Adobe: Tactical Buy Into Earnings, EPS To Be Buoyed By Buybacks

Summary

- Adobe's Q2 2023 earnings report is expected to show a GAAP EPS of $2.72 and revenues of $4.77B, a performance that Adobe appears readily able to achieve.

- This is because Adobe has an ongoing share buyback program working to improve its EPS. If it can match last quarter's profits, repurchases alone will bring it in-line with consensus.

- This should allow for the company to extend its current rally and trade higher on the basis of its momentum.

- Overall, this makes it a good tactical buy, heading into the earnings week ahead.

- Investors should note that while Adobe may outperform against consensus estimates in the short term, long-term concerns about organic growth and margin compression prevent it from being a long-term investment for now.

Michael Vi/iStock Editorial via Getty Images

Overview

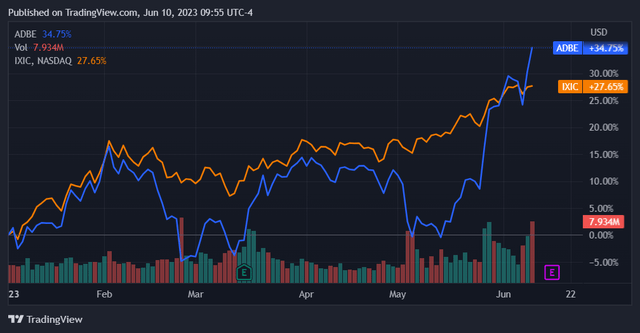

Adobe (NASDAQ:ADBE) is slated to release its Q2 2023 earnings results 5 days from now, on Thursday June 15th. In the run-up to these results there has already been action in Adobe stock, with the previous week seeing the stock gain 5.34% while the NASDAQ Composite (COMP.IND) closed flat.

Seeking Alpha

Interestingly, this recent appreciation has extended a multi-week rally to bring Adobe’s price return past that of the NASDAQ Composite for the first time this year.

Seeking Alpha

Given recent news items around the stock, including analyst upgrades and commentary on its capacity to benefit from AI, it is not immediately clear that this recent buying indicates market optimism around its upcoming results. The timing of the recent rally further compounds the difficulty of determining the nature of its current price action. The current rally that has brought Adobe’s YTD return beyond the index began at the end of May, over two weeks before earnings and at least a week prior to its recent AI product launch or analyst upgrade announcements. This timeframe is close enough to the earnings report date for the recent buying to be linked to investor earnings expectations.

In either case, we have a stock with significant momentum (32% month-to-date) that is now days away from releasing an earnings report. This kind of situation, in which the volatility of a stock is rising going into earnings, works to set up the stock for a stronger price response to the earnings results that it ends up releasing. This certainly looks like the case for Adobe this time around.

With this context in mind, I believe that Adobe will need to meet or exceed consensus earnings expectations in order to maintain the current rally in its shares. A miss against expectations would halt its momentum and subsequently result in the evaporation of its recent gains. Due to the significant pre-earnings price action that we are seeing, it is clear that momentum is very much in play here and should be considered as the primary force determining share price in the near-term.

As such I think it’s worth evaluating where expectations stand for Adobe’s Q2 2023 earnings and if we can glean any indicators as to the results that it will post. This should provide an immediately actionable view on the stock’s trajectory.

Earnings Expectations

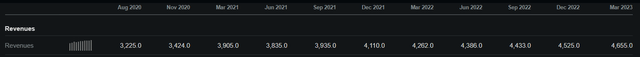

For this current quarter, Adobe is expected to post a GAAP EPS of $2.72 and revenues of $4.77B. These estimates are quite close to Adobe’s performance in its prior quarter (Q1 2023), during which it had generated a GAAP EPS of $2.71 and revenues of $4.66B. We can compare these forward estimates against Adobe’s recent/historical results in order to determine the growth rates and margins that are implicit within the forecast.

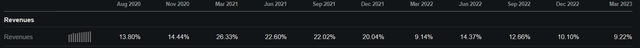

Expected revenues of $4.77B imply 8.76% y/y growth from Q2 2022. This is priced to reflect a continuing decrease in the firm’s growth rate that is nonetheless quite close to its recent y/y rates of revenue growth. Since there hasn’t been a material change in conditions for the company, I think this estimate is fair.

Ultimately, Adobe has not completed and integrated its Figma acquisition or had the time to bring AI products into the market. Since these are the two primary growth catalysts for Adobe, but are not yet in play, we can readily assume that growth should remain on a similar trajectory in the immediate.

