Fed Looms Over New 'Bull Market'

Summary

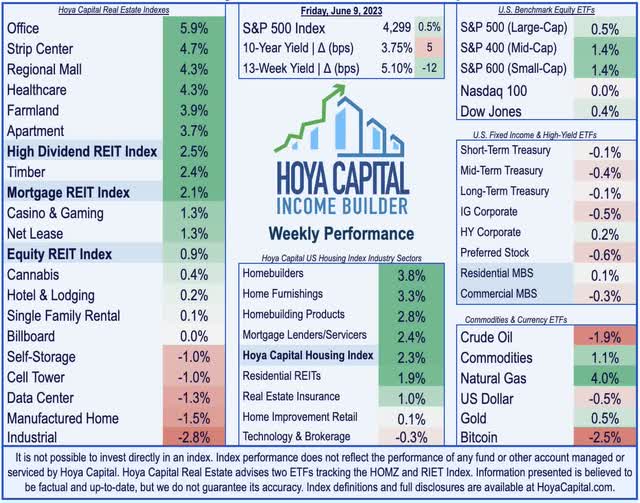

- U.S. equity markets climbed to their highs of the year as investors took positions ahead of a critical slate of inflation data and an anticipated "pause" in the Fed's rate hike cycle.

- Closing the week in 'bull market' territory, the S&P 500 advanced 0.5% this week, which lifted the major benchmark into 'bull market' territory with gains of over 20% from its October lows.

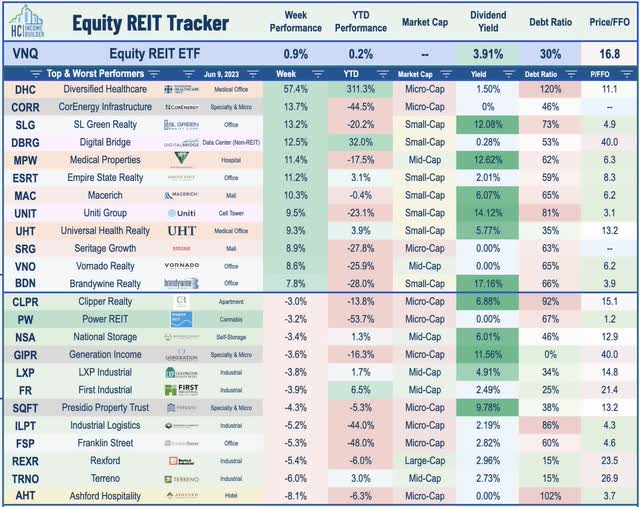

- Real estate equities were among the leaders for a second-straight week, lifted by a strong slate of business updates at the annual REITweek industry conference. The Equity REIT Index advanced 0.9%.

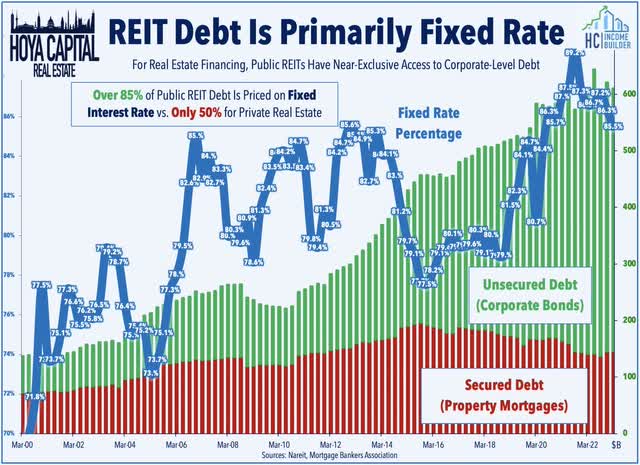

- The REITweek tone was notably upbeat, with a common sentiment that public REITs are well-positioned to "pounce" on external growth opportunities once "reality sets in" for private market real estate owners that lack the deep access to capital or balance sheet strength enjoyed by most of the mid-sized and larger public REITs.

