Freehold Royalties: Moving To The Sidelines

Summary

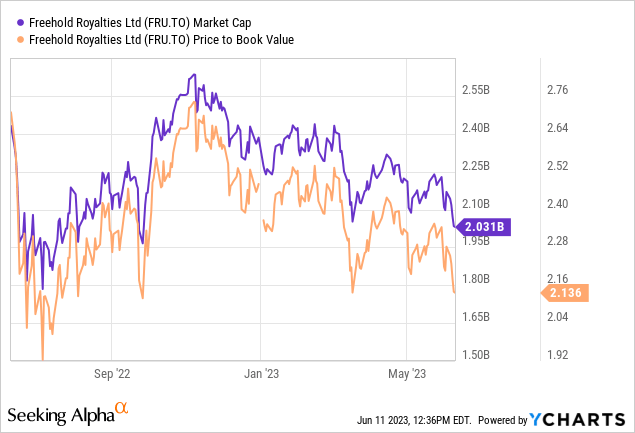

- Freehold Royalties remains a safe income play in the energy sector due to its low cost and leverage structure, despite trading at a premium to book value.

- FRU trades at a 12% FFO yield based on current guidance, and I expect this to increase as its U.S. Production increases.

- FRU can maintain the current dividend at $50/bbl USD.

- The valuation is not unreasonable but compared to other E&P plays is not well set up for market beating returns. I would consider at 6X FFO.

bymuratdeniz

Please note that since the company is based in Canada and trades on the TSX, any company-related figures, such as FFO, FCF, or dividends, are stated in Canadian dollars. All commodity prices such as oil and natural gas are quoted in U.S. dollars unless otherwise indicated.

Introduction

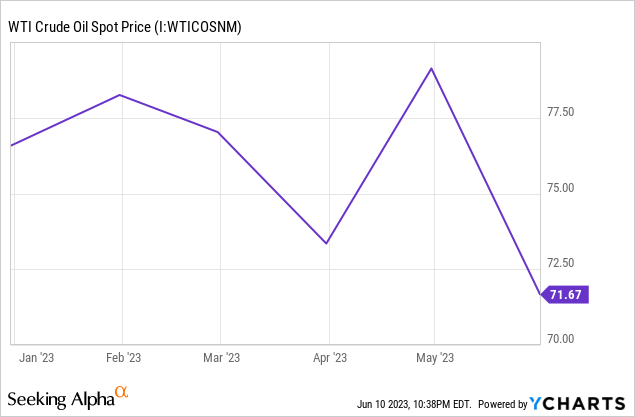

Those who follow my work may recall that I have written on Freehold Royalties (TSX:FRU:CA) several times with the most recent article being in March 2023. This was just shortly after WTI had taken a 10% plunge and natural gas by 40%. I concluded that the outlook still remained favourable and that the stock was still cheap even in a period of lower commodity prices.

You may recall commodity prices today were about the same level in Q2 2021 even a little lower and FRU still produced $0.31/share in the quarter ($2.20 annualized) and with production being ~80% of what it is today. That would imply a conservative ~9% FFO yield if these lower commodity prices persist. This provides a good proxy on downside protection. Despite the royalty trading at a premium to book value, this royalty stock is one of the safest income plays in the energy space as a result of its low cost and leverage structure.

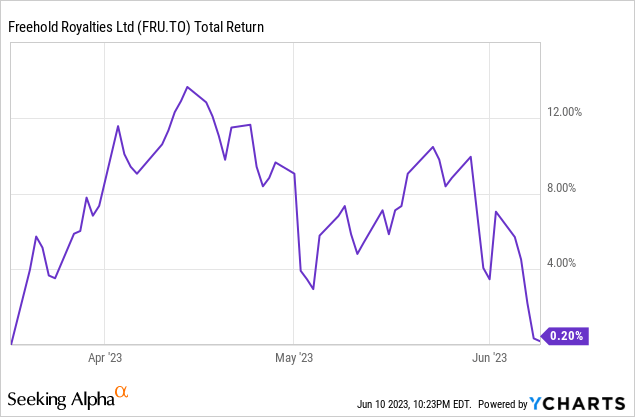

The stock had some strong returns right out of the gate since that thesis although much of the returns came from the $0.09/share dividend. The share price has since returned to its level in March 2023 of around ~$13.50/share as a result of the somewhat weaker Q1 2023 report that was recently released.

