Applied Materials: Market Share Decreased 0.3% In Top 10 Sectors It Serves

Summary

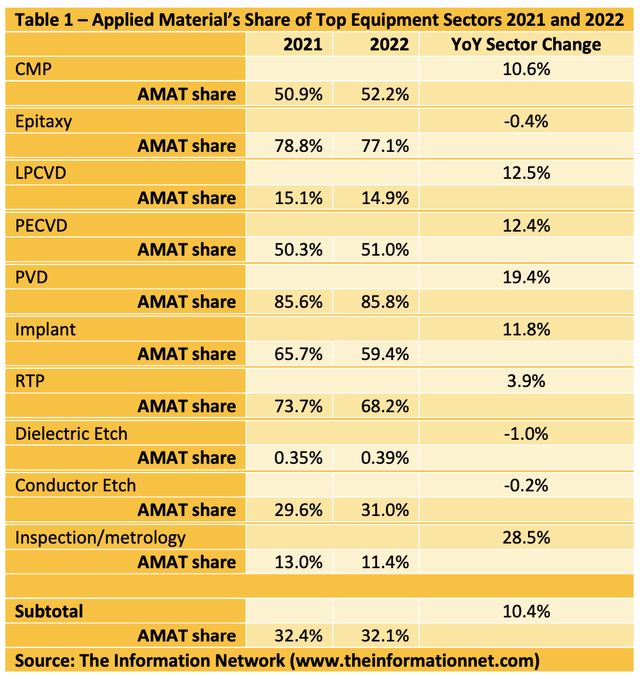

- The Top 10 semiconductor equipment companies in Applied Materials' served available market (SAM) increased 10.4% in 2022.

- Applied Materials' market share for this SAM decreased 0.3%.

- The Metrology/Inspection SAM grew 28.5% in 2022 while Applied Materials' revenue grew just 13.0% as its share dropped 1.6%.

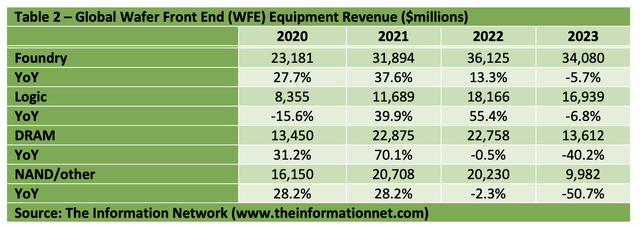

- For 2023, I'm forecasting WFE equipment sales will decrease 45% in memory, 6% in foundry, and 8% in logic spend, causing significant headwinds for Applied Materials.

- This idea was discussed in more depth with members of my private investing community, Semiconductor Deep Dive. Learn More »

studio-fi/iStock via Getty Images

Continued Market Share Loss

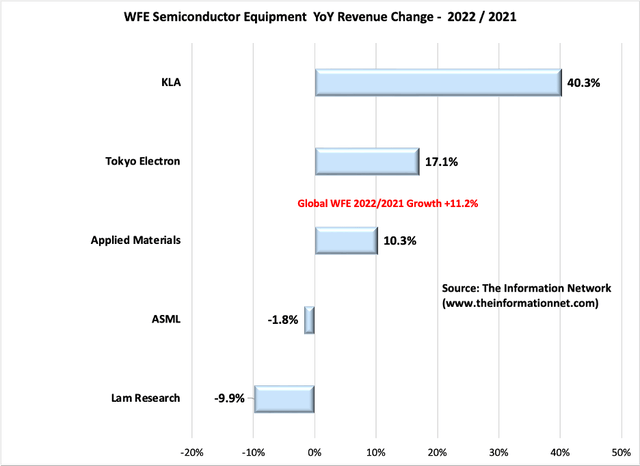

Applied Materials (NASDAQ:AMAT) demonstrated growth of 10.3% year-over-year in 2022 in the semiconductor equipment manufacturing market, as shown in Chart 1. However, the mean growth among the top 5 manufacturers as 11.2%, and KLA (KLAC) and Tokyo Electron ("TEL") (OTCPK:TOELY) outperformed the mean growth. KLAC and TEL are two of the strongest competitors of AMAT in metrology/inspection and deposition/etch, respectively

While the other top WFE competitors including AMAT, Lam Research (LRCX),and ASML (ASML) underperformed, KLAC demonstrated a YoY growth of 40.3%, according to our report entitled Global Semiconductor Equipment: Markets, Market Shares and Market Forecasts.

Chart 1

Applied Materials' YoY Market Share Change 2021-2022

In Table 1, I show revenue growth of the Top 10 semiconductor equipment sectors that AMAT competes. The total YoY revenue growth for these 10 sectors was 10.2%, ahead of the global WFE (wafer front end) growth of 8.4%.

AMAT's share of these 10 sectors decreased 0.2%, but YoY revenues for the company these 10 sectors increased 9.4%, less than the 10.2% for these sectors.

Note that I do not include other segments such as stepper lithography, which AMAT doesn't participate. In 2022, lithography revenues were $16.9 billion representing 20% of the global WFE equipment market.