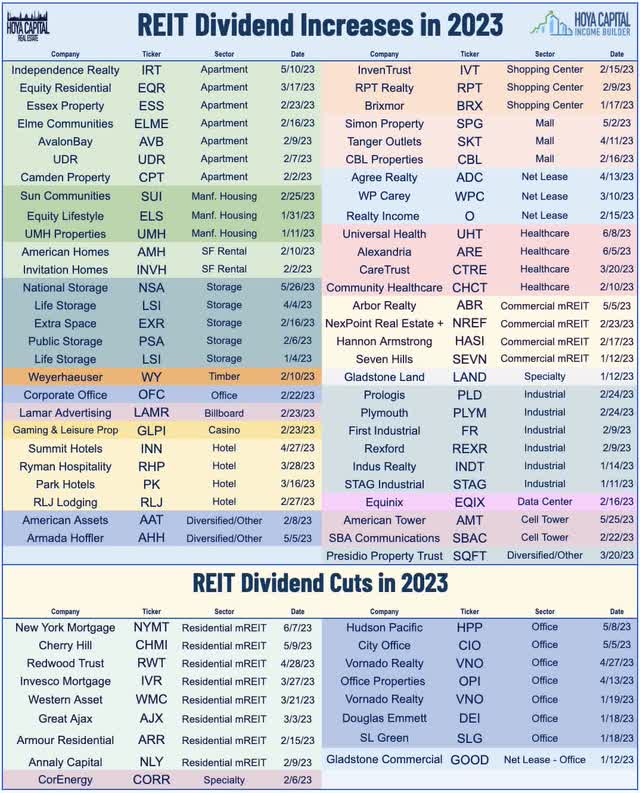

- A handful of REITs took advantage of the spotlight to announce dividend hikes. Lab space operator Alexandria Real Estate hiked its dividend by 3%, while Universal Health raised its dividend by 1%. For the year, we've now seen 55 REIT dividend hikes.

- This idea was discussed in more depth with members of my private investing community, Hoya Capital Income Builder. Learn More »

THEPALMER/E+ via Getty Images

Real Estate Weekly Outlook

This is an abridged version of the full report and rankings published on Hoya Capital Income Builder Marketplace on June 9th.

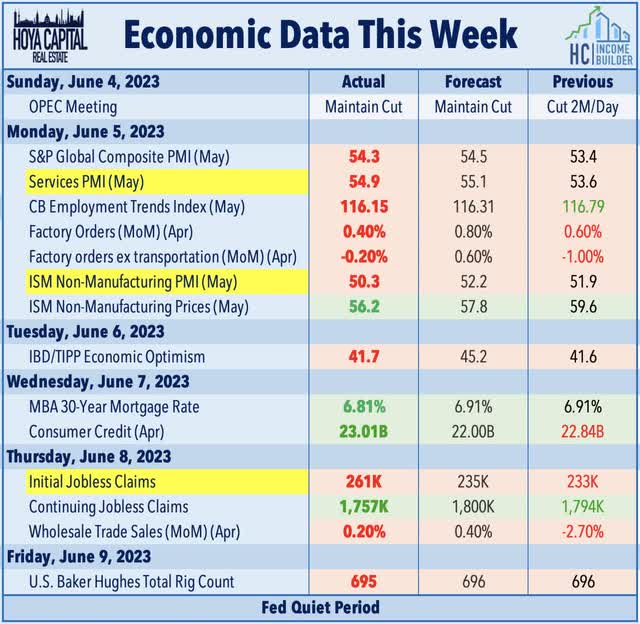

U.S. equity markets climbed to their highs of the year - led by a rebound from the most beaten-down market segments - as investors took positions ahead of a critical slate of inflation reports and an anticipated "pause" in the Fed's rate hike cycle. Beneath the smoky haze covering the Eastern half of the country, there was a sense of tranquility in markets with the central bank in its "quiet period" before next week's meeting. A relatively slow slate of economic data continued to provide fodder for both sides of the inflation debate as a weak slate of PMI data, and a jump in initial jobless claims pushed back on the apparent labor market strength in last week's employment reports.