Q1 2023 Results

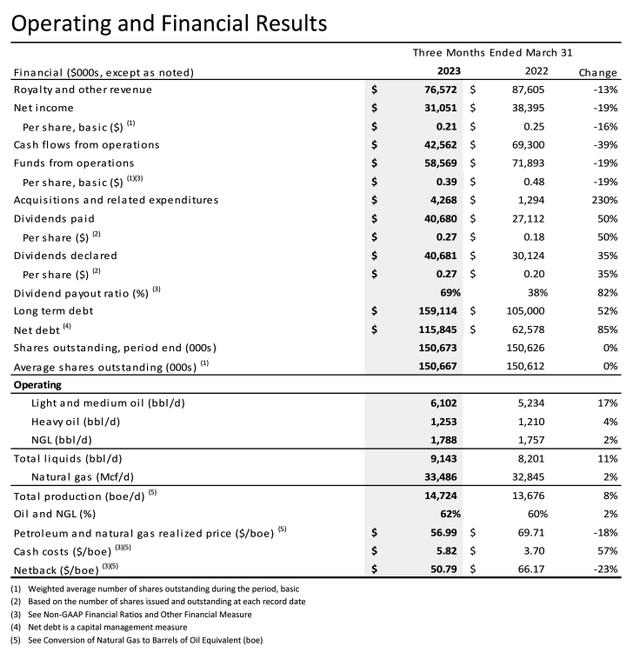

On a positive note, production increased 8% from Q1 2022 as 349 gross wells were drilled on FRU’s royalty lands in Q1-2023, a 43% increase versus the same quarter in 2022. This increase reflects U.S. acquisitions completed over 2020-2022 and increased third-party drilling and completion activities on FRU’s lands. As expected, the production mix shifted more towards liquids. The current production mix is comprised of 41% light and medium oil, 9% heavy oil, 12% NGL and 38% natural gas compared to 35%, 9%, 13%, and 43% respectively in Q1 in 2022. This is appropriate as these lighter oils tend to generate higher net backs in lower commodity price environments.

On the other hand, FFO per share fell 19% from Q1 2022. Royalty revenue fell 13% lower when compared to the same quarter in 2022 as a result of lower commodity prices realized in the quarter. The impacts were mitigated by the greater U.S. production and the stronger U.S. dollar, but potash royalty revenues decreased by 53% over the same quarter in 2022. In addition, G&A costs rose 44% as additional skill sets were required in 2022 to manage FRU’s expanding North American asset base. Higher annual performance-based bonuses were paid and interest expense rose 290% YoY as the interest rate on their credit facility rose from 2.2% to 5.9% from the same quarter one year ago.

On another positive note, net debt decreased by $12 Million, or 9%, to $116 Million from $128 Million at December 31, 2022, bringing net debt to annualized FFO to 0.49X which is very modest.

Q1 2023 Report (Freehold Royalties)

Outlook

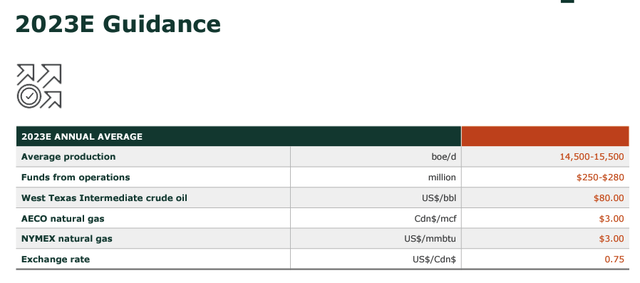

Management has provided updated guidance for 2023 which I deem not to overly aggressive.