AMAT Global Share Trend

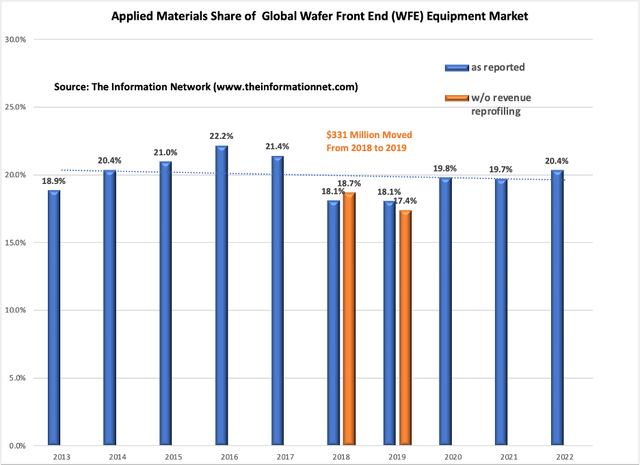

In Chart 2, I show AMAT's WFE revenues between 2013 and 2022. In these 10 years, the trendline (blue dotted line) shows a market share drop.

I also show on this chart with the orange bars that in 2019 AMAT took $331 million from 2018 revenues and put it into 2019 simply by changing its accounting policies. The $331 million propped up AMAT's share from $17.4% to 18.1%.

Chart 2

Headwinds for 2023

For the remainder of CY 2023, Table 2 shows that, while AMAT non-memory revenues were up 44% YoY, I project WFE sales for the sector will drop 12.5% in 2023. That means significant push-outs of equipment for AMAT.

Investor Takeaway

One must wonder why AMAT, which currently is the largest semiconductor equipment company in the world, would continue to lose market share to competitors and peers.

In this article, I showed statistical, empirical analysis in Chart 1 that YoY semiconductor revenues for AMAT increased 10.3%, but the mean growth of the Top 5 companies increased 11.3%.

I also showed in Chart 2 that between 2013 and 2022, AMAT's share of the WFE equipment market has decreased and the company underperformed even with devious attempts to prop up market share in 2019 by manipulating revenues.

At its last earnings call, CEO Dickerson commented:

"To position ourselves for the opportunities ahead, we are making strategic investments in R&D and infrastructure while driving improvements in productivity and speed across the organization."

Unfortunately, AMAT did not provide details of what these improvements will be, and again did not provide guidance for its semiconductor sector.

AMAT generated $2.29 billion in cash from operations and returned $1.02 billion to shareholders including $800 million in share repurchases and $219 million in dividends.

I've said consistently that AMAT, which is the largest equipment company and generated $6.2 billion in net income in F2023, continues to lose market share and underperform peers and competitors. They should be making the "equipment and hiring the best-of-the-best" employees, yet their share continues to drop since Dickerson took over.

Management continues to "talk-the-talk" by utilizing multimedia approaches to promote their products. However, I pointed out following two of their "webcasts."

I set the record straight following these with two Seeking Alpha articles:

- In my March 17, 2021, Seeking Alpha article entitled KLA Introduced 4 AI Metrology/Inspection Systems A Year Before Applied Materials, I noted that AMAT unveiled what they called a "major innovation in process control that uses Big Data and AI technology." However, I pointed out that KLAC had introduced four metrology/inspection systems utilizing AI a year earlier.

- In my December 20, 2022, Seeking Alpha article entitled Applied Materials Ballyhooed E-Beam Inspection Sector Lost Share To KLA's Optical, AMAT detailed its "eBeam Technology and Product Launch" in a webcast on December 14, 2022, I pointed out: 1) Despite efforts to promote its E-beam technology, Optical technology led by KLA continues to generate greater growth, 2) Optical wafer inspection held a 5.4X market share value over E-beam technology promoted by Applied Materials. 3) In the E-beam inspection sector, even ASML beats Applied Materials.

Perhaps the additional cash generated by AMAT in the past quarter could be used for that purpose.

Frankly, after analyzing AMAT since 1985, I don't concur, and rate the company a Sell.

This free article presents my analysis of this semiconductor equipment sector. A more detailed analysis is available on my Marketplace newsletter site Semiconductor Deep Dive. You can learn more about it here.

This article was written by

Dr. Robert N. Castellano, is president of The Information Network www.theinformationnet.com. Most of the data, as well as tables and charts I use in my articles, come from my market research reports. If you need additional information about any article, please go to my website.

I will soon be initiating an investor newsletter. Information to register will be online on my website.

I received a Ph.D. degree in chemistry from Oxford University (England) under Dr. John Goodenough, inventor of the lithium ion battery and 2019 Nobel Prize winner in Chemistry. I've had ten years experience in the field of wafer fabrication at AT&T Bell Laboratories and Stanford University.

I have been Editor-in-Chief of the peer-reviewed Journal of Active and Passive Electronic Devices since 2000. I authored the book "Technology Trends in VLSI Manufacturing" (Gordon and Breach), "Solar Panel Processing" (Old City Publishing), "Alternative Energy Technology" (Old City Publishing). Also in the solar area, I am CEO of SolarPA, which uses a proprietary nanomaterial to coat solar cells, increasing the efficiency by up to 10%. I recently published a fictional novel Blessed, available on Amazon and other sites.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.