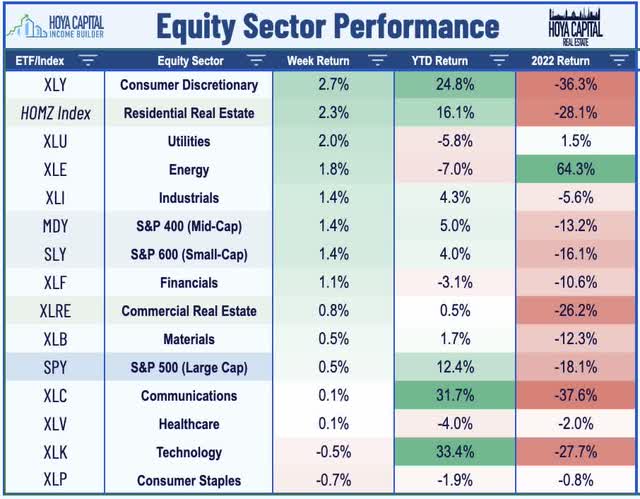

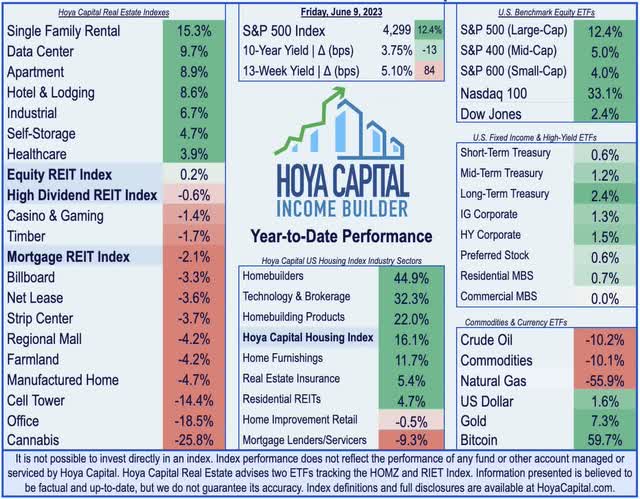

Closing the week in 'bull market' territory, the S&P 500 advanced 0.5% this week, which lifted the major benchmark into 'bull market' territory with gains of over 20% from its lows last October. The Mid-Cap 400 and Small-Cap 600 each advanced 1.4% on the week, narrowing the underperformance gap from smaller capitalization companies. The tech-heavy Nasdaq 100 finished flat on the week. Real estate equities were also among the leaders for a second-straight week, lifted by a strong slate of business updates at the annual REITweek industry conference. The Equity REIT Index advanced 0.9% this week, with 13-of-18 property sectors in positive territory, while the Mortgage REIT Index gained another 2.1%. Homebuilders and the broader Housing Index - a segment that was 'left for dead' by many investors and analysts several months ago - continued their rebound on data showing surprising resilience in homebuying and rental demand.

Benchmark interest rates ticked higher on the week as the soft slate of PMI and employment data stateside was countered by a surprise rate hike from the Bank of Canada, which raised its overnight lending rate by 25-basis-point to 4.75% - the highest level since 2001. The 2-Year Yield advanced 9 basis points on the week to 4.60% while the 10-Year Yield climbed 5 basis points to 3.75%. WTI Crude Oil prices finished lower by another 2% this week to around $70 per barrel - barely above its lowest levels since late 2021 - on reports that the U.S. and Iran made progress toward potentially reviving their Obama-era nuclear deal, which follows an OPEC+ meeting last week in which the cartel agreed to maintain their planned output cuts to support prices amid concerns over slowing global growth and sluggish demand from China, in particular. Nine of the eleven GICS equity sectors finished higher on the week with Consumer Discretionary (XLY) and Utilities (XLU) stocks leading on the upside while Technology (XLK) stocks lagged.

Real Estate Economic Data

Below, we recap the most important macroeconomic data points over this past week affecting the residential and commercial real estate marketplace.

Equity REIT Week In Review

Best & Worst Performance This Week Across the REIT Sector

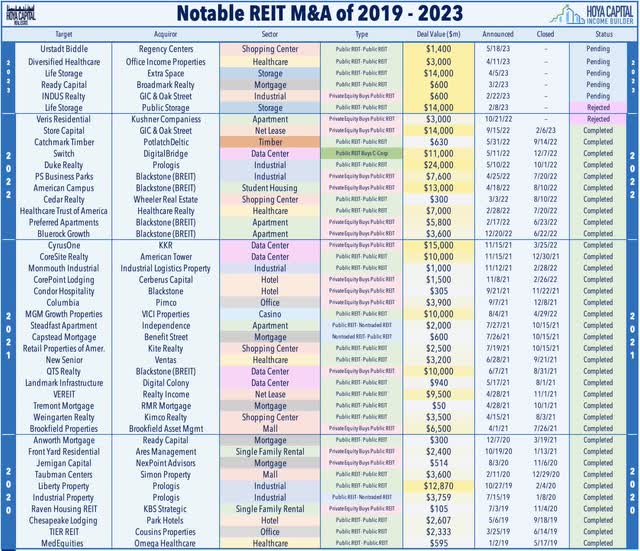

REITweek - the REIT industry's annual conference - was held this week in hazy New York City, where we attended public presentations and held with several dozen REITs. Overall, the tone was notably upbeat from both the REITs themselves and from a sampling of investors and analysts, with a common sentiment that public REITs are well-positioned to "pounce" on external growth opportunities once "reality sets in" for private market real estate owners that lack the deep access to capital or balance sheet strength enjoyed by most of the mid-sized and larger public REITs. We discussed these themes last week in State of REITs: Distress & Opportunity. We noted that the pockets of distress are almost entirely debt-driven, with the notable exception of coastal urban office properties. Property-level fundamentals are fine, but some balance sheets are not. Many real estate portfolios - particularly private equity funds and non-traded REITs - were not prepared for anything besides a near-zero-rate environment, creating an opportunity for REITs with deeper access to capital - specifically equity capital - to be accretive consolidators. Several REITs noted that they were waiting for a rebound in equity valuations - which combined with still-elevated interest rates - would give REITs a distinct cost of capital advantage over more their debt-dependent private competitors.

