The Trade Desk: ATT And CTV Winner

Summary

- The Trade Desk is poised to benefit from the rise of connected TV (CTV), due to its ability to consolidate demand and data at scale.

- The company's focus areas include shopper marketing, UID2, and supply path optimization, which are strengthening the company's competitive position.

- The Trade Desk's high valuation raises questions about future returns and the potential for the stock to continue outperforming the market.

Urupong/iStock via Getty Images

The Trade Desk (NASDAQ:TTD) looks set to be one of the big winners from the turmoil caused by Apple's (AAPL) ATT initiative and the rise of CTV. The company's competitive position also appears to be strengthening on the back of its ability to consolidate demand and data at scale. The Trade Desk's valuation is currently high though, raising questions about future returns. In particular, it may be difficult for the Trade Desk to generate the growth necessary for its stock to continue outperforming the market.

Market

On the back of a rapid shift in attitude towards user privacy, the adtech ecosystem has been undergoing a rapid transformation in recent years. For example, 2022 was the first year in a decade that Meta (META) and Google (GOOG) were not responsible for over half of the digital advertising market. Global ad spend continues to increase, but value appears to be shifting within the industry. Global ad spend increased by 8% last year, with spend on The Trade Desk’s platform increasing by almost three times as much.

Many digital advertisers are still adjusting to a more privacy focused internet though, and demand from a range of verticals is weak. The Trade Desk stated that spending by both brands and agencies was delayed somewhat at the start of the year, and that December was softer than normal in comparison to October and November, although the market had been recovering through 2023.

Many of the changes wrought by a greater focus on privacy appear to be benefitting DSPs, and The Trade Desk in particular. Data now commands an even greater premium, and The Trade Desk believes that an increased ability to leverage data across channels will lead to an increased focus on value rather than price.

The open internet can provide walled gardens with incremental demand and higher CPMs, leading to these walled gardens taking down some of their barriers. This certainly appears to be something that is playing out in the current weak demand environment. The Trade Desk is also potentially able to offer marketers a more objective measure of ROI. The Trade Desk believes that connected TV is another catalyst for a weakening of the walled gardens. Advertisers are shifting spend from user-generated content to premium streaming content, which is more fragmented and open.

Supply Path Optimization is another potential value catalyst for The Trade Desk. While header bidding provided benefits, it also led to a proliferation of ad exchanges and intermediaries selling the same inventory across different exchanges. Many of these intermediaries were providing no value to the ecosystem while adding fees and creating inefficiencies. Supply Path Optimization is a response to this, and refers to the process of DSPs finding an efficient path (short, low fees) to ad inventory. In theory this should help advertisers to maximize their ROI and allow publishers to receive more revenue. SPO is likely to result in consolidation of SSPs and ad exchanges, as they will need scale and must be able to provide value. In some cases The Trade Desk is disintermediating the supply side, but it probably can't aggregate all supply.

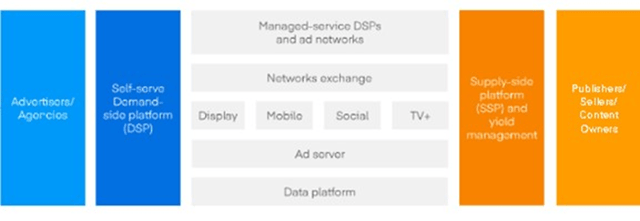

Figure 1: Typical Digital Advertising Market Structure (source: The Trade Desk)

Digital advertising still remains reasonably fragmented, which provides The Trade Desk with an opportunity to consolidate market share within the DSP and Data Platform segments. Scale and access to unique data are likely to be sources of competitive advantage that continue to drive consolidation going forward.

Figure 2: Digital Advertising Industry Players (source: The Trade Desk)

The Trade Desk believes that most advertising will eventually be digital and programmatic. Digital Advertising is rapidly maturing though, and now accounts for roughly two thirds of the advertising market.