Seeking Alpha

Seeking Alpha

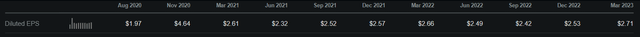

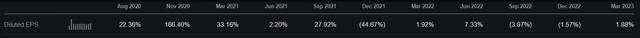

Proceeding to EPS estimates, we see that the expected GAAP EPS figure of $2.72 implies 9.24% y/y growth from Q2 2022. This would represent earnings per share growth beyond that which Adobe has generated since Q4 2021. Recent quarters don’t facilitate conviction in this EPS estimate because they have y/y EPS growth far below what is expected in this upcoming quarter.

Seeking Alpha

Seeking Alpha

Since there is not an immediately apparent trendline we must look at Adobe’s margin profile to see how feasible this level of projected EPS growth really is. Expanded margins within the past year would allow for greater EPS at similar levels of revenue, presenting a route for Adobe to hit consensus EPS growth targets.

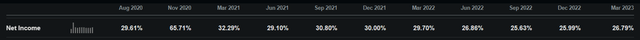

Unfortunately the margin story here appears to be going in reverse. Adobe’s margins have gotten worse over the past 4 quarters. This means Adobe has beat recent EPS estimates through means other than improving its margins, in fact counteracting this negative force on its profitability.

Seeking Alpha

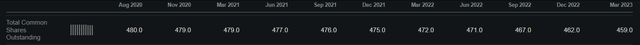

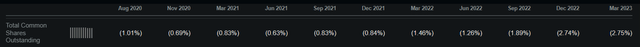

Adobe accomplished this through share buybacks. The last two quarters have seen an acceleration of its share repurchase program that has worked to keep per-share profitability high.

Seeking Alpha

Seeking Alpha

The current share repurchase program had $5.2B remaining for share repurchases as of last quarter’s earnings report, with the program authorized to run until the end of 2024. Furthermore, the most recent quarter saw $1.4B in share repurchases executed by Adobe.

Assuming that Adobe has continued to repurchase shares at the same rate as it did last quarter, we can calculate the impact on per-share earnings from the reduction in float that this will have achieved.

- At its current market cap of $208.25B and its current float percentage of 99.7%, we get $207.63B in total float for Adobe.

If Adobe repurchased $1.4B of this $207.63B float, it would have reduced its total float by 0.67%.

We can then take this number and use it to create an adjusted denominator. We can then divide last quarter’s EPS into this adjusted common shares outstanding denominator to see what EPS would be at the new float, all else held equal.

This calculation is as follows:

- $2.71/(1 - 0.0067)

- = $2.71/0.9933

- = $2.73

This shows that Adobe can hit consensus EPS estimates (and perhaps even exceed them by one cent) purely through its share repurchasing program. Given the recent acceleration in its share repurchases I think Adobe would have certainly continued to repurchase shares at last quarter’s rate, perhaps even increasing its levels of buying somewhat. Overall this gives me confidence that Adobe has what it needs to proceed through this upcoming earnings report in stride. Simply put, the math is sound.

Risk

The risks until and through this next earnings report are twofold. The first is that Adobe’s revenue growth rate could slow faster than expected, making the math unworkable for maintaining its EPS through share repurchases. This would yield an earnings miss for the upcoming report and generate immediate negative repercussions for its shares.

The second risk is if we see further deterioration in Adobe’s net margins, which are already far off from historical highs. While they are still quite high in an absolute sense, additional pressure here could very well unwind the present equation of share price repurchases and subsequent EPS increases that Adobe is relying on. This would crimp its ability to readily hit consensus and ultimately have the same downward share price effect mentioned above.

Long to medium-term, the risk around Adobe stock takes on a different form. We must remember that its current share repurchase program will run out at the end of 2024 at the latest, which would force the company to allocate more capital for further repurchases or to increase its earnings through margin improvements.

In general the current situation here is more precarious than I would like. It is clear that earnings would be down somewhat without the buybacks, and ongoing low levels of margin compression are another long-term concern. I would like to see a more organic growth profile before committing for the long-term.

Conclusion

I think that Adobe can and will outperform against consensus estimates in the quarter ahead, which should lead to continued tactical appreciation in its share price. The math is quite sound and the bar for outperformance is not high. As mentioned, even mirroring last quarter’s performance would see the firm pull ahead of consensus GAAP EPS by one cent at an identical level of buybacks.

Further ahead, however, I am far less certain. I would be very keen to see a more organic growth profile and a more robust driver of earnings growth than share buybacks for Adobe. Considering this, I think Adobe is a tactical buy but not a long-term one at present. Overall I do feel comfortable calling it a buy heading into earnings.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ADBE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.