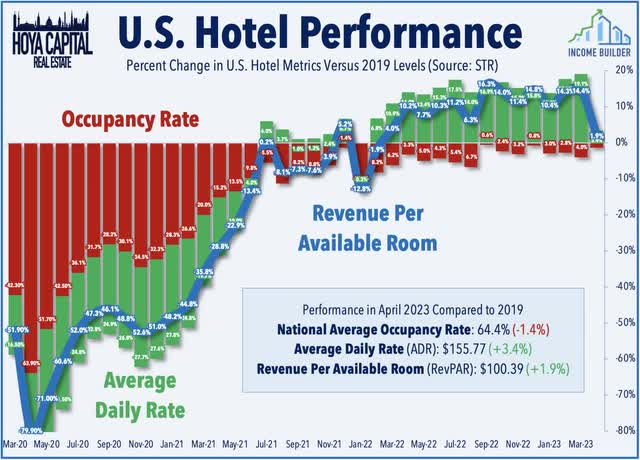

Hotel: On that theme, Ryman Hospitality (RHP) announced this week that it reached a deal with Blackstone's struggling private real estate platform BREIT to acquire the JW Marriott San Antonio Hill Country Resort & Spa for $800M. We've discussed over the past several months that BREIT's portfolio was "ripe for the picking" for public REITs as the non-traded REIT faces redemption requests that have significantly exceeded its liquidity limit in each month since November 2022. The 640-acre resort opened in 2010 and includes 1,002 rooms and 268,000 square feet of indoor and outdoor meeting and event spaces. BREIT has owned the property since 2018, and was among the limited number of properties that BREIT could sell for above its acquisition price as the majority of its portfolio by asset value was acquired at the recent "peak" of the market in 2021 through its five public REIT acquisitions. This week, leading hotel industry forecaster STR upgraded its full-year outlook for average Revenue Per Available Room ("RevPAR") as a 1.3% upward revision to its average daily rate ("ADR") forecast offset a 0.2% decline in occupancy rate compared to its prior outlook. STR now expects RevPAR growth of 5.0% this year, which would be roughly even with full-year 2019 levels.

A handful of REITs took advantage of the spotlight to announce dividend hikes. Lab space operator Alexandria Real Estate (ARE) - which we own in the Dividend Growth Portfolio - rallied nearly 5% this week after it hiked its dividend by 3% to $1.24/share. Universal Health (UHT) rallied more than 9% this week after it raised its dividend by 1% to $0.72/share. For the year, we've now seen 55 REIT dividend hikes, which is pacing slightly behind the roughly 60 dividend hikes at this point last year in which 120 of 205 REITs ultimately raised their dividends. While most REITs are still hiking dividends, we did see a pair of REITs lower their dividend this year, lifting the full-year total to 17 REIT dividend reductions. As indicated in early May during its earnings call, San Francisco-focused office REIT Hudson Pacific (HPP) lowered its dividend by 50% to $0.125/share, representing a dividend yield of 9.54%. As noted in the Mortgage REIT section below, New York Mortgage (NYMT) also trimmed its payout this week. Essentially all of the dividend reductions this year in the REIT space have come from just two property sectors: office and residential mortgage REITs. In our State of REITs report, we noted that the overall sector-wide REIT dividend payout ratio remained at just 74% in Q1, well below the 20-year average of 80%.

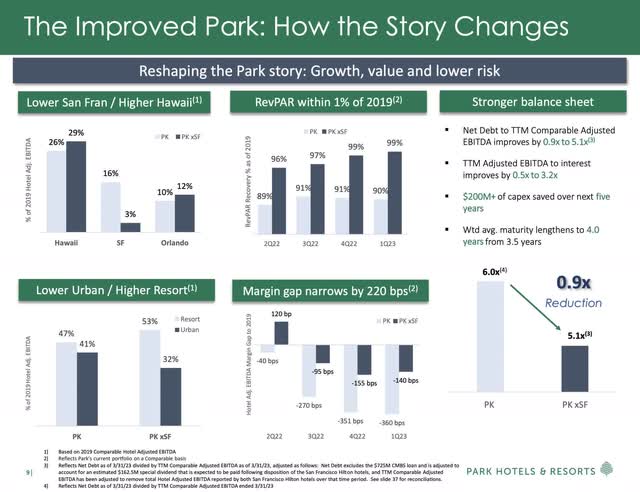

Back in the hotel sector - and the theme of "pockets of distress" - Park Hotels (PK) gained 1% this week after it announced alongside its REITweek presentation that it stopped making interest payments on its two troubled San Francisco properties - the Hilton San Francisco Union Square and Parc 55 San Francisco - as it looks to reduce its exposure to the struggling city. The hotels were financed through a $725M non-recourse CMBS loan scheduled to mature in November 2023. The REIT said it “intends to work in good faith with the loan’s servicers to determine the most effective path forward,” which is expected to result in “ultimate removal” of the assets. PK noted in its past earnings call that removing the loan and the hotels would materially improve Park's balance sheet and operating metrics and commented that it expects the special dividend following the disposition of both hotels to range between $150M to $175M. The disposition would reduce PK's San Francisco exposure to 3% from 12%. PK noted that Revenue Per Available Room ("RevPAR") was 10% below 2019 levels in Q1, but excluding its SF assets, its RevPAR is within 1% of pre-pandemic levels.