Figure 3: The Trade Desk's TAM (source: The Trade Desk)

Shopper marketing is also a potential growth area for The Trade Desk:

- 77% of CPG companies and retailers have a shopper marketing function

- 21% of total US digital ad spend in 2020 was on retail

- 35 billion USD was spent on digital retail ads in 2021

- One-third of US shoppers use online and offline info to make purchase decisions

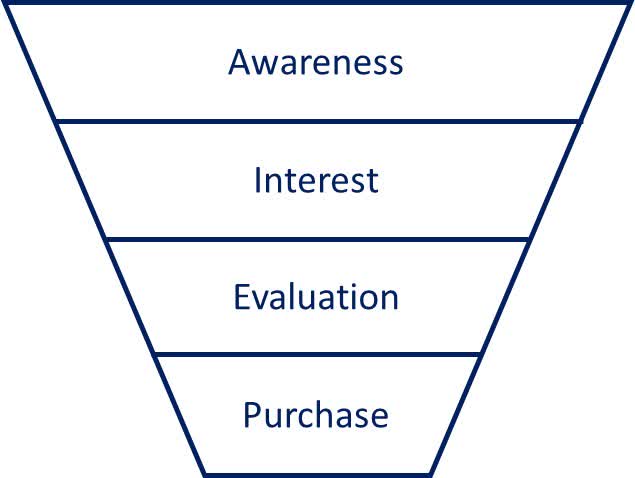

Shopper marketing covers the entire acquisition funnel and helps with attribution in a privacy first world.

The Trade Desk

The Trade Desk is predominately a DSP for digital advertising. The company has an omni-channel platform, covering areas like:

- Connected TV

- Online Video

- Display

- Native

- Mobile/Tablet

- Digital Out-of-Home

- Audio

With the rise of CTV, an omni-channel presence is potentially becoming an advantage, as DSPs can help guide buyers through the acquisition funnel. Many omni-channel campaigns are now starting with CTV followed up by display, audio, mobile and native ads to move the user down the funnel. The Trade Desk can provide advertisers access to these channels and a view of data across channels.

Figure 4: Customer Acquisition Funnel (source: Created by author)

Focus areas for The Trade Desk include:

- Connected TV

- Shopper marketing

- Global expansion

- UID2

- Data marketplace

- Supply Path Optimization

OpenPath

OpenPath is an important part of The Trade Desk's SPO efforts, providing advertisers with direct access to publisher inventory, and has been available for around 12 months. This disintermediates a number of players in the supply chain, helping to create transparency and efficiency. Advertisers gain direct visibility into inventory across channels and publishers receive a direct view of what advertisers are willing to pay for impressions.

This is potentially problematic for SSPs and exchanges as it provides buyers with a direct link to strategically important publishers. The Trade Desk has stated that it will never provide yield management, although disintermediation can occur if publishers choose to do this themselves. Given that The Trade Desk represents buyers, it would make little sense for them to try and offer yield management anyway, as it would be a conflict of interest. Within connected TV, many of the content owners have purchased SSPs, which could lead to increased disintermediation over time.

OpenPath appears to be gaining traction, with The Trade Desk stating that its customers are increasingly prioritizing direct channels, and that it is on boarding a large number of publishers at the moment.

UID2

UID2 is an identity solution for the open internet which is based on either an email address or a phone number. The Trade Desk’s stated goal for UID2 is to create a solution that provides more privacy than cookies while still enabling advertising precision.

The Trade Desk open-sourced the technology, encouraging adoption by the broader advertising ecosystem (agencies, brands, content providers, ad tech companies and data partners).

At the beginning of The Trade Desk’s fourth quarter 2022, around 15% of the third-party data ecosystem was using UID2. The Trade Desk stated on the first quarter 2023 earnings call that roughly 75% of third-party data providers are now leveraging UID2. Ad spend is also reportedly gravitating towards ad impressions that include UID2 and CPMs on ad impressions containing UID2 are meaningfully higher than those without in most channels.

