- News

- City News

- ahmedabad News

- Bank deposits swell 11% in FY23, breach Rs 10 lakh crore mark in Gujarat

Trending

Bank deposits swell 11% in FY23, breach Rs 10 lakh crore mark in Gujarat

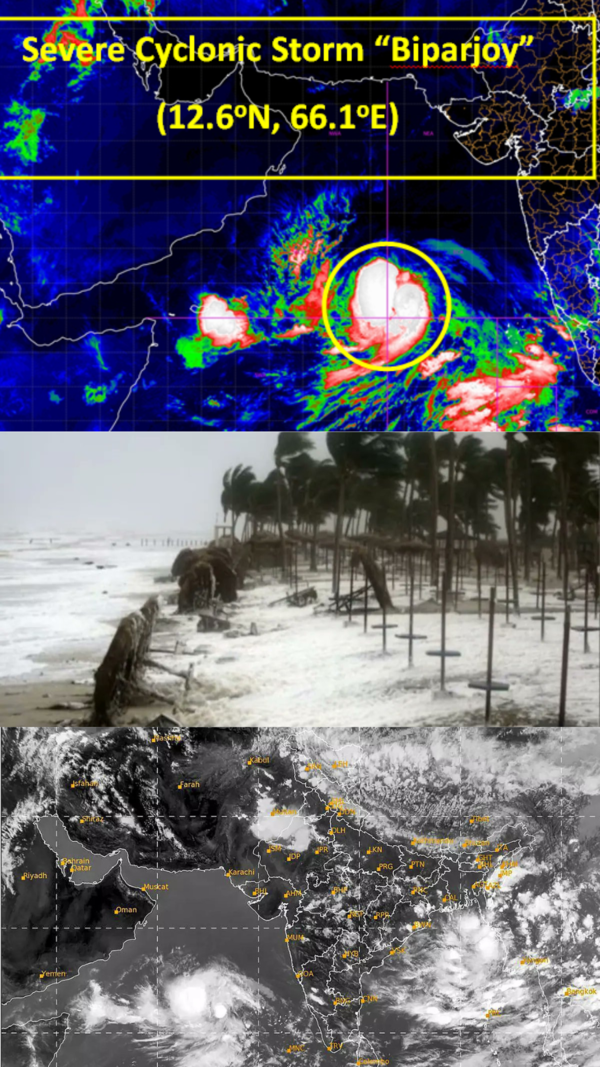

Representative Image

AHMEDABAD: Amid rising global uncertainty and economic upheaval, bank deposits continue to be customary favourites of investors across Gujarat. According to the latest report of the State Level Bankers' Committee (SLBC) - Gujarat, bank deposits breached the Rs 10-lakh crore mark in Gujarat and grew 11% in the fiscal year 2022-23 as compared to the previous fiscal.

The deposits stood at Rs 10.76 lakh crore during the fiscal year. The 177th SLBC meeting was recently held in Ahmedabad. Six of the top 10 districts where high deposits were made are in central and south Gujarat. These include Vadodara and Anand in central Gujarat and Bharuch, Surat, Navsari and Valsad in the South Gujarat region, which command 33.26% of the total deposits in the state.

Among major cities, Ahmedabad, Vadodara, Surat, Rajkot and state capital Gandhinagar account for 62% of the total deposits. Of this, Ahmedabad alone commands a lion's share of 28.8% of the state's total deposits at Rs 3.1 lakh crore.

Besides these, smaller centres like Navsari, Anand, Bharuch, Valsad and even Kutch districts account for a huge chunk of deposits, mainly driven by NRI deposits.

"After the Reserve Bank of India (RBI) hiked repo rates, the bank interest rates are currently as high as 7.5% and above. This has led a lot of investors to turn to bank deposits as a safe saving option. We have seen fresh deposits in a number of NRI accounts especially in these smaller centres, where people have parked their money anticipating better interests," said a top source in the SLBC - Gujarat.