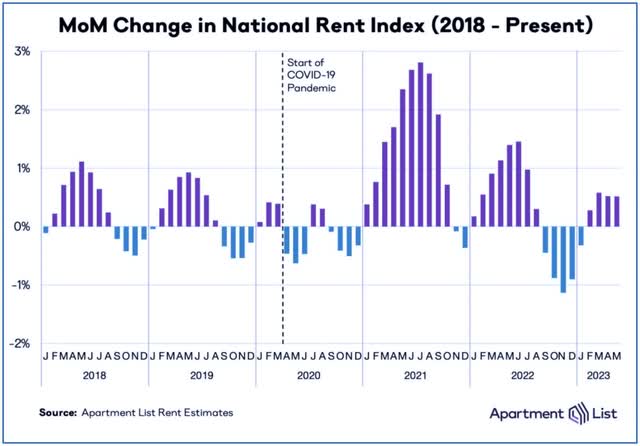

Apartment: The most impressive slate of REITweek updates came from the residential sector, as most apartment REITs provided leasing data through the end of May, showing a surprising buoyancy in rent growth. Reports were generally consistent with Apartment List's monthly Rent Report released last week, which showed that national average apartment rents increased for a fourth straight month in May, which follows a five-month stretch of sequential declines. Sunbelt-focused Camden Property (CPT) reported particularly impressive leasing trends, with its blended spreads rising 4.8% in May - up from 4.0% in Q1 - while also recording a sequential uptick in occupancy rates. Apartment Income (AIRC) gained after announcing the partial sale of 11 apartment properties across two new two joint ventures to generate $600M in proceeds which will be used to pay down debt. In the first JV comprised of 3,093 units across 10 properties across five markets, AIRC will retain a 53% interest. In the second JV - comprised of a 443-unit property in Virginia - AIRC will retain a 30% interest. AIRC will be the property manager on both JV's, which will contribute $2.5 million in annual margin. Upon completion of the transactions, AIRC's Total Debt to EBITDA will be less than 6:1. AIRC noted that these transactions will not affect its full-year FFO guidance.

Healthcare: Senior housing REIT Welltower (WELL) rallied 7% this week after it provided a strong operating update in its REITweek presentation, including an upward revision to its full-year guidance. WELL now expects to report full-year FFO growth of 4.3% - up 90 basis points from its prior outlook - driven by better-than-expected rent growth and occupancy trends at its senior housing facility, while expense pressures have waned in recent months following a period of surging labor expenses amid a severe nursing shortage. Ventas (VTR) reaffirmed its full-year guidance which calls for FFO growth of 7.8% this year, fueled by expected net operating income ("NOI") growth of 18% for its Senior Housing Operating portfolio. Elsewhere, Diversified Healthcare (DHC) surged another 55% this week - pushing its year-to-date gains to nearly 300% - amid an ongoing proxy battle over its proposed merger with Office Properties (OPI). Activist firm Flat Footed - which has a 9.4% stake in DHC - formally filed a proxy to oppose its deal with OPI, a controversial deal between two REITs that are externally managed by RMR Group. Announced in April, the deal would combine two REITs that have floundered under the weight of their elevated debt load, questionable corporate governance decisions, and sector-specific headwinds.

Net Lease: Sticking with the activist investor theme, the proxy battle between activist investor Blackwells Capital and AR Global - the external manager of Global Net Lease (GNL) and Necessity Retail REIT (RTL) - reached an apparent conclusion this week as the companies announced a cooperation agreement in which Blackwells will vote in favor of the proposed merger, and withdraw its board nominations and lawsuits in exchange for the firm's commitment to enhance its corporate governance practices along with a settlement fee of 495k shares of GNL stock paid to Blackwells. The agreement with Blackwells follows the proposed merger agreement between the two net lease REITs last month which would form one of the five largest net lease REITs by enterprise value. As part of the proposed merger - which the firms expect to close in Q3 - GNL announced last month that it expects to reduce its quarterly dividend by 12% to $0.354 per share.