Connected TV

Despite general market headwinds, CTV continues to be a bright spot for the adtech ecosystem. CPMs for CTV are currently higher than traditional TV, as demand has outstripped supply though, forcing advertisers to find ways to justify these higher prices. As a result, advertisers want a market where they can leverage data on an everyday always-on basis, rather than the current system of commitments.

Biddable marketplaces are inevitable in order for media companies to maximize demand. This makes integration with The Trade Desk somewhat inevitable for all major streaming platforms. UID2 also supports The Trade Desk's competitive position in this new market, and its adoption is accelerating.

The rise of CTV is being supported by the fact that upfronts have been charging higher CPMs for less reach in broadcast TV, highlighting the value of digital and CTV. CTV is currently the fastest growing part of The Trade Desk's business.

Shopper Marketing

Retail Media Networks have unique data that advertisers increasingly need access to, due to difficulties in attribution created by industry privacy initiatives. Retailers can drive growth by opening their shopper data up to advertisers in a privacy safe manner, helping advertisers to attribute sales to a campaign and optimize their ad spend. While it is still early days, The Trade Desk already has success stories with companies like Walmart, Target, Walgreens, Albertsons and Kroger.

Data Marketplace

The Trade Desk's third-party Data Marketplace allows advertisers to access and purchase data from a variety of third-party data providers. Data providers include data management platforms, survey companies and retailers. Advertisers can then use this data to target their advertising efforts more effectively.

Financial Analysis

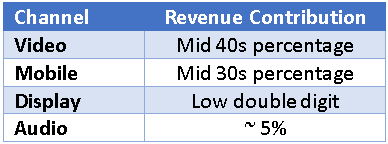

The Trade Desk's financial performance is still fairly robust, with growth across channels in the first quarter. Advertising dollars continue to shift from linear to CTV, which is a large driver of The Trade Desk's business at the moment.

Table 1: Revenue Contribution by Channel (source: Created by author using data from The Trade Desk)

The Trade Desk is relatively optimistic about forward growth, guiding to 20% YoY in the second quarter. While this guidance is likely conservative, there appears to be a growing belief that the bottom is in, and that growth will accelerate going forward. This is likely dependent on the macro environment improving though, and while the US stock market is doing well, the economy is deteriorating.

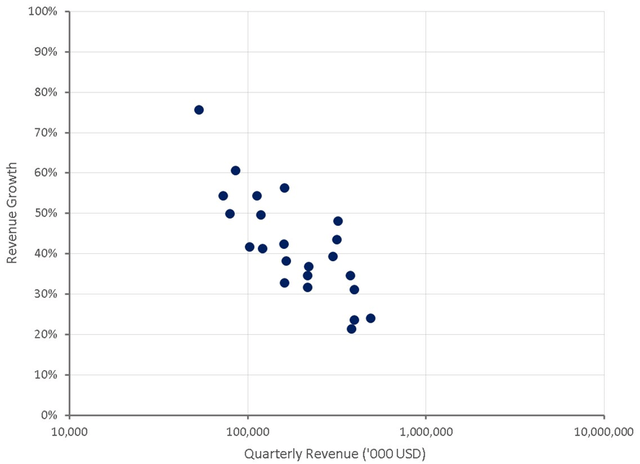

Figure 5: The Trade Desk Revenue Growth (source: Created by author using data from The Trade Desk)

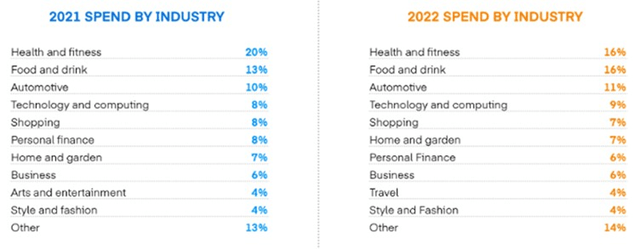

The Trade Desk’s travel vertical nearly tripled spend YoY in Q4 2022. This strong growth was driven by an ongoing recovery from the pandemic. Automotive was another area of strength in the fourth quarter as supply chain pressures have eased. Political election spend also doubled QoQ, representing a low single-digit percent of spend in Q4. These tailwinds will potentially fade in 2023 though.