Indicating better repayment capacities of micro small and medium enterprises (MSMEs) in Gujarat, the non-performing assets (NPAs) of MSMEs have significantly reduced in the fiscal 2022-23. Fuelled by post-Covid demand improvement in FY2023, the gross NPAs for MSMEs have gone down by 10% from Rs 9,326 crore in FY2022 to Rs 8,432 crore in a year, according to the latest report by the state level bankers' committee (SLBC) Gujarat. Also, advances to MSMEs went up 17% from Rs 2.13 lakh crore to Rs 1.82 lakh crore.

Bankers attributed the decline to major repayments that took place from a few major accounts, companies opting for restructuring as well as improvement of business.

"Big chunks of repayments have been made in the MSME sector, resulting in a major decline in NPAs for MSMEs. Overall, there was a demand improvement in some sectors during FY2023, which streamlined cashflow cycles for many MSMEs . As a result, the loan repayment trend improved," said a top source in SLBC Gujarat.

Bankers also indicated that many MSMEs have opted for restructuring, which sets aside the bad loan burden.

"Core manufacturing sectors such as pharmaceuticals and ceramics have done well. Ceramic demand was driven by exports. There was a boom in the real estate market. As a result, a number of slippages have been prevented. The pharma sector has seen a rise in credit offtakes, thanks to new plants and expansions of existing facilities being undertaken," the SLBC source further explained. Since FY2020, bank NPAs in Gujarat for MSME sector have dropped by 19.5% from Rs 10,481 crore.

The deposits stood at Rs 10.76 lakh crore during the fiscal year. The 177th SLBC meeting was recently held in Ahmedabad. Six of the top 10 districts where high deposits were made are in central and south Gujarat. These include Vadodara and Anand in central Gujarat and Bharuch, Surat, Navsari and Valsad in the South Gujarat region, which command 33.26% of the total deposits in the state.

Among major cities, Ahmedabad, Vadodara, Surat, Rajkot and state capital Gandhinagar account for 62% of the total deposits. Of this, Ahmedabad alone commands a lion's share of 28.8% of the state's total deposits at Rs 3.1 lakh crore.

Besides these, smaller centres like Navsari, Anand, Bharuch, Valsad and even Kutch districts account for a huge chunk of deposits, mainly driven by NRI deposits.

"After the Reserve Bank of India (RBI) hiked repo rates, the bank interest rates are currently as high as 7.5% and above. This has led a lot of investors to turn to bank deposits as a safe saving option. We have seen fresh deposits in a number of NRI accounts especially in these smaller centres, where people have parked their money anticipating better interests," said a top source in the SLBC - Gujarat.

Indicating better repayment capacities of micro small and medium enterprises (MSMEs) in Gujarat, the non-performing assets (NPAs) of MSMEs have significantly reduced in the fiscal 2022-23. Fuelled by post-Covid demand improvement in FY2023, the gross NPAs for MSMEs have gone down by 10% from Rs 9,326 crore in FY2022 to Rs 8,432 crore in a year, according to the latest report by the state level bankers' committee (SLBC) Gujarat. Also, advances to MSMEs went up 17% from Rs 2.13 lakh crore to Rs 1.82 lakh crore.

Bankers attributed the decline to major repayments that took place from a few major accounts, companies opting for restructuring as well as improvement of business.

"Big chunks of repayments have been made in the MSME sector, resulting in a major decline in NPAs for MSMEs. Overall, there was a demand improvement in some sectors during FY2023, which streamlined cashflow cycles for many MSMEs . As a result, the loan repayment trend improved," said a top source in SLBC Gujarat.

Bankers also indicated that many MSMEs have opted for restructuring, which sets aside the bad loan burden.

"Core manufacturing sectors such as pharmaceuticals and ceramics have done well. Ceramic demand was driven by exports. There was a boom in the real estate market. As a result, a number of slippages have been prevented. The pharma sector has seen a rise in credit offtakes, thanks to new plants and expansions of existing facilities being undertaken," the SLBC source further explained. Since FY2020, bank NPAs in Gujarat for MSME sector have dropped by 19.5% from Rs 10,481 crore.

Start a Conversation

FOLLOW US ON SOCIAL MEDIA

FacebookTwitterInstagramKOO APPYOUTUBE