JAAA: Becoming A Powerhouse On The Back Of Higher Rates

Summary

- Janus Henderson AAA CLO ETF provides retail investors access to the previously inaccessible AAA CLO asset class.

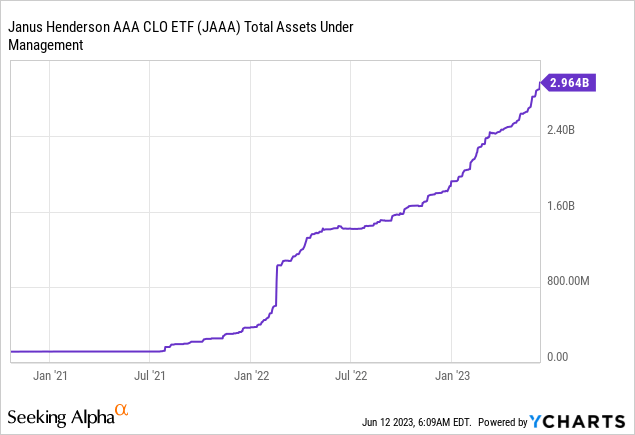

- JAAA has experienced a significant increase in assets under management, reaching nearly $3 billion in under two years, due to its floating rate nature and spread pick-up.

- The fund is an attractive yielding vehicle with minimal credit risk, making it a suitable option for investors seeking floating rate exposure and diversification benefits.

- AAA CLOs have de-minimis credit risk, but do have a slight liquidity constraint when compared to treasuries and corporate bonds.

Galeanu Mihai

Thesis

Janus Henderson AAA CLO ETF (NYSEARCA:JAAA) is an exchange traded fund. The vehicle focuses on a floating rate asset class, namely AAA CLO tranches. Until the advent of this fund, AAA CLOs were an asset class inaccessible to retail investors. CLOs are securitizations, which generally are available solely to qualified institutional buyers ('QIBs'). QIBs is a class of investors that are assumed to be sophisticated, hence do not require the regulatory protection of the Securities Act's registration. We are going to discuss the designation and its implications in a section below.

What is appealing in respect to JAAA and AAA CLOs generally, is their low credit risk and incremental dividend yield when compared to similarly rated corporate paper. More and more investors are realizing the benefit of this asset class, which has resulted in an absolute explosion of JAAA's assets under management:

Please note the parabolic rise in the AUM here. It is very hard to build a new fund in the fixed income space. To have a vehicle go from $100 million AUM to almost $3 billion in under two years is almost unheard of.

The main reason behind the increase in AUM is the floating rate nature of the underlying asset class. As rates have moved higher, investors have sought exposure to floating rate assets. JAAA has benefited. The second culprit for the increase in assets is the spread pick-up:

Spread Pick-Up (Santander)

The graph above represents the spread differential between AAA CLOs and AAA rated corporate paper. The higher the red line versus the median, the cheaper AAA CLOs versus their corporate peers. In effect, one can easily argue that AAA CLOs are preferrable due to their diversification benefits (when you buy a AAA corporate bond you have single issuer risk).

JAAA is currently yielding around 6%, and its yield will be greatly affected by the path of Fed Funds. AAA CLO spreads are somewhere around 180 bps on average, meaning most of the dividend yield in JAAA comes from SOFR (the floating index that replaced Libor). When Fed Funds decrease, we will see a similar decrease in JAAA's dividend yield.

Rule 144A & QIBs

Securitizations have historically been issued under Rule 144A, so that they do not have to be registered:

Rule 144A (formally 17 CFR § 230.144A) is a Securities Exchange Commission (SEC) regulation that enables purchasers of securities in a private placement to resell their securities to qualified institutional buyers (QIBs) under certain conditions.

Generally, under Rule 506 of Regulation D, purchasers of securities issued in a private placement may not resell their securities. Rule 144A allows purchasers of such securities to resell those securities if: (1) the sale is to a qualified institutional buyer (QIB); (2) the seller takes affirmative steps to ensure that the buyer is aware that the seller relies on Rule 144A to sell their security; (3) the securities are not of the same class as securities traded on a national securities exchange; and (4) the purchaser has the right to request information from the original issuer of the security.

Source: Cornell Law School

To translate the above in English - the idea is that securitizations are complex instruments, and regulators did not want to be sued by retail investors who did not understand what they bought, hence they carved them out for qualified institutional buyers only.

As a retail investor I can go on my brokerage platform and put in a Treasury, MBS or corporate CUSIP and just buy a bond outright. You cannot do that with securitizations. That is why JAAA is such an innovative fund, because it gives retail investors access to an asset class which was closed off beforehand. Investment banks are starting to fully recognize this feature:

What do you get when you cross an ETF with a CLO? Although the question might sound like the start of a bad joke, investors who favor this new product may well have the last laugh.

Exchange-traded funds and collateralised loan obligations (CLOs) are among the most significant innovations in the world of securities of recent decades, and they constitute two of the largest asset classes today. This article explains key features of each product, what their combination – in the form of CLO ETFs – can offer investors and, drawing on Deutsche Bank Research, provides an update on the current state of the CLO ETF market.

Performance

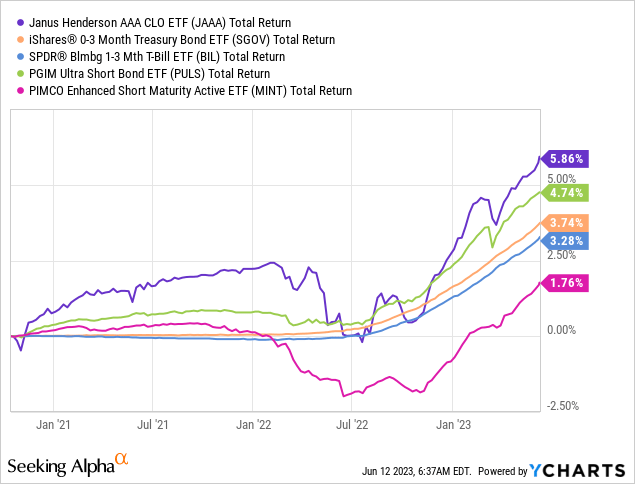

JAAA has done very well in the past year:

JAAA outperforms all other cash parking vehicles we have analyzed in the past. Yes, there is a slight element of illiquidity when it comes to JAAA. While AAA CLOs are very liquid, they are most certainly not as liquid as treasuries and corporate bonds. So there is a slight liquidity premium embedded in the return profile here.

There is certainly a credit spread component, albeit small. We can just see what happened to the total return line in the June-July 2022 period: While pure government funds like SGOV kept increasing in value, JAAA and MINT saw a slight decrease in returns due to increased credit spreads.

Conclusion

JAAA is a fixed income exchange traded fund. The vehicle provides retail investors with access to an institutional asset class, namely AAA CLOs. This asset class, issued under Rule 144A would otherwise be available to qualified institutional buyers only. AAA CLOs are now 'cheap' when compared to similarly rated corporate paper. There is a spread pick-up component here, which has helped the fund outperform treasuries funds. JAAA has managed to attract retail flows chasing floating rate paper, and has grown its AUM to almost $3 billion in the span of only two years. That is a massive achievement for a new fund in the fixed income space. This fund is an attractive yielding vehicle with de-minimis credit risk. We are Holding for the dividend.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JAAA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.