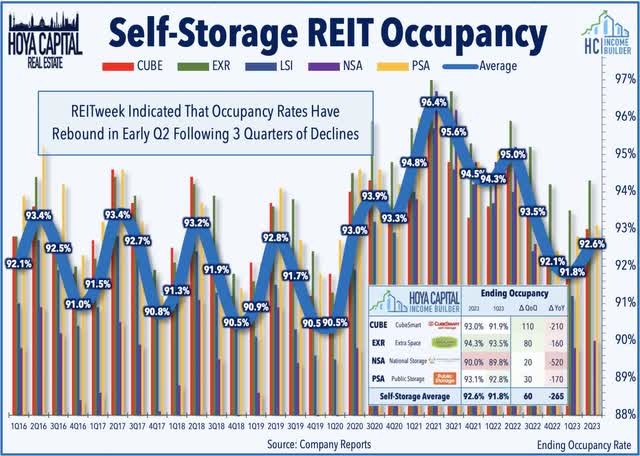

Storage: Self-storage REITs also provided a slate of strong interim updates this week. The trio Public Storage (PSA), Extra Space (EXR) and CubeSmart (CUBE) were among the leaders this week after REITweek results showing a rebound in demand during the peak season following a notable slowdown in late 2022 and into early 2023. PSA reported that its comparable occupancy increased 30 basis points since the of Q1 while its average rent per square foot rose 7.8% from a year earlier at the end of May. EXR reported that its comparable occupancy increased 80 basis points since the end of Q1 while CUBE posted occupancy gains of 110 basis points and NSA posted a 20 basis point increase. In REITweek commentary, PSA noted that the rebound goes beyond typical seasonality, citing a recent moderation in new supply growth and development activity.

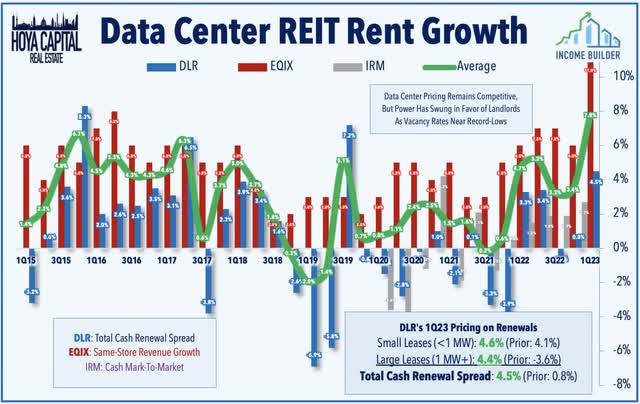

Data Center: This week, we published Data Center REITs: The Epicenter of AI on the Income Builder marketplace. Among the top-performing property sectors this year, the Data Center REIT rebound has been augmented by reports of "booming" demand for artificial intelligence ("AI") focused data center chips. Even before the Nvidia report, Data Center REITs were on the upswing in early 2023 after an impressive slate of earnings results showed improved pricing power and record-high occupancy rates. Ironically, this AI-wave comes just as Data Center REITs became a trendy “short” idea centered on a thesis of weak pricing power and competition from the "hyperscalers"- Amazon, Google, and Microsoft. A confluence of development bottlenecks - power shortages, higher cost of capital, supply chain constraints, ecopolitics, and NIMBYism - have created a more favorable dynamic and swung the pendulum of pricing power towards existing property owners. Barriers to supply growth combined with AI-accelerated demand should bring some sustained pricing power to a sector long-burdened by near-unlimited supply.

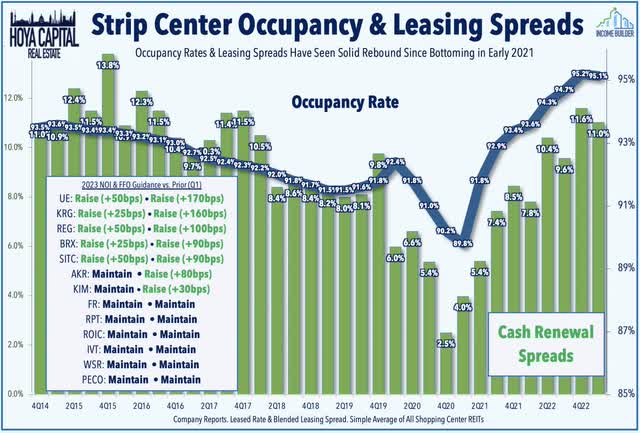

Strip Center: Urstadt Biddle (UBP) - which last month agreed to be acquired by Regency Centers (REG) - was little changed this week after reporting quarterly results for the three months ending April 31st. UBP - which focuses on grocery-anchored centers around the New York City suburban area - reported that its occupancy rate increased 100 basis points from last year to 93.1% - consistent with the positive trends seen across the strip center space in recent quarters, which has lifted average occupancy rates to record highs. Comparable leasing spreads were light, however, with renewal rates declining by 3.6% - the only strip center REIT to report negative rental rate spreads. UBP noted that it re-leased its former Bed Bath Beyond space at its Stamford, CT center to Burlington and is "currently working on several significant leases that we hope to sign and announce in the upcoming quarters."