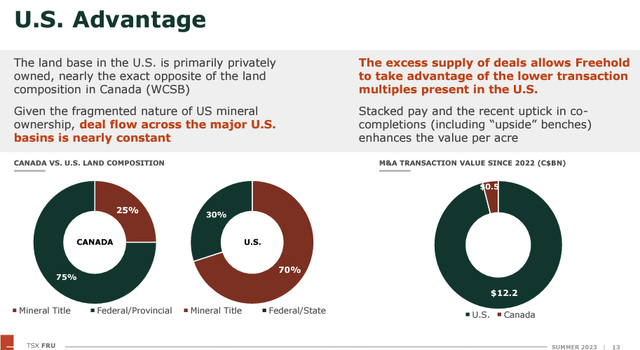

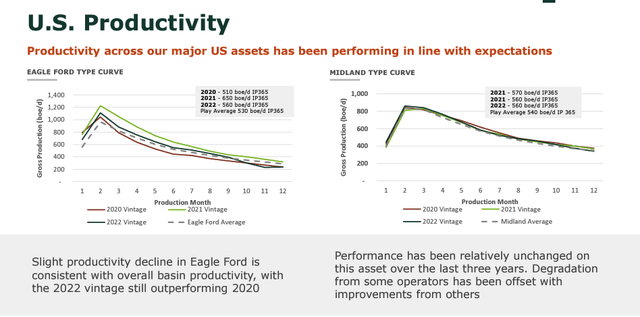

Updated guidance has indicated that production will increase between 5-10% for fiscal 2023 from 2022. This seems reasonable as $385 Million was invested in U.S assets like the Permian and Eagle Ford assets in 2021 and 2022. U.S. production now accounts for 35% of the total. In general, U.S. wells are more prolific as they can come on production at ten times that of a typical Canadian well. However, a U.S. well can take upwards of six to nine months from initial license to first production, compared to three to four months in Canada, on average. Approximately 70% of U.S. wells are held via mineral title where it is the reverse in Canada where 75% of wells are held via Government title. U.S. wells in the Midland and Eagle Ford generally have flatter production curves than their Canadian counterparts.

Q1 2023 Investor Presentation (Freehold Royalties)

Q1 2023 Investor Presentation (Freehold Royalties)

Q1 2023 Investor Presentation (Freehold Royalties)

OPEC+ announced on June 4, 2023, that they would extend cuts to crude oil production cuts through 2024, which will not help global inventories over the next few quarters. The EIA expects global liquid fuel consumption will rise by 1.6 million barrels per day in 2023 from an average of 99.4 Million last year. The EIA also expects natural gas prices to increase throughout the summer as production declines slightly and demand for air conditioning increases the demand for natural gas, but does not see production slowing enough to boost prices above $3/MCF in 2023.

As Freehold has increased its U.S. royalty exposure, its overall realized price has strengthened and is expected to be the case going forward as U.S. volumes realize prices closer to WTI and NYMEX natural gas benchmarks versus discounted pricing for Canadian production due to egress constraints, transportation costs to markets, and oil quality differentials. In fact, U.S. realized pricing in Q1 2023 was 38% higher than Canadian realized pricing. Moreover, any sustained dip below $70/bbl USD is likely to prompt refilling action by the Strategic Petroleum Reserves which will put a floor on oil prices. In conclusion, the assumptions for commodity prices are not unreasonable.

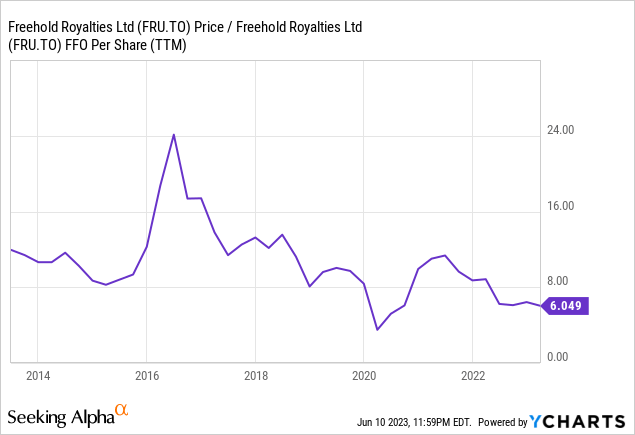

Therefore, $250 Million in FFO for 2023 is far from unreasonable and would work out to a ~12% FFO yield at current prices. In addition, management has indicated they intend for a 60% payout ratio this year which would mean $150MM to be paid out in dividends for a minimum ~7% dividend yield and could still nearly pay down all debt.

Valuation

FRU currently trades at 7-8X this year's expected FFO which is slightly below its average level of 8-9X over the last 10 years although the multiple has been up and down a lot over the years. The bulk of this 10-year chart was with near zero percent interest rates while the two-year Canada Bond is offering ~4.5%.