Travel spend almost tripled YoY in the first quarter, and has likely been a significant contributor to growth. Food and drink, automotive and home and garden were also strong verticals in the first quarter.

Figure 6: The Trade Desk Revenue Contribution by Vertical (source: The Trade Desk)

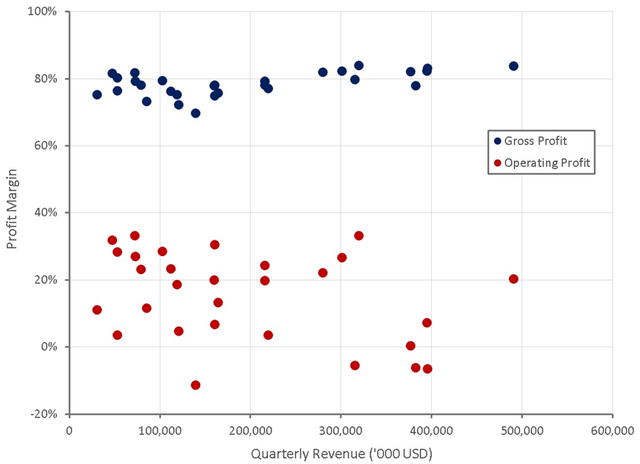

The Trade Desk's gross profit margins have generally been improving with scale, this hasn't translated into operating profit margins though, in part because the company has been investing in growth.

Figure 7: The Trade Desk Profit Margins (source: Created by author using data from The Trade Desk)

Operating expenses have also been elevated due to enormous SBC for the CEO. Existing shareholders are likely okay with this though given the stock's historical performance, and general and administrative expenses will normalize in time.

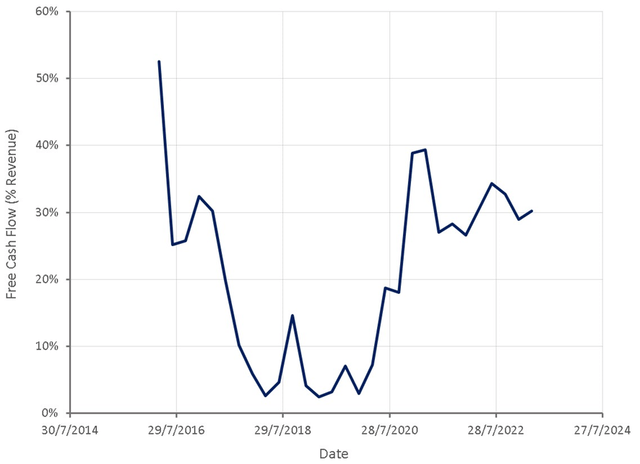

The Trade Desk has a track record of creating efficient growth and free cash flow margins are strong. This will eventually translate into high operating profit margins as the company continues to scale and growth moderates.

Figure 8: The Trade Desk Free Cash Flow TTM as a Percentage of Revenue (source: Created by author using data from The Trade Desk)

Valuation

The Trade Desk announced a 700 million USD share repurchase program in February. This decision was reportedly based on the strength of the company's balance sheet and cash flows. Approximately 5.1 million shares were repurchased for a total of 293 million USD in the first quarter. Repurchases are expected to be conducted opportunistically going forward based on market conditions.

This repurchase program could be considered indicative of management's view of the company, and hence a positive for the stock, but repurchasing stock on an EV/S multiple of nearly 20 in a weakening macro environment is risky. An enormous amount of growth, and a high ROIC, is implied by this type of valuation. While this is not impossible for a company of The Trade Desk's caliber, there is a high risk of the stock underperforming the market at some point.

Growth at scale is difficult, and spend on the platform in 2022 was already nearly 7.8 billion USD. North America accounted for 88% of The Trade Desk's revenue in the first quarter of 2023 though, demonstrating that there is still a large opportunity internationally, and CTV is still relatively immature.

Figure 9: The Trade Desk EV/S Multiple (source: Seeking Alpha)

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.