Mortgage REIT Week In Review

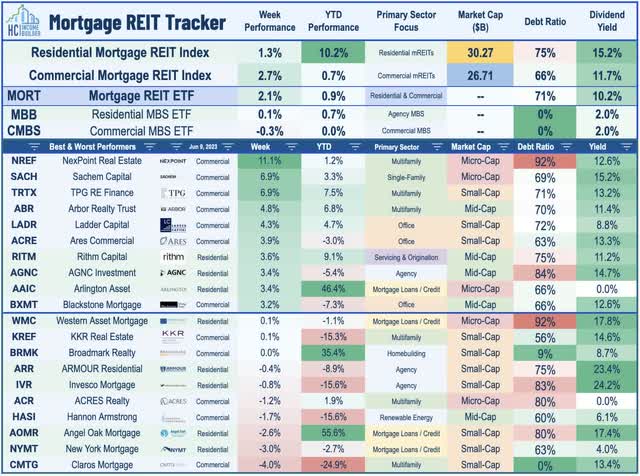

Mortgage REITs added to their gains following their best week since early January as the iShares Mortgage Real Estate Capped ETF (REM) advanced another 2.1% to push into positive territory for the year. Multifamily-focused lenders were leaders on the week following the wave of positive REITweek updates showing buoyant residential rent growth. Arbor Realty (ABR) continued its strong run with gains of nearly 5% this week following an analyst upgrade last week from Wedbush, lifting its gains to nearly 35% from its April lows. TPG RE (TRTX) - one of a handful of mortgage REITs to present at REITweek - was also among the upside leaders this week on positive commentary. On the downside this week, New York Mortgage (NYMT) slipped 3% after it reduced its quarterly dividend by 25% to $0.30/share. NYMT becomes the eighth mortgage REIT to reduce its payout this year, and as noted in our Earnings Recap, NYMT was one of 11 mortgage REITs that paid out more than 100% of its distributable earnings in Q1.

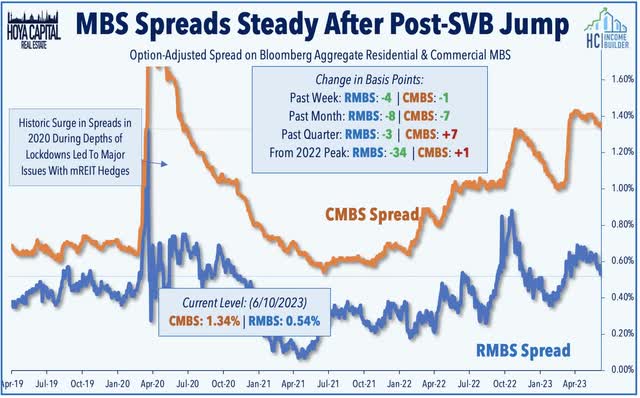

The three other mREITs that declared dividends this week all maintained payouts at current levels: Annaly Capital (NLY) maintained its dividend at $0.65/share, representing a dividend yield of 13.0%, Ellington Residential (EARN) maintained its dividend at $0.08/share, representing a forward yield of 13.4%, and PennyMac Mortgage (PMT) maintained its dividend at $0.40/share, representing a dividend yield of 12.6%. We've kept our eyes on the underlying Residential MBS (MBB) and Commercial CMBS (CMBS) benchmarks, which remain in positive territory for the year despite the chatter of "distress" in real estate markets. CMBS and RMBS spreads have both narrowed following the surge in the wake of the Silicon Valley Bank collapse in early March. CMBS spreads are still elevated at levels that are roughly even with their 2022 highs at 1.34% - up from 1.16% at the start of the year. At 0.54%, RMBS spreads have remained steadier throughout the banking turmoil and now higher by 4 basis points on the year but lower by 4 basis points for the quarter. We discussed in our Mortgage REITs report last week how sharp changes in benchmark rates and/or spreads in either direction can wreak havoc on mortgage REITs that are caught over-levered or improperly hedged.

2023 Performance Recap & 2022 Review

Through twenty-three weeks of 2023, the Equity REIT Index is now higher by 0.2% on a price return basis for the year (+2.1% on a total return basis), while the Mortgage REIT Index is lower by 2.1% (+2.4% on a total return basis). This compares with the 12.4% gain on the S&P 500 and the 5.0% advance for the S&P Mid-Cap 400. Within the real estate sector, 7-of-18 property sectors are in positive territory on the year, led by Single-Family Rental, Data Center REITs, and Apartment REITs, while Office and Cell Tower REITs have lagged on the downside. At 3.75%, the 10-Year Treasury Yield has declined by 13 basis points since the start of the year - up from its 2023 intra-day lows of 3.26% - but still below its late-2022 closing highs of 4.30%. The US bond market has stabilized following its worst year in history as the Bloomberg US Aggregate Bond Index has gained 2.0% this year. Crude Oil - perhaps the most important inflation input - is lower by 10% on the year and roughly 40% below its 2022 peak.