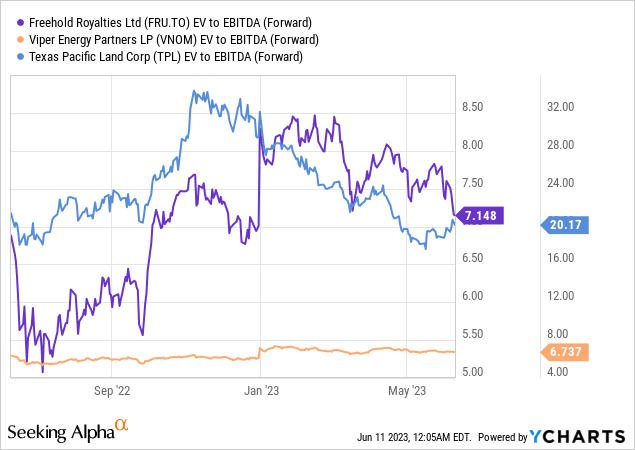

On the other hand, FRU trades in line with Viper Energy (VNOM) who I have also written on but nearly 13 multiples less than Texas Pacific Land Corp. (TPL). Although TPL has world class assets the multiple difference seems preposterous and if one was ambitious could look at a pair-trade.

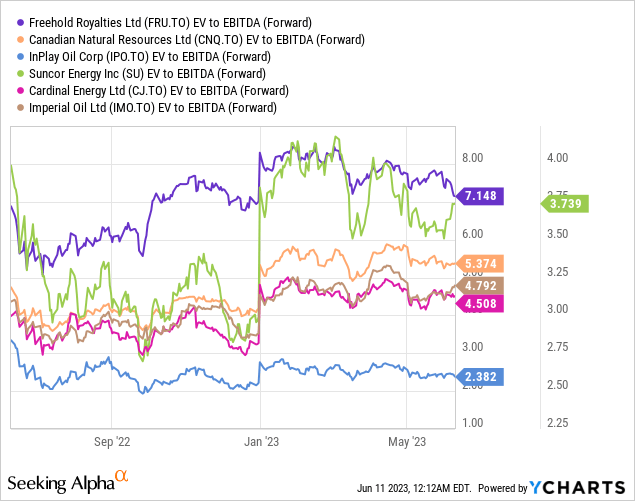

FRU does face competition from traditional exploration and production plays. The royalty model tends to be a lower risk play to gain access to oil and gas assets due to its absence of operating costs which should arguably necessitate a higher multiple than the traditional E&P play. The problem is that all of the E&P companies shown in the below graph have reduced debt levels to extremely low levels as well (less than 1.5X EBITDA). FRU management boasts it can maintain its dividend at $50/bbl USD, but many of the traditional E&P plays can also return funds to shareholders in lower commodity price environments. The case for FRU having a 3-5X multiple greater than the E&P counterparts for its inherent safety has begun to hold less weight for sure.

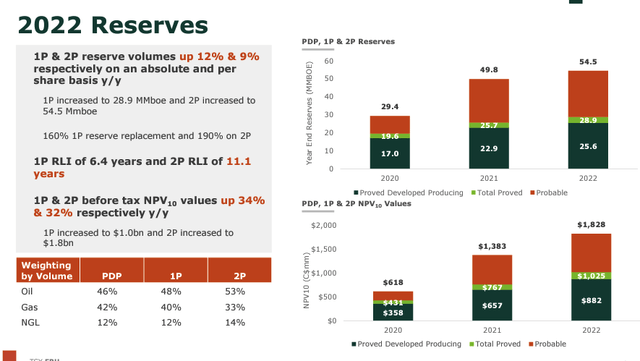

The PV10 of $1,828 Million before taxes is even less than FRU's market capitalization of ~$2 Billion. So unlike many of the traditional E&P plays I have covered on Seeking Alpha such as InPlay Oil (IPO:CA) you are actually paying a premium for their oil and gas inventories, relative to what it would cost you in the futures market. Keep in mind that these reserves were valued in December 2022 when natural gas prices were over $4/MCF so their reserves are likely overvalued at this point.

Q1 2023 Investor Presentation (Freehold Royalties)

Conclusion

I have sung the praises of FRU over the past few years and will continue to do so. If you are looking for an oil and gas play that you can sit back and collect the recurring dividends then this stock is for you. If you are looking to generate additional alpha in your portfolio, the set-up is a little lacking on the valuation front. I will continue to hold FRU in my personal portfolio and will consider adding to my position if it falls below 6X FFO.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of FRU:CA, IPO:CA, IMO:CA, CNQ:CA, SU:CA, CJ:CA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.