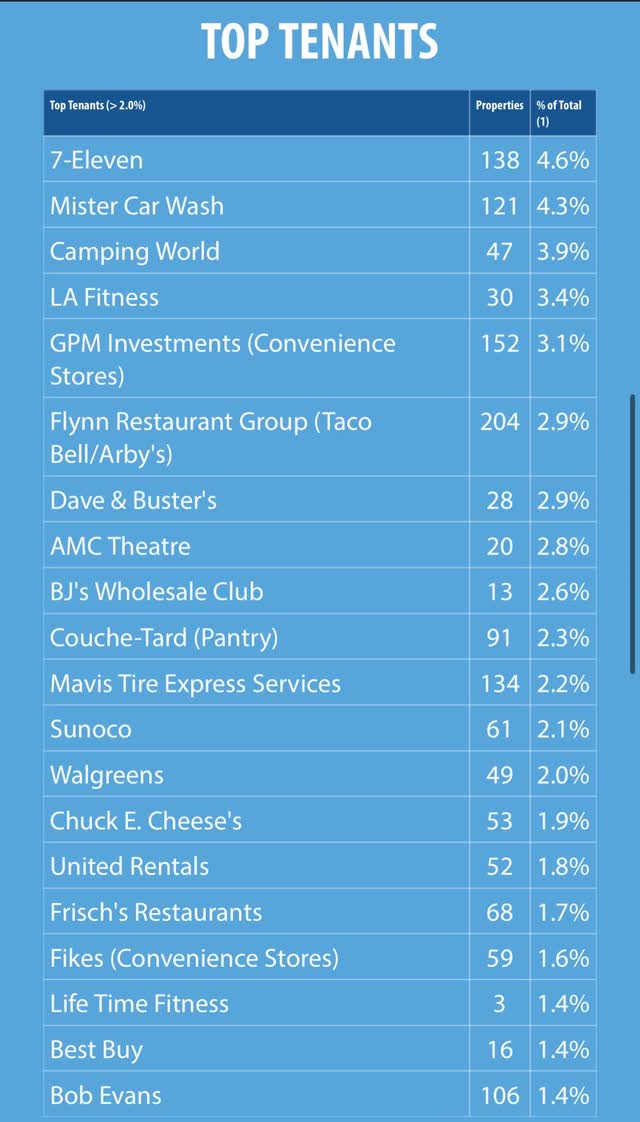

Tenant Strategy

Although a lot of REITs, like Agree Realty, focus on investment-grade tenants, NNN focuses on mostly non-investment grade tenants. This strategy allows the company to achieve better pricing, and better rent growth over lease term. Non-investment grade tenants are considered riskier, and could be something worth noting when looking into purchasing this REIT. But these tenants also allow the company to attain properties at a lower price, higher cap rate, allowing for an overall greater investment return. Think of the addition of Tim Duncan to the 1997 Spurs. They went from a record of 20-62 to making the playoffs every year he was on the team. Finding that key piece to for long-term stability and success, the Spurs and NNN have that in common.

Investor presentation NNNreit.com

In my opinion, this is the perfect stock to add in any portfolio looking to weather a storm. After all, who doesn't like steady dividends? A true set it and forget it stock. Furthermore, their top 5 states by number of properties are: Texas, Florida, Ohio, Georgia, and Illinois. All five just so happen to be in the top 10 of most densely populated states. Having properties in more densely populated areas have a likelihood of higher rental costs, whereas states with lower populations tend to have lower rental prices. Higher population equals higher rental demand, which also equals more sustainable, higher rental increases historically. It's more than just having quality, well-known tenants, it's also about location, location, location!

Investor Takeaway

NNN is a consistent, conservative and efficient REIT - in my opinion, a true SWAN. That’s why I compare them to Tim Duncan. A consistent player/payer on a nightly/quarterly basis. With their impeccable occupancy rating, long dividend growth and stellar management, I expect NNN to navigate the current macro environment and likely offer investors a steady return for the long term. Many REITs have been unfairly targeted due to the current macro environment, and this is a perfect opportunity to collect a 5% yield while you wait out the storm. If investors are looking for a stable, steady stream of income for their portfolio for many years to come, NNN is definitely a welcomed addition.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NNN, ADC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.