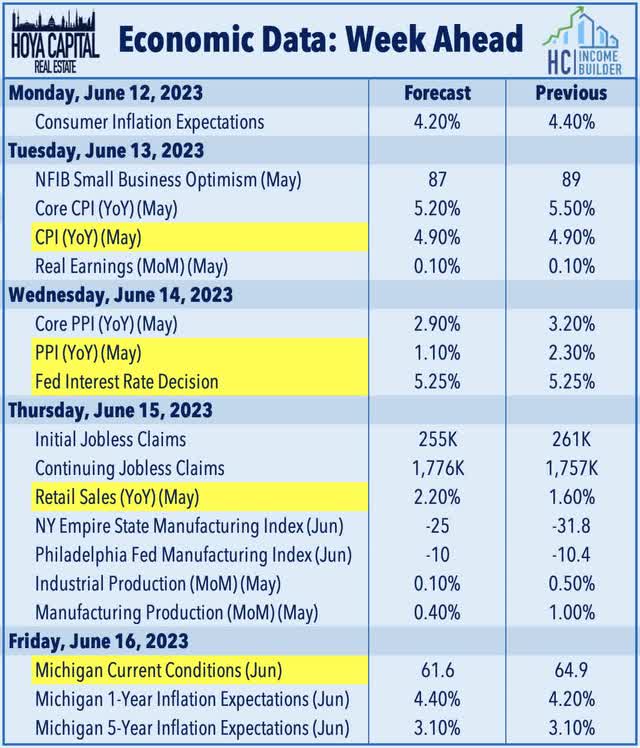

Economic Calendar In The Week Ahead

Inflation and central banks are in the spotlight in a jam-packed week of economic data in the week ahead. The Federal Open Market Committee's two-day policy meeting begins on Tuesday and concludes with its interest rate decision on Wednesday afternoon. Swaps market now imply a 70% probability that the Fed will "pause" its historically aggressive rate hiking cycle - maintaining the 5.25% upper bound - but investors will be parsing comments to glean the likelihood of a hike in July. Ahead of the Fed, the main event comes on Tuesday with the Consumer Price Index for May, which investors and the Fed are hoping will show a cooling of inflationary pressures. The headline CPI is expected to moderate slightly to a 4.9% year-over-year rate, while the Core CPI is expected to decelerate to 5.2%. As with recent months, the metric we're watching most closely is the CPI-ex-Shelter Index. On Thursday, we'll see the Producer Price Index, which is expected to show an even more significant cooling of price pressures with the headline PPI expected to slow to a 1.1% year-over-year rate - down from the recent peak last March at 11.8%. Also on Thursday, we'll see Retail Sales data and on Friday, we'll see get the first look at Michigan Consumer Sentiment for May - a report which includes the closely-watched inflation expectations survey.

For an in-depth analysis of all real estate sectors, check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read The Full Report on Hoya Capital Income Builder

Income Builder is the premier income-focused investing service on Seeking Alpha. Our focus is on income-producing asset classes that offer the opportunity for sustainable portfolio income, diversification, and inflation hedging. Get started with a Free Two-Week Trial and take a look at our top ideas across our exclusive income-focused portfolios.

With a focus on REITs, ETFs, Preferreds, and 'Dividend Champions' across asset classes, members gain complete access to our research and our suite of trackers and portfolios targeting premium dividend yields up to 10%.

This article was written by

Real Estate • High Yield • Dividend Growth

Visit www.HoyaCapital.com for more information and important disclosures. Hoya Capital Research is an affiliate of Hoya Capital Real Estate ("Hoya Capital"), a research-focused Registered Investment Advisor headquartered in Rowayton, Connecticut.

Founded with a mission to make real estate more accessible to all investors, Hoya Capital specializes in managing institutional and individual portfolios of publicly traded real estate securities, focused on delivering sustainable income, diversification, and attractive total returns.

Collaborating with ETF Monkey, Retired Investor, Gen Alpha, Alex Mansour, The Sunday Investor, and Philip Eric Jones for Marketplace service - Hoya Capital Income Builder.Hoya Capital Real Estate ("Hoya Capital") is a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations is an affiliate that provides non-advisory services including research and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital has no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIET, HOMZ, ABR, PLD, ARE, UHT, NLY, TRTX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry. This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing. The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized. Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes. Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receive compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.